Dear Members,

We have released 26th May’23: Vishnu Chemicals Ltd (NSE Code – VISHNU) – Alpha/Alpha Plus stock for May’23. For details and other updates, please log into the website at the following link – http://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 26th May’23

CMP – 315.40 (BSE); 315.70 (NSE) Face Value – 2.00

Rating – Positive – 3% weightage (this is not an investment advice, refer rating interpretation)

Introduction

Vishnu Chemicals Ltd (VCL) is India’s largest manufacturer of Chromium and Barium compounds.

The company was established in 1989 and serves over 100 customers across Pharmaceuticals, Electroplating, Wood Preservative, Leather, Pigments & Dyes, Ceramics, Refractory, Detergents among others.

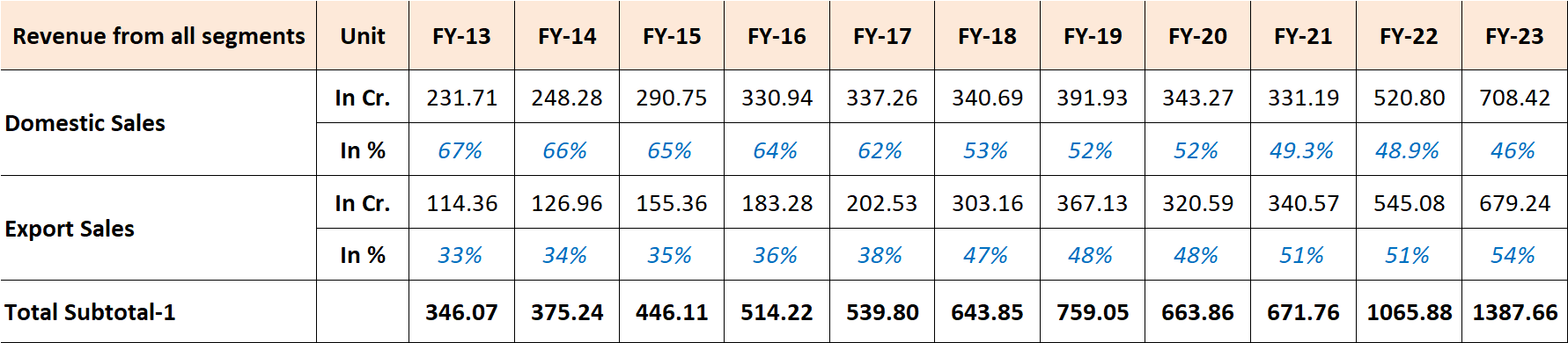

The company serves across 50 + countries and its domestic, exports revenue share is almost 50:50.

At around CMP of 315, we like the company for the following key reasons:

- Largest – Vishnu is primarily focused on Chromium and Barium compounds and has a strong moat of both being a low cost manufacturer and leader in India for both the compounds. In fact, as per the management, in Chromium chemicals, they lead both in India and South Asia

- Product diversification – Till FY16, the company was pretty much focused on two products – Sodium Dichromate and Basic Chrome Sulphate. In the last few years, the Company’s diversification into flexible derivative mix has allowed it to explore versatile applications across different industries and mitigate product and end use industry risk

- Backward integration – In Chromium segment, Soda ash is the largest contributor in its raw material basket. In Q4 FY 22, the company operationalized an in-house soda ash capacity which will cater to almost 50-60% of its soda ash requirement.

- Scope for improvement in capacity utilization – In FY 23, the capacity utilization in Chromium segment was around 80% on expanded capacity of 80,000 MTPA and 55-60% in Barium segment on expanded capacity of 60,000 MTPA.

- Precipitated Barium Sulphate – VCL is setting up 30,000 MTPA capacity of Precipitated Barium Sulphate which will be operational by H1 FY 24. Currently, it is being imported in India and there’s a growing demand for the same

- Promoter’s skin in the game – Promoter’s own 75% stake in the company and have not diluted equity in the company in more than 10 years. Further, at the end of Mar’22, Rs 27 crore interest-free loan was outstanding from promoters. Also, they own 7% cumulative redeemable preference shares worth Rs 76 crore on which they forego 6% dividend in FY 22 and complete 7% in FY 21

- Improving balance sheet – The debt equity ratio of the company was 3.4 in FY 18 which has reduced to 0.9 at the end of FY 23.

- Release of pledged shares – At the end of Mar’23, 36.07% of Promoter’s holding was pledged with the lenders. The same has been released completely

Last, but not the least, we believe the valuations of the company are reasonable at around 13.8 times trailing twelve months earnings. We believe, the current level of profitability is sustainable barring unforeseen major contraction in raw material prices or a sharp contraction in demand.

Business details

Vishnu Chemicals was established in 1989 and is a leader in India in manufacturing and sales of Chromium chemicals and Barium compounds.

Company’s products find application in 12 + industries, serves 100 + customers across 50 + countries.

