Dear Members,

We have released 30th Nov’21: Gufic Biosciences Ltd (NSE Code – GUFICBIO) – Alpha/Alpha Plus stock for Nov’21. For details and other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 30th Nov’21

CMP – 182.25 (BSE); 181.60 (NSE) Face Value – 1.00

Rating – Positive – 4% weightage (refer rating interpretation)

Introduction

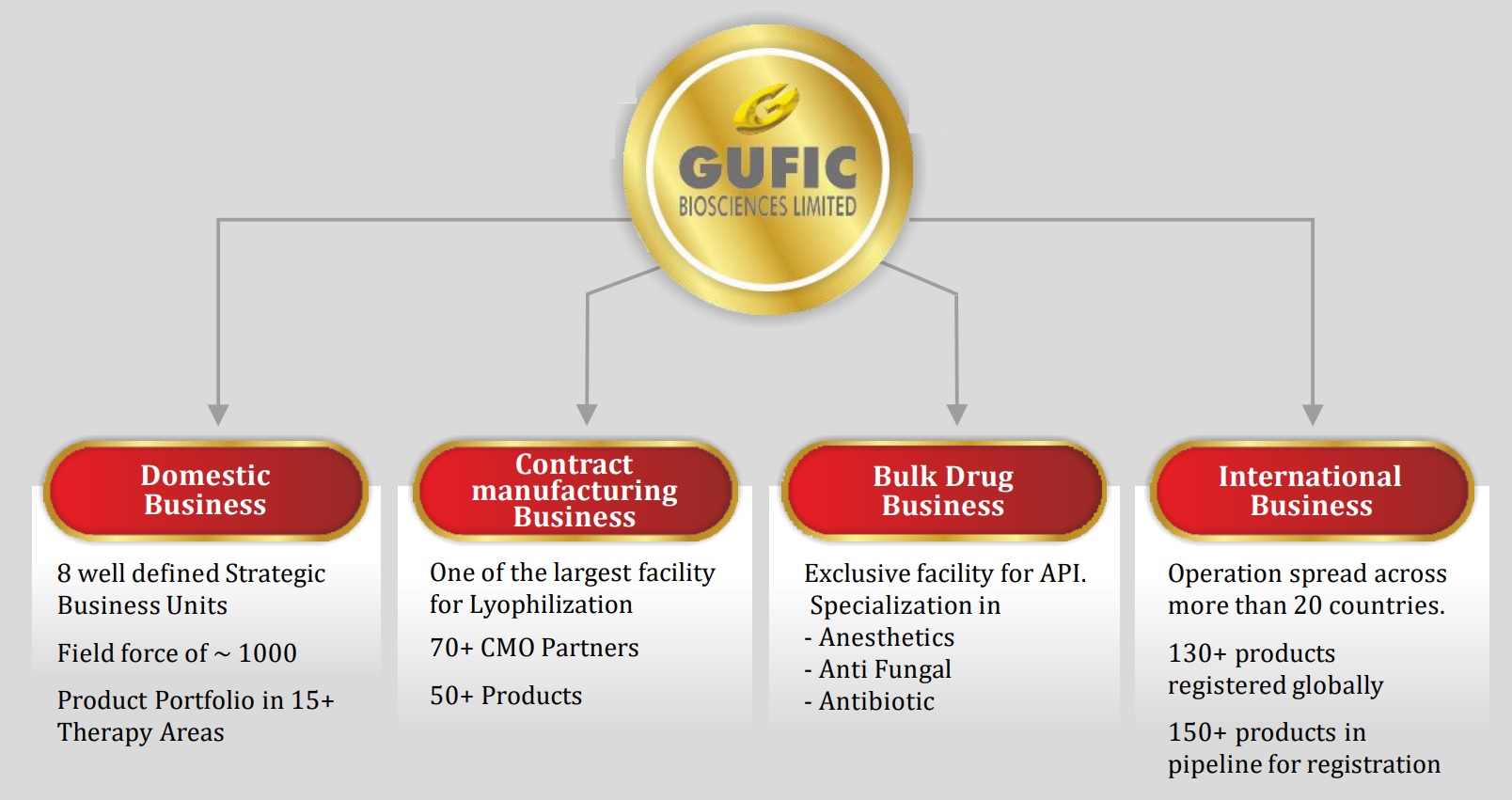

Gufic Biosciences Limited (GUFIC) was incorporated in the year 2000 as a public limited company and is engaged in manufacturing and marketing of pharmaceutical formulations in various dosage forms such as injectables, syrups, ointments, lotions etc.

