Hello Sir,

Hope you are doing well.

Recently, I was going through the details of Amara Raja Energy & Mobility Ltd.

Earlier its name was Amara Raja Batteries and is a very well known brand in the automotive batteries space.

We used to track this company before and even recommended it back in May 2012 to Alpha and Alpha + members around 150 odd levels and closed it with 300% + gain 2 years later in Sep 2014.

I think we did well by closing it around 600 odd levels in Sep 2014 as 9 years later the price is still around 650.

Nevertheless, the company has grown since then and is entering new energy spaces like Lithium-ion cell and pack manufacturing, EV charging products, etc.

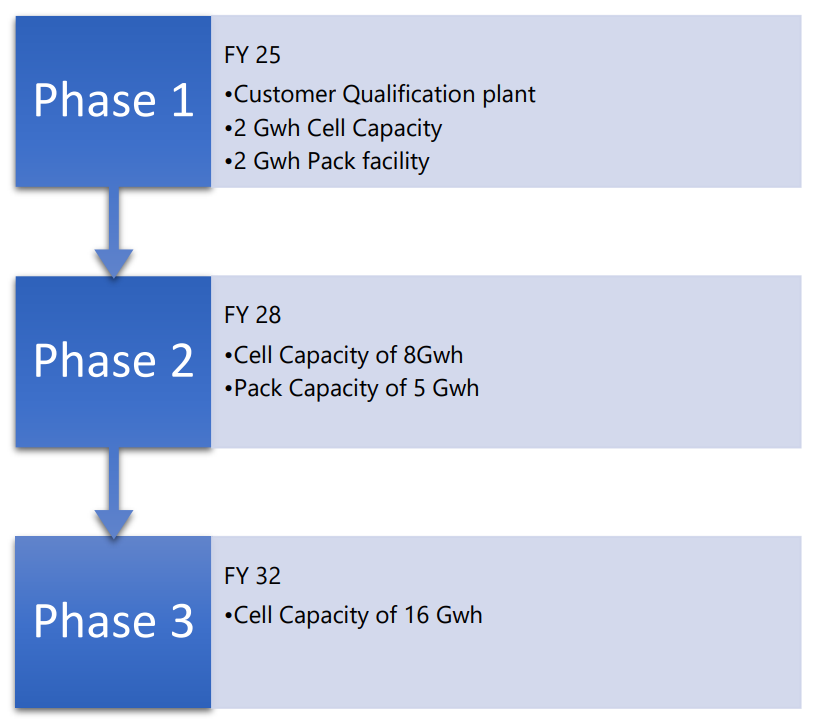

Source: Amara Raja Q4 FY 23 presentation

Below, we have shared interesting insights from the Q1 FY 24 con-call of Amara Raja Energy and Mobility to understand the current situation and the outlook for the company. Hope you find the details useful for your own investments or to add the stock to your watch list.

Before that, yesterday we released new Special situation opportunity for our Alpha + members

It’s an open offer cum ownership change based opportunity with potential for value unlocking

The company is very strong fundamentally, debt free with surplus cash and high profitability. We believe, change in ownership along with already strong profitability and growth can result in re-rating of the company to higher valuations.

Further, the stock is consolidating in a tight range and the open offer price caps the downside

For more details on the opportunity – click HERE

Amara Raja Energy & Mobility – Insights from Q1 FY 24 con-call of the company

– General

- We had a revenue of Rs 2,795 crore of which about 4% is coming from the new energy business

- The overall Lead acid revenue still has a mix of 70% from Automotive which includes 4W, 2W and the inverters and 30% from the industrial segment

- Lead acid battery business growth was around 4% YOY

- 4W grew at about 5%; within 4W, the after market has grown at around 7-8%

- 2W grew at about 9%

- there was a reduction of about 20% as far as inverters and other applications are concerned both due to poor season as well as lack of complete production facilities as the tubular factory was gutted in fire in the month of January

- During the quarter, replaced the entire tubular range with the traded products; of the total turnover, around 15-16% is coming from traded products which also had an impact on margins

- The industrial segment has shown a strong growth of about 15% on a YOY basis

- Capacity utilization on the automotive side for the quarter was around 75% and 95-97% on the industrial side

– New energy business

- 107-108 crore sales during the quarter

- This is 3.5 times increase in sales on YOY basis 23% on QOQ basis

- Today we are supplying the battery packs to mostly 3 wheeler applications

- We are also supplying battery chargers to again 3 wheeler OEMs

- For first phase, customer qualification plant, 2 GWh (gigawatt hour) cell line and a lab will cost around Rs 1,500 crore; revenue from this should start coming in from FY 26

- The asset turns could be 1-1.2 and can improve to 1.4-1.5 as well

- As far as profitability is concerned, at the operating level we believe 10-12% kind of a margin is possible at this point of time

– Exports

- We expect that the volumes will run up in the export segment again and then we continue to maintain these healthy growth rates of 15-20% a year as we move ahead

– Demand

- The aftermarket demand outlook for 4Ws is still in the range of 6-7%

- 2Ws are growing strong at about 11-12% we are growing a shade more than that as far as two wheeler aftermarket is concerned

- We have seen a strong uptick in the demand for Telecom batteries because of the tower augmentation requirements; Telecom is now growing at around 16-17%

- The UPS segment also has shown a very strong growth domestically…earlier we used to see a growth of around 7-8%…this quarter we have seen a growth of 10-12%

- We expect that both these Telecom and UPS demand at this demand levels may sustain during the current year

– EBITDA

- QOQ reduction due to trading mix and higher insurance cost…these two are compensated by reduction in the power cost due to higher usage of self generated solar power

- New energy business will also impact EBITDA margin negatively considering this being a new business the EBITDA levels are still to mature

– Lead pricing

- Net average for the quarter was around Rs 194 per KG while currently the lead base is still hovering around 2,150 dollars; the currency depreciation is keeping the lead level elevated

- Around 150 to 170 is where we can look for a 15% kind of an EBITDA margin beyond that EBITDA margins do get diluted

– Guidance

- FY 23 we will close with EBITDA of 13%

(End)

Disclaimer: This is not a recommendation to buy/sell Amara Raja Energy & Mobility. The securities quoted are for illustration only and are not recommendatory.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

Address – 7, Panch Ratan, 7/128, Swaroop Nagar, Kanpur – 208002, Contact No. – +91-7275050062

Compliance Officer – Mr. Ekansh Mittal, +91-9818866676, ekansh@

Grievance Redressal – Mittal Consulting, grievances@

“Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors”.

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing.”

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here – LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No