Hello Sir,

Hope you are doing well.

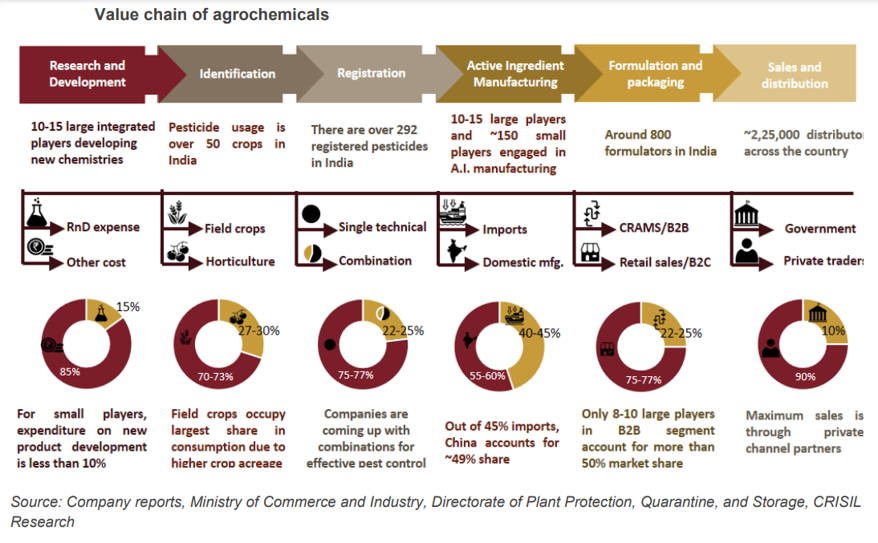

Agrochemical is an important industry for India, considering we have the largest population to feed to.

2022-23 was bad for the industry with pricing challenges and excess supply from China.

A lot of stocks are down 50% from highs. We therefore decided to look at some leading players to identify potential investment opportunities.

Below, we have shared notes from the Aug’22 credit rating report of Punjab Chemicals & Crop Protection. Hope you find the details useful for your own investments or to add the stock to your watch list.

Before that, in the last few days we have released 1 special situation opportunity and 1 new long-medium term investment recommendation for Alpha and Alpha + Members

- Special situation opportunity – Delisting Opportunity – Expecting Promoters to buy out shares at higher price – For details click HERE

- New Stock Recommendation – Sub 5000 crore market cap, fast growing Specialty chemicals company – For details click HERE

You can get the above mentioned recommendations, by subscribing HERE

Punjab Chemicals & Crop Protection – Notes from Aug’22 Care credit rating report

– General Points

- Incorporated in November 1975, Punjab Chemicals and Crop Protection Limited (PCCPL) was promoted by Shri S.D. Shroff in association with Excel Industries Ltd and Punjab State Industrial Development Corporation (PSIDC)

- In March 2006, the name of the company was changed to PCCPL with all its divisions – Agrochemicals, Pharmaceuticals, Intermediates, Chemicals & International Trading, under one umbrella

- The company specializes in agrochemicals which are key revenue driver for the company (70-80%)

- It is into Contract Research and Manufacturing (CRAMS) largely for agrochemicals

- CRAMS accounted approximately ~60-70% of the revenue over the years

– Management

- Mr. Shalil Shroff (Managing Director), the second-generation promoter has an experience of over 3 decades in the chemical industry

- Mr. Mukesh Patel (Chairman) is experienced in finance and corporate management for more than 4 decades

- Mr. Vinod Kumar Gupta (Chief Executive Officer, CEO), a Chemical Engineer, has more than 24 years’ experience in Operations Management in large Petrochemicals and Oleochemicals sector

- Dr. S. Sriram, (CFO), is a PhD in supply chain management and has 34 years of experience including 16 years of experience in UPL Limited

– Business Details

- PCCPL has arrangements with multinational companies under CRAMS business model which is based on cost plus pricing mechanism

- The contract has a tenor of 5 years and most of these agreements get auto renewed

- Product registration challenges like long tenor, high cost etc., at customer’s end, increases probability of contract renewal by the clients to a large extent

- Top five products driving revenue of PCCPL contributed around 40% (PY: 55%) of the total sales in FY22

- Further, the top 5 customers contributed nearly ~72% to total operating income in FY22 (similar to FY21)

- Major sales to single foreign market, Europe exposes PCCPL’s business to geographical concentration risk

- The major export destinations are Europe, Japan, Netherlands, Belgium, Israel and Italy

– Raw material

- Around ~60-70% of the operating cost of the company consists of raw material expenses

- The company has a long-term contract with the suppliers for key raw materials – Metamitron and Hydrazine Hydrate, imported from Europe, China and Japan

- Around ~30-35% of its major raw materials requirements are met through imports, hence is exposed to foreign exchange fluctuation risk as well

- The forex risk is partly covered by natural hedge, PCCPL being net exporter (~60% of sales)

– FY 22 performance

- During FY22, PCCPL witnessed significant growth of 37.46% in total operating income (TOI) over FY21

- The growth was driven by healthy demand in agrochemicals and orders in hand under contract manufacturing arrangement

- Further, addition of new molecules (3 molecules in FY22) and clientele resulted in scaling up at better pace

(End)

Disclaimer: This is not a recommendation to buy/sell Punjab Chemicals & Crop Protection. The securities quoted are for illustration only and are not recommendatory.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

Address – 7, Panch Ratan, 7/128, Swaroop Nagar, Kanpur – 208002, Contact No. – +91-7275050062

Compliance Officer – Mr. Ekansh Mittal, +91-9818866676, ekansh@

Grievance Redressal – Mittal Consulting, grievances@

“Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors”.

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing.”

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here – LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No