Dear Members,

We have released 30th Mar’23: 20 Microns Ltd (NSE Code – 20MICRONS) – Alpha/Alpha Plus stock for Mar’23. For details and other updates, please log into the website at the following link – http://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 30th Mar’23

CMP – 65.69 (BSE); 66.00 (NSE) Face Value – 5.00

Rating – Positive – 4% weightage (this is not an investment advice, refer rating interpretation)

Introduction

20 Microns Ltd (20 ML), the flagship company of the 20 Microns group was incorporated in 1987 by Mr. Chandresh Parikh to manufacture micronized minerals.

Today, it is among the largest producers of white minerals with access to captive mines.

Backed by seven mines (five captive and two leased), nine state-of-the-art manufacturing facilities and two R&D centres, the company’s white minerals help the company cater to a cross section of industries across the globe.

20 ML supplies to large and organised players in the paint industry, polymer, construction chemicals, rubber, paper, and a host of other industries.

At around CMP of 66, we like the company for the following key reasons:

- Sound financials – Since FY 15, the performance of the company has been decent with steady growth in sales, consistency in EBITDA margins, reduction in debt and interest cost and overall improvement in profitability

- Increasing focus on value added products – While nearly 50% of the products under 20ML are commoditised in nature, the remaining products are more specialised, depending on value addition

- The products under the subsidiary – 20ML Nano – are more specialised in nature and have higher value addition

- The management has been enhancing focus on innovative mineral-based products in the field of functional fillers, extenders, and specialty chemicals

- Captive mines – 5 captive and 2 leased mines acts as a strategic raw material source

- Exit from CDR and release of pledged shares – In FY 15-FY 16, due to low capacity utilization of expanded capacity, the company suspected strain on cash flows and approached the banks for restructuring of loans with interest payable there on

- In FY 22, the company exited the CDR by paying Rs 11.55 crore to its banks as part of recompense and got the pledged shares released

- As per CRISIL, pursuant to the CDR exit process, company has also been able to bring down its borrowing rates significantly

Last, but not the least, we believe the valuations of the company are extremely compelling considering the factors discussed above. At around CMP, the stock is available at only 5.40 times trailing twelve months earnings and around 0.8 times book value.