It is also backward integrated to manufacture active pharmaceutical ingredients/bulk drugs, some portion of which it captively consumes.

It also has presence in the herbal formulations and consumer/personal care products such as sanitary napkins, roll-ons, stretch mark creams, etc.

Injectables (liquid and lyophilized) remain its key revenue contributor forming ~75% of its revenues in the past few fiscals, followed by APIs. For the injectable segment, the company also carries out contract manufacturing for leading brands in the domestic and international market in addition to direct sales to hospitals/physicians.

At around CMP of 180-190, we like the company for the following reasons:

- Evolution from CMO to a domestic branded products company – In the year 2007, Gufic initiated contract manufacturing of lyophilized products for large domestic pharma companies. 2014-15 onwards the company increased its focus on branded domestic sales and since then it has been continuously adding new therapies with differentiated products and drug delivery systems. The field force has also increased from around 250 people in 2015 to around 1,100 people in 2021.

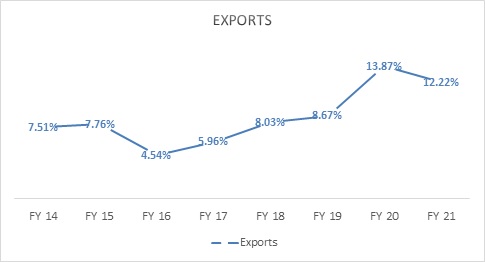

- Increasing presence in international markets including regulated ones – Exports is another area the company has increased its focus on in the last 4-5 years. International sales of the company have increased from Rs 10 crore in FY 16 to Rs 60 crore in FY 21. The company is continuously expanding both geographically (including regulated markets) and the registration pipeline and expects the exports contribution to increase from 12% in FY 21 to 30% in 2-3 years.

- Botulinum Toxin – Gufic is the first Indian company to make Botulinum Toxin from scratch. It is also the first company to launch ‘Make in India’ Botulinum Neurotoxin (branded as STUNNOX) – bioequivalent to the Innovator. Botulinum Toxin Type A, which is the only injection approved around the world is a US$3.6 billion market. In India, currently, it is around Rs 120-130 crore.

- Strengthening backward integration – Gufic has been manufacturing anti-fungal, anaesthetic and anti-bacterial APIs at its manufacturing facility for captive consumption. However, considering the geo-political issues and to reduce dependency on imports, the company has increased its capacity and doing R&D for development of certain cardiac, diabetic, hormonal and biological products and intends to use 50% of the production for captive consumption and rest for outward sale.

- Strategic partnerships – In order to develop new products and drug delivery systems, the company has forged partnerships and licensing deals with companies like Prime Bio, Singapore Biotech, Pharmaaz, Lucas Meyer, BrightGene. In-licensing and partnerships make sense for a company of Gufic’s size.

- Advanced drug delivery systems – Gufic has been working on NDDS formulations in the critical care and infertility segment to differentiate its presence in the segments. The company has successfully completed in-house trails on several innovative concepts in pre-filled syringes, dual chamber bags and dual chamber syringes (a novel concept to deliver critical care products). NDDS helps in enhanced efficacy, bio-availability and potency of existing and new products.

- Margin expansion – Over the years, Gufic’s EBITDA margins have expanded from 10-11% to around 17-18% currently. Most of the gains have come on the back of operating leverage and some on the back of gross margin expansion. With higher contribution of exports and branded domestic sales, the gross margins can expand further and the management expects EBITDA margins to increase to 21% in 2-3 years.

- Valuations – Gufic has been a consistent performer with 20% + CAGR in sales and 30% + CAGR for profits. The company is debt free on net basis. On the back of both expansion in capacity and new launches, the management is targeting 15-20% YOY sales growth for the foreseeable future. The growth in profits could be higher with further expansion in margins. Thus, at ~20 times FY 22 (E) earnings, we believe the valuations are reasonable.

Company details

Gufic manufactures and markets pharmaceutical formulations in various dosage forms such as injectables, syrups, ointments, lotions etc. It is also backward integrated to manufacture active pharmaceutical ingredients/bulk drugs.

Among the various dosage forms, injectables (liquid and lyophilized) remain its key revenue contributor forming ~75% of its revenues in the past few fiscals.

The company is amongst the largest manufacturer of lyophilized products globally and combines its Lyophilisation technology with R&D expertise to create differentiated products targeted at domestic and international markets.

About Lyophilisation

Lyophilization is a freeze-drying process used for the removal of water from the final product. In lyophilization, the output product is frozen under high vacuum.

