Dear Members,

We have released 28th May’17: Suven Lifesciences Ltd (NSE Code – SUVEN) – Alpha/Alpha Plus stock for May’17. For details and other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Detailed pdf report on the company can be accessed at the following link – Suven Lifesciences (NSE Code – SUVEN) – May17 Katalyst Wealth Alpha Report

Note: For any queries, mail us at [email protected]

Date: 28th May’17

CMP – 175.65 (BSE); 176.15 (NSE)

Rating – Positive – 3% weightage; this is not an investment advice (refer rating interpretation), the rating is only for indicative purpose and please take your own decision regarding the same.

Introduction

Promoted by Mr. Venkat Jasti, Suven is one of the very few companies in India focused on new drug discovery on its own and in partnership with several innovator companies.

The Hyderabad based company basically focuses on CRAMS (contract research and manufacturing services) and assists global innovators in drug development by supplying intermediates for relevant new chemical entities (NCEs) during the clinical phase of drug development. The projects undertaken by the Company include process research, custom synthesis and intermediate manufacturing.

Since inception the company has worked on more than 750+ projects and is partner of choice for several global innovators like AstraZeneca, Pfizer, Bristol Myers Squibb, JnJ, Merck, Sanofi, Novartis, etc.

Besides carrying out research and manufacturing activities for global pharma majors, the company also has a strong focus on its search for new CNS (central nervous system) therapies. It is leveraging its strong research capabilities to develop NCEs in this segment, of which SUVN-502 focused on treatment of moderate Alzheimer is particularly promising.

We are looking at Suven from long term investment perspective as drug discovery in itself is a very long cycle. As explained in the business section below, we believe movement of only few projects of the company to higher phases or to commercialization phase can result in substantial increase in sales of the company. Also, while new drug discovery has very low probability of success, more so in the case of CNS, we believe there can be good upside if the company’s SUVN-502 is able to successfully move to Phase III of clinical trials.

What is also pleasing to note is that management is not overly promotional of the business and likes to give very conservative guidance. Further, they do not capitalize R&D spends and do not intend to borrow for carrying out clinical trials.

At the same time there are a few concerns like, reducing R&D spend by global innovators, revenue concentration with ~40% revenue coming from supply of intermediate to one customer, huge spend on R&D by the company on new drug discovery for CNS and lastly difficulty in assigning a value to NCE business.

Business

Suven is primarily involved in following businesses:

- CRAMS and allied businesses

- New drug discovery i.e. NCE

Unlike some of its peers which work on under patent molecules or older generic molecules, under CRAMS Suven works with innovator companies on new chemical entities. So, Suven is basically positioned at the top of the value chain of CRAMS business.

The CRAMS and allied businesses account for 100% of the Company’s revenues and within the CRAMS vertical, the Company has three major revenue streams:

Base CRAMS: Suven works with global innovator companies, supplying intermediates for their NCEs during the clinical phase of drug development. When successful, this can translate into long-term supply agreements following launch. Over the years, Suven has reported a consistent rise in the number of active products under CRAMS. Currently, base CRAMS accounts for the lion’s share of the CRAMS vertical’s revenues.

Source: Suven Lifesciences Annual Report 2014

Source: Suven Lifesciences Annual Report 2014

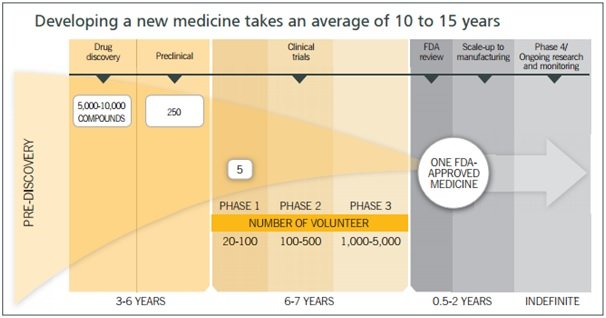

Currently, Suven has 116 projects in CRAMS, 70 in Phase I, 41 in Phase II, 2 in Phase III and 3 in commercialised stage.

As can be seen from the above illustration the patient pool differs significantly as the molecule progresses from phase to phase; with volumes growing ~10x from phase I to II and ~2x-5x from phase II to III. Hence, the number of phase III, pre-launch and commercialised opportunities becomes critical to the top line.

As per the management, even one commercially successful molecule or movement of molecules from one phase to another can bring about significant growth in the top-line of the company.

For example In FY14, three intermediates supplied to NCEs moved from phase III to the pre-launch stage, which triggered an uptick in volumes. These intermediates pertained to three therapeutic areas: rheumatoid arthritis for a US-based innovator, and anti-depressant and anti-diabetic for European innovators. Suven booked revenues of ~ Rs 180 crore in FY14 and this led to almost doubling of revenues in FY 14 from FY 13.

