Dear Members,

We have released 31st Jan’22: Vadilal Industries Ltd (NSE Code – VADILALIND) – Alpha/Alpha Plus stock for Jan’22. For details and other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 31st Jan’22

CMP – 872.90 (BSE); 873.00 (NSE) Face Value – 10.00

Rating – Positive – 3% weightage (refer rating interpretation)

Introduction

Incorporated in 1982, Vadilal Industries limited (VIL) manufactures ice-cream, frozen desserts and processed foods.

The brand ‘Vadilal’ was promoted by Mr. Vadilal Gandhi who started ice-cream business in 1907. Currently, the operations of VIL are managed by the third and fourth-generations of the family.

The brand has healthy market share in the states like Gujarat, Rajasthan, UP and Haryana.

Outside India, the company sells its products in 45 countries under the brand ‘Vadilal Quick Treat’. The key markets for export are: USA, South-East Asia, Europe, Middle-East and Australia.

At around CMP of 870-880, we like the company for the following key reasons:

- Evolution from domestic ice cream brand to processed food exports – Between FY 12-FY 17, international sales accounted for 10-11% of the overall consolidated sales of the company and remained range bound between Rs 35-50 crore. Since then, international sales have exploded from ~ Rs 50 crore in FY 17 to Rs 217 crore in FY 21.

- Major growth in US market – VIL’s subsidiary in US reported sales of Rs 6.41 crore in FY 16 and PAT of Rs 0.19 crore. In FY 21, the same subsidiary reported sales of Rs 181.37 crore and PAT of Rs 29.67 crore.

- Expected improvement in margins with higher contribution from US subsidiary – In the domestic business, VILs EBITDA margins have largely moved between 11-13%; however, the US subsidiary recorded EBITDA margins of 22% + in FY 21. The average realizations in the export markets are higher than the domestic markets.

- As the US subsidiary’s contribution increases further from 30% (on normalized sales), we believe it will have a positive impact on the margins and profitability of the company.

- Domestic ice cream business to resume normal operations from FY 23 – Domestic ice cream business was badly impacted in FY 21 and FY 22 as the Q1 of both the years got impacted due to the 1st and the 2nd wave of covid-19. Barring unforeseen circumstances, we believe FY 23 should be a normal year of operations for the domestic ice cream business.

- Expected improvement in balance sheet – Here again, due to the extremely profitable nature of the operations of the US subsidiary, it is cash rich and will gradually help lower the leverage on the consolidated basis and improve the overall debt profile of the company.

- Valuations – On TTM basis the company has recorded sales of Rs 600 crore + and PAT of Rs 41 crore. This is despite the major impact of 2nd wave of covid-19 in the Jun’21 quarter which is also the biggest quarter for the company on the domestic front. In a normal year, the sales would have been Rs 700 crore + and PAT of around Rs 60 crore.

- At around 10 times earnings (on normalized basis) and less than 1-time sales, we believe the valuations are quite reasonable.

Business details

VIL manufactures ice-cream, frozen dessert, and frozen foods.

The company markets its products under two brands: Vadilal and Vadilal Quick Treat.

In India, it sells ice cream and frozen desserts under Vadilal brand and processed foods under Vadilal Quick Treat; while globally the entire sales are under Vadilal Quick Treat.

Domestic business

In India, Vadilal is amongst the top 10 brands in the ice cream segment.

The brand has healthy market share in the states like Gujarat, Rajasthan, UP and Haryana. The product portfolio of VIL’s ice-cream and frozen dessert includes more than 150 flavours and varieties in different forms like cups, candies, cones, kulfis, tubs, large packs, etc.

As per CARE’s credit rating report, VIL earns nearly 70%-75% of its ice-cream revenue from the states of Gujarat, Rajasthan, Uttar Pradesh and Haryana; whereas balance comes from the other states.

| FY 13 | FY 14 | FY 15 | FY 16 | FY 17 | FY 18 | FY 19 | FY 20 | FY 21 | |

| Domestic Sales (Rs cr.) | 284.72 | 314.48 | 358.32 | 419.49 | 440.36 | 465.00 | 442.35 | 446.44 | *252.35 |

| * FY 21 – covid-19 impact | |||||||||

Source: VIL’s Annual Reports

VIL has also ventured into processed foods business under the brand ‘Quick Treat’ and the product portfolio includes frozen vegetables, ready-to-eat frozen snacks, Indian bread and curries, paneer and flavoured milk.

However, in the domestic market, ~90% of its sales come from ice-cream and the remaining from processed foods segment.

Impulse purchases vs bulk packs – Earlier, VIL was a bulk ice-cream player; however, over the years it has shifted its product range to the impulse category with price points ranging from Rs 5 to Rs 50.

Impulse category today accounts for ~75% of the total ice-cream sales and the remaining comes from bulk sales to hotels, restaurants, catering segments, etc.

Seasonality – In India, ice cream is a highly seasonal business with sales and profitability skewed towards Q1 in each financial year.

Historically, the first quarter of the financial year has contributed to about 40% of the company’s sales and 80% of its profitability; however, the same is set to change now with increasing contribution from the international markets.

Distribution – In the domestic market, majority of the sales of the company are through a related party, Vadilal Enterprises Limited (VEL). Through VEL, the company has marketing presence in 23 states of India with the support of 63 C&F agents, over 1,200 distributors, more than 55,000 retailers and 290 distribution vehicles.

It also offers a wide range of ice-cream and frozen desserts in leading modern trade outlets like Reliance Fresh, More, Hyper City, D-Mart, Food Bazaar and Star Bazaar, etc.

As per the agreement between VIL and VEL, the pricing of the products to be sold is determined by VIL.