Basically, many biotechnologically manufactured substances are not sufficiently stable in aqueous solutions. This becomes challenging to preserve liquid formulations for longer periods. In order to overcome this, companies are adopting lyophilization for the production of good quality products with expanded lifespan.

The lyophilized products are then further packaged in vials, dual-chamber syringes, and dual-chamber cartridges. Vials have set the gold standard for freeze-dried products.

As per the management, the market of Lyophilisation is likely to see significant growth. In the last 5 years, almost 25-30% of the new injectable products approved were lyophilised.

Business units

Source: Gufic’s Nov’21 presentation

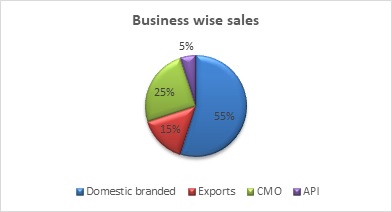

In 2007, Gufic initiated contract manufacturing of lyophilized products. So, till 6-7 years back, the company was primarily an API cum CMO partner. However, 2014-15 onwards, company started focusing on establishing its branded domestic business and then started expanding into international markets.

Source: Gufic’s Q4 FY 21 concall

As per the management, exports will be the fastest growing division because of both geographical expansion and registration of new products, followed by growth in domestic operations.

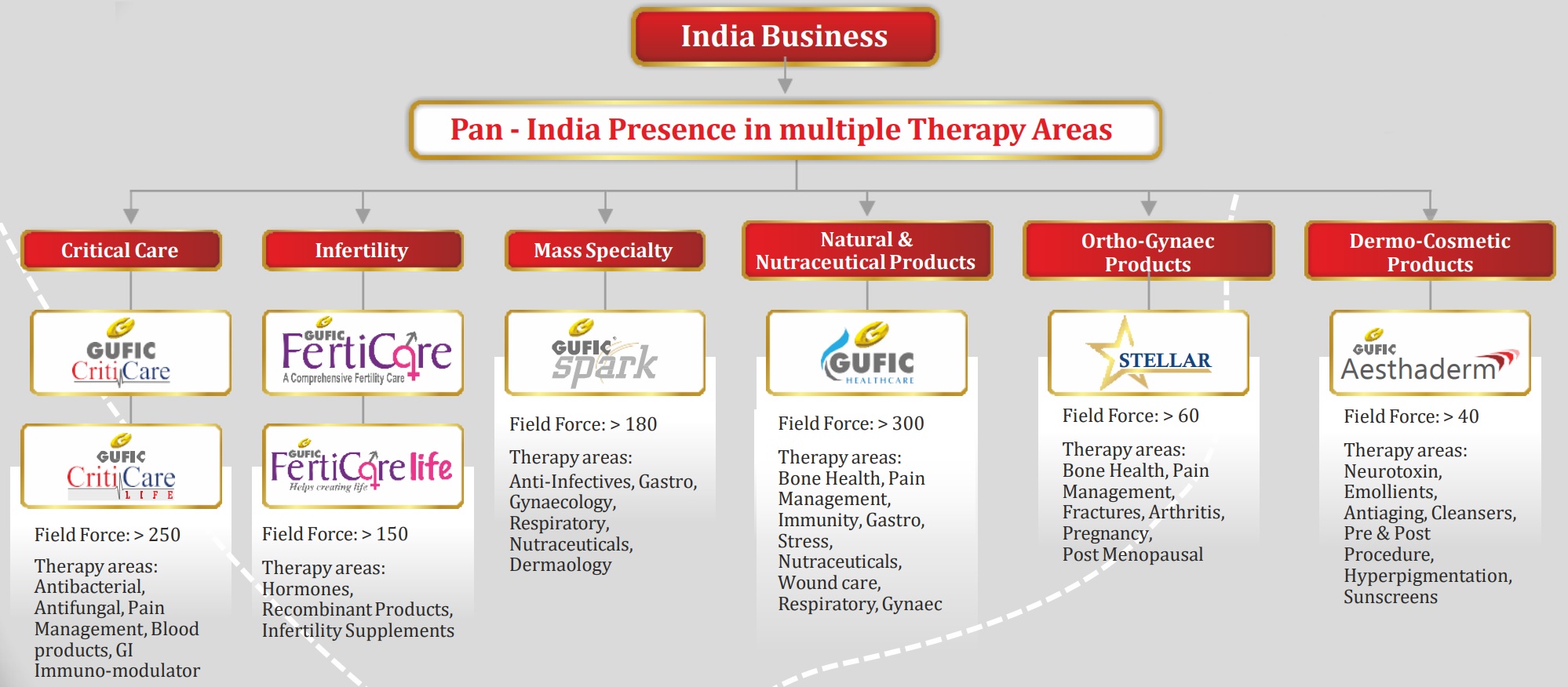

Domestic branded unit

Gufic’s rank in the domestic market has improved from 165 in around 2014-15 to 72 in 2021. At the same time, company’s field force has also increased from 250 people in 2015 to 1,100 people in 2021.

