Dear Members,

We have released 27th May’22: Time Technoplast Ltd (NSE Code – TIMETECHNO) – Alpha/Alpha Plus stock for May’22. For details and other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 27th May’22

CMP – 94.25 (BSE); 94.10 (NSE) Face Value – 1.00

Rating – Positive – 4% weightage (this is not an investment advice, refer rating interpretation)

Introduction

Incorporated in 1992, Time Technoplast Limited (TTL) is one of the leading manufacturers of polymer and composite products.

It is the flagship Company of the Time group and has subsidiary companies (including step-down subsidiaries) operating across the globe.

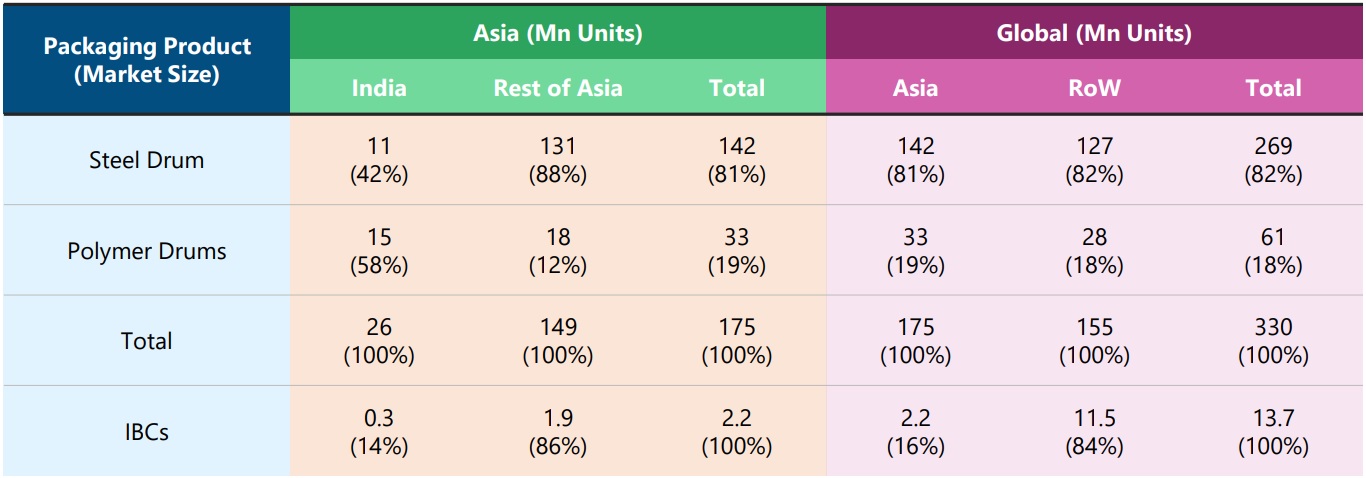

As per the company, globally, Time group is the largest manufacturer of large size plastic drums, the second-largest manufacturer of composite cylinders, and third largest intermediate bulk container (IBC) manufacturer.

The company has manufacturing facilities at 30 locations across the globe (including 20 within India).

At around CMP of 90-95, we like the company for the following key reasons:

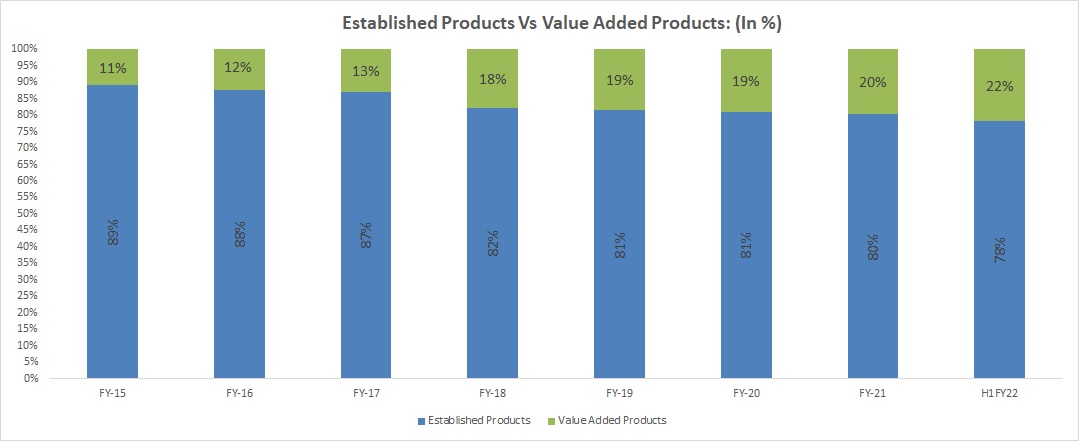

- Value added products – The company deals in 2 classes of products: Established products and Value-added Products.

- Established products account for 78-80% of the sales of the company while value added products account for the remaining.

- Over the next 3 years the management is targeting to increase the contribution of value-added products from 22% to 32%. Value added products command EBITDA margins in the range of 18-22% against 11-14% for established products

- CNG and LPG Type IV composite cylinders – TTL is the only maker of Type IV composite CNG cylinders in India and its cylinders have also been approved by PESO for on-board applications. Similarly, it is amongst the 2 companies that make type IV composite LPG cylinders in India.

- The composite cylinders manufactured by TTL come under valued added products category and have started witnessing a good inflow of orders.

- FY 25 guidance – By FY 25, the management is targeting sales of Rs 5,000 crore including around 32% sales from value added products with overall EBITDA margins of 14.5%-15.55%. Management is also focusing on improving the ROCE to 20% by FY 25.