Business details

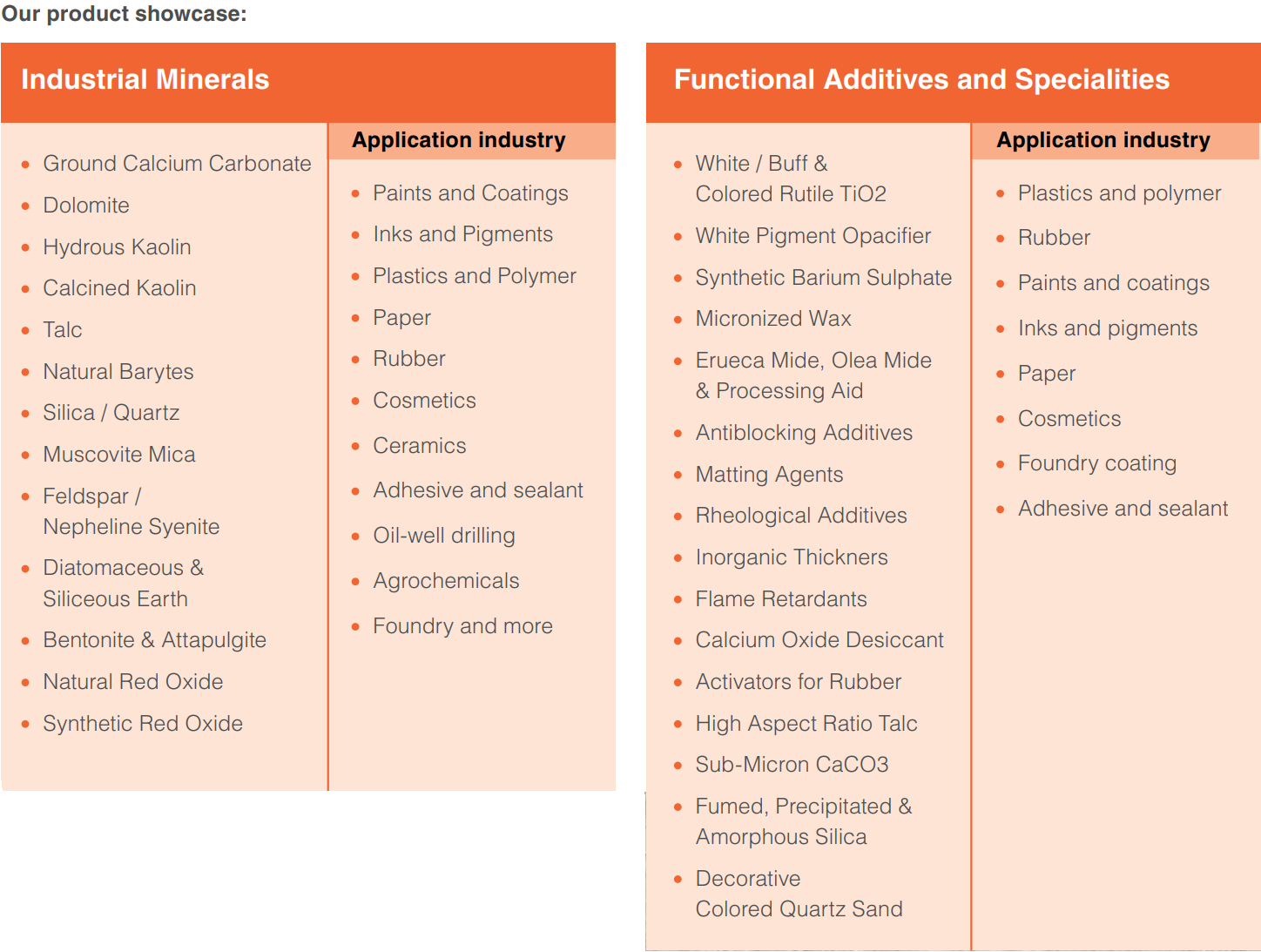

20 Microns Ltd (20 ML), the flagship company of the 20 Microns group, was incorporated in 1987 by Mr. Chandresh Parikh to manufacture micronized minerals.

It is one of India’s largest producers of industrial minerals offering products in the field of Functional fillers, Extenders, and Specialty chemicals.

The company supplies to large and organized players in the paint and coatings, plastics, textiles, rubber, paper, ceramics, adhesive & sealants industry, and a host of other industries.

Source: 20 Microns’ AR 21

The company procures the raw materials from captive and leased mines, domestic vendors and imports certain minerals. It then further processes the materials by refining and micronizing up to 0.5 microns.

The company is further working on nano-sizing of minerals.

Source: 20 Microns’ May’22 presentation

Key customers of the company include:

Source: 20 Microns’ AR 22

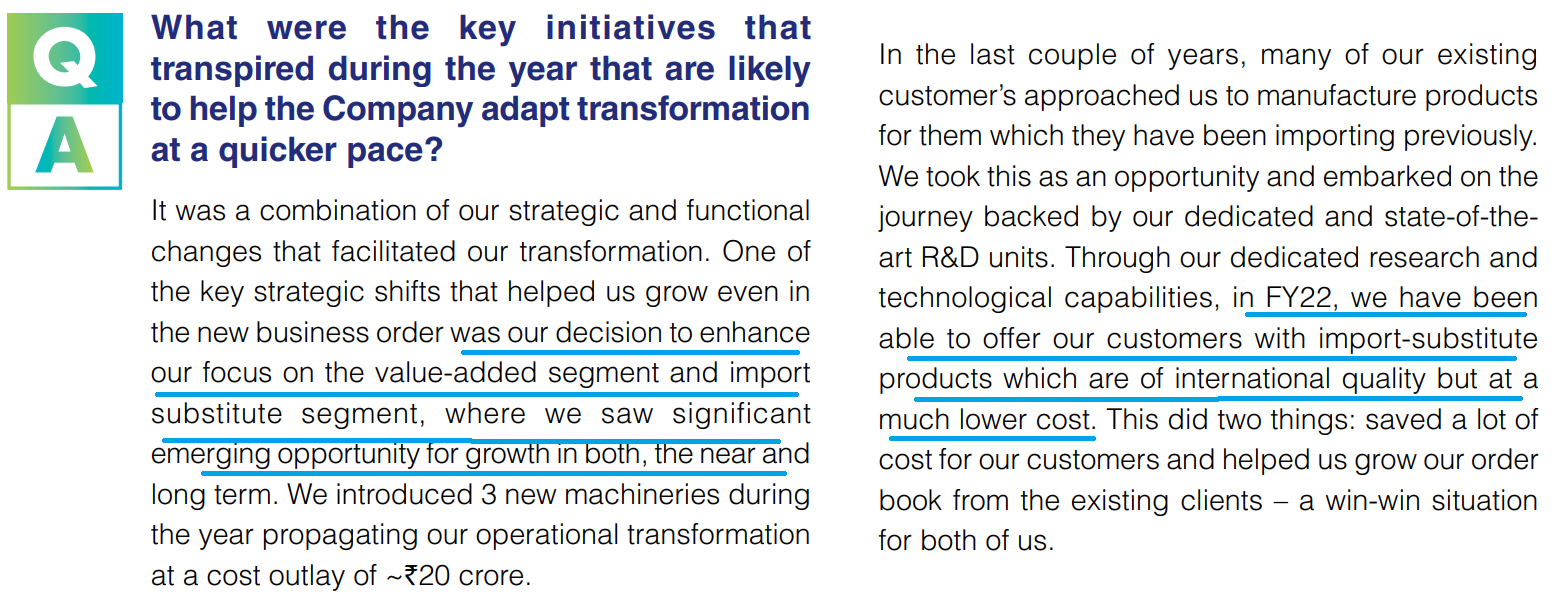

~50% of the products under 20 ML are commoditized in nature with sales primarily coming from Calcium Carbonate; however, over the last few years the management has been trying to transform the company from just another micronized mineral manufacturer to producer of ultrafine industrial material and specialty chemicals.

Source: 20 Microns’ AR 22

Value added and specialty chemical products command much better realizations and margins in comparison to products like Calcium Carbonate.

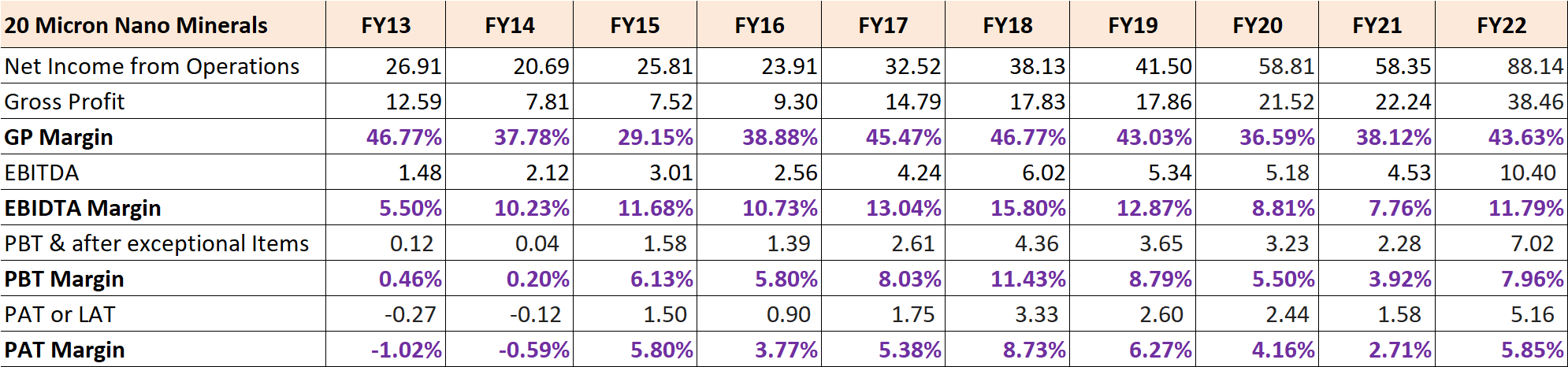

In fact, the company also has a subsidiary 20 Microns Nano Minerals dealing largely in portfolio mix of Soft Industrial Minerals & Specialty Chemicals.

