Dear Sir,

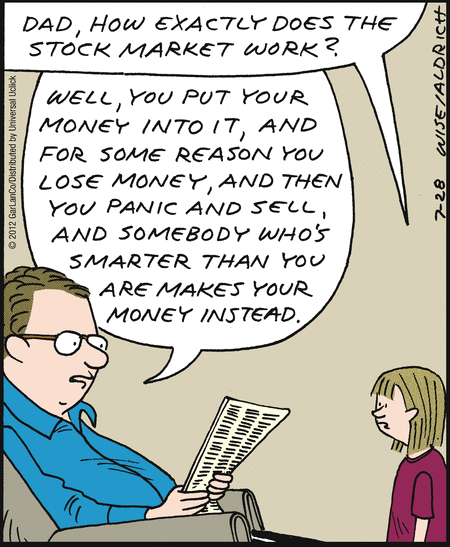

Considering the ferocity of market fall, especially small and mid cap stocks; it’s easy for investors to panic; however you can combat the same and befriend volatility by considering the following points:

It’s the very nature of the markets to rise and fall. There have been such falls in the past and will happen in the future as well and every time the markets have recovered and gone on to record new highs. The market correction of 2008 was one of the worst; however all those who remained invested and picked up good stocks during the correction are sitting on humongous gains since then.

Market movements are like pendulum; keep swinging between extremes. In 2017 and early 2018, the small and mid caps were approaching higher extreme and now the small and mid caps are approaching lower extreme. While one cannot predict market tops or bottoms, one can prepare himself and sow the seeds for future gains.

Small cap index is already down 30% and the mid cap index is down 20-25% and therefore in our view and looking at the past instances, the downside (if at all) might be limited at another 10-20%. Barring 2008 when the small cap index corrected by more than 70%, most of the corrections have been of the order of 20-50%.

Ask yourself whether you are in the market for next 6 months or next 5 years; whether you have bought on leverage or through regular savings. If the answer to both the questions is second option, there’s not much to worry and one should rather go on accumulating in phases as your investments will fetch more units of the same stocks.

One psychological way of dealing with corrections is to assume your portfolio value to be already lower by 20-25%. Normally, when the major corrections happen, one tends to get too fearful and delays gradual accumulation of stocks; however when you have already assumed your portfolio value to be lower and when the portfolio does come down to those levels you don’t get as much scared as you would have been otherwise and accept the fact that such corrections are part of market cycles.

Avoid looking at stock prices continuously. Once you have decided what to purchase, make the investments and close the terminal. By continuously watching you cannot obviously hold the stock prices from falling further; however you can avoid panicking and maintain rationality.

Lastly, you can’t go much wrong if you don’t diverge much from the basics like:

- Buying stocks where you can understand the business and have decent idea about the medium to long term trajectory

- Management/promoter’s interests directly aligned with the minority shareholders

- Decent past track record in terms of operating performance, capital allocation, balance sheet management, cash flows, etc

- Last but not the least, reasonable valuations

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]