The company caters to about 90 % of the tertiary care hospitals covering more than 1 lakh doctors and approximately 2 lakh retail counters.

Source: Gufic’s Q4 FY 21 concall

Till now, majority of the growth has been contributed by critical care products segment with leading brands in the anti-infective lyophilisation injectable categories. Now, the company is expanding into areas like Infertility, Derma, Orthopaedic and Gynaecology – backed again by lyophilisation.

Source: Gufic’s Nov’21 presentation

In FY 21, the company launched 13 new products under various therapies and it further has a pipeline of 40 odd products to be launched over the next 1-2 years.

Source: Gufic’s Nov’20 presentation

The company is also venturing into futuristic therapy areas like – Biologicals and Immuno-Oncology; however, such products will come onstream 4-6 years down the line.

As per the management, the company has 20 + brands ranked amongst the top 5 brands in the relevant categories and 18 brands command an annual sale of more than Rs 5 crore.

Criticare – The segments covered under criticare include – anti bacterial, anti-fungal, pain, blood products and gastro. Most of these are Lyophilised injectable and targeted towards tertiary hospitals.

Gufic already had a strong presence in the anti-infectives space and during covid-19 promoted an array of drugs such as Immunocin Alpha (Immuno-modulator), Doxific (Antibacterial/Antiviral), Ulinafic (Sepsis Management), Guficap (Antifungal) and Gufisome (Antifungal – Black fungus).

The company is working on new drug delivery systems and plans to launch many more products in the pipeline.

Ferticare – This includes recombinant products and infertility supplements. Most of these are again lyophilised injectable.

Before launching ferticare, Gufic was contract manufacturing infertility products. Later on, the management decided to market them under its own brand and is now one of the largest manufacturers of certain infertility hormones.

Here again the company’s strategy is to build brands in the hormone category and build NDDS offerings like transdermal products, pre-filled syringes, etc that make the patient administer the drug in the comfort of their home.

Gufic Spark and Healthcare – Gufic has 2 units to focus on mass specialty segment like general practitioners, paediatricians, gynaecologists and physicians. The market interest of these SBUs are nutraceuticals and natural products, pain/arthritis, immune boosters, respiratory products and mass anti-infectives.

Gufic Stellar – It’s a new division launched in Aug’20 with specific focus on orthopaedic and gynaecological products in various segments like pain, infection, pregnancy, lactation, bone and muscle products.

For orthopaedic, the company has the complete basket starting from basic pain management to arthritis and tendonitis.

Aesthaderm – This is again a new division launched in Dec’20 and caters to facial aesthetics and skin care.

It has been launched with aesthetic dermatology products in the segments of moisturizing agents, anti-aging, hyperpigmentation, sunscreen and pre/post procedural products.

Under Aesthaderm, Gufic has launched an indigenously manufactured Botulinum Toxin (for wrinkles and sagging skin) in collaboration with Prime-Bio, USA. Its brand name for Botulinum Toxin is STUNNOX.

Most of the other products have also been developed in technical collaboration with Lucas Meyer – a company that specializes in Aesthetic dermatology.

The major target audience for Aesthaderm is – Cosmetologists, Plastic Surgeons, Aesthetic Dermatologists and Beauticians.

Botulinum toxin – As mentioned above, Gufic is the first Indian company to make Botulinum Toxin from scratch, in collaboration, with Prime-Bio, USA.

Botulinum toxin is extremely poisonous and a teaspoon of the same can kill the entire world and therefore an extremely difficult material to handle.

Botox® is one of the most widely known brands of botulinum toxin injections and Gufic has launched its own brand by the name of STUNNOX.

Apart from facial aesthetics, the company is also working on other applications of Botulinum toxin like neurological conditions, sports conditions, pain management, etc.

In terms of numbers, Botulinum Toxin Type A, which is the only injection approved around the world is a US$3.6 billion market. In India, currently, it is around Rs 120 crore and is largely imported.

As per the management, in the next 2-3 years, a decent chunk of Gufic’s sales could come from Botulinum Toxin based products.

International business

Gufic has become aggressive in the international markets in the last 4-5 years. It was always there in certain Southeast Asian markets and South American market; however, it started putting in a lot more efforts in new product registrations and geographical expansion 6-7 years ago and the sales started increasing from FY 17.

