Dear Members,

We have released 1st Feb’24: Pokarna Ltd (NSE Code – POKARNA) – Alpha/Alpha Plus stock for Feb’24. For details and other updates, please log into the website at the following link – http://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 1st Feb’24

CMP – 471.35 (BSE); 470.85 (NSE) Face Value – 2.00

Rating – Positive – 4% weightage (this is not an investment advice, refer rating interpretation)

Introduction

Founded in the year 1991 by Mr. Gautam Chand Jain, Pokarna is one of the leading exporters of Granite and the largest exporter of Quartz surfaces from India.

The company has 10 + captive granite quarries, 2 state-of-the-art granite manufacturing units and 2 Bretonstone® specialized quartz surfaces manufacturing facilities.

At around CMP of 470, we like it for the following reasons:

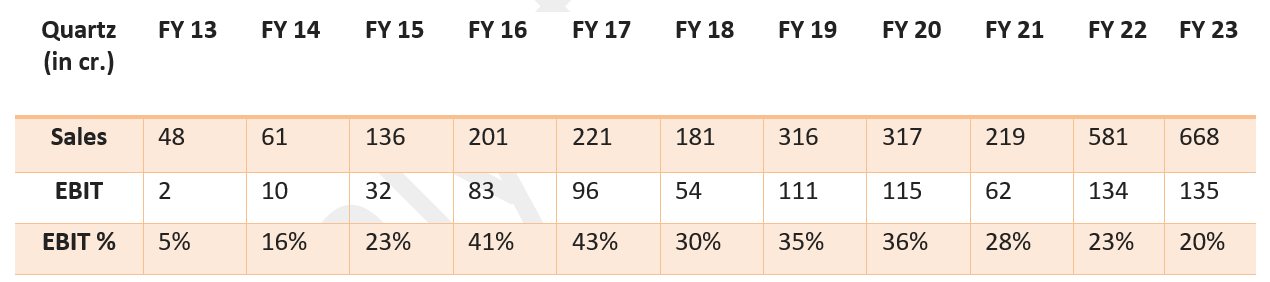

- Growing market – US is a major and growing market for Quartz surfaces. As per the report by Freedonia, Quartz accounts for 21% volume share of US countertop demand and expected to record 6.1% volume CAGR between 2022-2026

- Expanding into new regions – In FY 23, US accounted for 92.2% of company’s quartz sales, India 3.2% and the remaining came from rest of the world. The company recently expanded into markets like Canada, France, Russia, Mexico, and other geographies and expects contribution from rest of the world to increase to double digits in the next few years

