Dear Members,

We have released 17th Nov’24: Lords Chloro Alkali (NSE – LORDSCHLO) Insider Bets recommendation. The same has also been produced below. For details and other updates, please log into the website at the following link – http://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 17th Nov’24 CMP – 125.60 (BSE); 127.30 (NSE)

Rating – Positive (refer rating interpretation)

Duration – Medium to long term (refer rating interpretation)

Note: Members are free to make allocations of their choice in the stock, however as general guidance, we would suggest not allocating more than 4-5% to a single stock.

Lords Chloro Alkali (NSE – LORDSCHLO)

Established in 1979, Lords Chloro Alkali (LCAL) specializes in the production of Caustic Soda and has an installed capacity of 210 MT per day of Caustic Soda and 20 MT per day of Chlorinated Paraffin Wax (CPW).

It was incorporated as Modi Alkalies and Chemicals Limited (MACL) in 1979.

During the late 1990s, the company’s financial position became very weak and was declared sick in Jan 2002.

In 2005-06, company and management were taken up by Dhir’s and others prior to which name changed from Modi Alkalis to Lords Chloro.

New promoters filed a rehabilitation scheme in BIFR, which was sanctioned in November 2006 and the company got deregistered from the BIFR in March 2010.

The new management decided to revamp and get the old machinery changed during 2011 to 2014.

Company restarted commercial production with latest technology from Japan & Germany in 2015.

In 2021, Dhir’s made a voluntary open offer at Rs 47.75/- per share to buy out other promoters, increasing their stake to 74.72%, and taking over the company’s full management.

Preferential Warrants

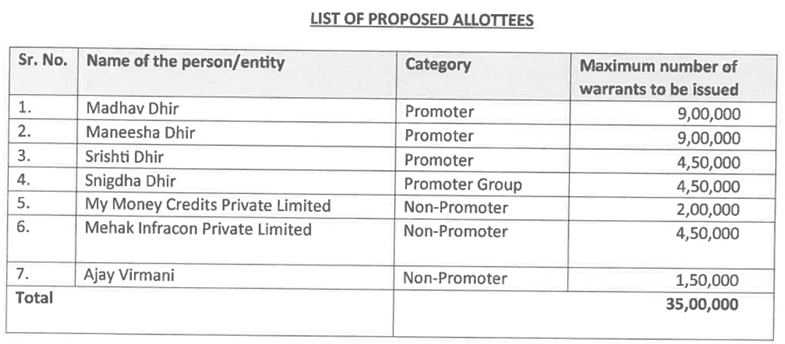

On 17th Jun’24, the Board of the company approved the issue and allotment of 35 lakh convertible warrants at a price of Rs 122/- per warrant.

Source: BSEINDIA

Out of 35 lakh, 27 lakh allotment is to Promoters and 8 lakhs to non-promoters.

Thus, promoters are taking up 77% of the preferential issue.

What’s interesting is that Mr. Ajay Virmani is the Managing Director of the company. Thus, despite not being a promoter, he is also an insider and taking up 1.5 lakh warrants.

Investment Rationale

Source: Screener

- Caustic soda is a commodity chemical which goes through major price swings. ECU (electro chemical unit) realizations peaked around Rs 55,000/MT in FY23 and have moderated to around Rs 30,000/MT now

- While prices are unlikely to go up in the short term due to enough unutilized capacities available, the long term trend suggests, the scope for further correction is also minimal