Manufacturing – VIL has two ice cream manufacturing units with total capacity of 3.8 lakh litre/day (LPD) day and one processed food plant with a daily capacity of 33,000 kg/day.

As per the management, the ice cream capacity operates at 90-95% capacity utilisation in the peak summer season and 10-15% in the winter season. Therefore, the average utilization turns out to be around 40%.

Thus, rather than investing in capex for further expansion, VIL has undertaken the strategy of producing during the off-season to evade the risk of running out of capacity during the peak season.

Raw material – The major raw materials for manufacturing of ice-cream are SMP (skimmed milk powder), milk, cream and nuts, which VIL procures from local dairies near its manufacturing units.

It also procures palm oil for manufacturing frozen dessert.

International business

VIL sells ice cream, frozen dessert and processed foods in overseas markets such as USA, South-East Asia, Europe, Middle-East, Africa and Australia.

The company seems to offer a much wider range of products in the overseas markets than in India:

| Ice-creams | Dairy | Processed Foods |

| Ice cream tubs | Frozen Mithai | Sprouts and beans |

| Kulfi tubs | Shrikhand | IQF Vegetables |

| Sugar Free tubs | Paneer | Fruits and pulps |

| Matka Kulfi | Khoa-butter | Ready to serve |

| Kulfi sticks | Badam milk | Flavours of Gujarat |

| Dollies and Bars | Snacks | |

| Cassatta | Indian Breads | |

| Cones | ||

| Mithai ice cream |

Source: Vadilal World website

As per the management, in USA, the brand has leaped ahead to become America’s largest selling Indian ice cream brand. This doesn’t sound surprising considering almost 9x increase in US subsidiary’s sales in the last 4 years.

| (Rs cr.) | FY 13 | FY 14 | FY 15 | FY 16 | FY 17 | FY 18 | FY 19 | FY 20 | FY 21 |

| Sales to other countries | 32.89 | 46.48 | 43.90 | 34.74 | 31.44 | 31.21 | 30.38 | 29.46 | 35.93 |

| Sales by US subsidiary | 5.13 | 6.25 | 4.07 | 6.41 | 17.72 | 54.11 | 99.44 | 127.13 | 181.37 |

Source: VIL’s Annual Reports

In fact, US contribution to VILs sales has leapfrogged from 1-2% a few years back to around 25-30% (on normalized basis).

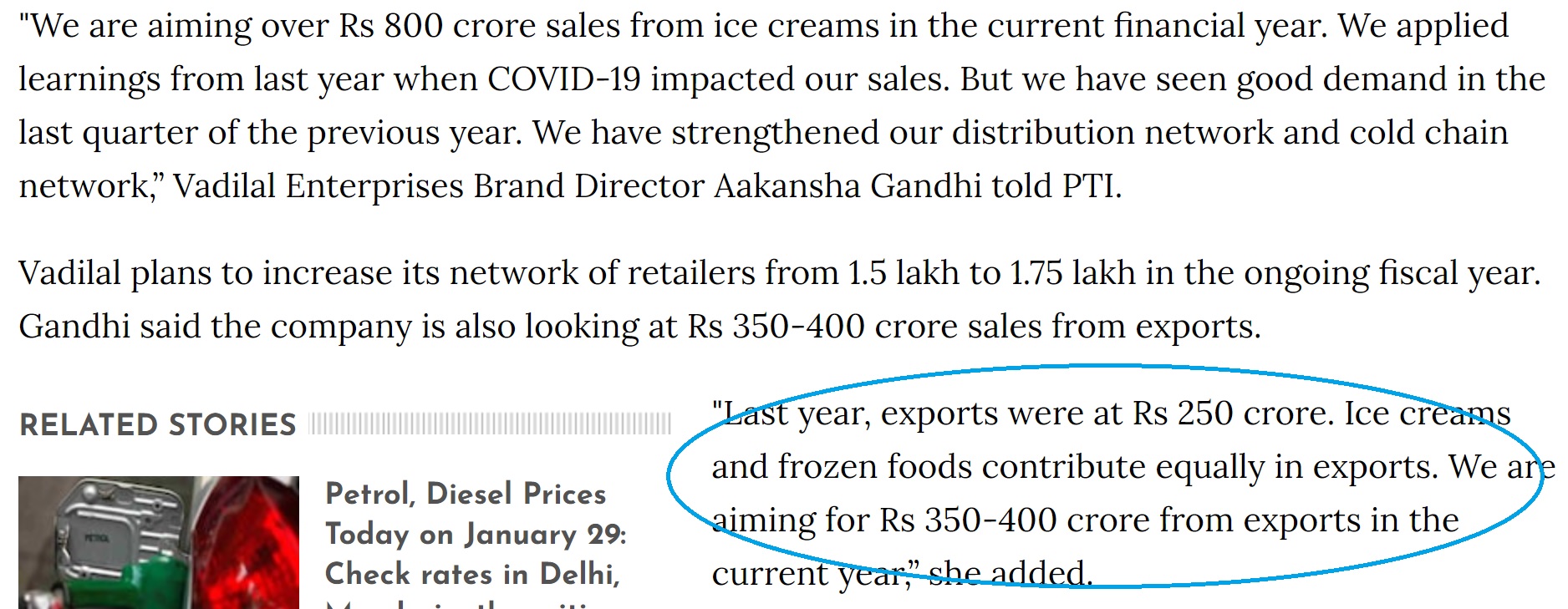

Ice cream vs processed foods – While the company doesn’t give the actual break up of sales between ice cream and processed foods, the recent interviews of the management suggest that both contribute almost equally in the international markets.

Source: moneycontrol

It is also important to note that till 4-5 years back, sale of mango pulp used to account for major share of the processed foods export; however, on account of very low margins in the same, the company has largely discontinued it and focusing on more profitable segments like ready to serve, ready to eat, ice cream, Indian mithai, etc.