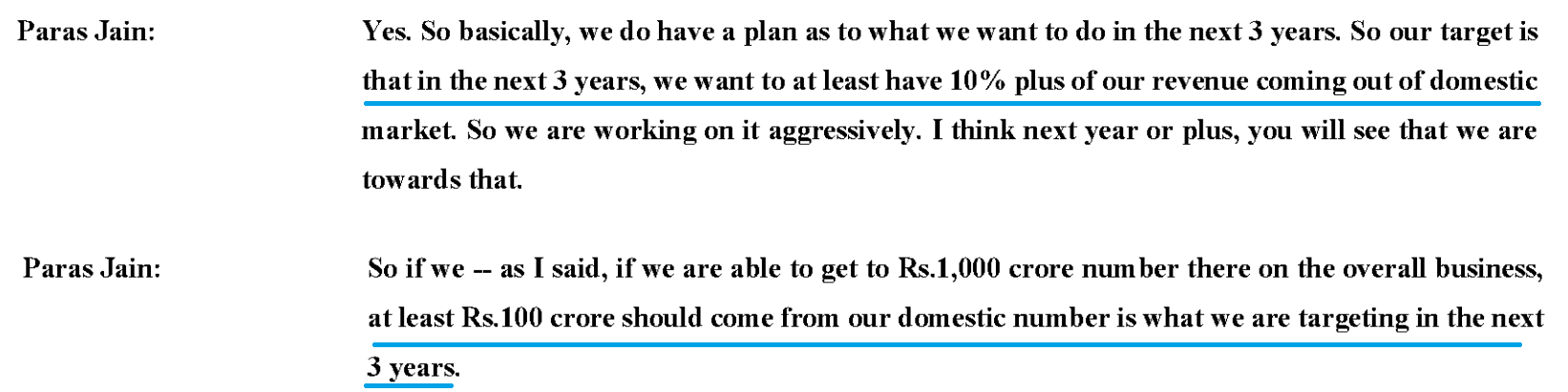

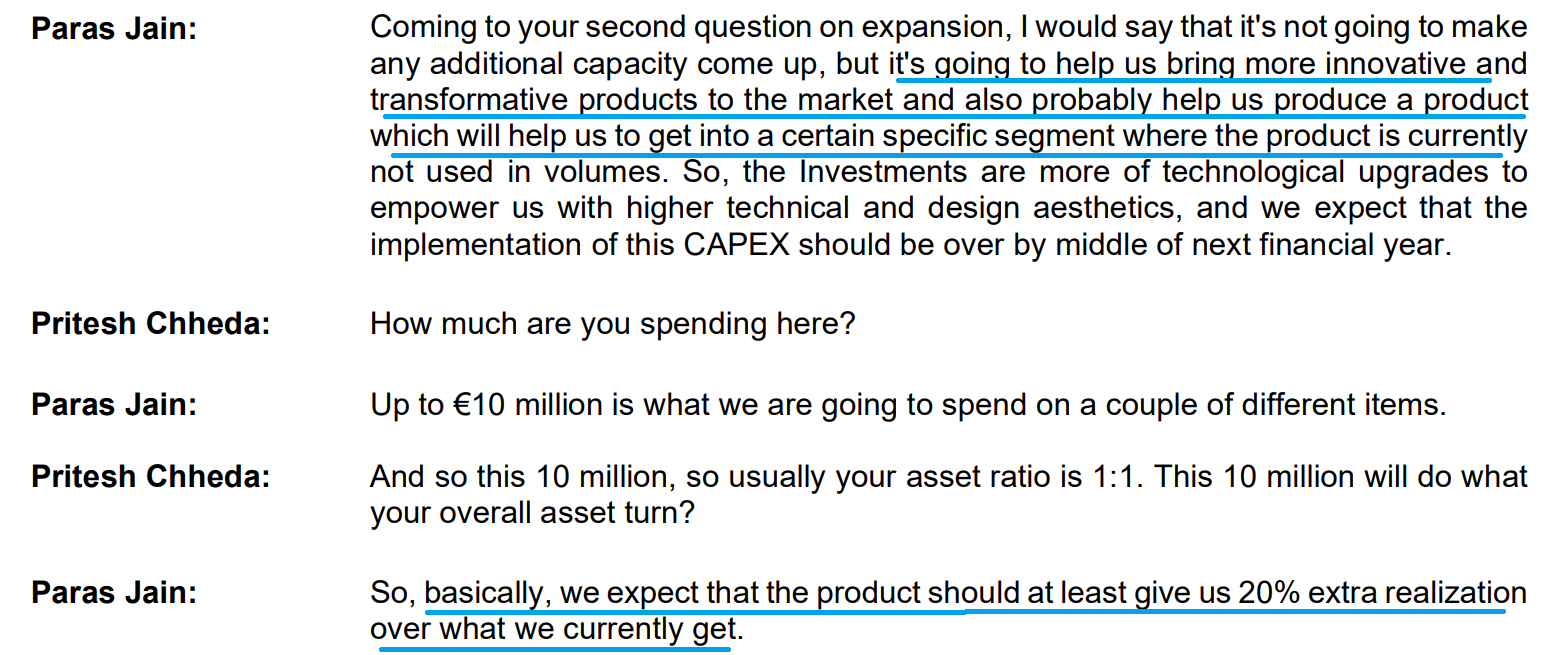

- The company is also expanding its distribution in India and is targeting 10% Quartz sales from India in the next 3 years

- Scope for increase in capacity utilization – In Mar’21, the company commercialized 2nd Quartz surfaces manufacturing unit and increased the capacity from 6.5 mn sq. ft. per annum to 15 mn sq. ft. per annum. In Sep’23 quarter, the company recorded Rs 190 crore sales from Quartz surfaces and the management indicated there’s good headroom for the capacity utilization to increase once the demand improves

- The 2nd Quartz unit that the company developed in Hyderabad is equipped to add a new line immediately. Thus, the capacity expansion can happen much faster this time around than the last time

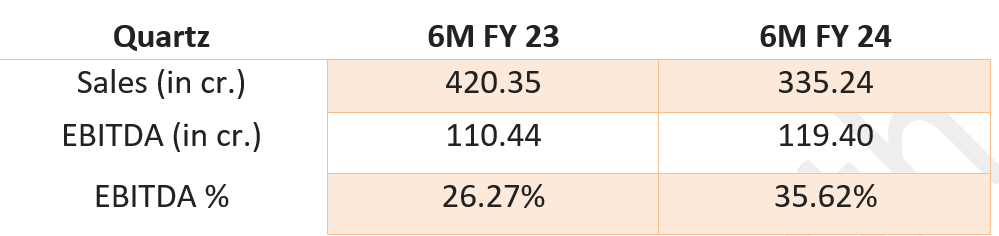

- Technological upgrades for product mix improvement – The company has chosen to invest up to 10 million Euros in technology upgrades to Quartz plants with likely completion by middle of FY 25. The CAPEX will help the company introduce innovative products with realizations ~20% higher than what the company currently gets

- Improving balance sheet – Post completion of CAPEX in 2021, the debt on the balance sheet has peaked out and has reduced from Rs 500 crore + at the end of FY 22 to around Rs 400 crore now

- Scope for improvement in profit – The company saw a dip in EBITDA margins to 24% in FY 23; however, on the back of improvement in product mix and prudently managing operating expenses, the management is focusing on sustaining 30% + EBITDA margins

- On the back of improvement in volumes, technology upgrades, we believe the company has the potential to clock sales of Rs 1,000 crore and PAT of Rs 115-175 crore in the next 3 years against the current market cap of Rs 1,450 crore

Business details

Set up in 1991 by Mr. Gautam Chand Jain, Pokarna exports granites from its quarries and manufactures apparels under the Stanza brand.