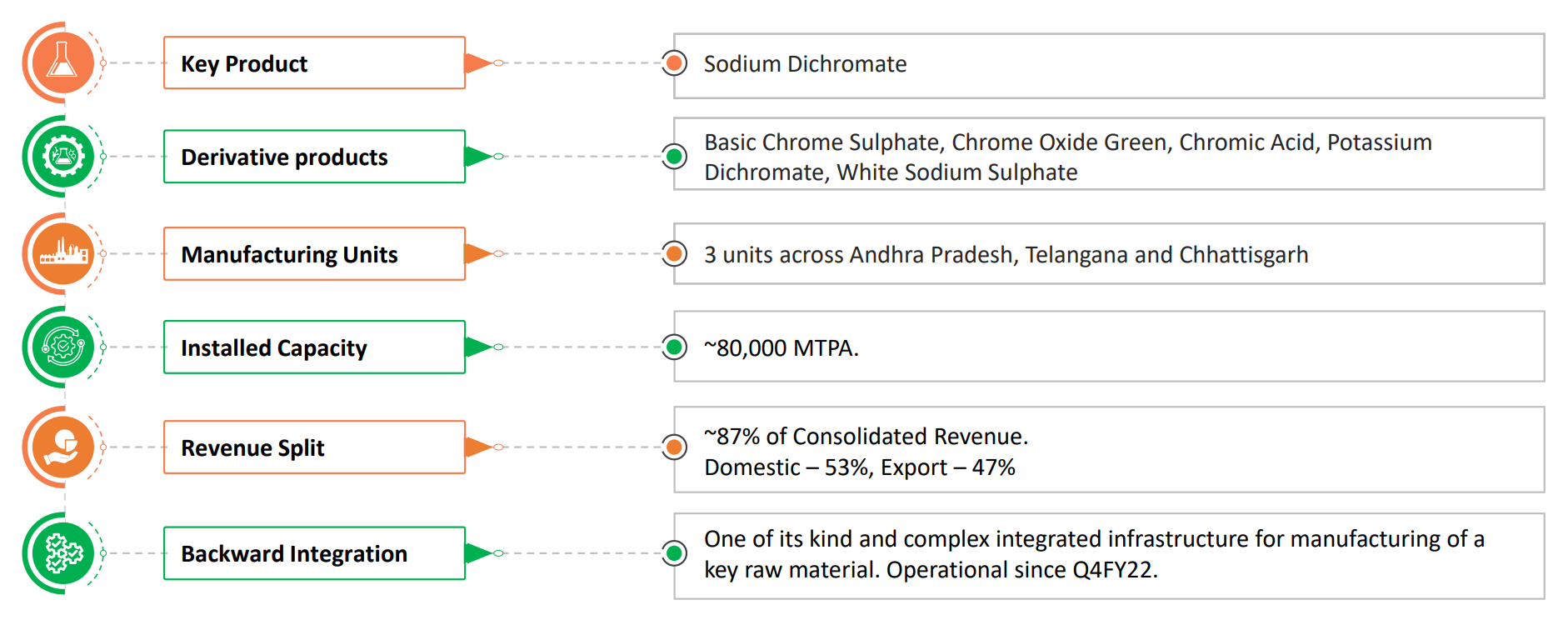

Chromium Chemicals

Chromium chemistry possesses properties of high corrosion resistance, colours, and uniformity, thereby improving the performance and life of industrial components, timber treatment, pharmaceuticals, pigments, and dyes.

In the chromium business, VCL commands leadership position in India with an 80,000 MTPA capacity.

As per the Q4 FY 22 presentation of the company, 700,000 MTPA was the global demand for Chromium chemicals then and was growing at 6% p.a.

Indian demand was expected around 60,000 MTPA, including Sodium Dichromate and its derivatives.

Source: VCLs Q4 FY 23 presentation

Sodium Dichromate is the key product of the company and is also a source for preparing chromium based derivatives.

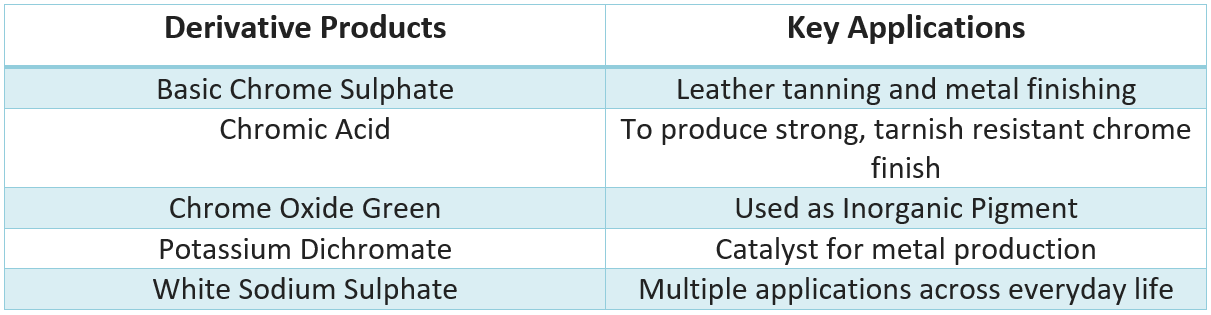

Till FY16, the company was pretty much focused on two products – Sodium Dichromate and Basic Chrome Sulphate.

In the last 7-8 years it has been constantly expanding its derivatives product portfolio which has applications across industries. Around 1/3rd of sodium dichromate is sold in market while the remaining is used for manufacturing derivative products.

Source: VCLs Q4 FY 23 presentation

Earlier, concentrated portfolio of products in Chromium Chemicals led to low operating levels and exposed the business to multiple risks.