- General points – Over the last 10 + years the company has diluted equity only once and has been consistently paying out 10-15% of the profits as dividends to the shareholders.

- Debt – Despite the increase in the scale of the operations, the borrowing of the company is almost same as it was Mar’13.

- Valuations – We like companies with not much expectations built into the price. The stock is currently trading around 1.1 times book and 11-12 times trailing twelve months earnings. Stronger growth in valued added products with improvement in margins and return ratios may lead to re-rating of the stock.

Business details

TTL is a leading manufacturer of polymer and composite products.

The company holds the following distinctions in its product categories:

- First to launch Intermediate Bulk Container (IBC) in India and 3rd Largest IBC manufacturer worldwide

- 2nd largest MOX film manufacturer in India

- 60% market share in domestic Industrial packaging. World’s largest manufacturer of large size plastic drums

- First to launch Type-IV Composite Cylinders for LPG and CNG (CNG cascade and on-board application) in India. 2nd Largest Composite Cylinders manufacturer worldwide

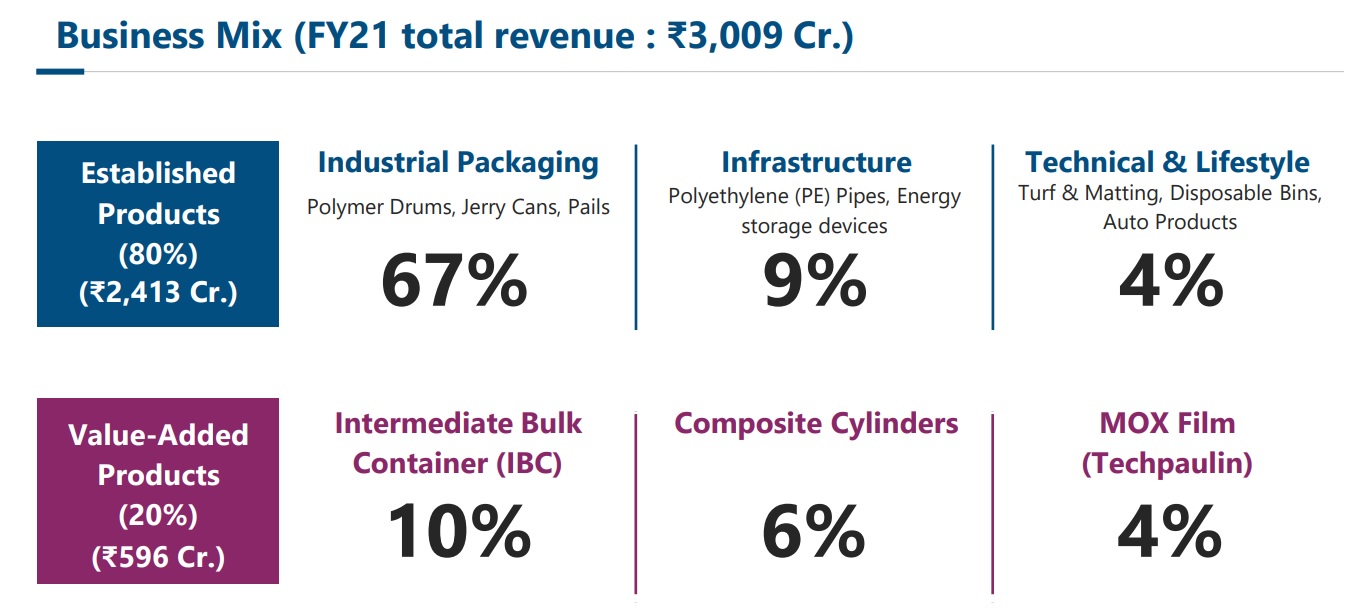

The company has categorized its business mix into two categories

- Established products

- Valued added products

Source: TTL’s Mar’22 presentation

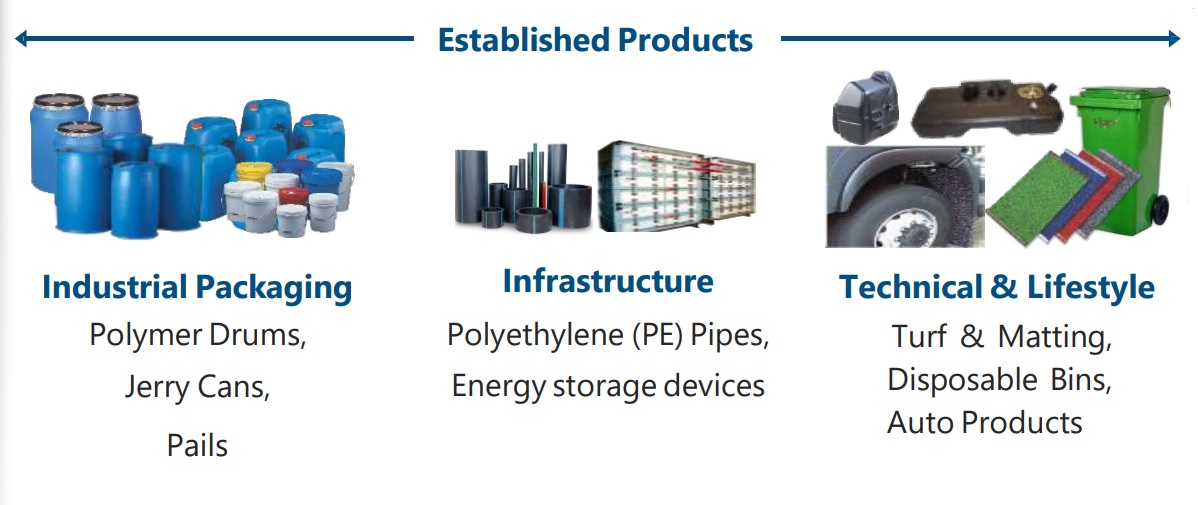

Established Products

Source: TTL’s Q3 FY 22 presentation

Established products are the ones which are already in the market since several years now and there are already significant number of players dealing in similar products.