The company has a wholly owned subsidiary, PESL, which manufactures Quartz surfaces (also known as engineered stone) and serves the market through private label products and Quantra brand.

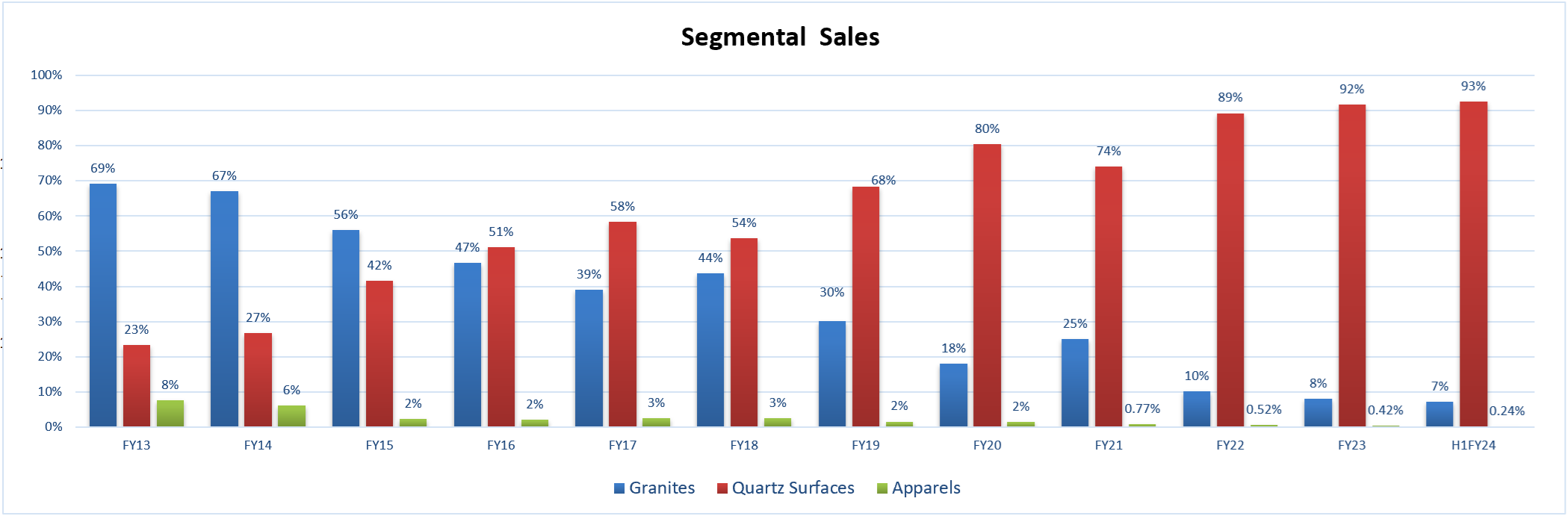

Source: Pokarna’s Annual Reports

As can be observed from the above charts, apparels were never a major segment for the company over the last 10-12 years, though it did impact the profitability negatively till FY 21. Even now it does; however, the contribution is minuscule.

A few years ago, the company tried to sell off the apparels division; however, the exercise was unsuccessful.

As far as the Granite segment is concerned, it was the largest segment for the company both in terms of sales and profits till FY 15; however, since then the contribution has been declining and is now less than 5% in terms of profit.

Since FY 19, granite division sales have more than halved while the Quartz surfaces sales have more than doubled. As per the management, they don’t foresee much scope for revival in the sales of granite to America as the market is moving towards Quartz.

Thus, our investment thesis on Pokarna largely revolves around its Quartz surfaces division.

Quartz surfaces

The company started with the commercial production of quartz based engineered stone in Oct’09 and spent ~200 crores on the set up of the 1st unit at Vizag with a capacity of 6.5 mn sq. ft. per annum.

Then, Pokarna was the exclusive licensee and the only producer of natural quartz surfaces in India using the patented technology – Bretonstone System of Breton S.P.A, Italy.

However now, there are several manufacturers using Bretonstone technology and Chinese technology.

