Hello Sir,

Hope you are doing well.

In the last 1 month there has been flurry of good news for Investors who have a 3-4 years investment horizon or more. Let's look at them:

'SIP stoppage ratio, the ratio of closed accounts under SIP to new account openings, shot to 27 months high of 0.68 in Feb against long-term average of 0.51'

Clearly, those who wanted quick returns and didn't know about market cycles are losing interest and clearing way for medium-long term investors to accumulate stocks at good valuations. Here's another one:

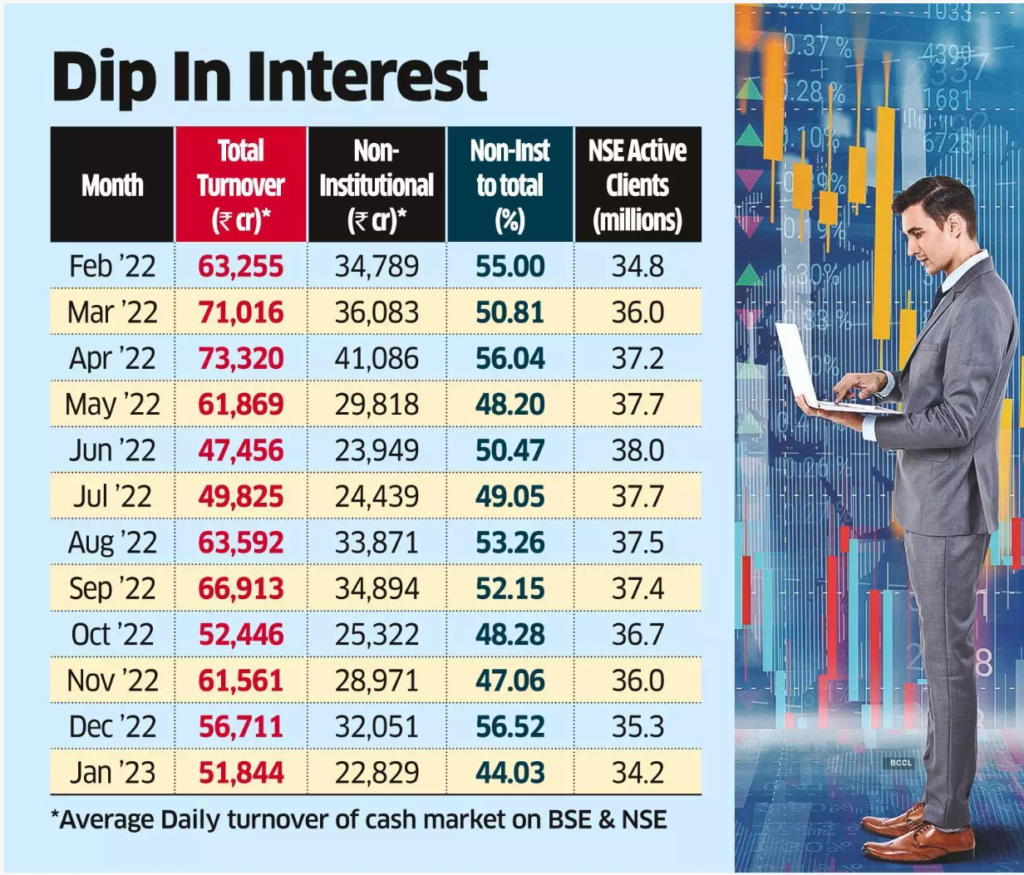

'Individual investor participation in shares dropped to 34 months low in Jan'23.

Daily cash market average volumes of non-institutional investors (Retail and HNI investors) were at 22,829 crore in Jan'23. This is the lowest since Mar'20 and 61% below peak of 58,409 crore in Feb'21’

Source: Economic Times

Source: Economic Times

How is this good news for medium-long term investors?

If you have been investing for 8-10 years or more, you will realize that such times usually prove to be good periods for accumulating stocks for medium-long term.

As the investor participation is low, one gets good stock prices and enough time for gradually building a position in the stock.

Check out the below data on investor participation in earlier years.

Source: BSE India

Source: BSE India

FY 01, FY 08 and FY 18 marked the peaks of equity turnover and the same also coincided with the peaks of broader market.

The turnover dropped significantly in FY 02, FY 03, FY 09, FY 12, FY 13, FY 19 and FY 20 and coincided with market lows. We know how markets went up in 2020 and 2021 after the lows of 2019.

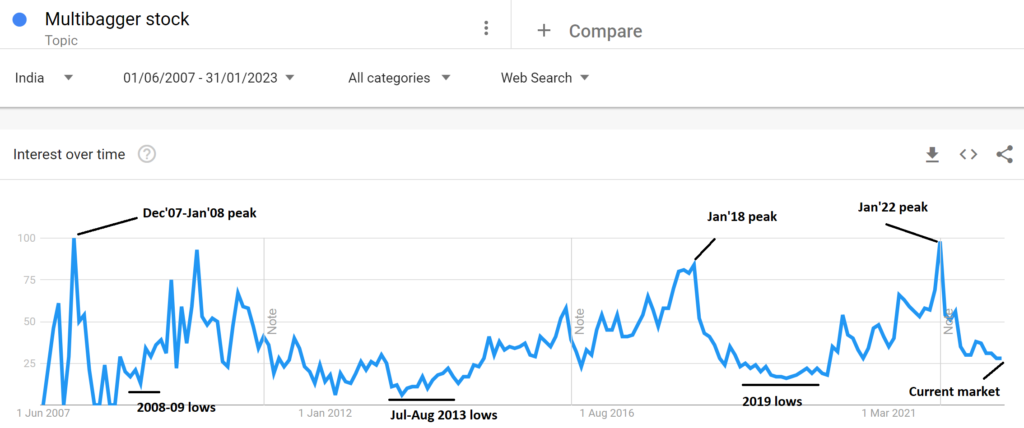

Another chart which indicates that it’s a good market for accumulation is the Google Trends – Multibagger chart.

Source: Google Trends

The above graph depicts investor participation (through google search for term “multibagger stock”) at various points of time.

The chart peaked out just around the time markets peaked out. Similarly, Google Trends – Multibagger chart bottomed out around the time markets bottomed out.

Currently, Google Trends – Multibagger chart is around 2019 lows.

If you accumulated stocks in 2019, you got greatly rewarded in 2020-22.

We think something similar will pan out over the next 2-4 years.

Remember, we don’t expect immediate gains. In fact, the markets could remain rangebound or in a slow decline mode. But, unless you know how to perfectly time the market and buy just at the bottom or just before the up move starts, it’s a good time for medium-long term investors for accumulating stocks.

(End)

If you are looking for wealth creation with growth stocks do check out our premium subscriptions. We have been helping our clients with our stock research for over a decade now.

Happy Investing.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here - LINK