The company derived 80% of its sales from established products in FY 21; however, the management expects the contribution from such products to reduce to around 68% by FY 25.

The established products category is further sub-divided into Industrial packaging, Infrastructure and Technical & Lifestyle.

Industrial Packaging

TTL produces Polymer drums / barrels, Jerry cans and Pails for varied packaging requirements.

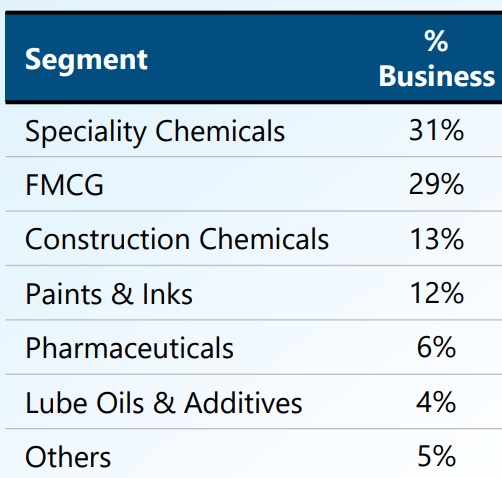

These are primarily used in sectors like chemicals, paints and pigments, food and beverage, petroleum, industrial coatings, agricultural, pharmaceutical, mineral, packaging, automotive and building products.

Source: TTL’s Mar’22 presentation

As per the management, they serve over 900 institutional customers and are the largest manufacturer of Industrial Packaging in Asia and MENA Region.

The demand for industrial packaging products is likely to be driven by shift from metal to polymer packaging and by MNCs looking east for lower cost of production.

Industrial packaging segment accounts for the bulk share of the established products sale at 67% out of 80%.

Infrastructure

Under this segment, the company manufactures High Density Polyethylene (HDPE) Pipes & Double Wall Corrugated (DWC) Pipes.

Source: TTL’s Mar’22 presentation

HDPE pipes are preferred over Galvanized, Ductile iron, Cement and conventional piping systems as they are 100% leak proof and capable of handling semi-solid & gaseous effluents.

DWC pipes are technically superior and cost-effective solution for drainage & sewerage systems over conventional RCC pipes.

Technical & Lifestyle

This is the smallest segment and includes products like turf and matting, disposal bins and some automotive products like rain flaps, air ducts, fuel tanks, etc.

Value added Products

Source: TTL’s Q3 FY 22 presentation

TTL has an in-house R&D team of around 30 people for upgrading existing and developing futuristic products.

As a result of the same, the company has been able to introduce products such as IBCs, Composite cylinders and MOX Film and many more products are in the pipeline.

As mentioned above, TTL is the first to launch IBCs and Type-IV Composite Cylinders for LPG and CNG in India.

Unlike established products, value added products have relatively less competition, contribute higher operating margins of around 18-22% against 11-14% for established products and are expected to record stronger growth.

Source: TTL’s Annual Reports and Presentations

As per the management, they expect the contribution of value-added products to increase from 20% in FY 21 to around 32% by FY 25.

The value-added products can be further sub divided into 3 segments: IBC, MOX Film and Composite cylinders.

Intermediate Bulk Containers (IBC)

IBC is a pallet mounted, industrial grade reusable container that is used for storing and transporting bulk liquids and powders.

Source: TRANPAK

Cube shaped rigid IBCs often have a standard footprint of 48″x40″ which enables easy shipping, conveying and transport due to it being a common pallet size in North America and other countries.

India is still a small market for IBCs while major demand comes from developed nations which account for around 84% of the total demand.

Source: TTL’s Mar’22 presentation

Thus, out of overall IBC capacity of 12.3 lakh units per annum, only 2.7 lakh is in India while the remaining 9.6 lakh units’ capacity has been setup overseas by TTL.

As per the management, TTL is the 3rd largest manufacturer of IBCs globally.

MOX Film

TTL launched MOX film in Apr’17 under the brand name of Techpaulin.

It’s a multi-layer, multi-axis-oriented X cross laminated film (MOX).

It’s basically a better form of conventional Tarpaulin and has multiple applications across industries such as: Agriculture, Infrastructure, Packaging, Commercial Vehicles, etc.

TTL has a total capacity of 12,000 MTPA for MOX film.

Composite Cylinders (LPG)

These cylinders are extremely lightweight, rust and corrosion proof, U.V. resistant, attractive in colour and shape and most importantly are 100% explosion proof.

TTL is the second largest manufacturer of composite cylinders in the world.

TTL has the largest range of composite cylinders ranging from 2 kg-22 kg and overall name plate capacity of 14 lakh units p.a.; however, as different sizes get manufactured the actual capacity turns out to be around 10 lakh units p.a.

Source: TTL’s Mar’22 presentation

As composite cylinders are relatively expensive then their metal counterparts, the demand for composite cylinders has been slow to pick up in India.

However, the company supplies to more than 40 countries and has approvals to supply in more than 50 nations.

Recently, with the increase in the prices of steel, the price differential between metal and composite cylinders has reduced from 30-40% earlier to 10-20% now and considering several other advantages, companies like IOC, BPCL, HPCL, etc are more willing to test and order the composite cylinders.