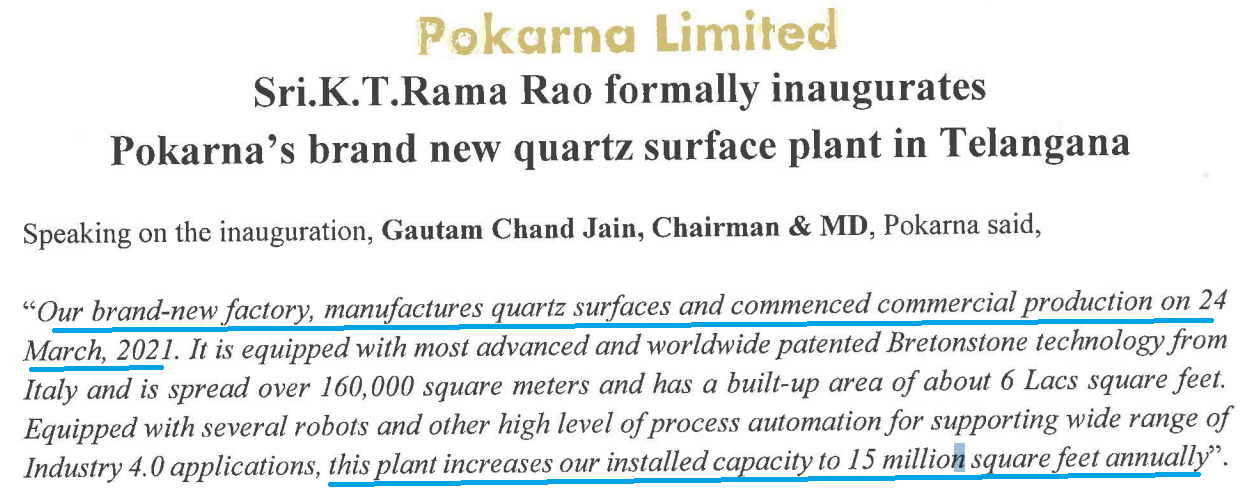

12 years after setting up the first plant, in Mar’21, the company commercialized 2nd Quartz surfaces manufacturing unit and increased the capacity from 6.5 mn sq. ft. per annum to 15 mn sq. ft. per annum.

The company spent around Rs 500 crore on setting up the 2nd unit.

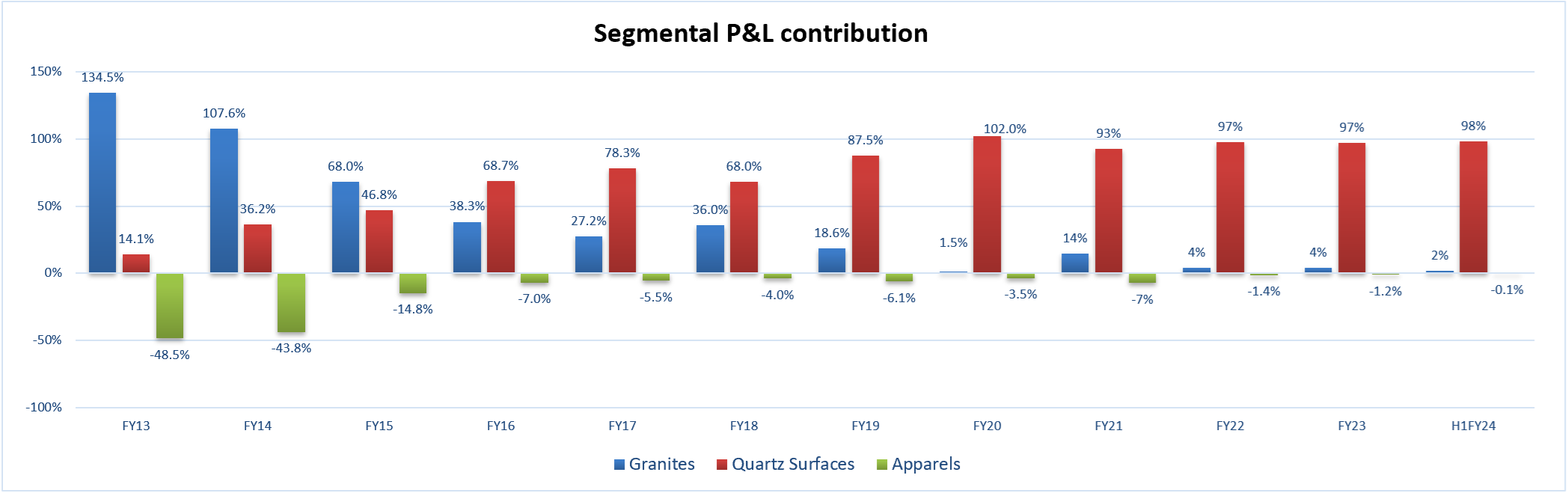

Source: Pokarna’s Annual Reports

As can be noted from the above table, Pokarna has done well in the Quartz segment with the business scaling up more than 10x in the last 10 years.

The growth has come primarily on the back of strong countertop demand in US and the increasing penetration of Engineered Quartz.

As per the estimates by Freedonia, at the end of 2014, quartz market share was 8% in terms of volume in US (increased from 5% at the end of 2010) and the same increased to 21% at the end of 2022.

Source: Caesarstone Nov’23 presentation

Geographical expansion – In the Quartz segment, the company derives 90% + revenue from sales to US.