On the exports front, the company has 130 + products registered in 20 + countries.

It further has 150 + products in pipeline for registration in 30 + countries.

Except for US and Japan, the company is increasingly focusing on developed markets such as Europe, UK, Canada, Australia, Brazil, Russia and South Africa.

With the enhanced lyophilization capacities and multiple approvals from the regulatory bodies like WHO GMP, EU GMP, ANVISA Brazil, Russian GMP, Health Canada, Ukraine GMP, Australia TGA, Colombia INVIMA, Uganda NDA, SAHPRA South Africa, etc., Gufic is geared up to explore the CMO and the out-licensing business in the international markets.

Source: Gufic’s Annual Reports

Even though the current contribution from the international business is around 15%, the management expects the same to be the fastest growing division with the contribution increasing to 30% in the next 2-3 years.

Contract Manufacturing (CMO) business

Gufic started contract manufacturing of lyophilized products in 2007.

Gufic offers 170+ lyophilized products across multiple therapy areas. It serves more than 70 companies in India including large players like Glenmark Pharmaceuticals Ltd, Lupin, Abbott Healthcare, Zydus Healthcare among others.

The company generates around 25% of its revenue from the CMO division and its contribution is likely to go down to 20%.

As per the management, they have a diverse product portfolio and considering they may not be able to commercially launch all of them, they look for strong front-end players and strong pharma companies so as to manufacture for them and more than recover their R&D and manufacturing expenses.

API business

API is around 5% of the sales of the company and its contribution is likely to increase to 10% in the years ahead.

Currently, the categories of API manufactured by the company include – anti-fungal along with their Intermediates, anti-bacterial and anaesthetic agents.

Going forward, the management intends to expand its API facilities to de-risk from external procurement and also insulate somewhat from price volatility. Some of the products will also be used for outward sale.

Currently, the API R&D of the company is developing molecules in therapeutic categories like – antifungal, anticoagulant, tetracycline-antibiotics, progestin, Beta-3-adrenegic agonists, antidiabetic and cyclopeptides.

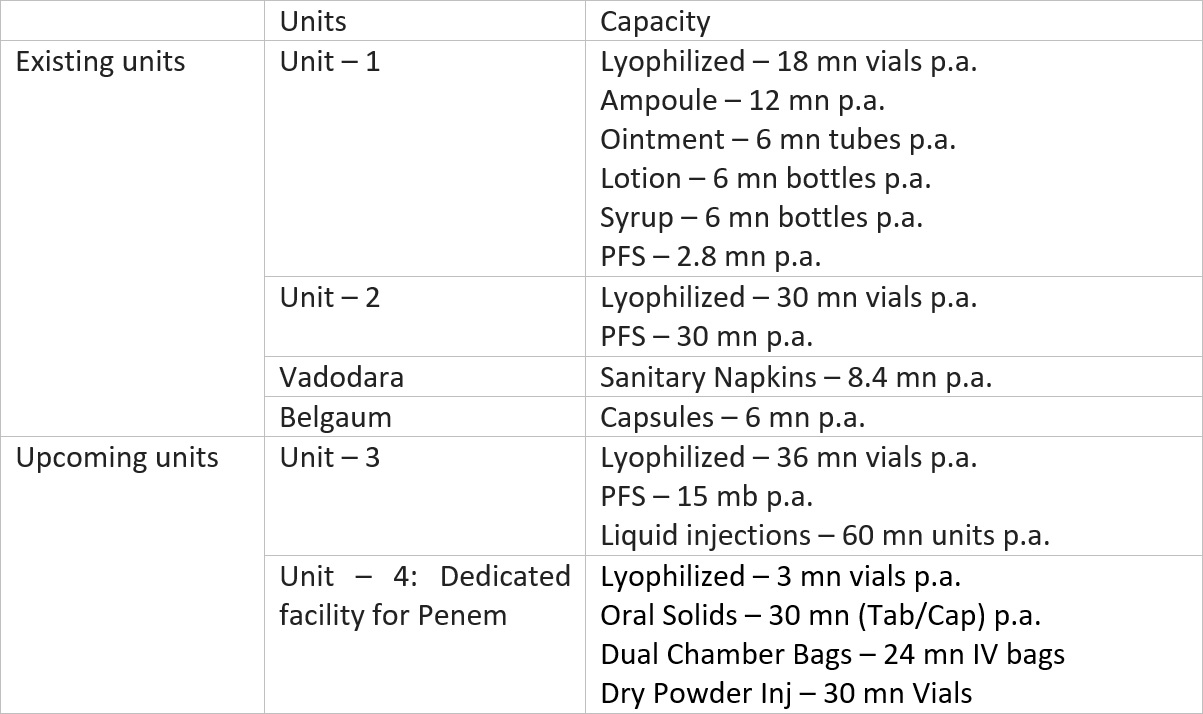

Manufacturing facilities

Gufic’s manufacturing plants are located at Navsari in Gujarat (injectables and API), Vadodara and Belgaum in Karnataka (API and Herbal formulations).