Orders by Indian OMCs – For the past few quarters TTL has been supplying smaller quantities of composite LPG cylinders to OMCs like IOC, BPCL, HPCL, etc.

In Q2 FY 22, the management talked about receiving an order of 30,000 cylinders.

Further, in Dec’21, there was a tender by IOC for 15 lakh cylinders.

Out of the same, TTL received the order on 3rd Mar’22 of 7,58,814 cylinders of 10 kg for a value of Rs 180 crore to be supplied over 12 months.

Till now this is the single largest order granted by Public OMC for Type-IV composite LPG cylinders.

Market potential – In India more than 36 crore LPG cylinders are in circulation and there’s annual replacement demand of 2-2.5 crore cylinders. All of this is currently being met through metal cylinders.

Globally as well there are 250 crore metal cylinders in circulation with annual replacement demand of 24 crore cylinders.

Capacity expansion – Considering the recent order win, TTL plans to add additional 10 lakh cylinders manufacturing capacity with a capital outlay of Rs 90 crore over the next 12-15 months.

Composite Cylinders (CNG)

Source: TTL’s Mar’22 presentation

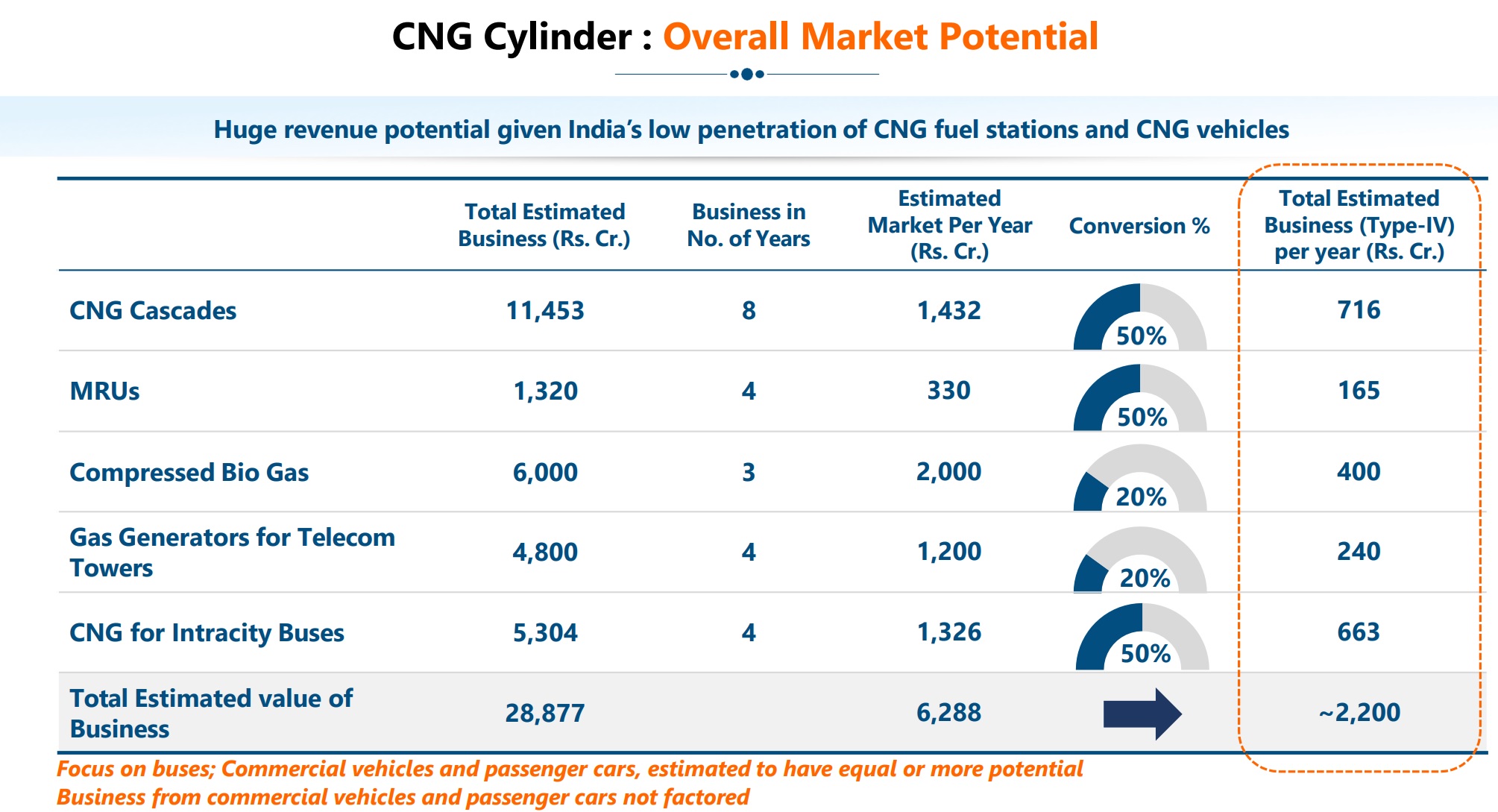

TTL has also developed Type-IV Composite CNG cylinders for various applications pertaining to CNG gas distribution (cascades, mobile refuelling units, gas generators for telecom towers, etc) and On-board applications in roof mounted buses, trucks, boats, cars, etc.

Currently, TTL is the only manufacturer of Type-IV Composite CNG cylinders in India and in May’21 it received approval from PESO and Bureau Veritas under ISO: 11439-2013 for manufacturing of Type-IV Composite Cylinder for On Board (vehicle) applications, for the first time in India.