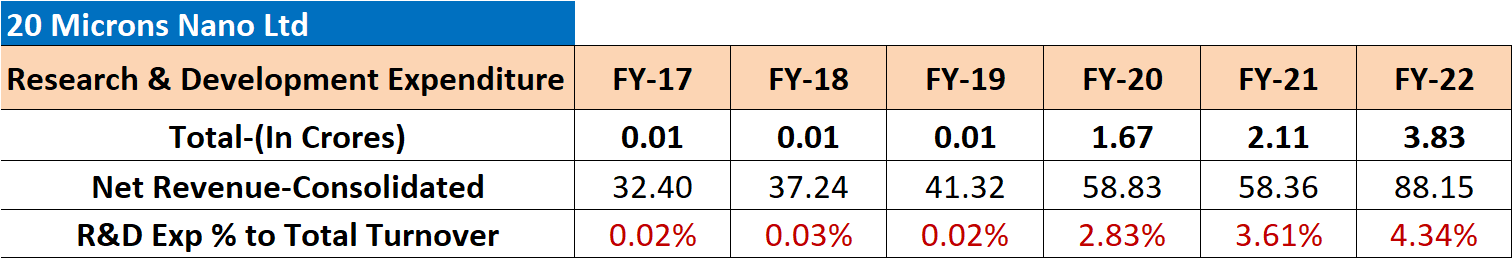

Source: 20 Microns Nano Annual Reports

Source: 20 Microns Nano Annual Reports

It’s interesting to note that in the last 3 years 20 ML Nano has increased the R&D expenses considerably.

Further, during FY 22, 20 ML launched 41 new products and 32 out of those came from 20 ML Nano limited.

Captive mines – Key raw materials required for the manufacturing of 20 ML products are Calcium carbonate, Limestone, Marble lumps/powder, China clay crude/powder, Talc lumps/powder, Mica powder, Silica powder, Red Oxide, Dolomite powder and Chalk powder and these are available only in the mineral mines.

The company has 5 captive mines through which it sources around 30-40% of its raw material requirement which gives it an edge over companies which don’t own such mines.

Source: 20 Microns’ AR 22

These captive mines have a total mining reserve of 169.64 lakh million tonnes (MT), equivalent of around 25 years at current capacity.

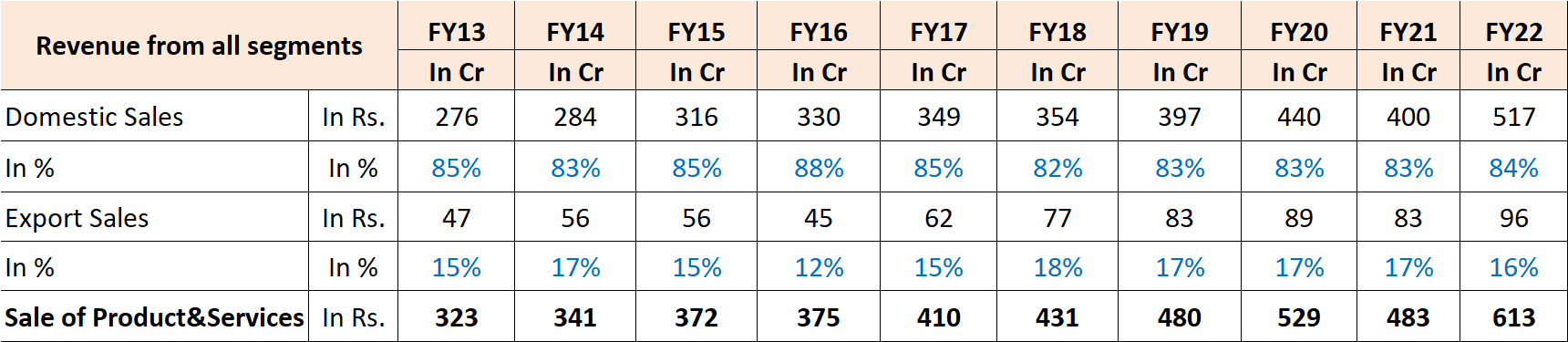

International sales – 20 ML also exports to more than 65 countries.

Over the years, the contribution from exports has remained largely stable in the range of 15-18%.

Source: 20 Microns’ Annual Reports

During FY 22, the company entered the South American market for the 1st time.

As per the management, for the international markets their focus will be on few important products like Calcined Kaolin, Fumed Silica, Modified Bentonite, Aluminium Trihydride, Barium Sulphate Synthetic, Barium Sulphate Natural, Iron Oxide, etc.