CRAMS for commercial products: At present, Suven has three molecules in the commercialised stage. It involves supplies of intermediates for NCEs that have cleared clinical trials and are ready for launch. Suven has already supplied pre-launch material for three products (Rheumatoid Arthritis RA, Anti-Diabetic, and Anti-Depression) which received FDA approvals in FY14 and FY15 and also supplied Rs 34 crore worth of commercial quantities for RA in FY 17.

The management expects RA order to double to around 65-70 crore in FY 18 and will probably have some visibility on the other two products in next 6-7 months.

Supply of intermediates for specialty chemicals: Suven is supplying intermediates for one specialty chemical product to a large global pharmaceutical and agrochemical conglomerate.

The company started with the supply of intermediate for specialty chemical in FY 12 and over the years it has grown from Rs 30 crore sales to around Rs 224 crore in FY 17. The supply arrangement is likely to continue for another 5-7 years.

Going forward the management believes that growth from supply of intermediate for specialty chemical will be muted and will be in the range of +/-5%; however the company has sufficient capacity in place to even account for 50% growth in orders.

ANDA Filings: Suven has filed several ANDAs with the USFDA in collaboration with its customers and is working on 8 more molecules for ANDA filing. In the past, it granted an exclusive marketing license to Taro Pharma (Taro) for its Malathion lotion. It supplies the product on cost plus margin basis to Taro for US, Canada and Mexico markets (to continue until 2026) and generates royalties of around Rs 10-20 crore which get directly added to the EBITDA.

Currently ANDA filings account for small portion of the revenue of the company; however considering the filings already made and the pipeline of molecules, the management expects attractive growth in revenue with the ANDA approvals.

New drug discovery i.e. NCE: Suven has a drug discovery pipeline of 13 molecules in the lucrative Central Nervous System (CNS), Obesity and Pain segments. Suven has 4 clinical stage compounds, a Phase 2 undergoing SUVN-502; Phase 2 ready SUVN-G3031, Phase 1 completed SUVN-D4010 for Alzheimer’s disease and Schizophrenia and now SUVN-911 is progressing into Phase 1 clinical development.

Of the above SUVN-502 is the most promising and the most advanced product from the pipeline and is used to treat moderate Alzheimer’s. The product is currently undergoing proof-of-concept (POC) Phase II A trials in US. The company has already enrolled 40% of the patients needed for the study and expects the results to be out by the end of 2018.

If POC study is successful, the management intends to out-license the molecule for an upfront, milestone and royalties subsequently. Comparatively in this space in June-13 when it cleared Phase-II, Lu AE58054 was licensed by Otsuka from Lundbeck for US$ 150mn (approx Rs 975 crore) in upfront licensing fees and US$ 675mn in development, regulatory and commercial milestones.

Thus, SUVN-502 is a promising molecule with huge embedded value; however proof-of-concept study holds the key. The management believes that the higher efficacy, no adverse impact till now and differentiated dosage strengths of SUVN-502 sets it apart from peers.

It is important to understand here that new drug discovery is a lengthy process with very low success rate. Further, company has been spending huge amounts of money (spent Rs 99 crore on R&D in FY 17) while there’s no surety of payback. What is good though is that management is conservative, hasn’t raised debt for NCE development and expenses yearly R&D expenses instead of capitalizing them.

However, the company did dilute equity marginally and raised Rs 200 crore through a QIP in 2015 to ensure uninterrupted Phase II clinical trials for SUVN-502 and to de-risk the core business model from the risks of clinical trials.

Overall, we believe there are very strong tailwinds for the company in CRAMS, ANDA and New drug discovery businesses.

Promoters/Management

Suven was promoted by the Jastis in 1989, and went public in 1995. Suven is well placed in the business, with a well-qualified research team of ~390 scientists, USFDA-approved facilities and global pharma innovators as its clients.

The company is an owner operated business with Mr. Venkat Jasti helming the affairs of the company as the Chairman and the CEO and ably supported by his wife Mrs. Sudha Rani Jasti, Dr. NVS Ramakrishna (Vice President – Discovery Research and with the company since 2002), Dr. C Rajendiran (Vice President – R&D and with the company since 2002) and Mr. P Subba Rao as the CFO.

The 2 daughters of Mr. Jasti have also been inducted into the business and they serve the US operations and HR & Administration departments.

In small cap companies, we believe it’s important as an investor that the promoters hold reasonably high stake and in the case of SUVEN the promoters own 60% stake in the company. In FY 16, the promoters increased their stake in the company from 59.44% to 60% through open market purchases. Earlier, in FY 15 their stake had got diluted from 64.76% to 59.44% on account of QIP issue of the company.

In the last 10 years, there has only been one instance of equity dilution and this despite the fact that company has been pursuing drug discovery model and spending huge sums of money on R&D. The company also expenses the R&D completely rather than capitalizing it.

