Hello Sir,

Hope you are doing well.

Recently, I was watching an episode of Shark Tank India in which the founders of ‘JewelBox’, a jewellery brand from Surat talked about Lab Grown diamond (LGD) jewellery and got funding from all the sharks.

In case you are not aware, there’s already a listed company in India which is one of the largest players in the space of Lab Grown diamond jewellery. It is Goldiam International (NSE – GOLDIAM).

LGDs are chemically, optically and physically identical to earth mined diamonds, but are significantly more affordable. They cost 1/5th to 1/10th of a similar natural diamond.

Below, we have shared interesting insights from the Q3 FY 24 press release and investor presentation of Goldiam International to understand the current situation and the outlook for the company.

Before that, a few days back, we released our new stock recommendation for our Alpha and Alpha + Members

Company’s main growth and profit driving segment has grown more than 10x in terms of sales and profit in the last 10 years. We believe it has the potential to double its PAT in the next 3 yrs

For details on the stock click HERE

Goldiam International – Insights from Q3 FY 24 press release and investor presentation

– Basic numbers

- Goldiam’s Q3 FY24 consolidated revenue at Rs 205 crore increased by 10% Y-o-Y basis

- Goldiam’s Q3 FY24 EBITDA at Rs 43.8 crore increased by 9% Y-o-Y

- EBIDTA margins at 21.3% remained stable in Q3

– LGD

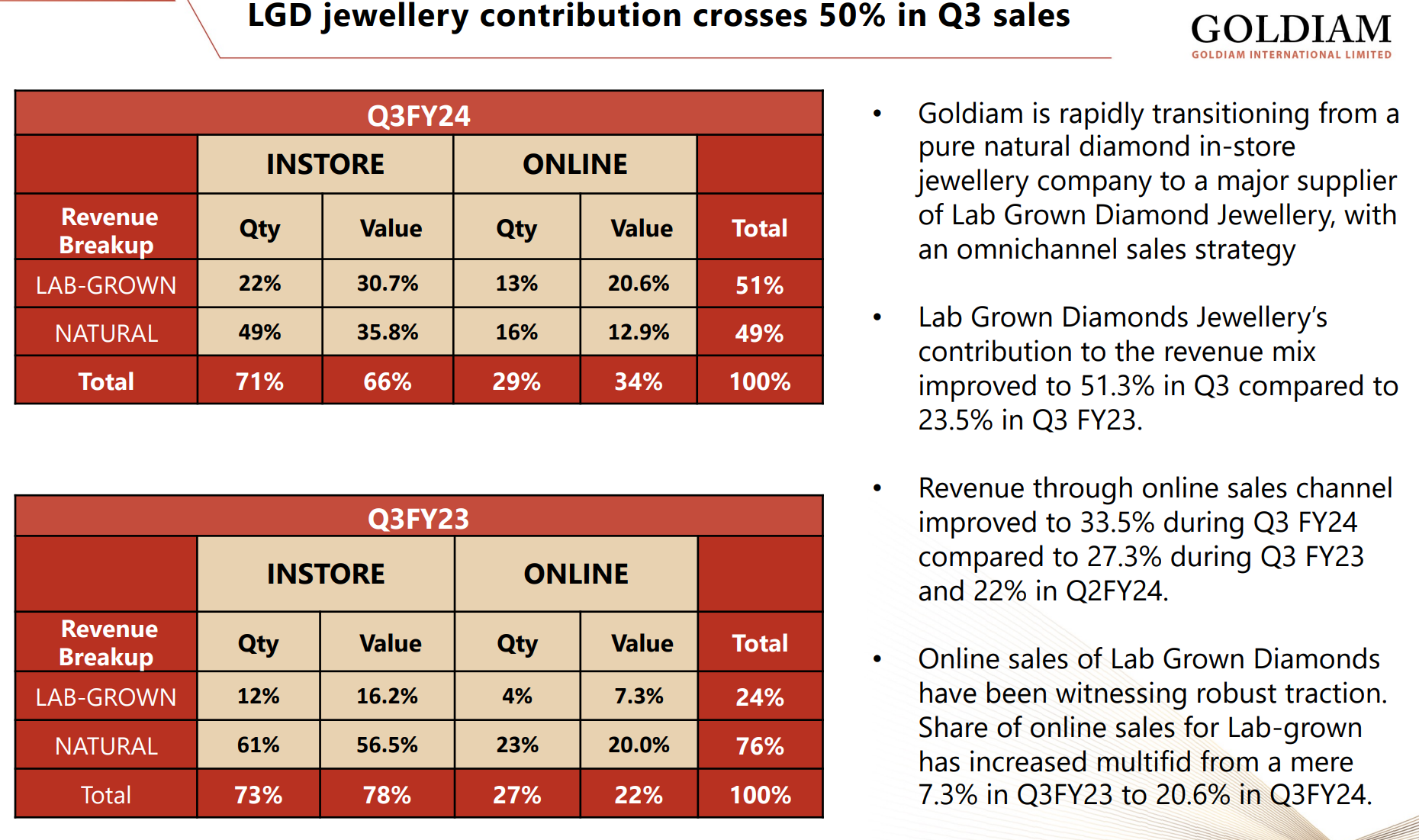

- During the third quarter of FY24, Lab Grown Diamond jewellery exports contributed more than 50% to the overall sales mix

- Lab Grown Diamonds jewellery’s contribution to the revenue mix improved to 51.3% in Q3 compared to 23.5% in Q3 FY23

- Revenue through online sales channel improved to 33.5% during Q3 FY24 compared to 27.3% during Q3 FY23 and 22% in Q2FY24

- Share of online sales for Lab-grown has increased almost 3-fold from 7% in Q3FY23 to 20.6% in Q3FY24

– Order wins

- During Q3, Goldiam had won orders worth Rs 70 crore for the export of gold studded diamond jewellery, bulk of which constituted supply of lab grown diamond jewellery. These orders need to be fulfilled by March 2024

– New Geographies

- During Q3, Goldiam added one more retailer as a client in the USA

- The company will soon start supplying diamond jewellery in Australia as well

- Goldiam is taking significant steps for its foray into India’s B2C market with its own stores to offer Lab Grown Diamond jewellery exclusively

– Other details

- At Goldiam, company is focusing more on producing higher carat diamonds in the range of 3-5 carat through its subsidiary Eco Friendly Diamonds

- Goldiam has built significant cash and cash equivalent position of Rs 318.6 crore

(End)

Disclaimer: This is not a recommendation to buy/sell Goldiam International. The securities quoted are for illustration only and are not recommendatory.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

Address – 7, Panch Ratan, 7/128, Swaroop Nagar, Kanpur – 208002, Contact No. – +91-7275050062

Compliance Officer – Mr. Ekansh Mittal, +91-9818866676, ekansh@

Grievance Redressal – Mittal Consulting, grievances@

“Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors”.

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing.”

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here – LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No