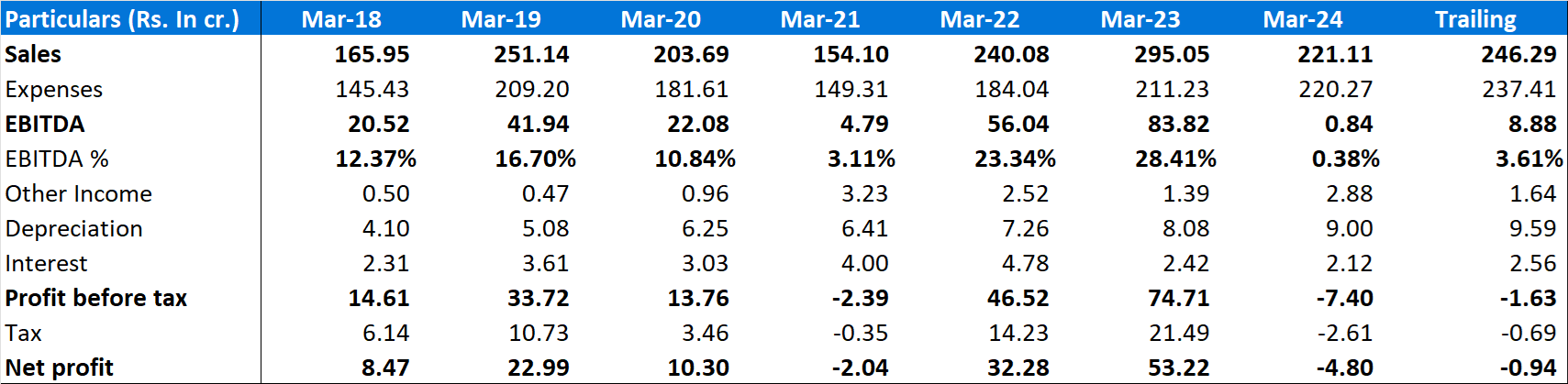

- Due to the drop in realizations, company’s sales have dropped from high of Rs 295 crore in FY 23 to only Rs 221 crore in FY 24 and PAT from Rs 53 crore in FY 23 to loss of Rs 5 crore in FY 24

- As a result, the stock has also corrected from highs of 400 odd levels to around current levels of 125-130 with lows of 110

- Meanwhile, company is undertaking a capacity expansion and adding 90 TPD of caustic soda capacity and 30 TPD of CPW capacity

- With capacity addition and based on current realizations, the management is aiming to achieve at least Rs 400 crore in sales. This could go up much higher if realizations increase

- The company started with 20 TPD of CPW in 2023 and expanding it to 50 TPD with plans for a further 50 TPD expansion later. Chlorine sells at negative price while conversion to CPW can help improve profitability

- It has also set up 16 MW solar power plant which will supply more than 10% of its energy requirements and help reduce power bill

- As per the management, this is expected to save the company Rs 1 crore per month upon stabilization

- For next year, the management is planning to put up additional 40 MW solar plant so that 30% + power requirement can be met through renewable and result in substantial savings on power and fuel cost

- 3 years + plan is to meet 70% + power requirement through renewable

Overall, we like the fact that Promoters are pumping in money into the company with major allotment to themselves around current levels.

We also like the fact that the MD of the company is also participating despite not being a promoter.

What’s also interesting is that Promoters have chosen to invest when the stock is down more than 60% from the highs and the industry is going through a downcycle.

In most such cases it is indicative of Promoters either finding value at such low prices or expecting improvement in performance going ahead.

Valuations – Being a cyclical business, it’s difficult to value such stocks based on PE; however, in terms of Price to Book, the stock is quoting at 1.8 times book value against long term median value of 2.1.

Barring covid-19 lows, the stock has largely traded in the range of 1 to 5 times book value.

Risks/concerns

For FY 24, the capacity utilization of the caustic soda industry dropped to 75% from around 80%.

New capacities are being added by Reliance and Adani. In case the demand growth remains subdued, the utilization levels will remain low, and the ECU realizations can remain depressed for longer periods.

Lords Chloro is expanding caustic soda capacity by 43%. In case the company is unable to improve the capacity utilization on the expanded capacity, the margins and the profitability of the company will be impacted.

Disclosure: I have personal investment in Lords Chloro Alkali and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

http://www.katalystwealth.com

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – This is based on our 20-25 stocks investment philosophy. Members are free to make allocation of their choice (if you invest) or consult their Investment Advisor for the same

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: Yes

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to investors on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690, BSE Enlistment No. 5114.

Address – 7, Panch Ratan, 7/128, Swaroop Nagar, Kanpur – 208002, Contact No. – +91-7275050062

Compliance Officer – Mr. Ekansh Mittal, +91-9818866676, [email protected]

Grievance Redressal – Mittal Consulting, [email protected], +91-9818866676, +91-7275050062

“Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors”.

Performance numbers do not include the impact of transaction fee and other related costs. Past performance does not guarantee future returns.

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing.”

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – Yes

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No