The company started the CNG Cascades and CNG Cylinder business with a small investment of Rs 25 crore on which it can generate sales of Rs 55-60 crore. However, as they now have an order book of around Rs 250 crore, they will be investing behind capacity expansion as it can take 4-5 months to commercialize the same.

Composite CNG cylinders. opportunities – TTL management plans to address the CNG market in the following steps:

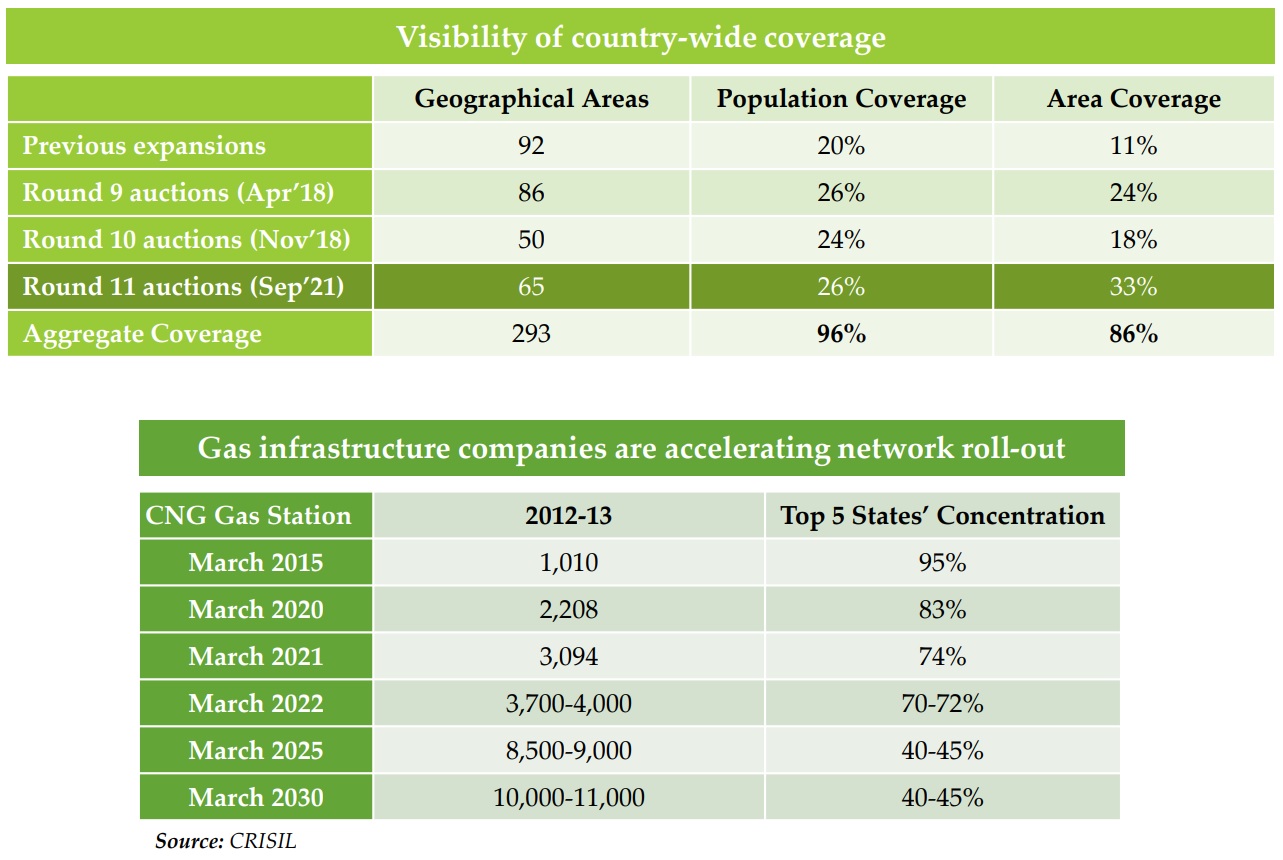

- First, the company plans to supply the cylinders used in cascades as there’s a very strong demand for the same. The 9th, 10th and 11th round of auctions for City Gas Distribution (CGD) geographical areas have been a great success.

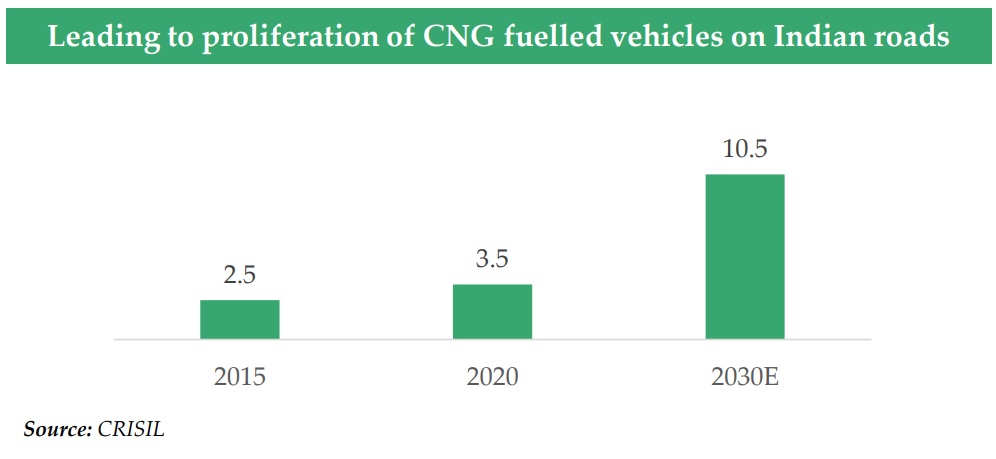

- As a result, the CNG gas stations are expected to increase from 3000 at the end of Mar’21 to 10,000-11,000 by Mar’30.