Source: Gufic’s Nov’21 presentation

Besides the existing units, the company is setting up 2 more units in Indore.

Unit – 3 will be a general lyophilized injectables facility while Unit – 4 will be a dedicated facility for Penem.

Increasing lyophilized injectables facility will help the company accelerate new launches in the domestic market and also take care of the increasing registrations and demand from the international market.

Regarding the Penem unit, as per the management, with the production of penem based drugs, their basket of anti-infective space will be complete and that will help them both in the contract manufacturing space (domestic and international) and the branded domestic business.

Management intends to complete the expansion at Indore by Apr’23 and the same will largely be funded through internal accruals.

Promoters/Management

Gufic Biosciences is an owner operated business with Mr. Jayesh Choksi as the CMD of the company and his son Mr. Pranav Choksi as the CEO and WTD of the company. Both are Bachelor in Pharmacy, while Mr. Pranav has done Masters in Biotechnology from The John Hopkins University, USA and has also done specialization in Autologous Cancer Vaccines from US.

Promoters are also supported by a professional team comprising of:

- Dr Debesh Das – President, Domestic formulations

- D. B. Roonghta – CFO

- Nagesh Yarrabathina – COO

- Satyen Manikani – Senior Vice President – Strategy and Business Development

Dr Balram Singh is serving as a Non-Executive Director on the board of the company. He is a B. Sc. (Chemistry, Biology), M. Sc. (Life Sciences, Major-Biochemistry) and M. Phil (Life sciences, Major-Biophysical chemistry) from India. He is doctorate in Chemistry with major in Biophysical Chemistry from Texas Tech University, USA.

He is the President & CEO of Prime Bio Inc and Neuromedicine Inc. and the founding Director of Botulinum Research Center, MA (BRC).

It is important to note here that Gufic could become the first Indian company to make Botulinum Toxin from scratch on account of its collaboration with Dr Balram Singh and Prime Bio Inc.

Related parties – In the last 2-3 years, Gufic has completed the process of consolidating all related pharmaceutical group companies: Gufic Stridden Bio-Pharma in FY 19 and Gufic Lifesciences in FY 22.

We believe it’s a move in the right direction as the companies were operating in the same line of business and from minority shareholder’s perspective, it didn’t make sense to have them as associate companies.

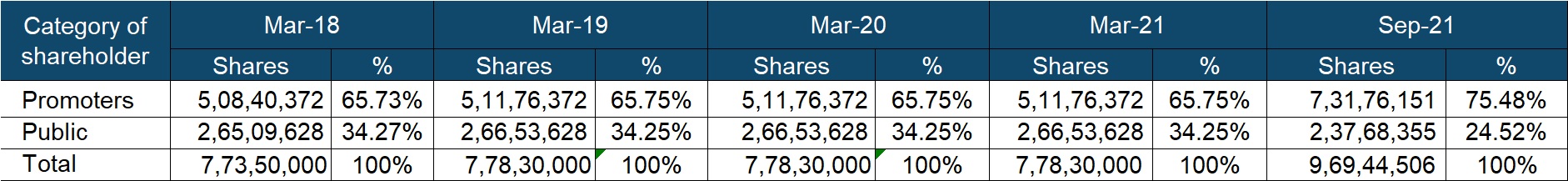

Shareholding – Promoters hold more than 75% stake in the company. In Jun’21 they got allotted 1.19 crore shares on account of the merger of Gufic Lifesciences with Gufic Bio. Further, one of the existing shareholders, Ms. Vipula Choksi got reclassified to promoter from public in the Sep’21 quarter.

