Hello Sir,

Hope you are doing well.

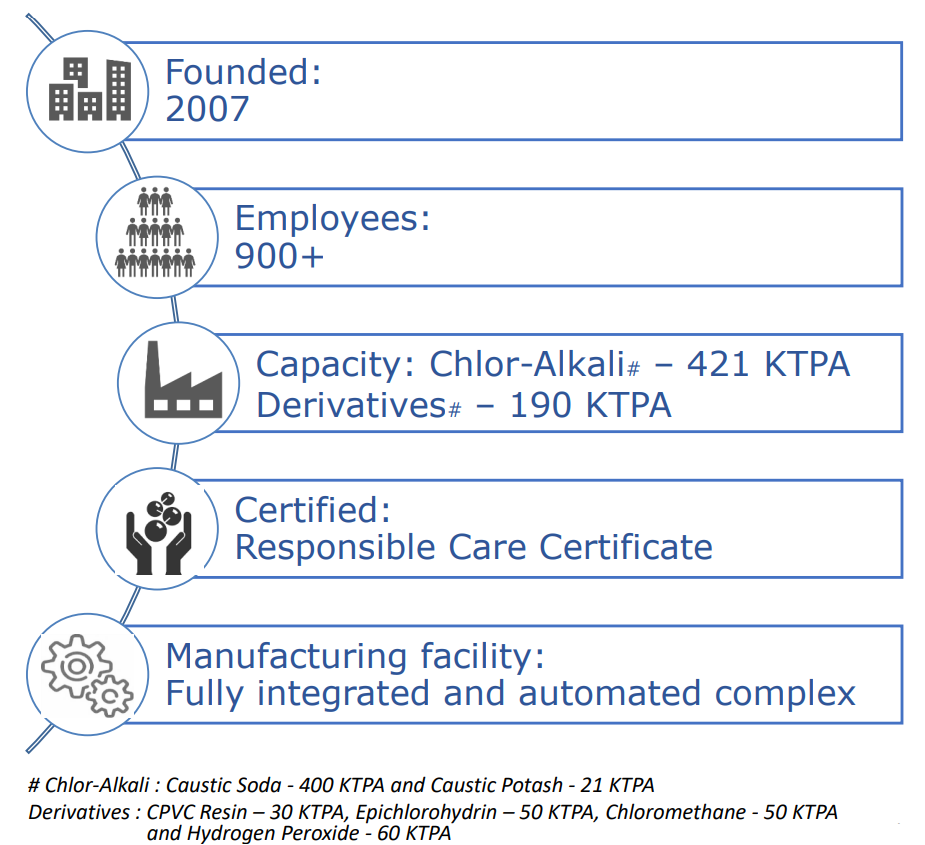

Recently, I was scanning through some stocks and came across Meghmani Finechem which is one of the largest Chlor-Alkali and its derivatives manufacturer in India.

Source: Q4 FY 23 Meghmani Finechem presentation

On reading further, found out that the company is transitioning from Chlor Alkali to its derivatives and specialty chemicals segment.

What’s interesting is that the company’s operating margins are very high at around 30% and the management targets 25% ROCE when setting up any new project.

Below, we have shared interesting insights from the Q4 FY 23 con-call of the company. Hope you find the details useful for your own investments or to add the stock to your watch list.

Before that, currently we have around 6 recommendations for Alpha and Alpha + Members where in we have a positive rating and the stocks are in the buy price range.

You can get the above mentioned recommendations along with others, by subscribing HERE

Meghmani Finechem – Insights from Q4 FY 23 con-call of the company

– About Business

- Currently, in-house chlorine consumption is around 65%

- As we are again increasing the capacity of CPVC, resin, plus entering into chlorotoluene. So, we expect that when both these plants are commissioned, the 65% will move to 75% and then further products will lead this to 85%

- In FY ’23, the exports as a company put together is around 4%. And considering the ECH export that we are expecting in next year, that percentage would go somewhere around 9%-10%

- Caustic soda – Capacity utilization around 78% on increased capacity of 410,000 TPA

- ECH realization would be revolving somewhere around 1,20,000 to 1,25,000 TPA

- CPVC realization would be somewhere around 1,50,000 to 1,60,000. Anti-dumping duty is available for the CPVC resin

- Capacity utilization – CPVC, it has run at the capacity utilization of around 90% (of the 30,000 TPA already commissioned). H2O2, it’s somewhere around 98% to 100%. in ECH the capacity utilization is around 40% (in Q4 FY 23)

– Q4 FY 23 performance

- In Q4 FY 23, we witnessed volume growth of 15% YOY and 13% on QOQ basis. Even after realizations for all the products had cooled off, we were able to witness growth in top line on account of volume contribution from existing as well as new products

- Volume growth of 15% majorly coming from the commissioning of the new capacity that is ECH and CPVC and partially from the existing product

- EBITDA de-grew YOY basis on account of decrease in realization and consumption of the high-cost inventories

- In Q4 FY 23, derivatives and specialty chemical segment contributed 38% to the top line versus 19% in Q4 FY 22

- Contribution from derivatives and specialty segment will keep on increasing as CPVC and ECH will contribute in sizable way in FY ’24 and also because our all-future expansion plans are towards this segment for the business

– FY 23 performance

- On annual basis in FY ’23, we grew by 41% as revenue from operation to INR 2,188 crores backed by high realization and volume growth of 9%

– CAPEX

- In FY ’23 in total we spent INR 416 crores on capital expenditures. The same was INR 456 crores in FY ’22

- In FY ’23, we commissioned CPVC resin, epichlorohydrin, and additional capacity of caustic soda

- This new and additional capacities have contributed marginally for the year as a whole and will contribute in a sizable way in FY ’24

- The capex that we are already working on in FY ’24 towards additional capacity of CPVC resin and chlorotoluene and its value chain will bring volume growth in FY ’25

– Debt

- Our net debt has decreased by INR 112 crores to INR 877 crores in FY ’23 versus INR 989 crores in FY ’22

- In FY ’23 we have redeemed the preference share of 62 crores and have outstanding at 150 crores as on March 31, 2023 compared to INR 211 crores as on March 31, 2022

– Guidance

- For FY 24, we expect volume growth in the range of 15% to 20% and that will drive the value growth somewhere around 20% +

- our margin would be in the range of 28% plus minus 2 and that is something which can sustain for a longer period of time

- We are focusing to reach 5000 crore sales by FY 27

- In the next five years our strategy is very clear we are going to focus 100% on the derivative side only

(End)

Disclaimer: This is not a recommendation to buy/sell Meghmani Finechem. The securities quoted are for illustration only and are not recommendatory.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

Address – 7, Panch Ratan, 7/128, Swaroop Nagar, Kanpur – 208002, Contact No. – +91-7275050062

Compliance Officer – Mr. Ekansh Mittal, +91-9818866676, ekansh@

Grievance Redressal – Mittal Consulting, grievances@

“Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors”.

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing.”

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here – LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No