- In terms of supply chain, the companies have to ensure that the CNG gas is available across different retail outlets and thus there’s a strong demand for cylinder cascades

Source: Everest Kanto’s Feb’22 presentation

- As per TTL, each station requires around 2 cascade and the estimated cost of one cascade is around Rs 70 lakh. Thus, there’s potential opportunity of around Rs 11,000 crore over the next 8 years; however, it remains to be seen as to how much of the same comes from Composite cylinders over steel cylinders

- Second, the company intends to work with OEMs and retro-fitters for development of onboard cylinders. The company already has the approval by PESO for onboard applications.

Source: Everest Kanto’s Feb’22 presentation

- On the back of expanding network of CNG gas stations and rising fuel cost, the demand for CNG fuelled vehicles is also expected to rise

- The company is working with the OEMs like Maruti, Tata Motors, Ashok Leyland, etc., to get the CNG approval for their own requirement. However, it’s a long cycle of development as the samples have to be submitted, trials happen and the whole thing can 2-3 years.

Overall, the management foresees the following streams of revenue to open up for the Type – IV Composite CNG cylinders.

Source: TTL’s Mar’22 presentation

We think that the estimates are somewhat optimistic and the actual estimated value of business per year may turn out to be only around Rs 500-1,000 crore; however, it would still be great considering the sales from Type-IV CNG cylinders has only started and TTL is the only manufacturer in India.

Promoters/Management

TTL is an owner operated business supported by a professional management team. Late Mr. Anil Jain along with 3 other Co-Promoters started the company 35 years back.

- Bharat Vageria – MD – Holds a Degree in Commerce and a Fellow of Institute of Chartered Accountants (FCA) with over 35 years of experience in the Polymer Industry.

- Raghupathy Thyagarajan – WTD, Marketing – Holds a Degree in Science and Masters in Business Administration from Mumbai University with over 30 years of industrial experience in Polymer Products.

- Naveen Jain – WTD, Technical – Holds a Degree in Engineering from IIT Delhi with over 30 years’ experience in Production, Quality Management and Projects Management.

Mr. Vishal Jain, son of Mr. Anil Jain has also been inducted as an Additional Director. He is 37, an engineer and has done an Executive Finance course from IIM Bangalore.

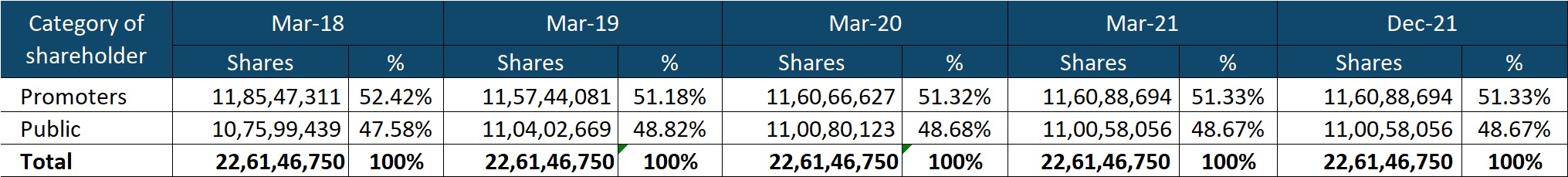

TTL is listed on exchanges for over a decade now and has diluted equity only once in 10 years. Promoters’ stake in the company has reduced from 62% in Mar’11 to 51.33% in Dec’21; however, there’s a minor increase since the lows of 51.18% at the end of Mar’19.