Source: VCLs Nov’21 and Q4 FY 23 presentation

The Company’s diversification into flexible derivative mix has allowed it to explore versatile applications across different industries and geographies and mitigate product and end use industry risks.

As per the management, the capacity utilization was around 60% between FY 15-FY 18. With product and geography diversification, the average capacity utilization was around 80% between FY 19-FY 23.

New products under development – As per the management, they are working closely with R&D team to produce Chromium metal which will give them an entry into Super Alloy industry and the growing opportunity in the defence sector.

Currently, Chromium metal is largely imported and therefore it can prove to be a good import substitution opportunity.

Backward integration – Chrome ore and Soda ash are the key raw materials in the Chromium segment.

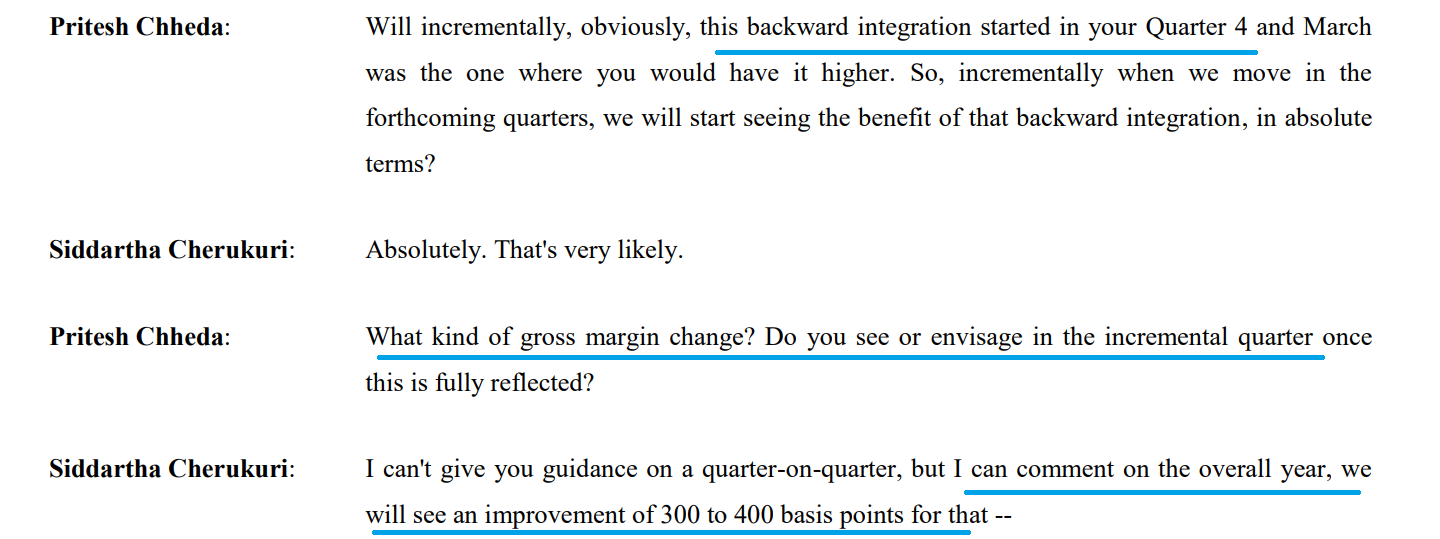

Soda is the largest contributor in the raw materials basket. To insulate itself from raw material availability and price volatility, in Q4 FY 22, the company operationalized an in-house 30K MTPA soda ash capacity which will cater to almost 50-60% of its soda ash requirement.

At the end of FY 22, the management had indicated that operationalization of soda ash plant (backward integration) will result in an improvement of 300-400 bps in margins.

Capacity expansion – During FY 23, the company undertook debottlenecking operations at its existing plants which resulted in 14% increase in capacity to 80,000 MTPA from 70,000 MTPA.

During FY 23, the company’s capacity utilization was around 80% on expanded capacity of 80,000 MTPA.

Going forward, the management expects improvement in sales volume of chromium compounds on the back of unutilized capacity in FY 23 and strong overall demand.