Naturally so, considering in 2022, North America accounted for the largest share, representing 35% of global engineered stone countertop demand.

However, with the rise in interest rates in US and across the world and the anticipated challenges in sustaining the strong growth rate of the past, the company is looking at expanding distribution in other countries.

Source: Pokarna’s Annual Reports

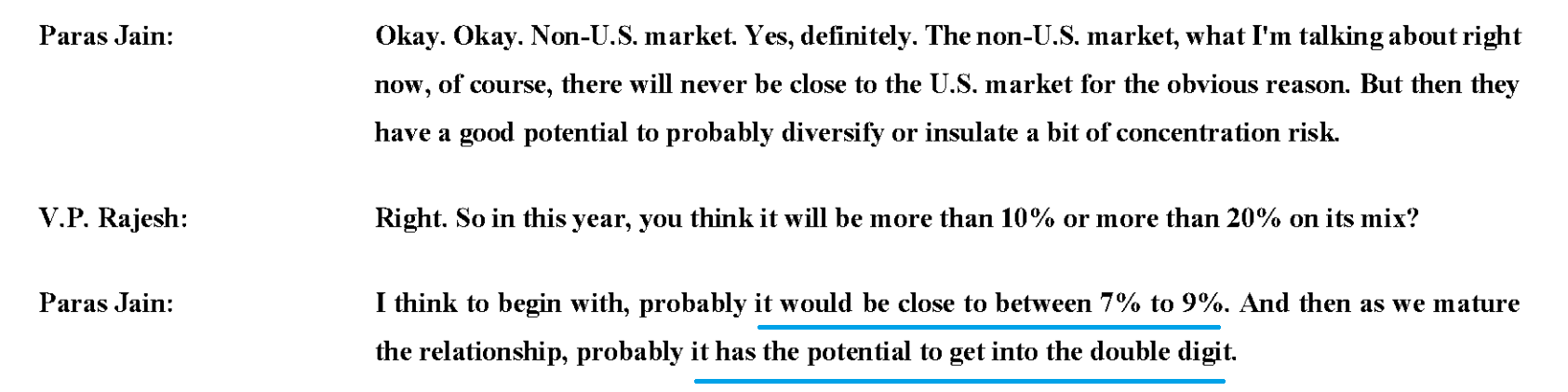

As per the management, in the last few quarters, they have started selling in new geographies like – France, Mexico, Canada, Russia, etc. and believes the share from the rest of the world can increase to double digit from around 5% currently.

Source: Pokarna’s Q4 FY 23 concall

India is another country the management is focusing on now and has started tapping the kitchen and the bath segment.

Source: Pokarna’s Q4 FY 23 concall

The company’s products are available in around 110 stores run by its dealers.

Technology upgrade – Company’s ability to introduce new product designs is a major factor in determining the realizations and the profitability.

As per the management, there’s excess capacity currently while the demand is somewhat subdued, and the design innovation is the way forward.

For instance, in H1 FY 24, while the capacity utilization has been low, the company could still report higher profit on lower sales due to higher contribution of new design collections.

Source: BSEINDIA

To continue coming out with innovative products, the company has chosen to invest up to 10 million Euros in technology upgrades to Quartz plants with likely completion by middle of FY 25.

Source: Pokarna’s Q2 FY 24 concall

The CAPEX will help the company introduce innovative products with realizations ~20% higher than what the company currently gets.

Capacity expansion – Pokarna started talking about 2nd Quartz unit and 130% expansion in capacity in Jan’17 and was expecting to complete the same by Jun’18; however, the timeline got greatly extended and only by Mar’21 the company could commercialize the 2nd plant and increased the capacity from 6.5 mn sq. ft. per annum to 15 mn sq. ft. per annum.

Source: BSEINDIA

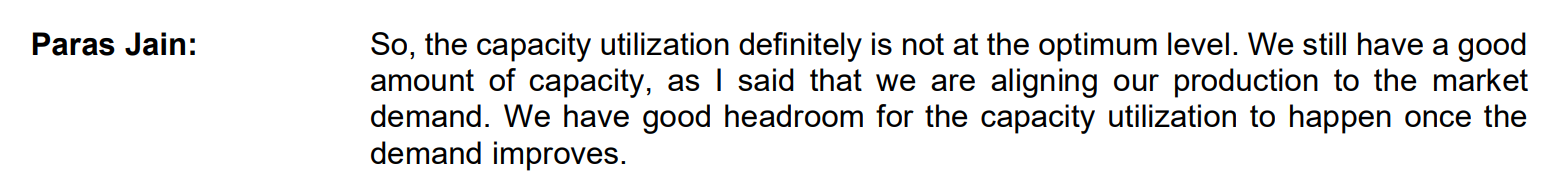

What’s important is that the capacity is not fully utilized yet.

Source: Pokarna’s Q2 FY 24 concall

In Sep’23 quarter, the company recorded Rs 190 crore sales from Quartz surfaces and the management indicated there’s good headroom for the capacity utilization to increase once the demand improves.