Source: bseindia.com

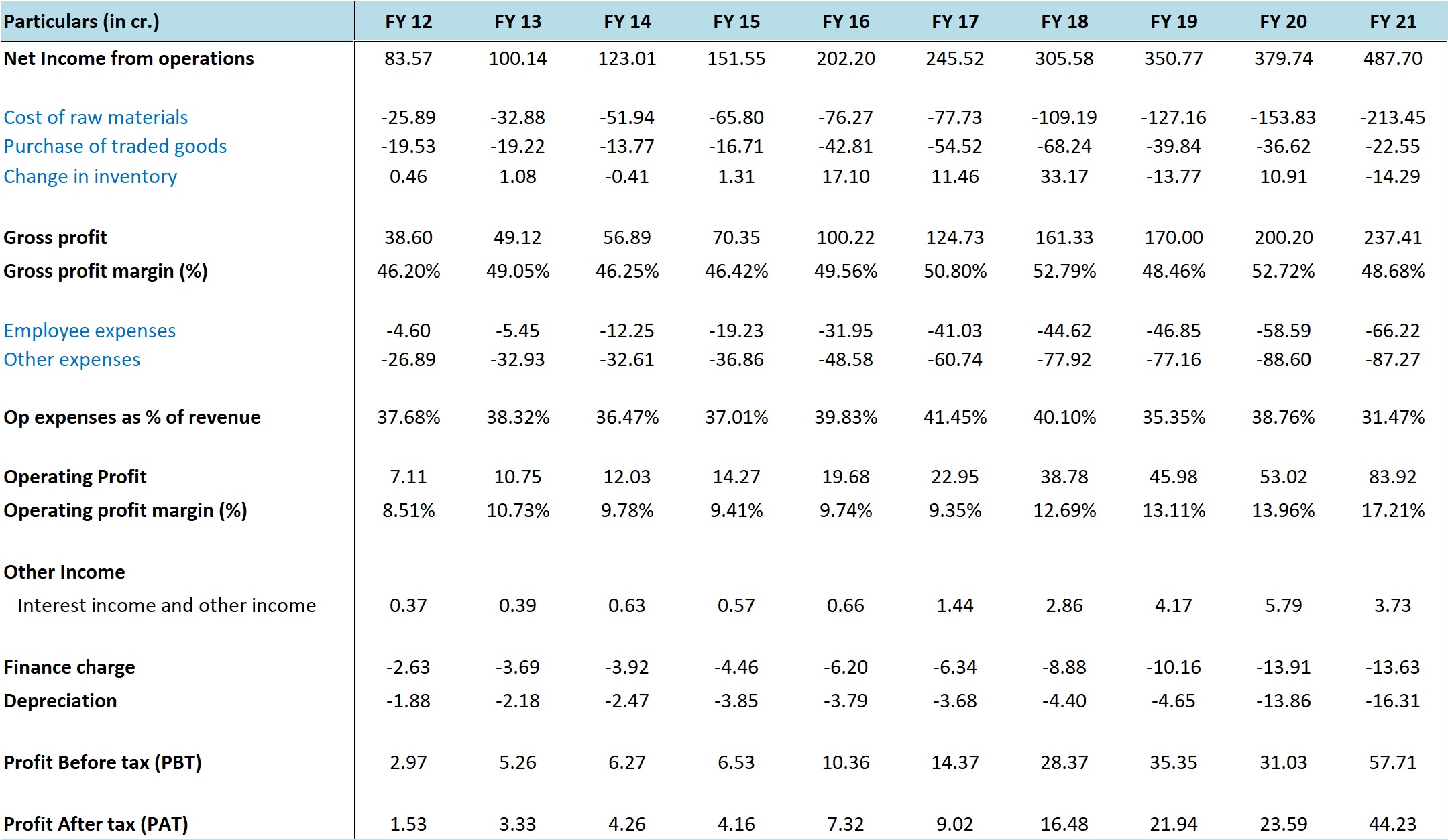

Performance Snapshot

Source: Gufic’s Annual Reports

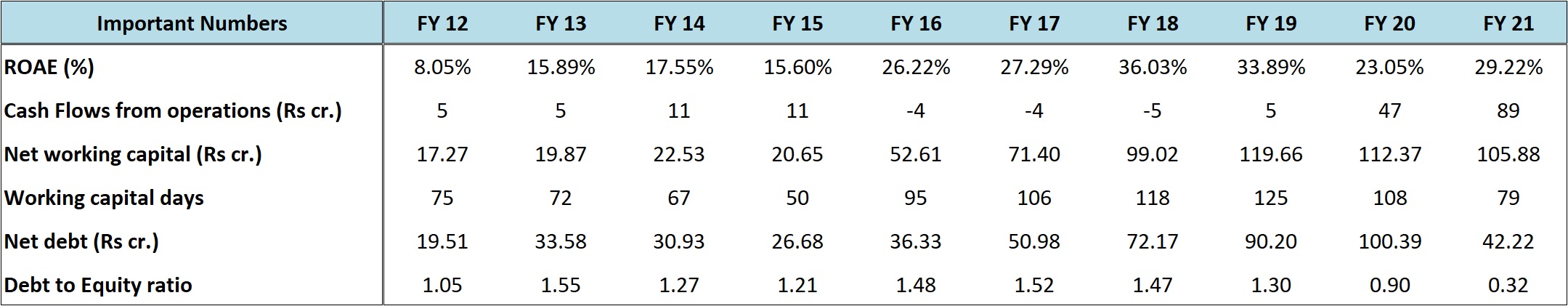

Gufic has been a very consistent performer across various metrics. Some important numbers are as below:

