Dear Members,

We have released 19th Sep’23: Special situation opportunity on the proposed demerger of Jasch Industries (BSE Code – 500220). The same has also been produced below. For details and other updates, please log into the website at the following link – http://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 19th Sep’23

CMP – 243.95 (BSE)

Rating – Positive – 3% weightage; this is not an investment advice (refer rating interpretation at the end)

Jasch Industries (BSE – 500220)

Jasch Industries operates in 2 businesses now:

- Coated Fabrics division – It manufactures PU/PVC Coated Fabrics (also known as synthetic Leather or Artificial Leather) and Polyurethane Resin

- Industrial Gauges and Equipment – It makes Radiation-based Gauging Systems

PU/PVC Coated fabrics and PU resin are mostly used in footwear industry, in garment industry (as lining material) and in automobiles (as seat covers).

These are also used in furniture upholstery material, purses, bags, luggage and in the manufacture of sports goods & accessories.

Most of Synthetic Leather Units in India manufacture only PVC Leather and Jasch is one of the few significant manufacturers of PU Synthetic Leather.

Radiation-based Gauging Systems are used for online measurement of thickness, grammage, moisture & ash content in paper making industry, on-line measurement of thickness & coating weight in plastics, steel, sheet rolling, galvanizing, aluminium foil & non-ferrous metal rolling industry.

Scheme of Arrangement

In 2022, the company proposed a scheme for demerger of Industrial Gauges and Equipment division to Jasch Gauging Technologies Ltd (Resulting company) and consequent listing of the same on the exchanges.

Basically, the Industrial Gauges division will be transferred to Jasch Gauging while the Coated Fabrics division will be retained in Jasch Industries.

Jasch Gauging will subsequently get listed on the exchanges.

In lieu of the demerger, the existing shareholders of Jasch Industries (as on the record date) shall be issued 2 shares of Jasch Gauging for every 5 shares held in Jasch Industries.

Further, the existing share capital of Jasch Industries will be reduced and post reduction the shareholders holding 5 shares of Jasch Industries will continue to hold 3 shares and the remaining shares will be extinguished.

To sum it up, if you buy 5 shares of Jasch Industries before the record date, you will be allotted 2 shares of Jasch Gauging which will be subsequently listed and your 5 shares of Jasch Industries will be reduced to 3.

The company has received the NCLT approval for the above scheme and the record date should be announced in some time. Jasch Gauging will get listed 3-5 months post the record date.

Scope for value unlocking

As mentioned above, currently 2 entirely different businesses are housed in Jasch Industries and thus it makes sense for the company to demerge and separate the two.