While the revenue depends on both capacity utilization and product mix (realization), it’s good to note that the company can do ~ Rs 750-800 crore sales even with less than optimum capacity utilization.

Also, the 2nd Quartz unit that the company developed in Hyderabad is equipped to add a new line immediately. Thus, the capacity expansion can happen much faster this time around than the last time.

Anti-dumping duty – On 16th May’18, US initiated an antidumping investigation on imports of certain quartz surface products from China.

On 11th Jul’19, US imposed a definitive antidumping duty on imports of the subject good from China. The rate of duty on imports from China ranged from 265.81% to 333.09%.

Similar investigation was initiated against Indian exporters and on 28th Apr’20, the Department of Commerce (Commerce) announced its final determinations.

Source: enforcement.trade.gov

In the India AD (anti-dumping) investigation, Commerce calculated a final dumping rate of 2.67% for Pokarna and in the CVD (countervailing duty) investigation, Commerce calculated final subsidy rates of 2.34% for Pokarna.

Later, DOC completed first and second review of quartz surfaces anti-dumping duty order and in both, Commerce determined that Pokarna did not make sales of subject merchandise at less than normal value during the period of review.

Accordingly, Pokarna’s AD assessment rate reduced to 0% from 0.33% and the AD cash deposit reduced to 0% with effect from 9th Jan’23.

Promoters/Management

Pokarna is an owner operated business.

Source: Pokarna AR 23

Pokarna was started by Mr. Gautam Chand Jain.

He is ably supported by his son, Mr. Rahul Jain, who is also the MD of the company.

Mr. Paras Kumar Jain is the CEO of Pokarna Engineered Stone Limited.

The good thing about the promoters is that they don’t have related entities in their main line of business, i.e. Quartz surfaces.

Source: Pokarna’s Annual Reports

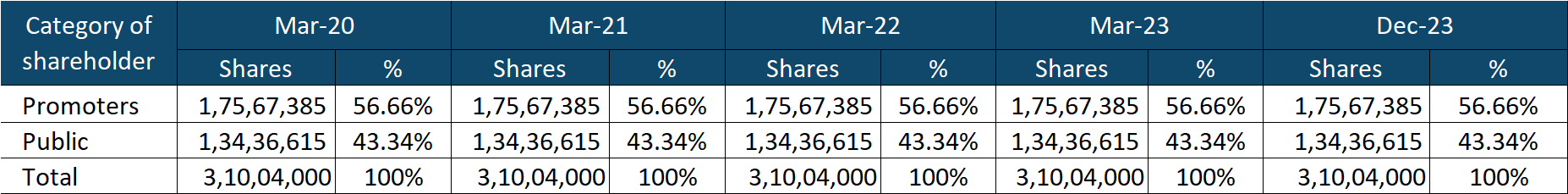

Another positive is that despite carrying out major capacity expansions pertaining to Quartz in 2007-09 and 2018-21, the company never diluted equity and the promoter’s holding has consistently remained above 50%.

Promoters have also advanced loans worth around Rs 100 crore to the company.

A major positive would have been discontinuation or sell-off of apparel business as the same has been loss making for several years now. The management did pursue restructuring of the same, but then reclassified it from discontinued operations to continuing operations in FY 19.