Industry outlook

Domestic ice-cream industry –

Source: Indpaedia

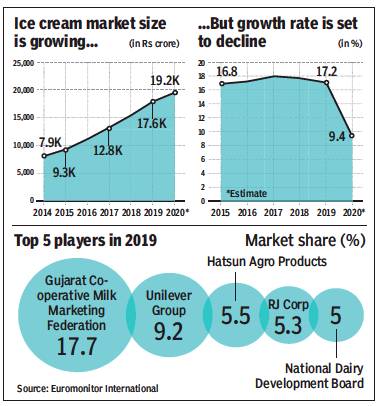

As the industry has too many players and largely unorganized, there’s no reliable source of data; however, various reports peg the industry size between Rs 15,000-20,000 crore.

Amul, HUL (Kwality Wall’s), Hatsun Agro, Havmor, Vadilal, etc are amongst the largest brands in the domestic market.

The industry, which was pegged at around Rs 17,639 crore in 2019 by Euromonitor, lost a major chunk of its annual sales due to covid-19 in both FY 21 and FY 22.

In the summer months of Mar-June, the industry generates around 60% of its annual domestic sales and both the seasons were impacted by the lockdown and the absence of migrant workers, who man ice cream carts in several markets across the country.

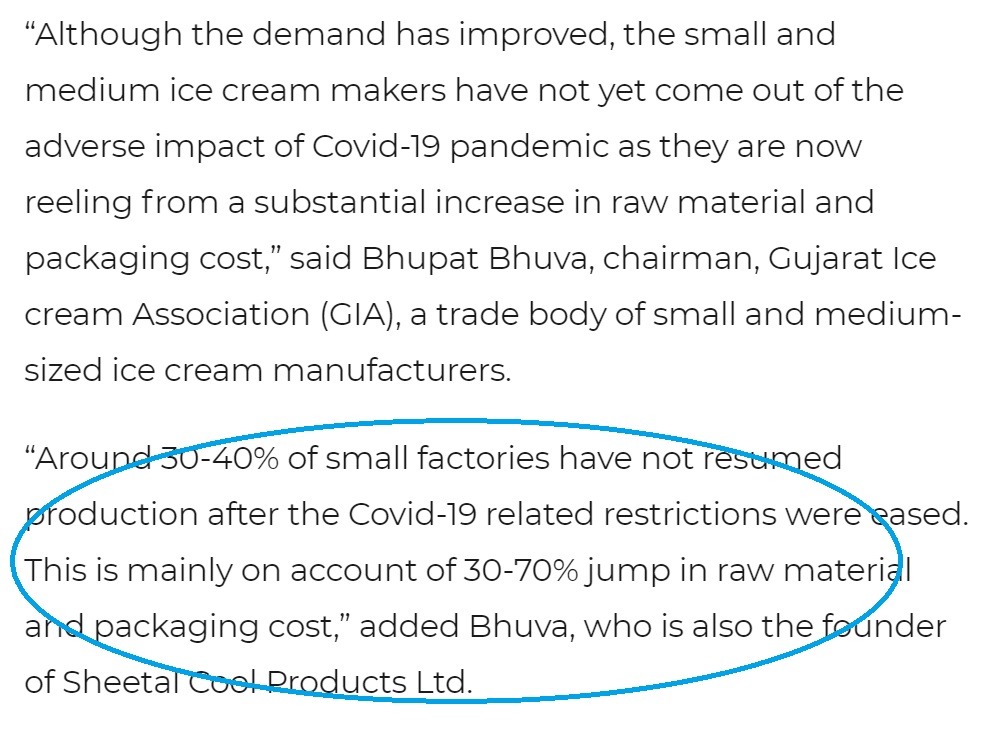

As per the Mar’21 report, while the big companies have started reporting a turnaround, the small and medium players have not yet come out of the woods and this could play to the advantage of companies like Vadilal.

Source: Times of India

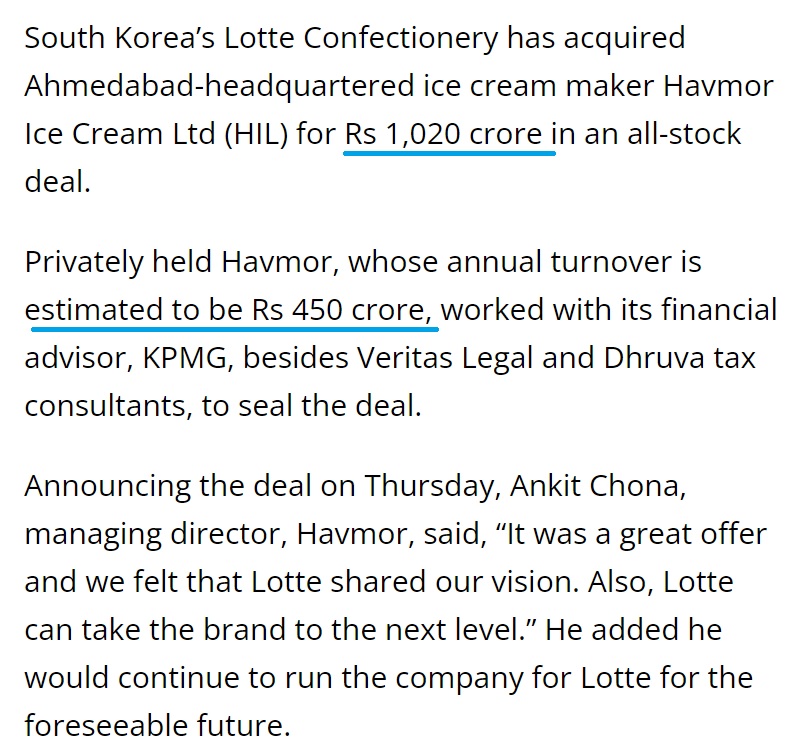

Havmor ice-cream deal – In 2017-18, Lotte Confectionery acquired 100% stake in Havmor Ice Cream Limited (HIL) for Rs 1,020 crore.