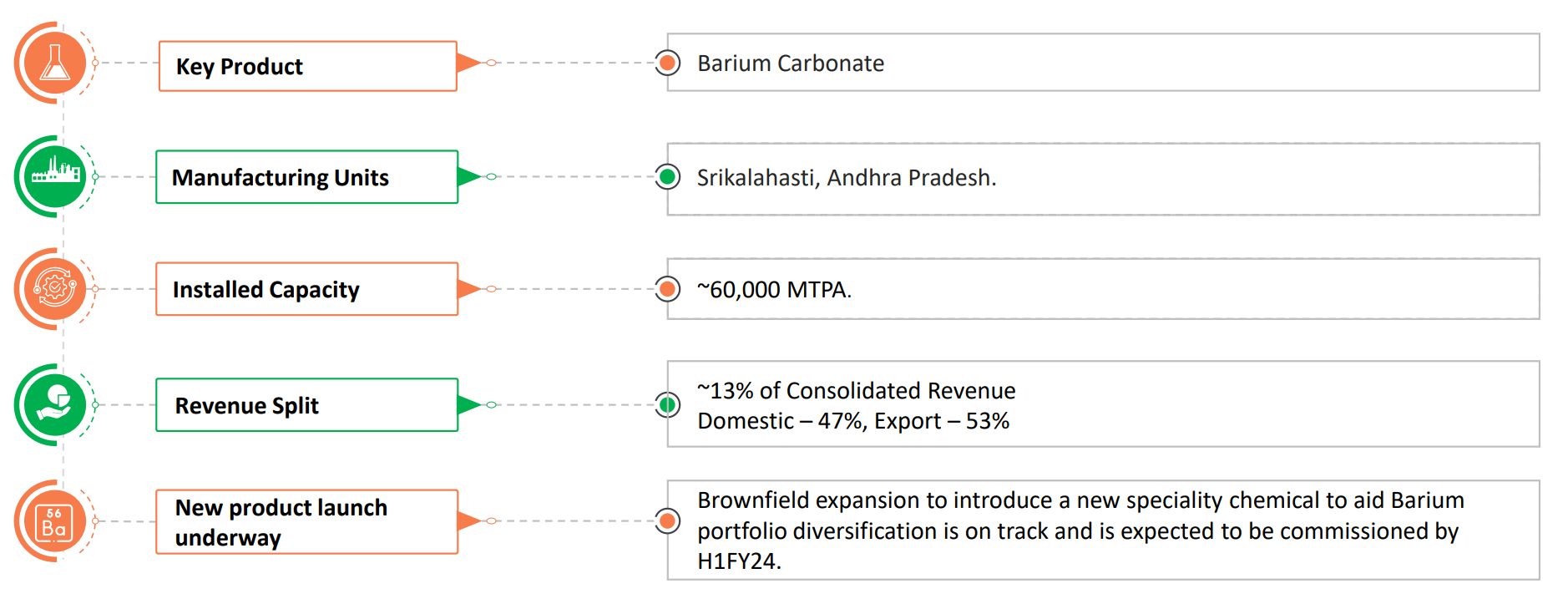

Barium Chemicals

VCL entered the Barium segment in 2015 with the acquisition of loss making Barium carbonate facility of Solvay Barium GMBH in India.

Source: VCLs Q4 FY 22 presentation

Post the acquisition, the company has turned around the business and is on an expansion spree.

The company manufactures industry grade Barium Carbonate that finds applications in the manufacturing of ceramic, tiles, glass, enamel products and caustic lye brine purification process.

As per Q4 FY 22 presentation of the company, the global Barium Carbonate market size is USD 575 mn growing at 3.4% CAGR. The Indian demand is about 35,000 MTPA and Vishnu commands ~40% market share in India.

Source: VCLs Q4 FY 23 presentation

Like Chromium segment, here too the company has an almost equal sales mix between India and exports. Europe accounts for the largest share at around 60-70% in the export sales mix.

FY 23 was relatively weak for the Barium segment with flattish sales of Rs 170 crore and PAT of just Rs 8 crore. This was largely on account of slowdown in demand in Europe on the back of high energy prices.

Capacity utilization – Towards the end of FY 22, the company completed the expansion of installed capacity to 60,000 MTPA from 40,000 MTPA.

For FY 23, the company’s capacity utilization was only around 55-60% on expanded capacity of 60,000 MTPA. This was on account of lower demand from Europe.

Q2 and Q3 were especially low on demand, while demand started picking up from Jan’23.

As per the management, with the lower natural gas prices, the demand is expected to be much better in FY 24 which should result in higher capacity utilization and improvement in margins to 16-20% from 13% recorded in FY 23.

New products under development – As per the management, they are working on value added products and high purity barium carbonate which is used in the semiconductor industry and some battery chemicals.

Precipitated Barium Sulphate

Under Barium chemicals division, Vishnu is diversifying the product mix and is currently in the process of brownfield expansion of 30,000 MTPA capacity for Precipitated Barium Sulphate.

The facility will be operational in Q2 or by the end of Q2 FY 24.

Here are some interesting details about the chemical:

- The annual global demand is around 140,000 MTPA and in India it’s around 25,000 MTPA

- Currently, no domestic production in India and completely imported; around 70% from China and 30% from Italy

- Entered Guinness Book of World Records for its ability to reflect 98% of sunlight

- Finds application in paints, powder coating, batteries

- Good demand in North America, Europe, India

- Comes in various grades; commodity range starts at 50/kg and specialty 100/kg

- there’s been consistent 12% YOY growth in demand as related to power coating industry

- 4 years back, powder coating industry was around 67,000 tons; now, it’s around 140,000 tons

- Barium sulphate used as primary filler in powder coating to replace titanium dioxide

As mentioned above, the installed capacity will be 30,000 MTPA and the management is expecting sales upwards of Rs 250 crore as the focus will be on specialty grade.

Also, here again the management intends to create a balance of 50% export and 50% domestic sales.

International sales

Vishnu Chemicals exports to 50 + countries and in both the divisions the contribution from the exports has been increasing.

Source: VCLs’ Annual Reports

As per the management, the diversification in product mix in chromium segment enabled them to explore applications and expand geographical reach.