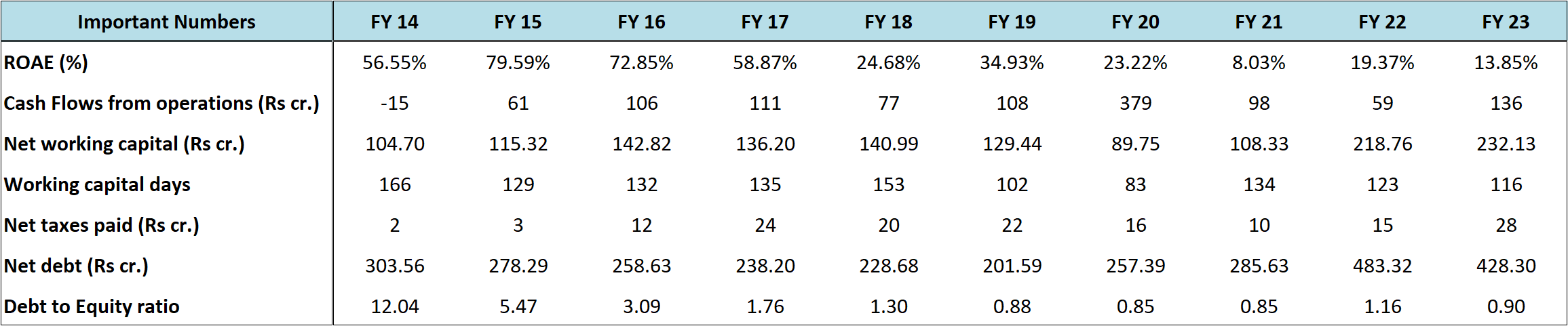

Performance Snapshot and Valuations

Source: Pokarna’s Annual Reports

Source: Pokarna’s Annual Reports

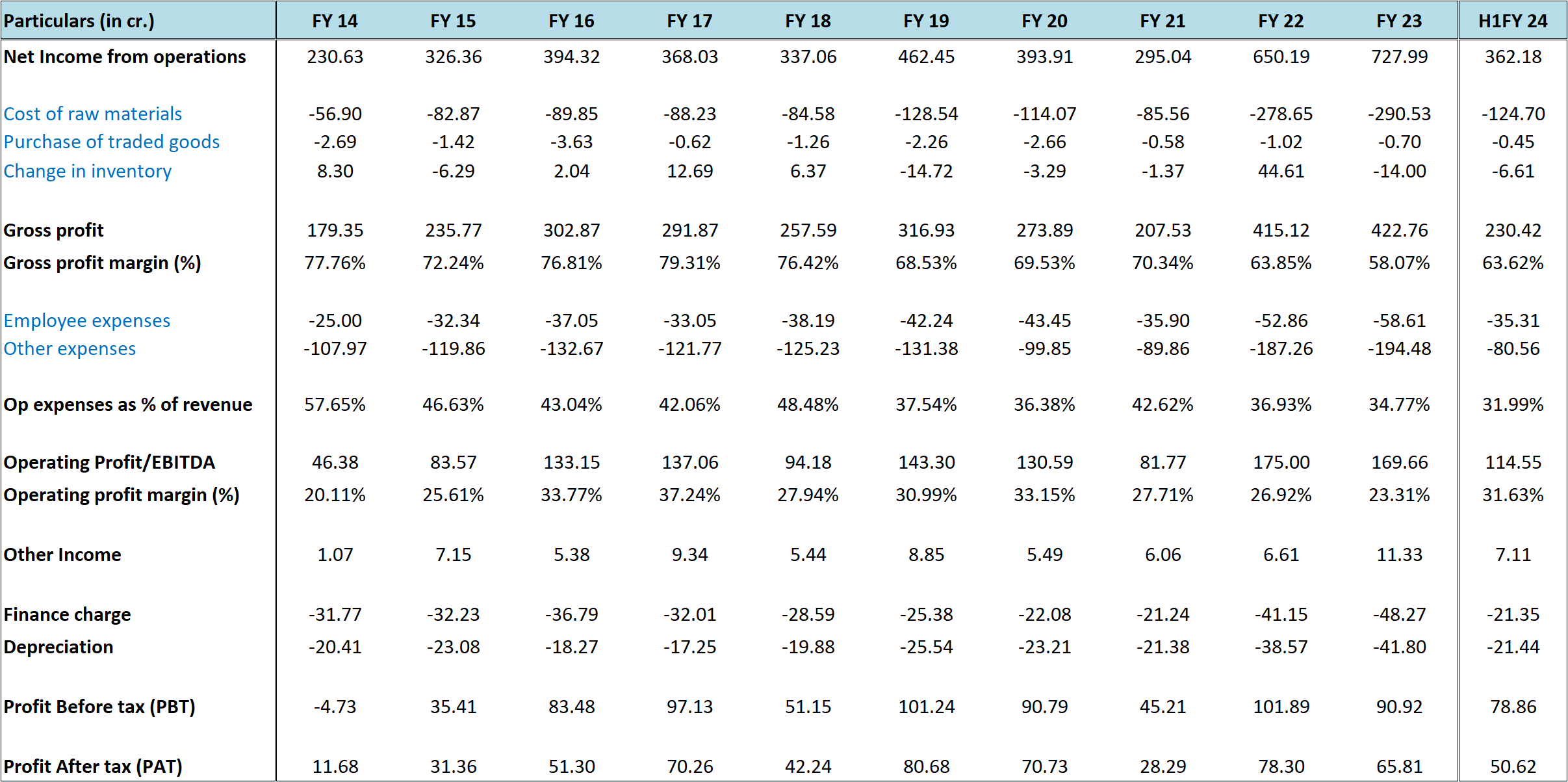

As mentioned in the sections above, the investment thesis on Pokarna largely revolves around its Quartz surfaces division.

From around 20% revenue contribution 12 years back, Quartz now accounts for more than 90% sales of the company and the entire PAT.

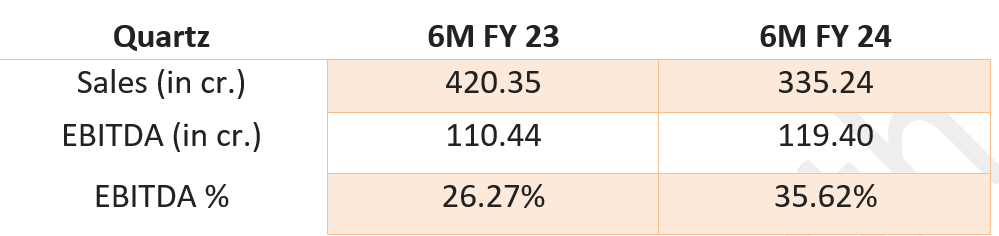

FY 23 ended on a sombre note for the company, with significant fall in sales, margins, and profits in H2; however, the company has made a decent comeback in H1 FY 24, especially Q2 FY 24.