Then, Havmor’s annual turnover was estimated to be Rs 450 crore and therefore the deal happened at 2.26 times annual sales.

Source: Business Standard

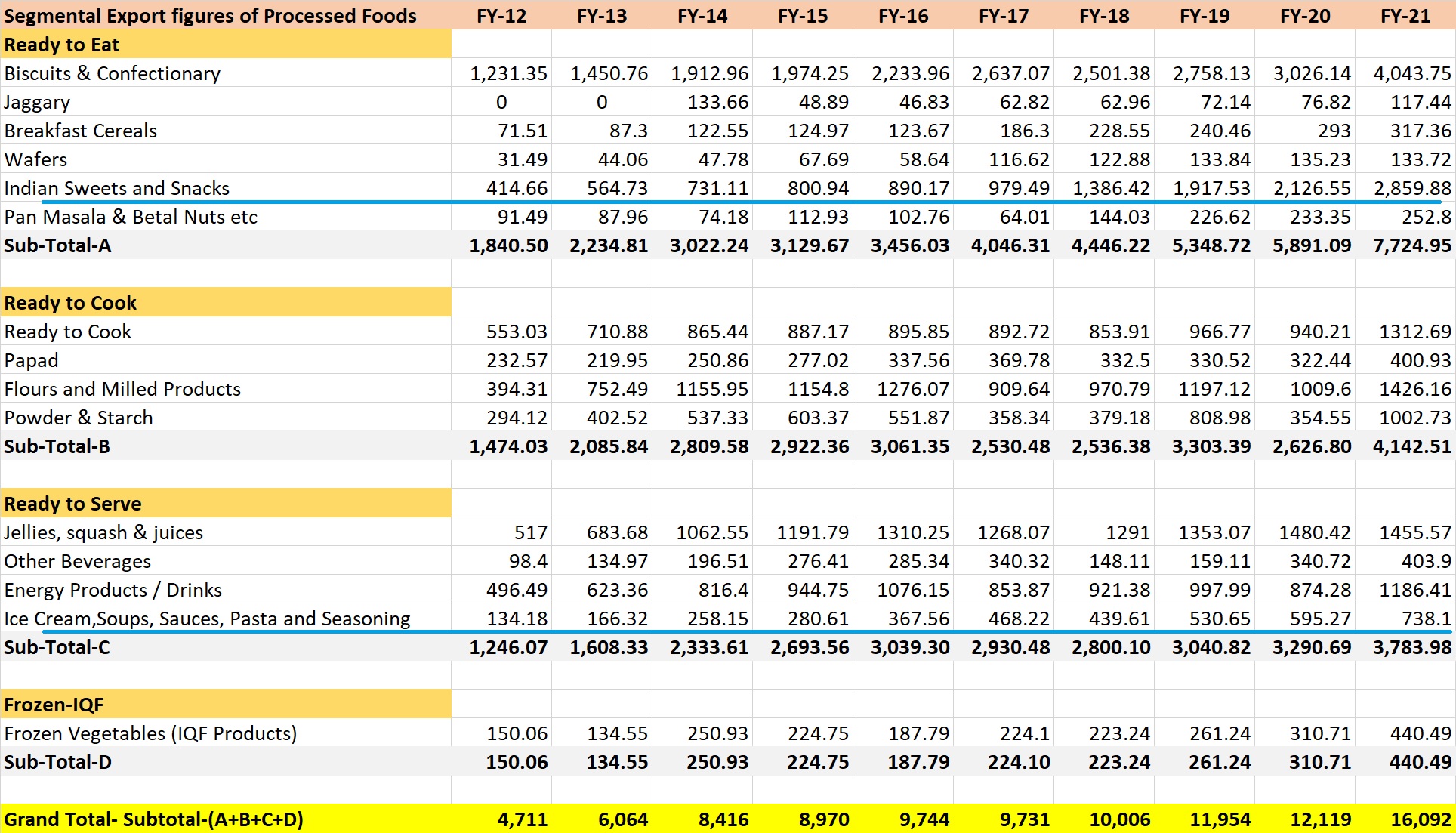

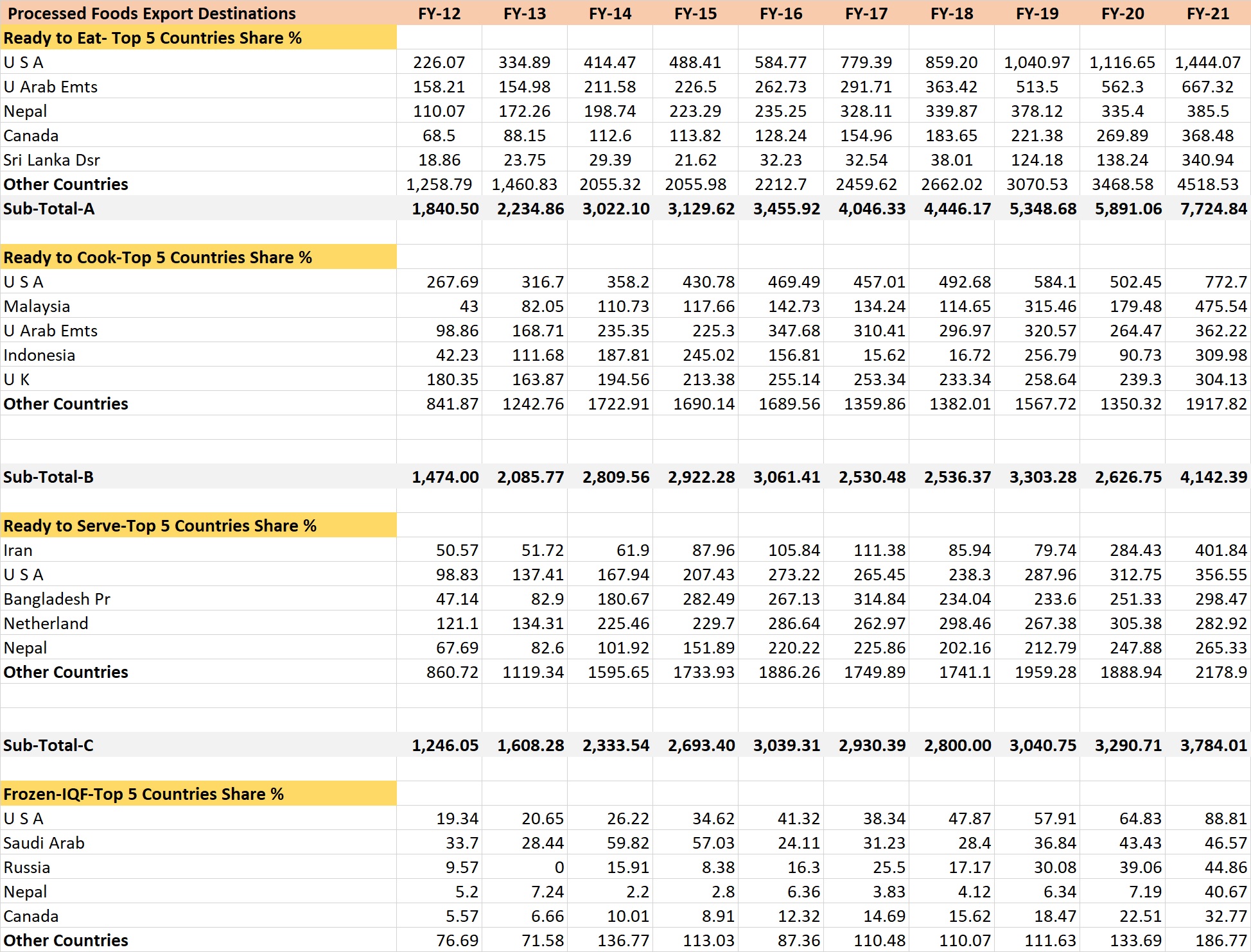

Ice-cream and other processed foods export – Based on the data available on APEDA Agri exchange, India is doing quite well in the export of various kinds of processed foods.

Some major points that came out from the data:

- Indian sweets and snacks segment has been the most consistent and the fastest growing segment across the last 10 years

- Another segment that has been very consistent in terms of growth is – Ice cream, soups, sauces, pasta

- Almost all the segments have reported double digit growth across the 3-, 5- and 10-years cycles