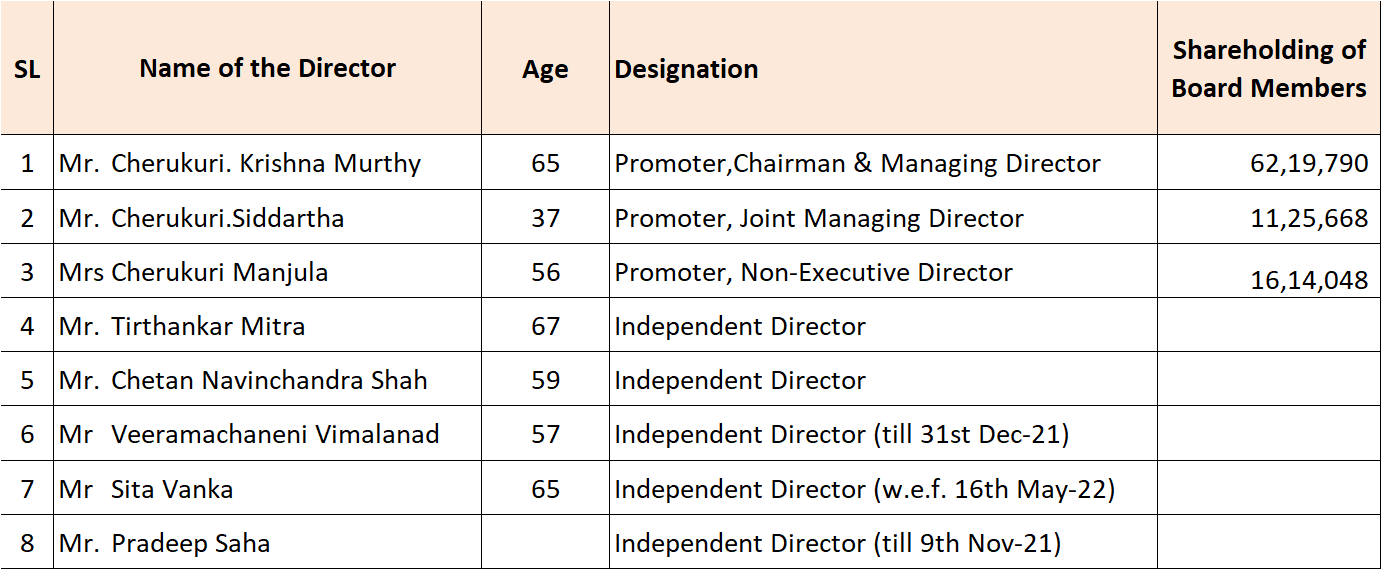

Promoters/Management

Vishnu Chemicals is an owner operated business.

Source: VCLs’ Annual Reports

Mr. Ch. Krishna Murthy, CMD, is a first-generation entrepreneur and is a founder, promoter and one of the key architects in developing & transforming the organization from single product to multi products manufacturing unit.

He is supported by Mr. Ch. Siddartha, JMD, who has been at the helm of the company for more than a decade. He holds MS in Biotechnology from Northumbria University & MBA from Saginaw University.

What we like about the promoters is that they are devoted towards the company and from the viewpoint of minority shareholders, the interests are directly aligned.

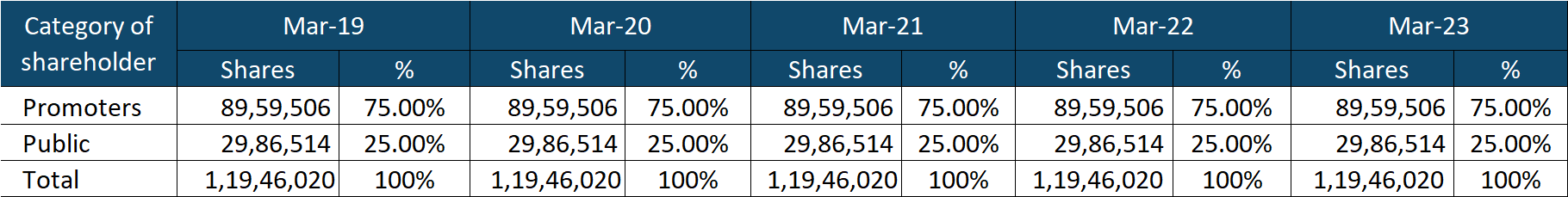

Promoter’s own 75% stake in the company and have not diluted equity in the company in more than 10 years.

Source: VCLs’ Annual Reports

Further, at the end of Mar’22, Rs 27 crore interest-free loan was outstanding from promoters. Also, they own 7% cumulative redeemable preference shares worth Rs 76 crore on which they forego 2.5% dividend in FY 23, 6% dividend in FY 22 and complete 7% in FY 21.

At the end of Mar’23, 36.07% of Promoter’s holding was pledged with the lenders. The same has been released completely by the lenders.