Source: BSEINDIA

For H2 FY 24, while the Quartz sales are lower by 20% on YOY basis, the EBITDA is higher by 8% on YOY basis.

In Q2 FY 24, the company recorded Rs 190 crore sales from the Quartz segment and as per the management there’s still good headroom for the capacity utilization to increase.

Further, the company is embarking on a technology upgrade CAPEX which will help launch innovative products with realizations ~20% higher than what the company currently gets.

Lastly, to counter the slowdown in the US market, the company is expanding into newer geographies including India and is aiming double digit contribution from both Indian and Rest of the World.

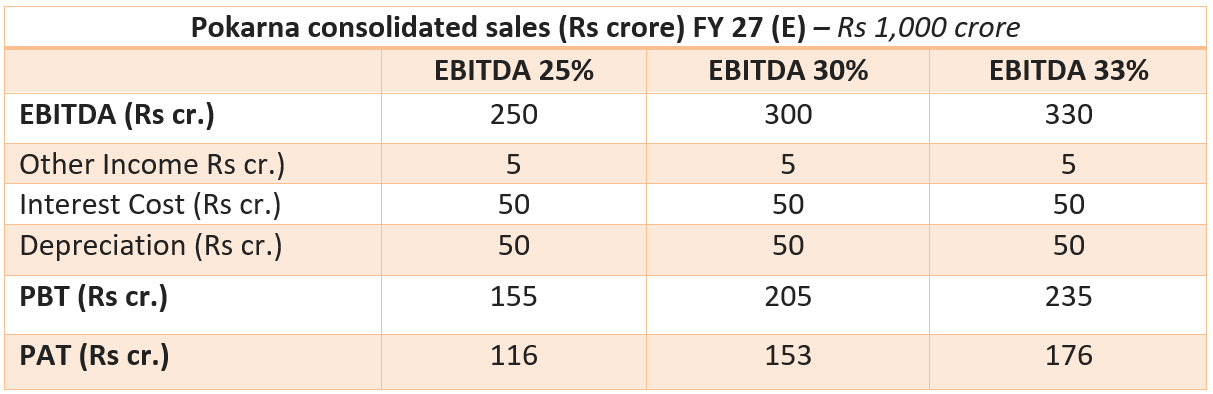

Thus, considering the factors above, we believe there’s a strong likelihood of the company crossing Rs 1,000 crore sales with 30% + EBITDA margins in Quartz segment in the next 2-3 years.

Now, let’s look at some scenarios assuming Rs 1,000 crore sales on company level in the next 3 years and different EBITDA margins

It is a well-known fact that projections rarely come true because they get influenced by the prevailing situation and that’s why we have taken different scenarios for EBITDA margins.

We believe, for the reasons explained above, the likelihood of crossing Rs 1,000 crores sales in the next 3 years is high. Margins can fluctuate, depending on the product mix.

We have assumed Rs 50 crore interest cost, even though it might be lower with repayment of debt related to 2nd quartz unit.

Overall, we believe there’s good potential for the company to double its PAT or even higher in the next 3 years from the TTM PAT of Rs 64 crore.

Regarding valuations, for the last 5 years, the median PE of the stock has been 16.8. We believe, 15-25 PE is a reasonable range for the company.

Risks/concerns

Quartz engineered stone has crystalline silica; in certain markets, there is a concern about respirable crystalline silica being generated when there is a dry cutting of the engineered store. So, there is certain regulatory scrutiny which is happening in certain markets. While the company has developed alternative formulations; should there be a ban on Quartz surfaces in its current form, the business of Pokarna will be disrupted in the short term.

Our investment thesis incorporates assumptions about growth in Quartz segment; if the demand doesn’t grow at the expected rate or if the cut-throat competition results in price wars, the company might end up reporting much lower numbers than our expectations.

We have assumed exit multiples in the range of 15-25. In case the market attributes lower valuations to the business, the returns will fall flat.

While the company has done well in various anti-dumping duty investigations by the US Department of Commerce, there’s always a risk of adverse regulatory actions by the authorities.

Disclosure: I don’t have any investment in Pokarna and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

http://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

Address – 7, Panch Ratan, 7/128, Swaroop Nagar, Kanpur – 208002, Contact No. – +91-7275050062

Compliance Officer – Mr. Ekansh Mittal, +91-9818866676, [email protected]

Grievance Redressal – Mittal Consulting, [email protected], +91-9818866676, +91-7275050062

“Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors”.

Performance numbers do not include the impact of transaction fee and other related costs. Past performance does not guarantee future returns.

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing.”

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart.

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director, or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No