- US is the biggest destination for exports in almost all the segments

Source: agriexchange.apeda

Source: agriexchange.apeda

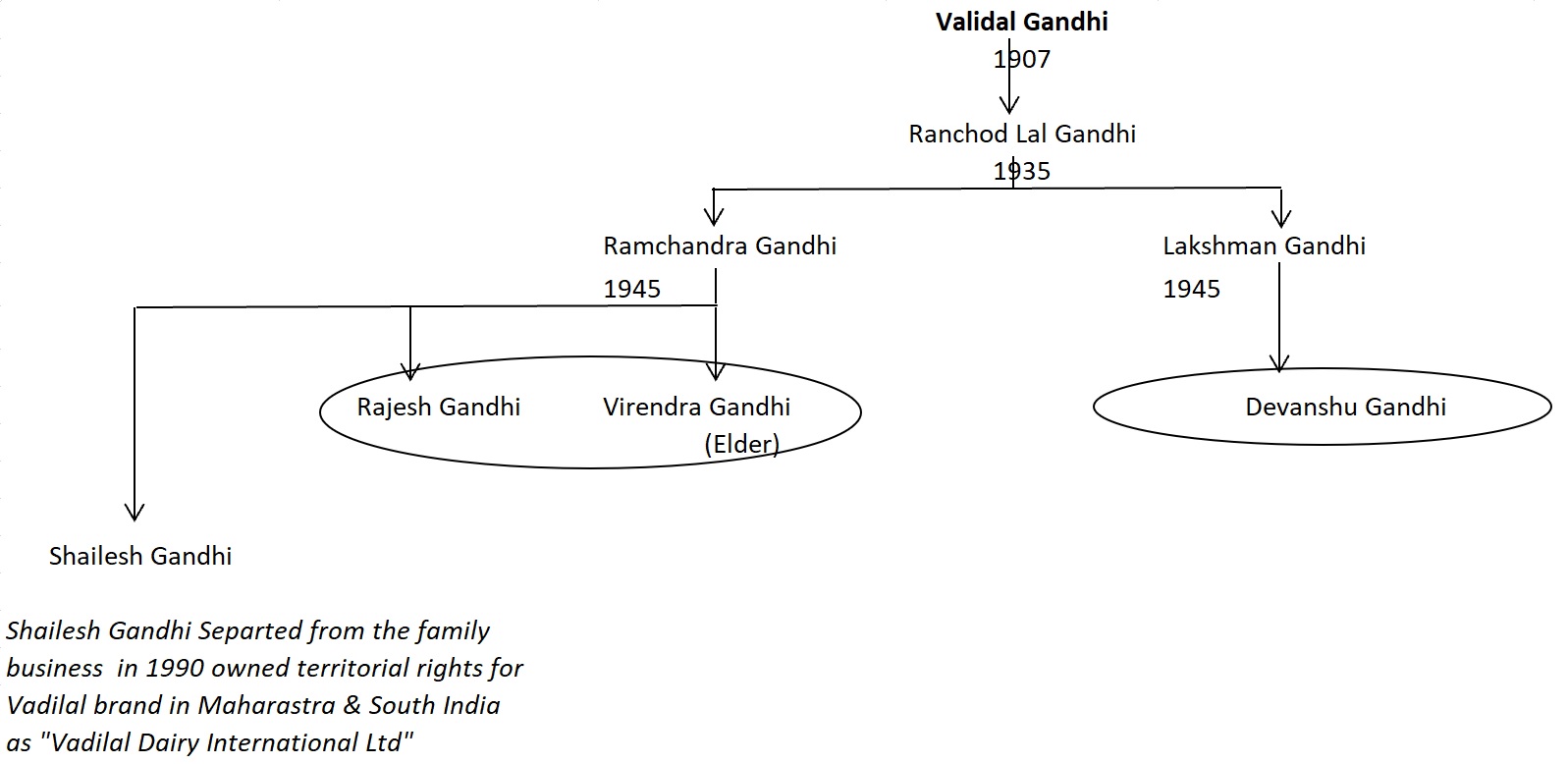

Promoters/Management

VIL is an owner operated business. Currently, the operations of VIL are managed by the third and fourth-generations of the family i.e., Mr. Rajesh Gandhi, Managing Director, Mr. Devanshu Gandhi, Managing Director and Mr. Kalpit Gandhi, Director and CFO (son of Mr. Rajesh Gandhi).

While Mr. Rajesh Gandhi looks after the overall operations of the company, Mr. Devanshu Gandhi looks after the sales, marketing and distribution functions. Apart from the finance function, Mr. Kalpit Gandhi looks after the plant operations on day-to-day basis.

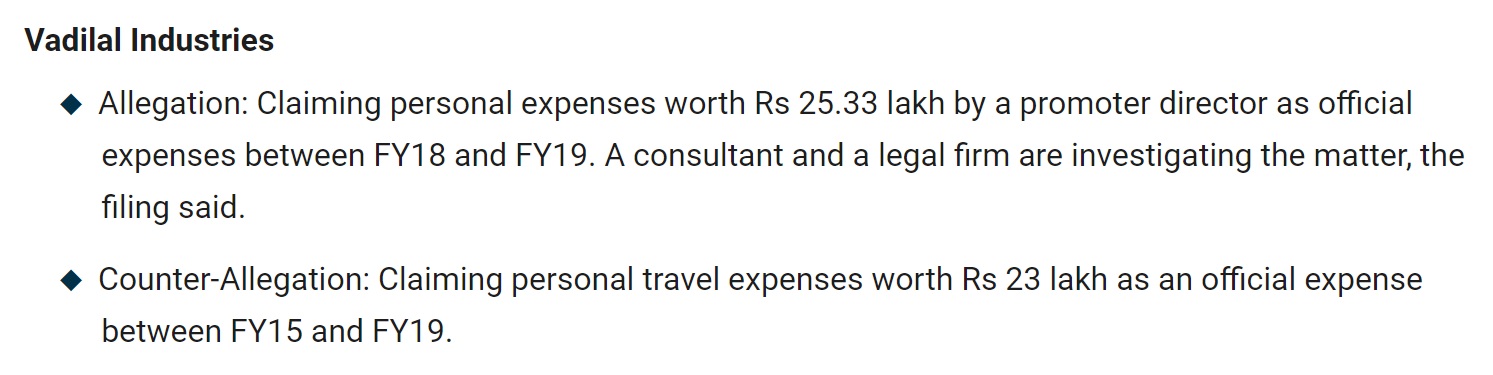