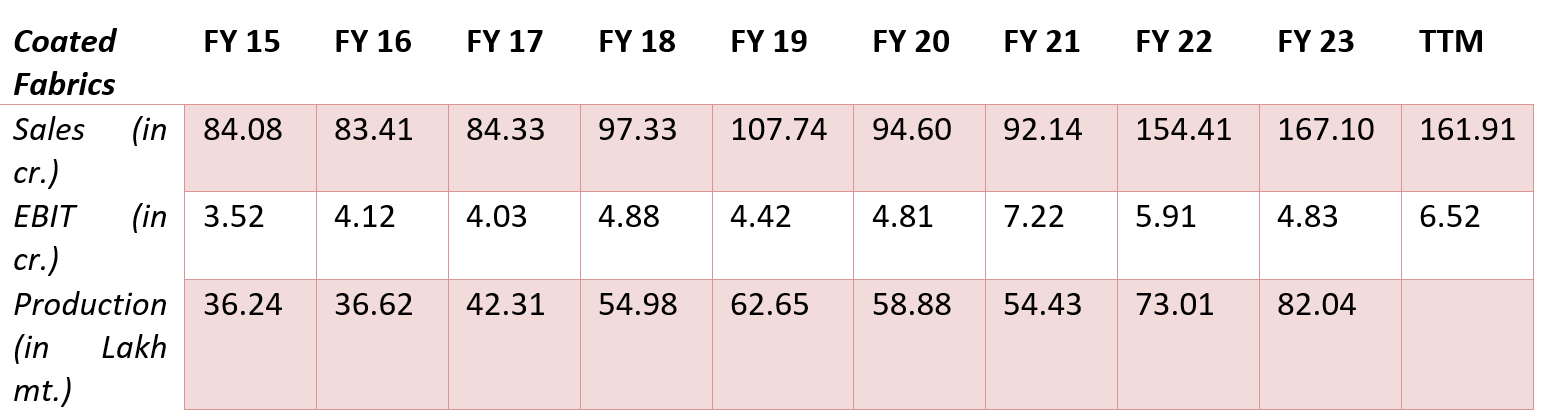

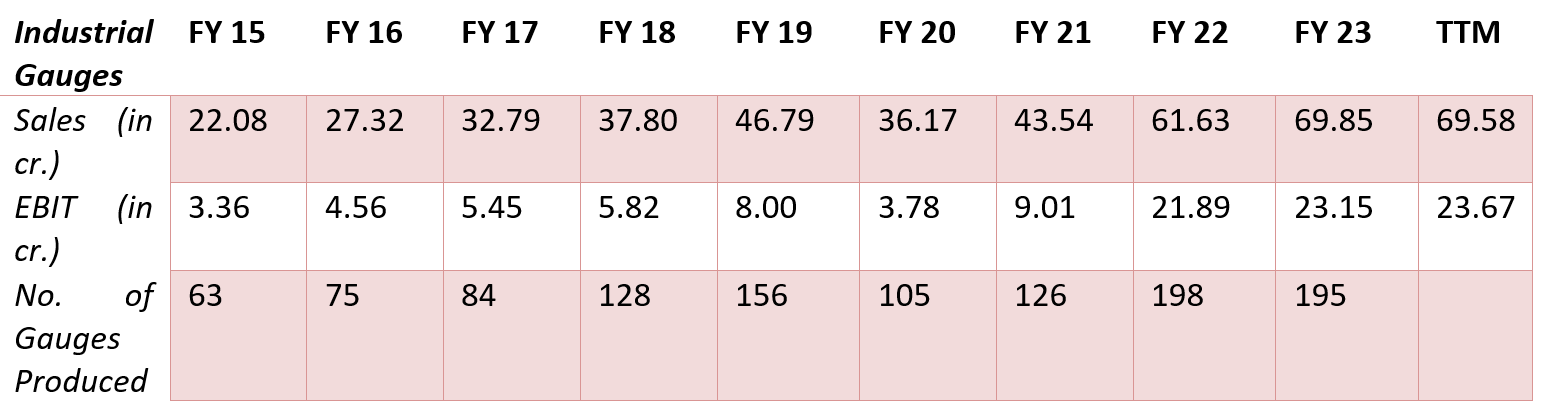

Here’s the performance of the 2 divisions over the last few years:

Source: Jasch Industries Annual Reports

Source: Jasch Industries Annual Reports

As per our understanding, the segmental sales and EBIT reported for Gauges division includes the other income.

The company accrues around Rs 3-4 crore other income annually since the past few years which is largely in the form of interest income on FDRs.

At the end of FY 23, the company had Rs 49.7 crore of Bank deposits (FDRs).

The annual interest outgo has only been around Rs 1 crore since the past few years. So, the EBITs mentioned above can largely be considered as PBTs for the respective divisions.

Coming back to the performance of the 2 divisions, both have been growing well and reasonably profitable; however, clearly, the Industrial Gauges division has been growing much faster and is significantly more profitable in comparison to the Coatings division.

On TTM basis, Rs 4 crore PAT can be attributed to Coatings division and Rs 17-18 crore PAT to Gauges division.