Further, the focus will be on value products and specialty segment with a plan to exit the volume game.

In May’21, the company entered a strategic JV with German firm Dorfner Holding GmbH & Co. KG which will give it access to the European market for micronized minerals and specialty chemicals. It would also enable 20 ML to develop, market and sell coloured Quartz-related products in India, Asia, and Africa.

Promoters/Management

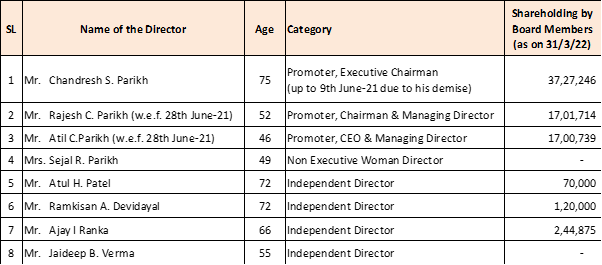

20 ML is an owner operated business and currently the 2nd generation of the promoter family is involved in the business.

Source: 20 Microns’ Annual Reports

Mr. Chandresh Parikh founded the company in 1987. Currently, his sons, Mr. Rajesh Parikh and Mr. Atil Parikh are at the helm of the affairs of the company.

Mr. Rajesh C Parikh, CMD, is a Mechanical Engineer and joined the company at an early age of 27, overlooking the product development and marketing strategies of the new products being launched.

Mr. Atil C Parikh, CEO & MD holds a bachelor’s degree in chemical engineering from Gujarat University and an MBA with a specialization in Finance from a reputed business school in California, USA.

Overall, the promoters have run the company well barring two years in the last 10 years.

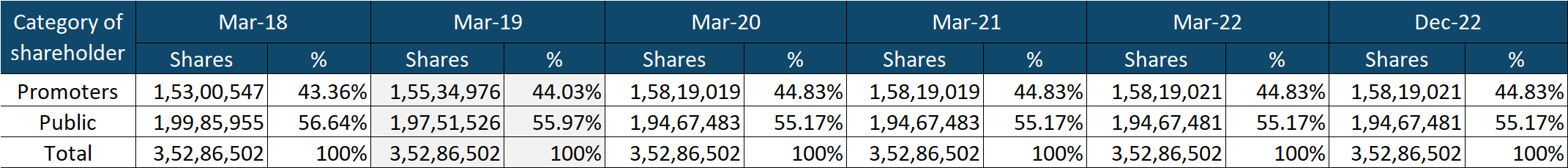

Regarding shareholding of promoters, they owned 44.83% stake in the company at the end of Dec’22 quarter.

Source: 20 Microns’ Annual Reports

One of the independent directors of the company, Mr. Ajay Ranka bought ~56,000 shares of the company in Oct-Nov’21 around 60 odd levels and ~1.89 lakh shares in Sep’19 around 35-40 odd levels.

Till Dec’21, 53.74% of the shareholding of the promoters was pledged with the banks in lieu of the CDR scheme availed by the company in FY 15-FY 16.

By the end of FY 22, all the shares got released as the company exited the CDR by paying the recompense amount to the banks.