VIL’s promoters have had an acrimonious relation in the past. In 1990s, Shailesh Gandhi separated from the family business. In 2015, Virendra Gandhi levelled allegations against Rajesh Gandhi and Devanshu Gandhi.

Recently, Rajesh and Devanshu Gandhi traded allegations for a year, but later on withdrew all the allegations except two, one each related to VIL and VEL.

Source: bloombergquint

While the amounts involved in the allegations are small, the acrimonious relation between the promoter-directors isn’t good from the perspective of well-being of the company.

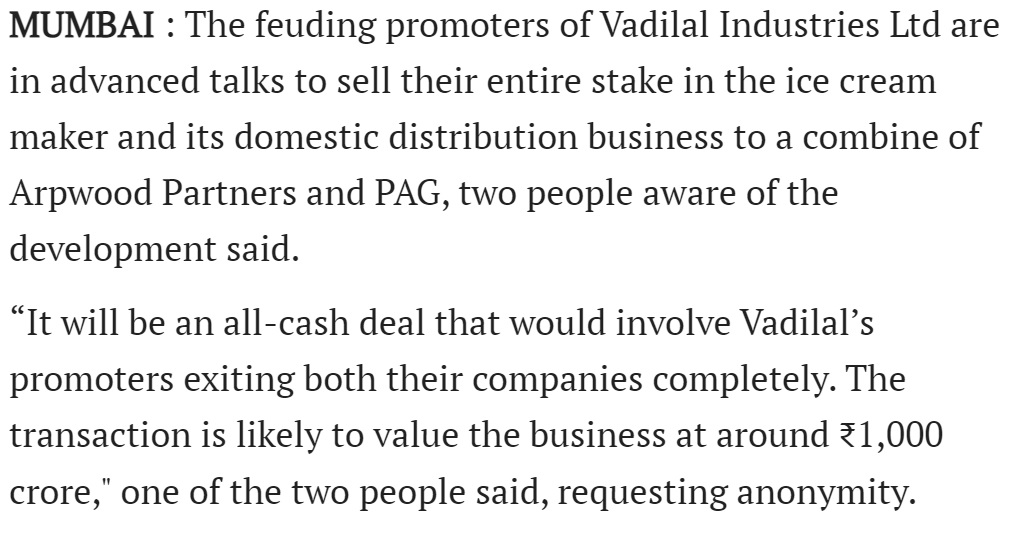

However, what’s interesting is that before covid-19 struck, there was a news of the promoters of Vadilal being in advanced talks with two PE firms, Arpwood Partners and PAG to sell their entire stake in VIL. The transaction would have valued the business at around Rs 1,000 crore.