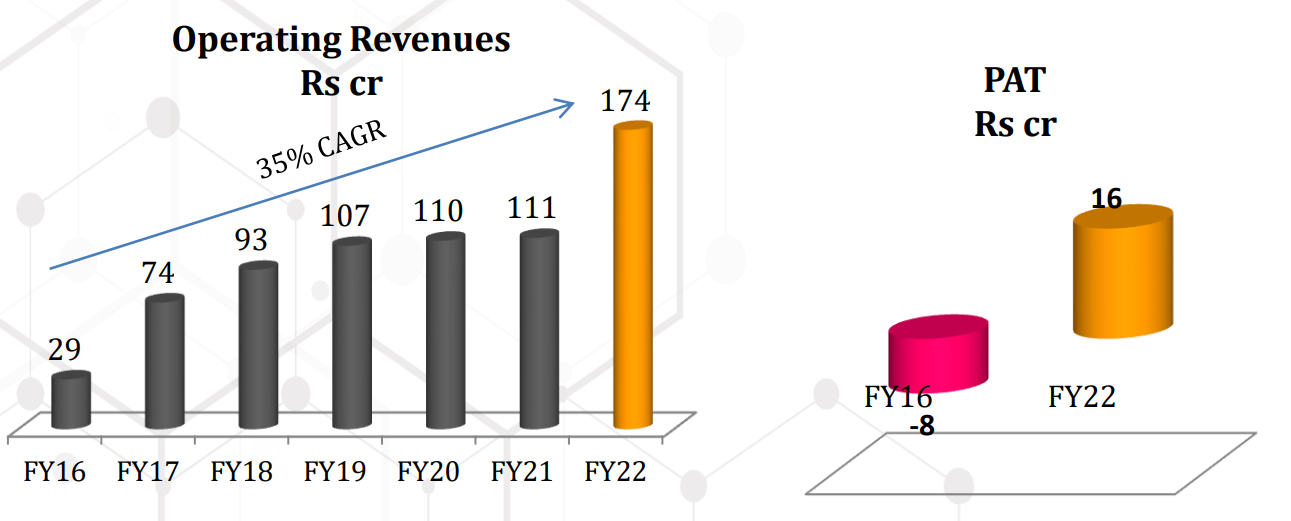

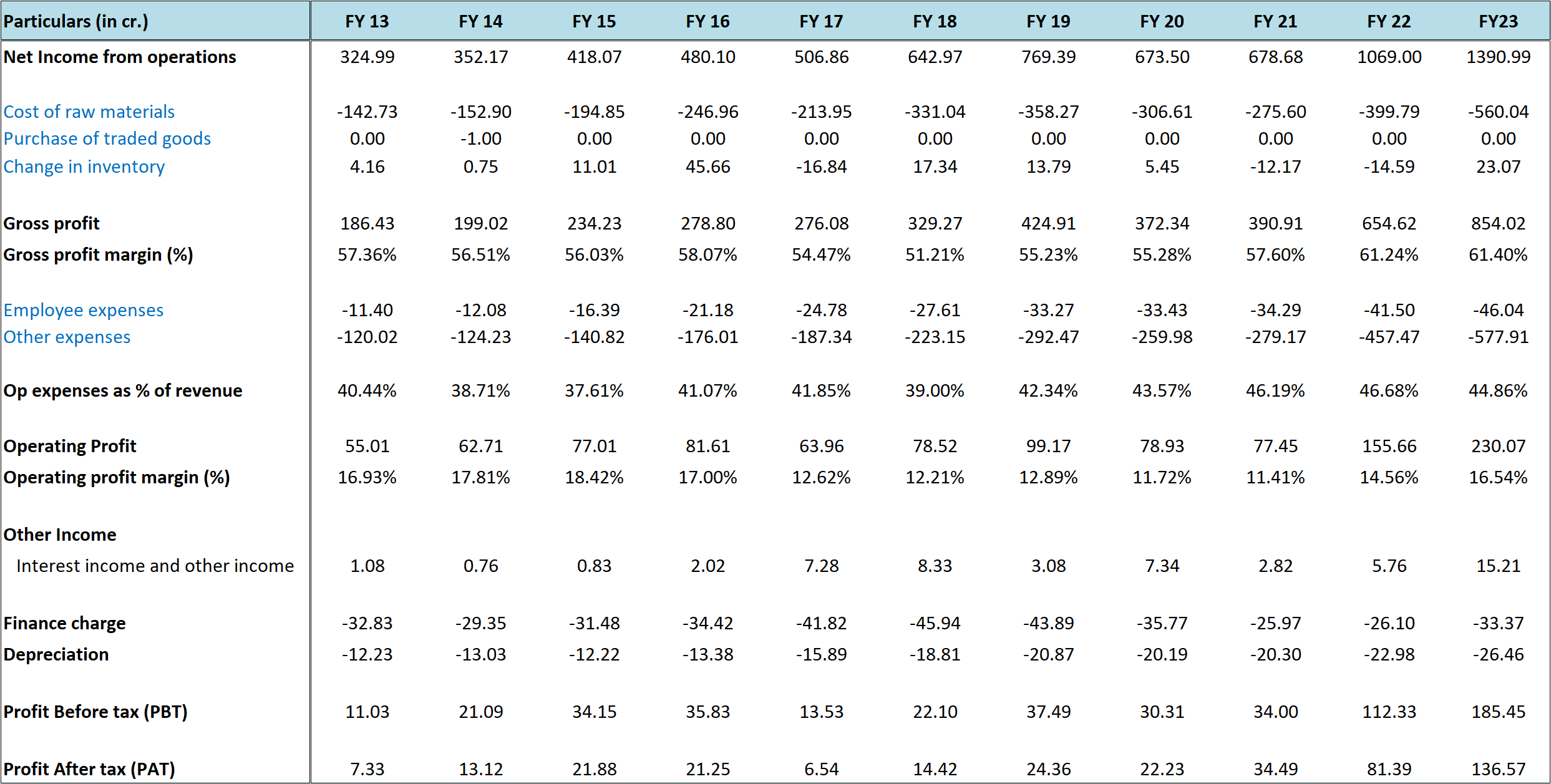

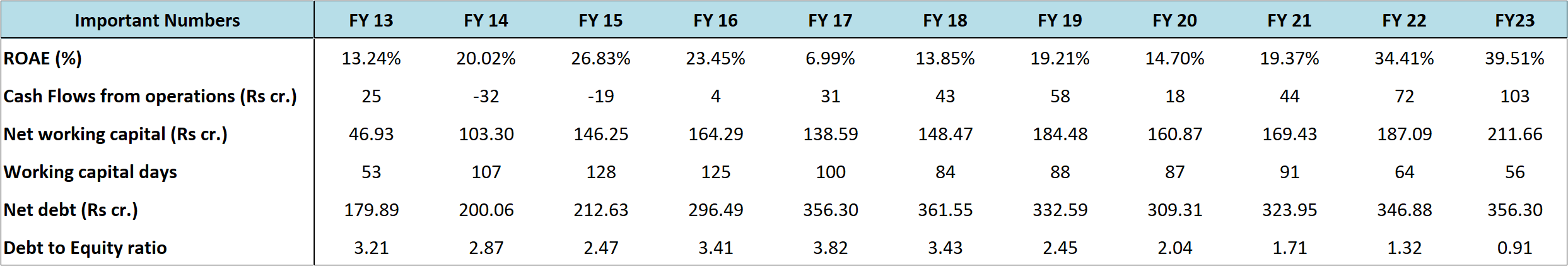

Performance Snapshot

Source: VCLs’ Annual Reports

Above we have posted the 11 years P/L snapshot of VCL.

As can be noticed, the company has done well over the years with steady growth in sales and profits.

We like companies that can grow their sales year after year and over the last 10-11 years, VCLs sales dipped only once in FY 20.

The company also has very strong gross margins of 50% +. In fact, barring 1-2 years, gross margins have largely been above 55% indicating specialty nature of the chemicals they deal in.

EBITDA margins have been a bit more volatile and ranged between 12% to 18%. FY 21 was an aberration because of covid-19.

As per the management, there was low capacity utilization of around 60% in the Chromium chemicals division between FY 15-FY 18 and around 58% in Barium chemicals division between FY 16-FY 19.

As mentioned in the sections above, earlier, in the Chromium division, the company had a concentrated portfolio of products which led to low operating levels. However, in the last 7-8 years, the company has diversified into a flexible derivative mix which has allowed it to explore multiple applications across different industries and geographies and helped in better capacity utilization of its plants.

Another aspect where the company has done well is working capital management, cash flows and thereby overall debt management.

Source: VCLs’ Annual Reports

In the above numbers, we have reduced interest expense from reported cash flows from operations to get a better picture of operating cash flows. Also, we have considered preference capital as part of borrowings and not as part of net worth.

