Hello Sir,

Hope you are doing well.

We scan through 100s of stocks in a year and analyze several of them to come up with few good stocks recommendations for our Alpha/Alpha + members.

Our focus is medium-long term wealth creation and the idea is to try identify opportunities with long runway for 20-25% CAGR possibility.

Recently, I was looking at Gokul Agro Resources.

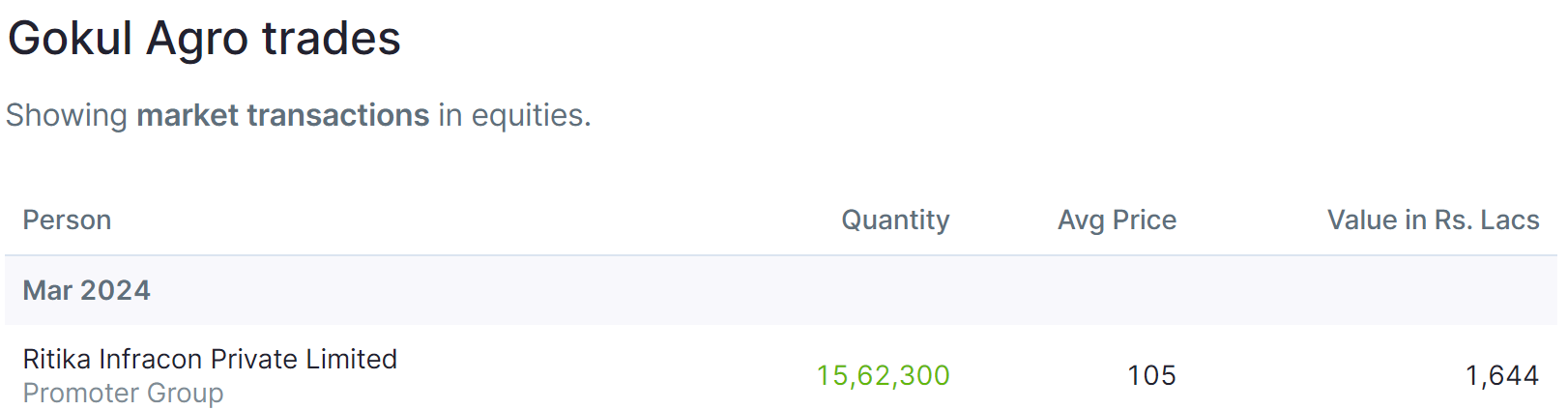

What caught my eye is that the promoters have bought 15 lakh + shares from the open market worth Rs 16 crore + in the month of Mar’24.

Source: Screener

The company manufactures edible oil and industrial oil and recently set up edible oil refinery in Haldia, West Bengal.

Below, we have shared basic details about the business and expansion plans of Gokul Agro from CRISIL Aug’23 report.

Note: We have started a telegram group by the name of Katalyst Wealth. The purpose of the same is to disseminate information/knowledge. You can join the group by Clicking HERE

Currently we have around 10 stocks in our buy-list.

4 days back, we initiated a New Stock Recommendation for our Alpha and Alpha + members. It’s indirectly related to Real Estate segment with reasonable valuations and strong growth outlook. We believe, there’s a good potential for market cap to cross Rs 5,000 crore in next 3 years. You can know more about the stock HERE

You can get the above stocks and other recommendations by signing up HERE

Gokul Agro – Notes from CRISIL Aug’23 credit rating report

– About Company

- Gokul Agro Resources Limited (GARL) was formed after the demerger of Gokul Refoils and Solvent Ltd (GRSL) in July 2015

- They have a subsidiary, Maurigo Pte Ltd, and step-down subsidiary, Riya International Pte Ltd, based in Singapore for procurement and supply

- The group is controlled by the promoter Mr Kanubhai Thakkar and his family

– Revenue and Customers

- 10-12% of the group’s revenue comes from exports of soya meal, mustard de-oiled cake, castor oil and its derivatives

- The remaining revenue is from domestic sales spread throughout India

- The group has over 500 dealers and distributors and a well established clientele including Parle, ITC Ltd, Britannia Industries Ltd, and Godrej Industries Ltd.

- Their brands include Vitalife, Zaika, Mahek, Pride, Richfield, Puffpride and Biscopride

– Procurement

- The group benefits from its subsidiaries in Singapore, a key oil trading hub, for procurement

- They also have longstanding relationships with industry players and plantations

– Manufacturing Capacity

- The Gokul Agro group has manufacturing facilities in Gandhidham, Gujarat with the following capacities:

- Seed Processing: 3,200 tonnes per day (TPD)

- De-oiled cake (DOC): 1,000 TPD

- Oil refining: 3,400 TPD

- Vanaspati manufacturing: 200 TPD

- Castor derivatives: 100 TPD

- The group is expanding capacity with new refineries at Krishnapatnam and Haldia

– Financial Performance

- The revenue contribution from palm oil declined from 63% in FY22 to 58% in FY23, with soya, mustard, etc. growing year-on-year

- Despite debt-funded capital expenditure, the financial risk profile is expected to improve over time due to a strengthening net worth.

– Risk Management

- The group hedges against inventory price fluctuations through back-to-back purchase arrangements and commodity exchange hedging

– Leverage

- The group’s net worth is estimated at Rs 650 crore as of March 31, 2023

- The total outside liabilities to tangible net worth ratio (TOLTNW) is moderately high at 2.26 times, but improved from 2.65 times a year earlier

– CAPEX

- The group has undertaken a debt-funded capex of Rs 230 crore in fiscal 2022 for a new oil refining unit at Krishnapatnam, Andhra Pradesh with a capacity of 1,400 TPD

- In June 2023, the group acquired an oil refining unit in Haldia, West Bengal with a capacity of 1,200 TPD

(End)

Disclaimer: This is not a recommendation to buy/sell Gokul Agro Resources. The securities quoted are for illustration only and are not recommendatory.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

Address – 7, Panch Ratan, 7/128, Swaroop Nagar, Kanpur – 208002, Contact No. – +91-7275050062

Compliance Officer – Mr. Ekansh Mittal, +91-9818866676, ekansh@

Grievance Redressal – Mittal Consulting, grievances@

“Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors”.

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing.”

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here – LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No