Source: livemint

It’s important to note here that since then the US business has more doubled and the domestic business is likely to return to normalcy in FY 23. So, if at all the deal goes through, it is likely to be at higher valuations.

Shareholding – Promoters hold more than 60% stake in the company and since the company has never diluted any equity in the last several years, their stake in the company has largely remained same at around 65% for the last many years.

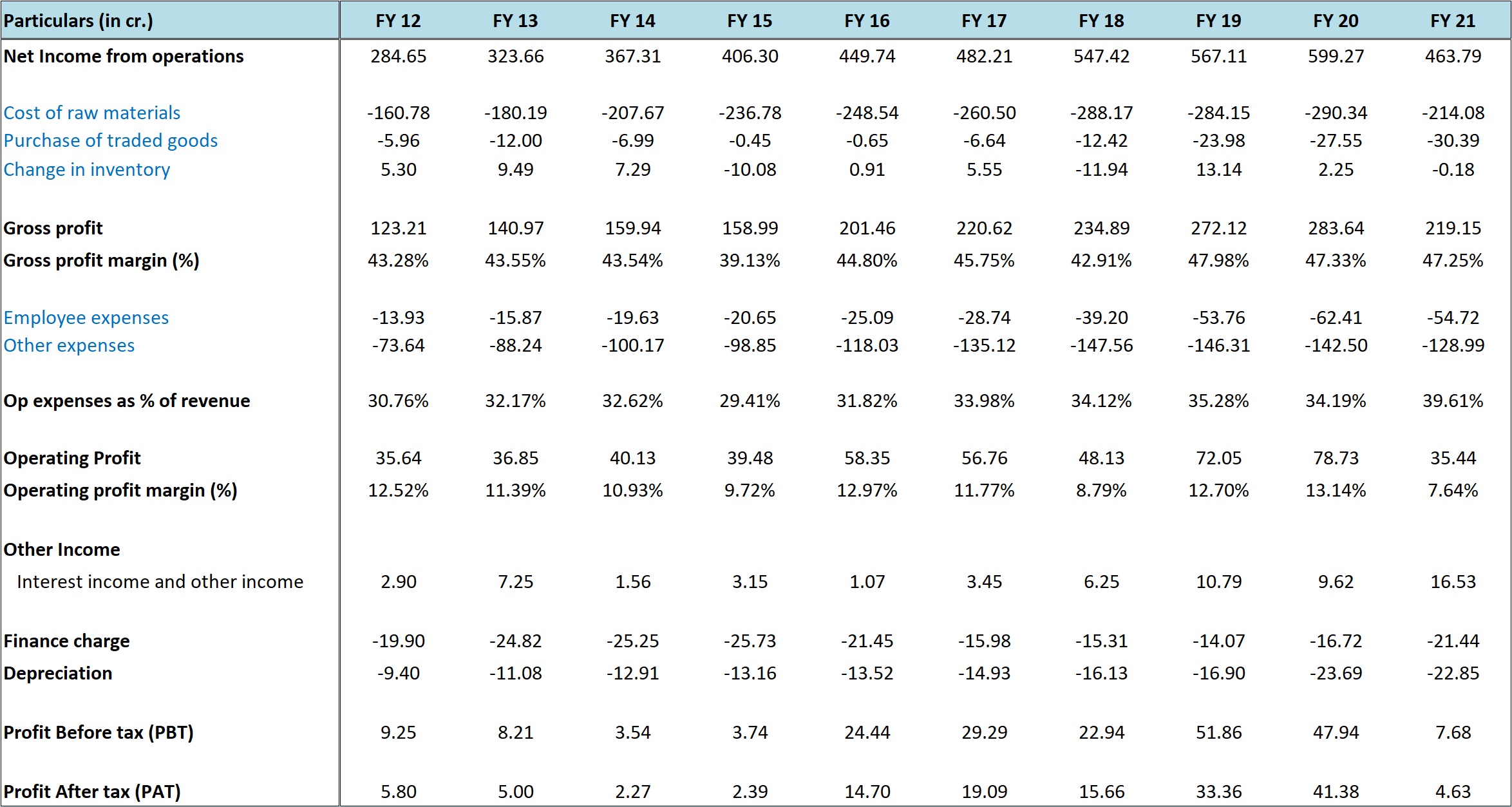

Performance Snapshot

Source: VIL’s Annual Reports

Above is the consolidated P/L snapshot of VIL. However, it fails to capture the transformation in the numbers taking place since the last 2-3 years.