Source: BSE India

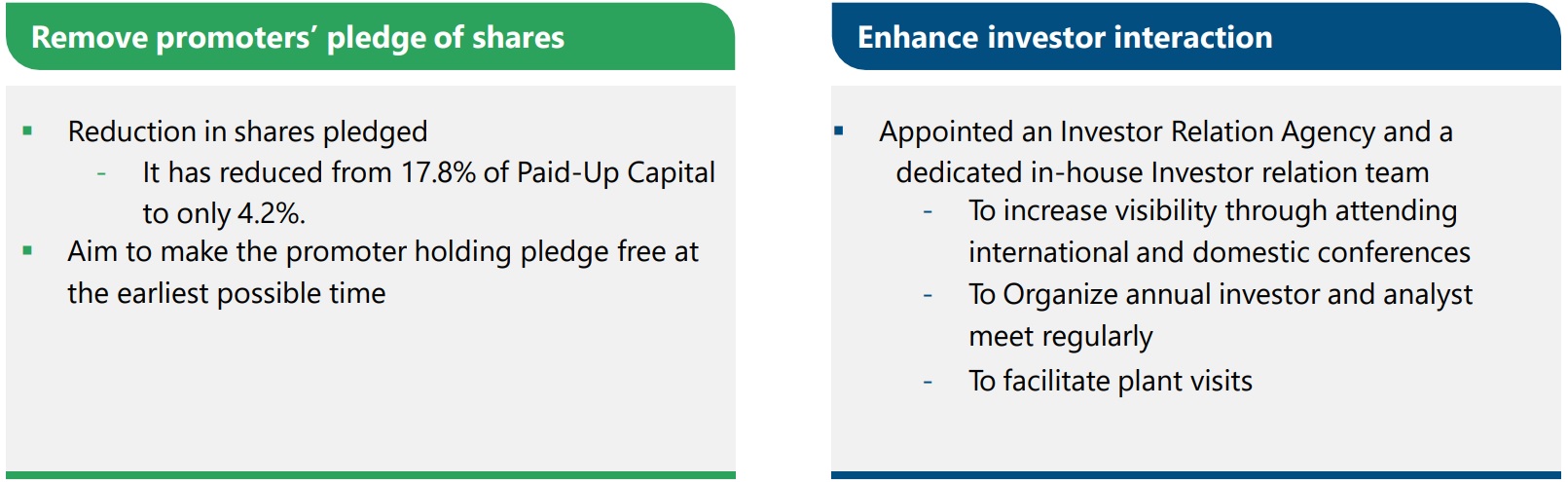

What’s interesting though is that Promoters have set 2 key priorities as below:

Source: TTL’s Mar’22 presentation

So, back in Mar’20, Promoters had 51.32% stake in the company and out of the same 34.76% or 17.84% of the total paid-up capital of the company was pledged. High pledge also resulted in a precipitous fall in the stock price of TTL which corrected from a high of 220 in Jan’18 to 24-25 odd levels in Mar’20.

Thus, it’s good to note that Promoters have started reducing pledge which is now down to only 8.18% of the stake held by them and 4.20% of the total paid up capital of the company.

Further, they plan to make the promoter holding pledge free at the earliest possible time.

Also, the management seems more willing to share and discuss the details with the investor and analyst community.