On the front of rationality and transparency, we again find the management good as we have found the annual reports of the company to be very detailed and find the management conservative and not being overly promotional.

Operating Performance

Suven operates at the top of the value chain of CRAMS business as it supplies intermediates to pharma innovators for their NCEs. CRAMS for NCEs is a sticky business as innovators are concerned about protection of IP (intellectual property) and like to work with preferred vendors.

As a result it’s a high margin business with reasonable entry barriers, though growth tends to be lumpy depending on progression of molecules through various phases.

Over the years the company has consistently been able to add to its project repertoire with number of projects increasing from 43 in FY 04 to 116 currently; however the growth in sales has been more than 10 fold from ~ Rs 50 crore to Rs 544 crore in FY 17; thus clearly indicative of the fact the sales depend not only on number of projects but more pre-dominantly on the phase of the projects. As mentioned above, the volume requirement is the lowest in phase I trials but can jump ~10x-20x in phase III as the trial batch size increases and can increase further in the pre-launch and commercialization phase.

We believe, due to lumpiness in the business it’s important to look at the performance in the blocks of 3-5 years and the company has done very well in such blocks and over longer term periods of 7-10 years.

In the last 10 years the company has reported 17% CAGR in sales, 26% CAGR in EBITDA and more than 27% CAGR at PBT level.

Similarly, in the last 5 years the company has reported 21.5% CAGR in sales, more than 7x growth in EBITDA and 15x growth in PBT.

With expansion in sales and resultant economies of scale, the company’s EBITDA margins have improved from 14-15% to around current levels of 30%. The management expects to sustain 30% EBITDA margins.

It is important to note here that out of total R&D expense, 90-95% is towards company’s new drug discovery business, while the corresponding sales are zero. If we were to exclude R&D expenses and look at new drug discovery business separately, then company’s remaining and revenue accretive businesses recorded EBITDA margins of 41% in FY 17.

Suven’s business is not only high on margins, but the company’s cash flows from operations have also been very good. As a result, the company is now debt free on net basis and this is after excluding the QIP proceeds of ~ Rs 200 crore.

The return ratios are also very good with CRAMS and other revenue accretive businesses delivering pre-tax ROCE of 38% (this is after excluding ~ Rs 200 crore cash raised from QIP for new drug discovery)

Valuations

At around current price of 176 the market capitalization of the company is Rs 2,236 crores and the enterprise value is ~ Rs 2000 crores. The company is debt free on net basis with gross debt of around 74 crores and cash surplus of around 300 crores.

We believe it’s important to look at Suven as two businesses. One is revenue accretive CRAMS and related businesses and the second one is new drug discovery business.

Looking simplistically, without segregating the two businesses, the stock is currently trading around 25.60 times trailing twelve months earnings; however it is important to look at two businesses separately is because if the company were to stop the new drug discovery business, its R&D expenses on consolidated basis will probably go down from 99 crore for FY 17 to around 5-10 crore and with almost zero impact on CRAMS and other businesses.

So, excluding the impact of new drug discovery business and its R&D expense, the CRAMS and allied businesses reported sales of Rs 544 crore in FY 17 with PBT of around Rs 217 crore and PAT of around Rs 167 crore. Thus, CRAMS business is trading at around 13.40 times trailing twelve months earnings which we believe is very reasonable for a business with reasonable entry barriers, high margins, strong tailwinds, strong cash flows and very good return ratios.

Coming to new drug discovery business, since 2006, the company has invested around Rs 500 crore + in NCE research with one of the molecules SUVN-502 undergoing Phase II A proof-of-concept trials. There are 3 other molecules as well which are in various phases of clinical trials. Along the way, the company has also acquired several patents.

As mentioned above, if POC study of SUVN-502 is successful, there can be huge upside for the company in the form of upfront licensing fees, milestones based fees and royalty fees; even if the study fails, there should still be some value of the IP acquired by the company over the years; however it is too difficult to determine and we would like to assign zero value to the NCE business.

Risks and Concerns

Global innovators have reduced R&D spends on discovery of new drugs and thus if there’s substantial reduction, Suven may lose out on some projects.

Suven has US based companies as its clients and therefore the risk of US FDA persists.

The company derives around 40% of its sales from sale of intermediate for a specialty chemical to one of its customers and therefore there’s huge revenue concentration risk.

The company has been spending decent sums of money on new drug discovery while it is well known that probability of success is very low and more so in CNS therapies.

Disclosure: I don’t have any investment in Suven Lifesciences and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

Ekansh Mittal or its associates including its relatives/analyst do not hold beneficial ownership of more than 1% in the company covered by Analyst as of the last day of the month preceding the publication of the research report. Ekansh Mittal or its associates/analyst has not received any compensation from the company/third party covered by Analyst ever. Ekansh Mittal/Mittal Consulting/analyst has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market-making activity of the company covered by Analyst.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis. A graph of daily closing prices of securities is available at www.bseindia.com

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.