For the same, we will have to look at the domestic business sales, international sales and the US sales and profit numbers separately.

| FY 13 | FY 14 | FY 15 | FY 16 | FY 17 | FY 18 | FY 19 | FY 20 | FY 21 | |

| Domestic Sales (Rs cr.) | 284.72 | 314.48 | 358.32 | 419.49 | 440.36 | 465.00 | 442.35 | 446.44 | *252.35 |

| * FY 21 – covid-19 impact | |||||||||

Source: VIL’s Annual Reports

| (Rs cr.) | FY 14 | FY 15 | FY 16 | FY 17 | FY 18 | FY 19 | FY 20 | FY 21 | H1 FY 22 |

| Sales to other countries | 46.48 | 43.90 | 34.74 | 31.44 | 31.21 | 30.38 | 29.46 | 35.93 | |

| Sales by US subsidiary | 6.25 | 4.07 | 6.41 | 17.72 | 54.11 | 99.44 | 127.13 | 181.37 | |

| US PAT | -1.18 | -1.37 | 0.19 | 2.52 | 2.65 | 4.53 | 9.09 | 29.67 | 22.31 |

| PAT excluding US subsidiary | 3.45 | 3.76 | 14.51 | 16.57 | 13.01 | 28.83 | 32.29 | -25.04 | 3.09 |

Source: VIL’s Annual Reports

Important points from the above numbers:

- Domestic sales had more or less stagnated around Rs 450 crore before covid-19 struck

- While the domestic sales had stagnated, the company had become more efficient and the profits (excluding US subsidiary PAT) gradually increased to 25-30 crore

- US business has gained massive momentum in the last 4-5 years with sales expanding 10x from Rs 17.72 crore to Rs 181.37 crore in FY 21

- US business is highly profitable as the same could achieve similar profitability as the parent company VIL, at less than half the sales

- For H1 FY 22 US business has again reported very strong numbers with 50% + growth in sales over H1 FY 21 and already achieved PAT of Rs 22.31 crore against Rs 12.67 crore in H1 FY 21

- Assuming normalcy of domestic operations in FY 23 and no growth in US business, the company should be able to record consolidated PAT of Rs 55-65 crore

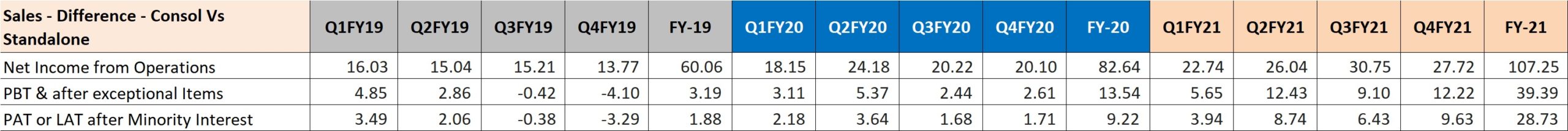

We also looked at the quarter wise numbers of US subsidiary and it’s good to note that unlike the domestic operations which are highly seasonal, US subsidiary’s sales are more consistent across the quarters.

Source: Screener

It’s important to note here that the above sales numbers do not represent the actual US subsidiary sales. They represent the difference between the consolidated and the standalone numbers and therefore cancel out the impact of sale of raw material by VIL to US subsidiary.

US subsidiary is also cash rich with net surplus cash of around Rs 15 crore at the end of FY 21.

Way forward – As depicted above, domestic business has more or less stagnated with annual sales of around 450 crore and PAT of Rs 25-30 crore. Even before stagnating, the growth was in single digits.

Going forward, we don’t expect any major fireworks from the domestic business.

However, looking at the growth of the processed foods export from India and VILs own performance, especially the US subsidiary and its growing contribution to the overall sales and profits of the company, the base PAT should be around Rs 60 crore with scope for double digit growth in PAT due to higher margins in the US business.

As mentioned above, the management is targeting 40% + growth in international sales in FY 22 from ~ Rs 250 crore to Rs 350-400 crore and for H1 FY 22 the US subsidiary has already reported 50% + growth in sales.

The US subsidiary has already reached 50% of the overall profit (on normalized basis) of the company and going forward the impact of the same will be profound on the overall operations of the company.

Valuations

At around current price of 870-880, VIL is available at a market cap of Rs 630 crore and 15.36 times trailing twelve months earnings. Company’s debt to equity ratio is around 0.5.

We believe the company can close FY 23 with PAT of Rs 55-65 crore and thus the stock is available at 9.7-11.5 times FY 23 (E) earnings.

We are talking about FY 23 because the ongoing FY 22 was again impacted by the 2nd wave of covid-19.

The company’s US subsidiary has started performing extremely well, has grown 10x in sales in the last 5 years, is extremely profitable, net debt free and now contributes ~50% to the profits of the company (on normalized basis) as against reporting losses in FY 15.

From the above sections, we also know that around 2 years back the promoters were looking to sell their stake in the company while giving it a valuation of around Rs 1,000 crore.

We also know that in 2017-18 Lotte Confectionery acquired 100% stake in Havmor Ice Cream Limited (HIL) for Rs 1,020 crore when the estimated annual turnover was Rs 450 crore and therefore the deal happened at 2.26 times annual sales.

Until now, the growth factor was lacking in VIL; however, that could change now assuming US subsidiary continues on its growth path.

Thus, at around ~ 10 times FY 23 (E) earnings, we believe the valuations are reasonable and therefore have a positive view on the stock. Stake sale by the existing promoters, if at all, can prove to be a positive trigger for the company.

After reaching a high of 1,240 in Aug’21, the stock is currently in a downtrend and may find support around 750-800 odd levels.

Risks/concerns

As mentioned above, promoters have had an acrimonious past. While they have withdrawn most of the allegations against each other, such issues may surface again and will negatively impact both the prospects and the investor’s perception about the company.

In our thesis and analysis, the performance and the growth of the US subsidiary plays a crucial role. If for some reason, the performance of the US subsidiary fizzles out or if it is not able to maintain the same level of sales and profitability as FY 21, the growth potential of the company will be severally hampered.

Vadilal has seemingly lost market share in the domestic ice-cream business. Any further loss in market share or its inability to maintain the normalized annual sales of around Rs 450 crore will impact the growth prospects of the company.

Disclosure: I don’t have any investment in Vadilal Industries and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart.

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No