Performance Snapshot

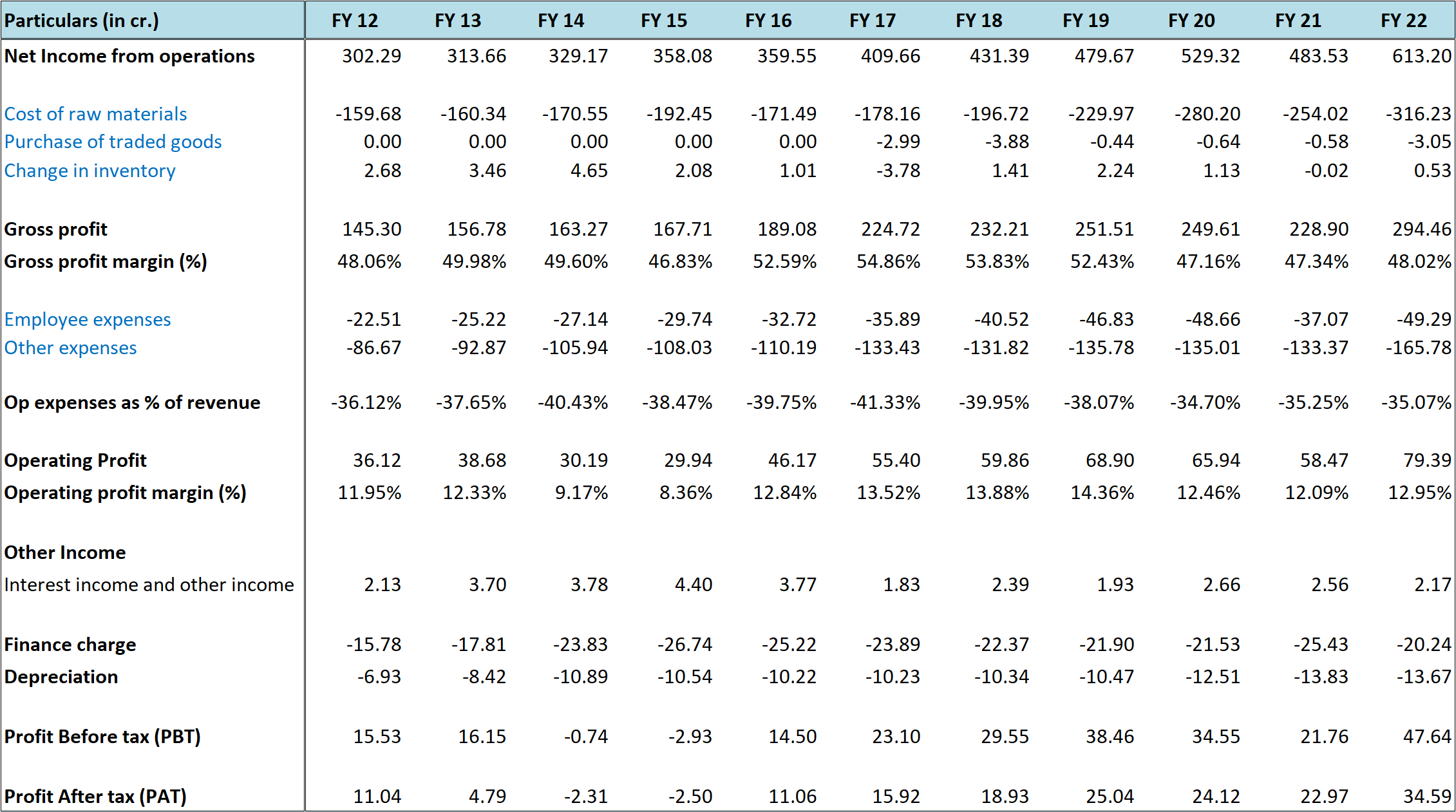

Source: 20 Microns’ Annual Reports

The performance of 20 ML has been decent over the years. Not a very fast grower but has been growing steadily in terms of sales at around 10% CAGR since FY 16.

The company got into trouble in FY 14 and FY 15 when it expanded capacity but could not run the same at optimum levels and as a result availed debt restructuring from banks.

Since then, the performance trend has only been upwards with steady growth in sales, stable EBITDA margins in the range of 12-14% and decline in interest cost.