- Sales CAGR – 21% for 10 years; 20% for 5 years

- Operating profit CAGR – 30% for 10 years; 34% for 5 years

- Gross profit margin – 47.50% for FY 12-FY 16; 50.69% for FY 17-FY 21

- ROAE – 16.66% for FY 12-FY 16; 29.90% for FY 17-FY 21

- debt to equity ratio – 1.31 for FY 12-FY 16; 1.10 for FY 17-FY 21

- cash flows from operations – Rs 6 crore for FY 12-FY 16; Rs 26 crore for FY 17-FY 21

Source: Gufic’s Annual Reports

As the numbers indicate, the company has been very consistent in terms of sales growth and there’s been an all-round improvement in metrics like gross margins, operating margins, reduction in debt on both absolute and relative basis and return ratios.

In fact, at the end of Sep’21 quarter, the company was debt free on net basis with some surplus cash.

The working capital cycle had deteriorated a bit from FY 16 to FY 19; however, that has also shown signs of improvement since FY 20.

Margins – Over the years, Gufic’s EBITDA margins have expanded from 10-11% to around 17-18% currently. Most of the gains have come on the back of operating leverage and ~200 bps on the back of gross margin expansion.

As per the management, both domestic branded and international businesses command much higher gross margins of 55-60% against 35-40% for API business and 30% for CMO.

Currently, the gross margins are not reflecting the increasing contribution of branded domestic and international sales as each quarter company is investing substantial amount towards new product and dossier development which involves raw material and packaging costs for developing validation batches which are put into stability for 6 months or beyond and then a large part of it has to be written off.

Way forward – The management is guiding for 15-20% YOY growth in sales on the back of new product launches, potential applications of Botulinum toxin, new registrations in the international markets, geographical expansion and expansion in capacity.

On the margins front, with higher contribution of exports and branded domestic sales, the gross margins can expand further and the management expects EBITDA margins to increase to 21% in 2-3 years.

The company has started generating strong cash flows from operations and therefore we don’t expect any major increase in debt despite the upcoming CAPEX at Indore.

Valuations

At around current price of 180-190, Gufic is available at a market cap of Rs 1,800 crore and 21.7 times trailing twelve months earnings. The company is debt free on net basis.

We believe the company can close FY 22 with PAT of Rs 90-100 crore and thus the stock is available at 18-20 times FY 22 (E) earnings.

The company has been performing well with around 20% CAGR in sales and 30% CAGR in profits since FY 11. The company has also been performing well on metrics like margin improvement, leverage and return ratios.

As discussed above, Gufic is transforming from primarily a CMO company to domestic branded and international sales driven company. Further, it is also expanding the API division to reduce the impact of price volatility and dependence on imports.

The company has been doing well on the R&D front and continuously launching new products and new drug delivery systems. Development of Botulinum toxin and further exploring its various applications is indicative of the management’s intent to develop complex products.

Looking at the past track record and the various initiatives including capacity expansion, we believe the company should be able to sustain 15-20% CAGR for sales and profits. Improvement in margins for the reasons discussed above will be cherry on the cake and will push up the growth in profits.

Thus, at around 20 times trailing earnings, we believe the valuations are reasonable and therefore have a positive view on the stock. During periods of major correction, the stock may fall to 15 times earnings, but assuming the growth story remains intact, the downside over the medium to long term seems low.

Risks/concerns

There’s been a significant improvement in the performance of the company since covid-19 struck; though management has indicated that there was no major contribution of covid-19 drugs in the Sep’21 quarter, unless the company is able to maintain and improve upon its performance of the Sep’21 quarter, the stock could witness both lower profits and de-rating of valuations.

Some of the expenses, especially travelling related got curtailed in FY 21. If the company isn’t able to contain expenses and the gross margins don’t improve further, overall EBITDA margins of the company might contract, thus impacting both the profitability and the valuation multiple.

Company is still dependent on imports for some of the key raw materials and therefore huge volatility or the supply constraints could impact the production and the profitability of the company.

Disclosure: I don’t have any investment in Gufic Biosciences and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart.

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No