Hello Sir,

Hope you are doing well.

Every investor wishes to own stocks that could turn out to be potential multi-baggers. While there’s no fixed formula; however, as we analyze several stocks on a daily basis, we think there’s one pattern that does help in identifying stocks that could do well in future.

It’s important to know here that we are talking about medium to long term investment, i.e., 3-4 years +. Below, we have discussed the pattern and also shared an example.

Before that, in the last few days we have released 1 special situation opportunity and 1 new long-medium term investment recommendation for Alpha and Alpha + Members

- Special situation opportunity – Delisting Opportunity – Expecting Promoters to buy out shares at higher price – For details click HERE

- New Stock Recommendation – Sub 5000 crore market cap, fast growing Specialty chemicals company – For details click HERE

You can get the above mentioned recommendations, by subscribing HERE

How does a stock deliver good returns?

Stocks deliver good returns when the earnings expand or if the market perception of the stock improves, i.e., the valuation multiples expand.

If we get the combination of both, that’s when the returns tend to be extremely good.

So, here’s 1 basic pattern we identified that can help you get good returns on stocks.

Look for companies with the following traits:

- Rising sales year on year

- Depressed margins and earnings at one point of time

- Depressed valuations during periods of low margins

Let’s understand each point in some detail:

Rising sales year on year: Here, we are looking for companies which have this uncanny ability of growing sales on sequential basis. Yes, there could be 1-2 odd years (in say 10 years history) where there might be a small drop in sales; however, the general trend should be moving upwards.

It’s not easy for companies to grow year after year and that’s why the above trait ensures that in general you are looking for growth companies.

Do check for details like if the company is expanding capacity, or adding new clients or new products as that would ensure continuity of growth.

Depressed margins and earnings: Unless there’s a very high-quality business with great operating efficiency or very strong pricing power, the margins of the companies tend to be volatile.

Mean reversion does work in a lot of cases and therefore if the margins are significantly higher than average range, it’s important to determine if there’s a change in product mix or some significant improvement in operating efficiency which will sustain.

If not, then margins could revert to mean levels or drop further.

Here, we are in general more interested when the margins are lower than mean values or if there’s a drop in earnings despite the increase in sales.

The trick is to determine if the lower margins is a temporary phase and if they will revert back to mean or move up even higher; because if they do, there could be major growth in earnings from the depressed state.

Other way earnings could move higher is if the company is repaying debt which could result in substantially lower interest outgo.

Depressed valuations during periods of low margins: The way the markets are, more so in the case of small and mid-caps, once the earnings go down, the stocks tend to start correcting.

Also, despite higher sales, margins could remain depressed for 2-3 years and small-mid cap stocks tend to start trading at very low valuations in terms of both earnings and Price/book.

Thus, there are times when you get growth stocks (refer 1st point, i.e., sequential growth in sales) at depressed valuations on depressed earnings.

Conclusion: Assuming the analysis is correct and the company does deliver higher turnover with expansion in margins, there could be substantial growth in earnings and at the same time re-rating in valuations to higher multiples.

Here’s an example:

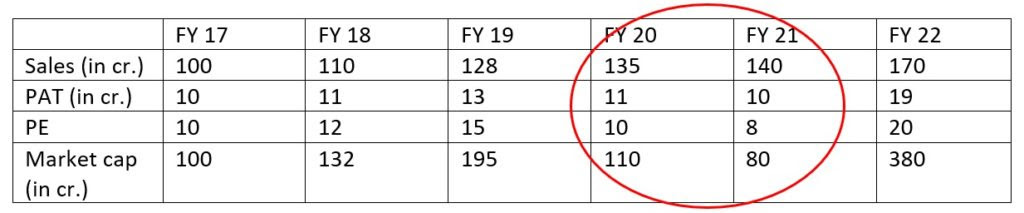

The encircled numbers are where things start getting interesting and one should dig deeper because while the sales did grow, the earnings declined because of contraction in margins and the valuation multiples declined further.

(End)

Disclaimer: The securities quoted are for illustration only and are not recommendatory.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

Address – 7, Panch Ratan, 7/128, Swaroop Nagar, Kanpur – 208002, Contact No. – +91-7275050062

Compliance Officer – Mr. Ekansh Mittal, +91-9818866676, ekansh@

Grievance Redressal – Mittal Consulting, grievances@

“Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors”.

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing.”

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here – LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No