Till FY 17, the debt to equity ratio of the company was increasing and reached a high of 3.82. Since then, the absolute net debt has remained largely same while the overall net worth of the company has improved with improvement in profitability.

All this while, the company didn’t dilute the equity and carried out expansion of barium chemicals capacity, de-bottlenecking at chromium chemicals plant and set up soda ash plant for backward integration. The company is also in the process of setting up 30,000 MTPA Precipitated Barium Sulphate capacity.

The company also got the requisite support from Promoters who extended interest free loan to the company. Further, they converted their existing 4.75 crore (FV – 10) 7% cumulative redeemable preference shares (CRPS) to 7.66 crore (FV – 10) 7% CRPS in Mar’17 and extended the redemption tenure from 10 to 15 years.

Going forward, the balance sheet is likely to improve further with Rs 40 crore expected reduction in debt in FY 24.

Way forward – FY 23 was a flattish year in terms of volume growth in both the Chromium and the Barium divisions; however, the company could report 30% growth in sales on the back of higher realizations.

The volumes were flattish because company undertook maintenance in the chromium division which impacted utilization and regarding barium division, the demand was slow in Q2 and Q3 on the back of high energy prices in Europe.

Since Q2, the realizations have started coming down largely on the back of drop in freight rates. As per the management while the pricing is a function of demand supply, raw material pricing, etc., they don’t expect any major correction in prices on account of steady demand for both chromium and barium chemicals.

Also, even if the prices come down, they don’t expect contraction in margins as their core focus is to maintain spreads.