Source: 20 Microns’ Annual Reports

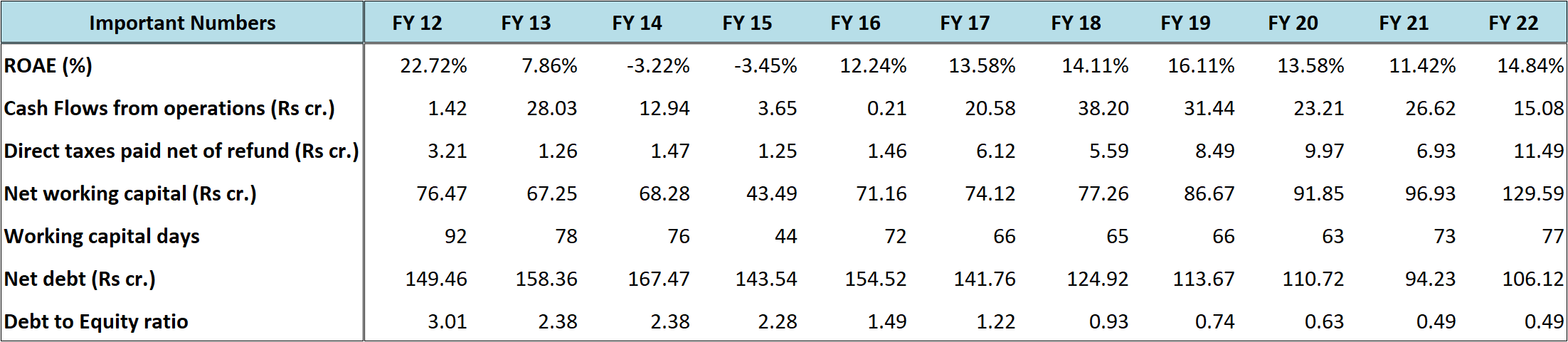

What’s not evident from the interest cost of the company is the reduction in net debt over the years.

Since FY 14, almost each year the company has reduced the net debt on the balance sheet and the debt to equity ratio has reduced from 3.01 in FY 12 to only 0.49 at the end of FY 22.

The company could do so on the back of strong cash flows from operations. In the above snapshot, the reported cash flows from operations are after deducting finance cost.

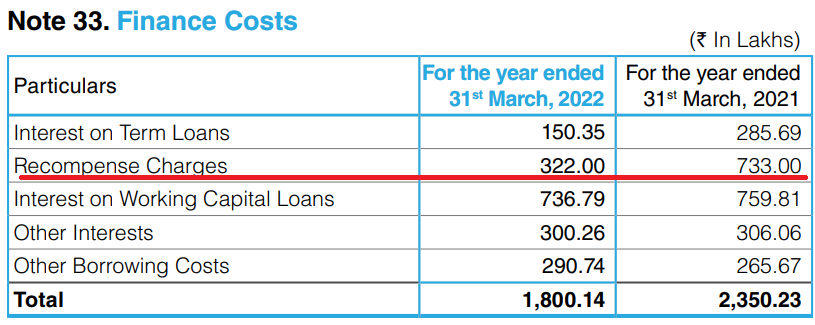

As mentioned above, towards the end of end of FY 22, the company exited the CDR by paying the full recompense amount and got the pledged shares of the promoters released.