Performance Snapshot

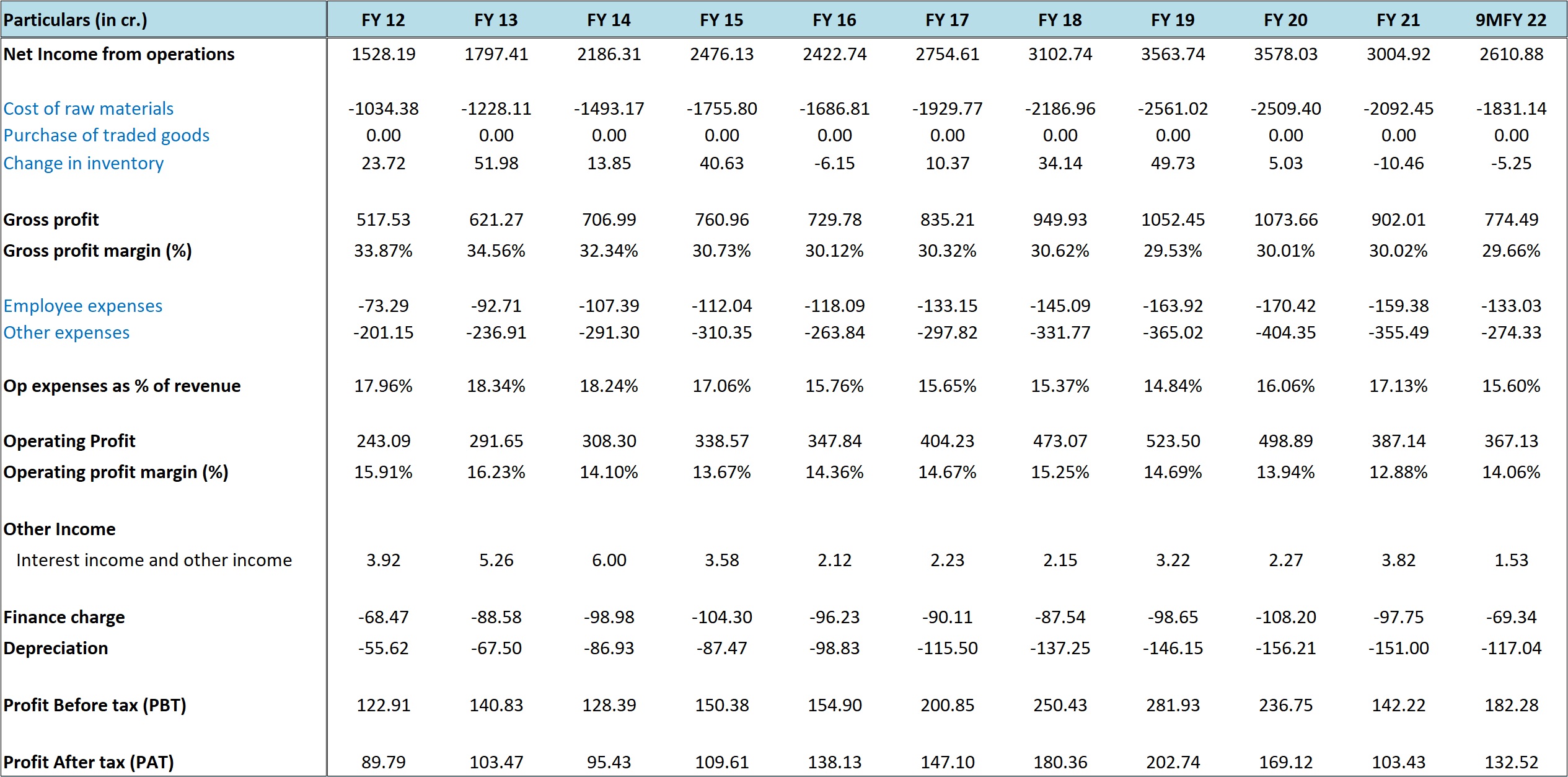

Source: TTL’s Annual Reports

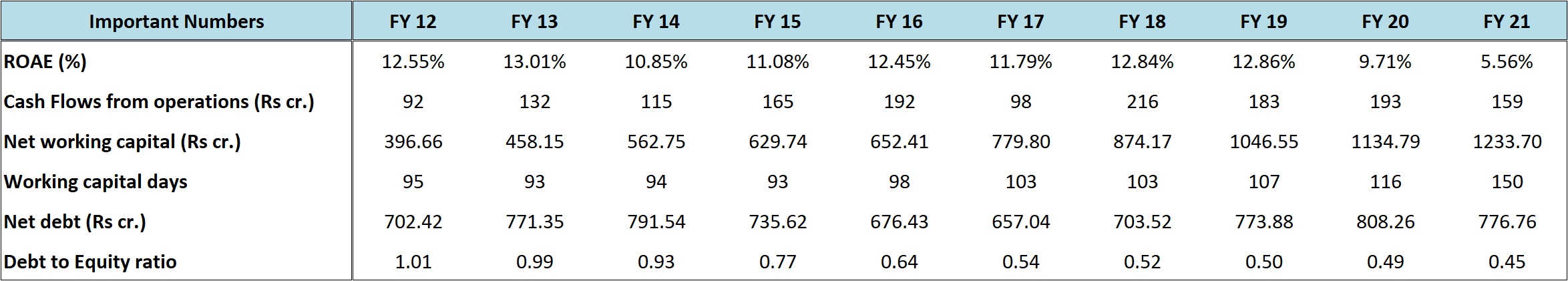

TTL’s performance has been average over the years. Some good bits have been consistency in operating margins (14-15%), no major increase in borrowing despite the increase in scale of operations and steady growth in sales (~10% YOY) barring the last 2 years.

Where the company has lacked is somewhat slow growth and lacklustre return ratios with Return on Average Equity (ROAE) not going higher than 13% in the last 10 years.

Source: TTL’s Annual Reports

FY 20 and FY 21 got impacted because of the overall slowdown and the impact of Covid-19.

For FY 22, the company is already back to FY 19, FY 20 numbers both in terms of sales and margins.

Way forward – As per the management, going forward products like IBCs are likely to find higher acceptance and similarly composite products like cylinders are expected to record much better growth.

Remember, TTL launched Composite LPG cylinders in India way back in FY 14; however, it’s only recently in Mar’22 it got a major order of Rs 180 crore from IOC.

Similarly Type-IV Composite CNG cylinders have been launched and the company got the approval from PESO and Bureau Veritas for on-board applications only recently in May’21.

Thus, overall, the value-added products could turn out to be the major growth drivers going forward. In fact, the management has set a target of Rs 5,000 crore sales by FY 25 with value added products share of 32% against only around 20% in FY 21.

Source: TTL’s Mar’22 presentation

Value added products have twin advantages of higher EBITDA margins in the range of 18-22% (against 11-14% for established products) and lower working capital cycle.

Thus, if the company is able to achieve the stated target, there could be multiplier effect in the form of higher operating margins, lower working capital cycle and higher ROCE too from the pre-covid levels of 13-15%.

The sales growth target of 11-12% CAGR seems reasonable considering the company was clocking similar growth pre-covid and now with the expectation of higher demand for composite cylinders (LPG and CNG), Rs 5000 crore sale by FY 25 seems achievable.

On the front of debt as well, the management has set a target of < 0.5 times FY 25 EBITDA. Thus, the absolute value of debt may go down to around Rs 400 crore from Rs 800 crore currently.

Valuations

At around current market price, TTL is available at a market cap of Rs 2,100 crore and 11.35 times trailing twelve months earnings. TTM earnings include the negative impact of covid-19 wave 2, else the normalized earnings would have been around 200-210 crore.

On Price to Book value basis, the stock is trading in the range of 1-1.1 times.

The overall borrowing of the company has remained more or less same at around 700-800 crore for the past few years while the debt equity ratio has reduced to less than 0.5 times.

Promoters have reduced pledge on their holding from a high of 34.76% in Mar’20 to 8.18% in Mar’22.

The outlook for the company looks good considering the expected improvement in demand for value added products like IBCs, Composite cylinders (LPG and CNG), etc.

The stock is trading around long term median PE and PB values of 10 and 1.1 respectively.

Thus, if the growth pans out as shared in the above sections, along with improvement in metrics like operating margins, working capital, debt and return ratios, the stock could benefit from both earnings’ growth and re-rating.

So, on account of reasonable valuations, ongoing positive transformations and expectation of a good growth, we have a positive view on the stock.

Risks/concerns

We don’t like the fact that over the past 10 odd years Promoters have reduced their stake in the company from 62% to around 51%. While selling by promoters can be for a variety of reasons and the current stake in the company is still high at 50% +, we will be watchful of promoter’s actions going forward.

In May’18, Economic Offences Wing (EOW) filed an FIR against TTL on the basis of a complaint filed by London-based Aburi Composites alleging TTL provided them ‘substandard quality’ cylinders worth Rs 14 crore.

TTL claimed that Aburi is a habitual litigant and filed the case to divert the attention from TTL’s claim from Aburi of USD 15 mn against breach of contract and un paid dues.

While nothing major has come out of the litigation, such news items dent the image of the company and also the confidence of the investors.

Industrial packaging accounts for a major share of the sales of the company and if there’s a prolonged slowdown across the customer industries, the growth plans of the company will be negatively impacted.

Last but not the least, if the steel prices reduce substantially, the price differential between the composite and the metal cylinders will widen and can impact the demand for composite cylinders.

Disclosure: I don’t have any investment in Time Technoplast and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart.

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No