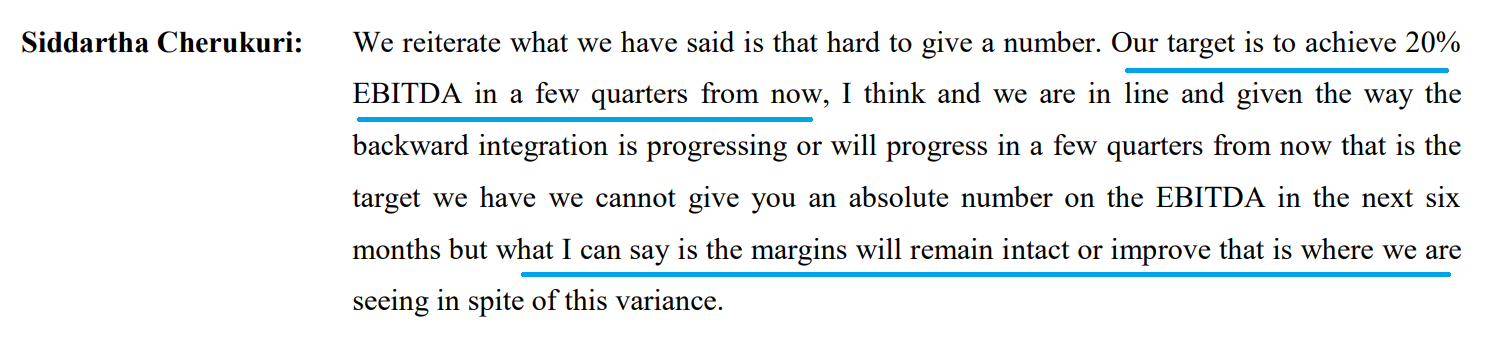

Source: VCLs Q2 FY 23 concall

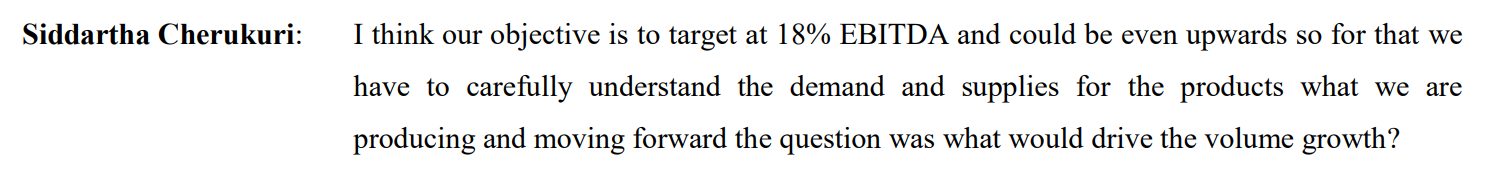

Source: VCLs Q4 FY 23 concall

Besides stable pricing, product mix and higher capacity utilization, another factor that can help sustain 18-20% EBITDA margins is soda ash backward integration.

Source: VCLs Q4 FY 22 concall

On the volume growth front, in the chromium division, the company’s capacity utilization was around 80% on expanded capacity of 80,000 MTPA in FY 23.

Going forward, the management expects improvement in sales volume of chromium compounds on the back of unutilized capacity in FY 23 and strong overall demand.

In the Barium division, in FY 23, the company’s capacity utilization was only around 55-60% on expanded capacity of 60,000 MTPA. This was on account of lower demand from Europe.

As per the management, with the lower natural gas prices, the demand is expected to be much better in FY 24 which should result in higher capacity utilization.

The Precipitated Barium Sulphate capacity will also be online by the end of H1 FY 24 and is expected to contribute Rs 250 crore to sales annually at peak utilization.

The company is also working on new value added products in both the divisions and this should help sustain the growth momentum for the next 3-4 years.

Valuations

From the above sections we know the following about the company:

- Focused on Chromium and Barium compounds and has a strong moat of both being a low cost manufacturer and leader in India for both the compounds

- Diversifying product mix which has helped reduce industry and geography risk

- Backward integrated for a key raw material in Chromium division

- Scope for volume growth with improvement in capacity utilization from 80% in chromium division and 55-60% in Barium division

- 30,000 MTPA capacity for Precipitated Barium Sulphate to be operational by end of H1 FY 24 with Rs 250 crore sales potential annually

- Strong growth in demand for Precipitated Barium Sulphate and it is being imported completely

- Working on new value-added products to be launched in coming years

- Promoters hold 75% stake in the company and have been lending strong support through interest free loans and foregoing dividends on preference shares

- Considerable improvement in cash flows and balance sheet in the last few years

- Management hopes to sustain EBITDA margins around 18% and targeting 20% on the back of improvement in capacity utilization, favourable product mix and backward integration

Because of the above, we believe the valuations of the company are reasonable at around 13.8 times trailing twelve months earnings.

We believe, the current level of profitability is sustainable barring unforeseen major contraction in raw material prices or a sharp contraction in demand.

Risks/concerns

FY 23 saw a good jump in realizations on the back of higher raw material and freight prices. Going forward, if the prices of the products the company deals in collapse, the company might find it difficult to sustain spreads and margins and the profitability might suffer.

As per the management, they have a strong peer in Russia which was facing challenges to produce and export the chemicals out of Russia. In case of normalization of operations at Russian peer, there might be excess supply which could impact the pricing of the products.

It could take a few quarters for the Precipitated Barium Sulphate capacity utilization to attain breakeven levels and it could impact the profitability of the Barium division in the short term.

Disclosure: I don’t have any investment in Vishnu Chemicals and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

http://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

Address – 7, Panch Ratan, 7/128, Swaroop Nagar, Kanpur – 208002, Contact No. – +91-7275050062

Compliance Officer – Mr. Ekansh Mittal, +91-9818866676, [email protected]

Grievance Redressal – Mittal Consulting, [email protected], +91-9818866676, +91-7275050062

“Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors”.

Performance numbers do not include the impact of transaction fee and other related costs. Past performance does not guarantee future returns.

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing.”

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart.

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director, or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No