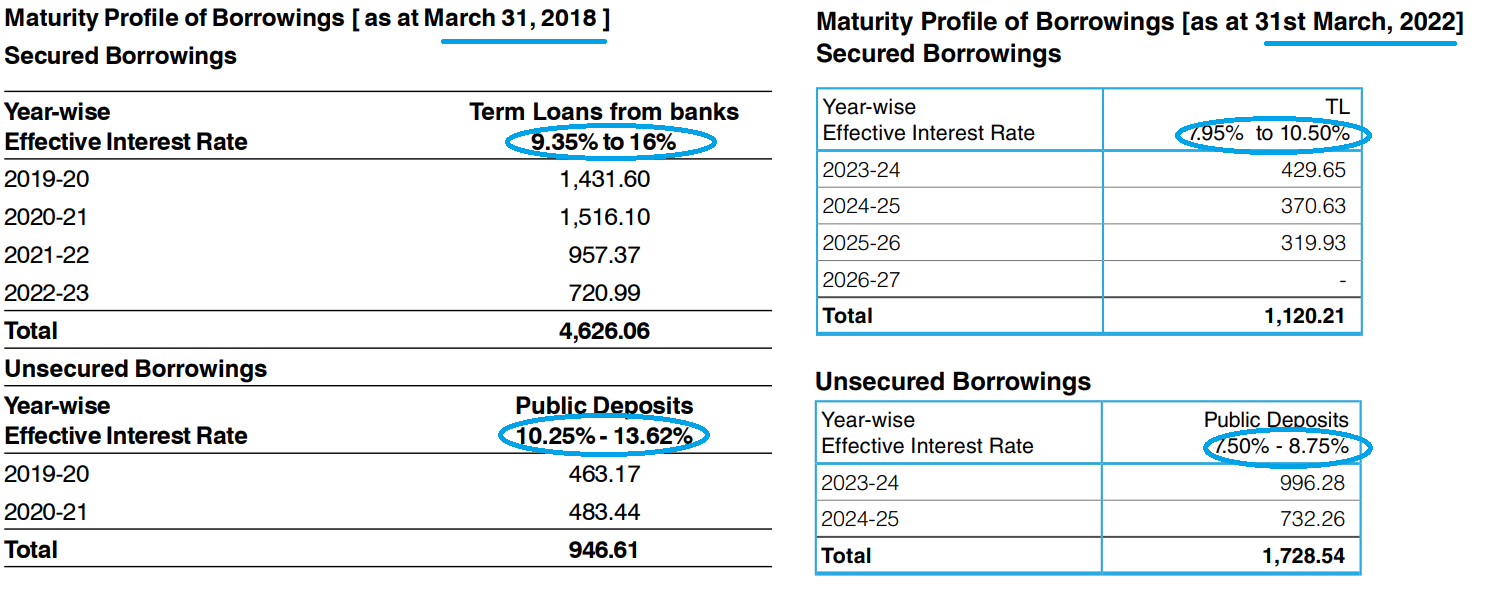

In the past, the company was paying significantly high interest rates.

Source: 20 Microns’ Annual Reports

As can be seen above, the interest rates have come down for the company and with the improvement in credit profile and rating, the interest rates may go down further, barring obviously the impact of rate hikes.

Source: 20 Microns’ AR 22

Another positive for the bottom line is that going forward there won’t be recompense charges which were substantial in FY 21 and FY 22.

As per ICRA Mar’23 credit rating report, with no major debt-funded capex plans in the medium term, the deleveraging trend is expected to continue.

Way forward – In Dec’21, the company launched the ‘Velocity 2026’ strategy.

Based on the same, the management has set a target of Rs 1000 crore + sales by 2026.

Further, the management has indicated about maintaining operating margin around 13-15% in the medium term.

Source: 20 Microns’ Q4 FY 22 earnings update

On TTM basis, the company has recorded sales of around Rs 700 crore with PAT of Rs 43 crore.

Source: 20 Microns’ Q3 FY 23 earnings update

Based on the guidance shared by the management, the company is likely to close FY 23 with Rs 700-725 crore sales and Rs 42-45 crore PAT.

Going forward, we believe 1,000 crore sales target is possible in the next 3-4 years and assuming 13% EBITDA margin, the company might be able to attain PAT of ~ Rs 70 crore in the next 3-4 years.

Valuations

From the above sections we know the following about the company:

- One of the largest sellers of white minerals with access to captive mines

- The management has been enhancing focus on innovative mineral-based products in the field of functional fillers, extenders, and specialty chemicals which may prove to be margin accretive in medium to long term

- Since FY 16, the company has reported 10% CAGR in sales and ~300% growth in PAT

- Since FY 14, the company has reduced the net debt from Rs 167 crore to Rs 106 crore in FY 22

- In FY 22, the company exited the CDR by paying the recompense amount and got the pledged shares of the promoters released

- In Oct-Nov’21, one of the independent directors, Mr. Ajay Ranka bought ~56,000 shares around 60 odd levels

- In Dec’21 the company launched the ‘Velocity 2026’ strategy based on which the management has set a target of Rs 1,000 crore + sales by 2026

We believe, in the next 3-4 years the company might be able to achieve sales turnover of Rs 1,000 crore with EBITDA margins of 13% and PAT of around Rs 70 crore.

At around current market price, 20 ML is available at a market cap of Rs 230 crore, 5.4 times TTM earnings and around 0.8 times book value.

Over the last 5 years, the stock has traded largely between 4 times to 12 times earnings and between 0.6 times to 1.5 times book value.

Risks/concerns

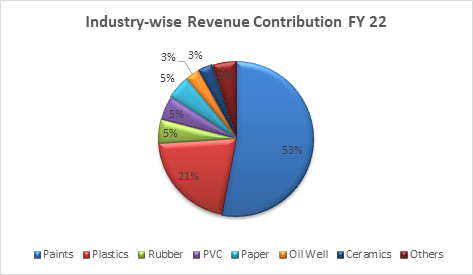

Even though company has a large client base and serves multiple industries, Paints industry still accounts for bulk share of the revenue of the company at 50% and any slowdown in the same will have a direct impact on the demand for the company’s products.

Adverse changes in mining regulations can impact the company’s ability to source raw materials.

Company doesn’t seem to have a well defined dividend distribution policy.

Disclosure: I have personal investment in 20 Microns Ltd and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

http://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: Yes

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart.

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – Yes

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director, or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No