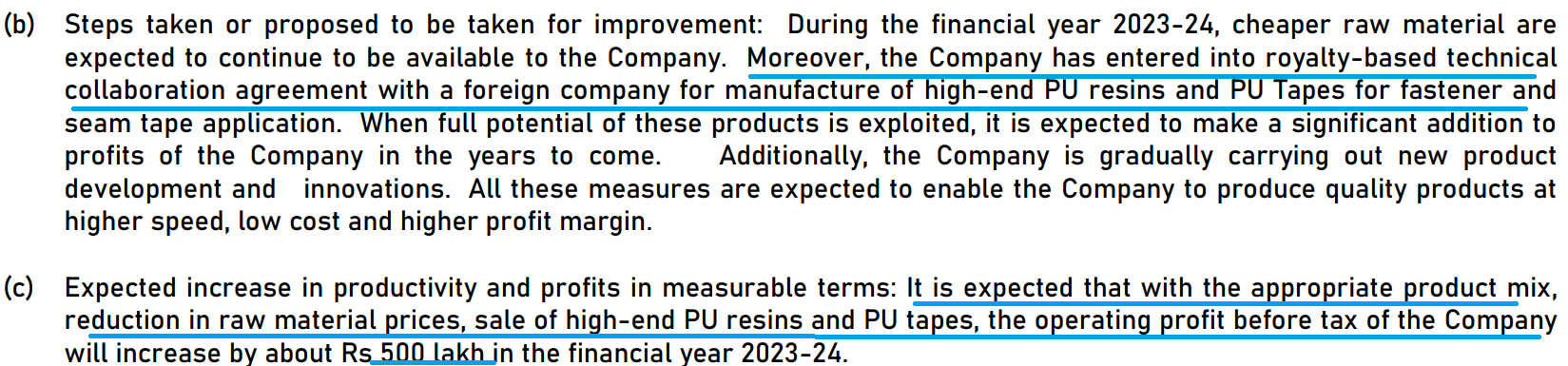

What’s interesting though is that the management expects significant improvement in profitability in the Coatings division in FY 24.

Source: Jasch Industries AR 2023

Assuming there’s no improvement in profitability of coatings division, at around Rs 4 crore PAT, we believe post demerger Jasch Industries should be easily valued around Rs 40 crore market cap.

Regarding the industrial gauges division which will be listed as Jasch Gauging, the PAT should be around Rs 17-18 crore (assuming no change).

Here’s how the market cap of Jasch Gauging will look like at various PE ratios:

| PE | Jasch Gauging Expected Market cap (in cr.) |

| 12 | 210 |

| 15 | 262.5 |

| 20 | 350 |

The current market cap of Jasch Industries is Rs 275 crore.

Thus, sum of the parts can be greater than the whole if the market ascribes higher valuations to much more profitable Industrial Gauges division.

The coatings division can also surprise on the upside if the company achieves the stated expectations of increase of Rs 5 crore in operating profit before tax for FY 24.

Risks/concerns

Since the last 2 years there’s been a significant increase in the profits of Industrial Gauges division due to higher sales and operating leverage. While the company has been consistent in terms of sales growth, the fortunes of the division are linked to investment by user-industries on capital goods or on quality control equipment. Fall in demand and sales can significantly impact the profitability and the valuations of the industrial gauges division.

Over the past few months there’s been a significant rise in small cap index and small cap stocks. In case of a major correction, stocks across the board will get de-rated and can impact the valuations of Jasch Industries and Jasch Gauging.

The stock is only listed on BSE and being a micro-cap, the average daily volumes are low which can have significant impact cost while buying and selling.

Disclosure: I do not have any holding in Jasch Industries.

Best Regards,

Ekansh Mittal

Research Analyst

http://www.katalystwealth.com

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to investors on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

Address – 7, Panch Ratan, 7/128, Swaroop Nagar, Kanpur – 208002, Contact No. – +91-7275050062

Compliance Officer – Mr. Ekansh Mittal, +91-9818866676, [email protected]

Grievance Redressal – Mittal Consulting, [email protected], +91-9818866676, +91-7275050062

“Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors”.

Performance numbers do not include the impact of transaction fee and other related costs. Past performance does not guarantee future returns.

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing.”

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No