EASY TO IMPLEMENT

Simplicity is the ultimate sophistication. - Leonardo da Vinci

Do you think that investing is a game reserved for finance and economics experts? If the answer is yes, don't worry. For a long time large institutions have managed to keep things complicated enough for people from other industries to get intimidated.

As I understood personal finance better I realised that this is something that is necessary for each and every one of us to understand. Each and every one of us uses money daily and personal finance teaches us how to use it better. If money plays such an important role in our life then how can the study of understanding how to manage money not be just as important.

Since that day I have strived to make personal finance and investing easy to understand and accessible for as many people as possible. In 2018, we launched a model portfolio service as an extension of our stock recommendation service. The purpose of this was pretty simple. We want you to be able to make the best use of our recommendations and match our portfolio returns. And most importantly we want you to be able to do it effortlessly, it should be as simple as making a toast. So, this is what we came up with.

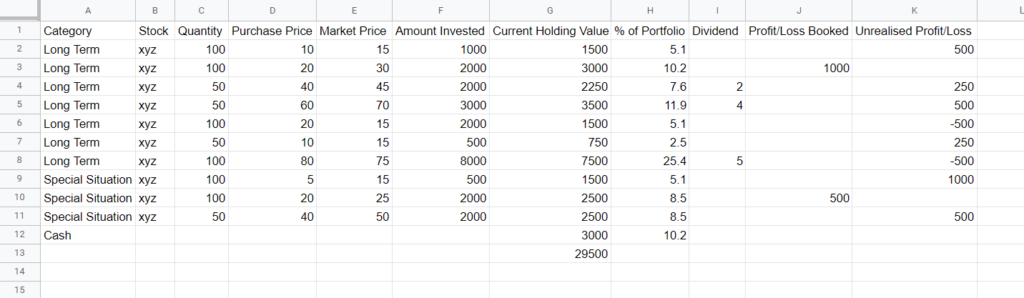

SAMPLE MODEL PORTFOLIO

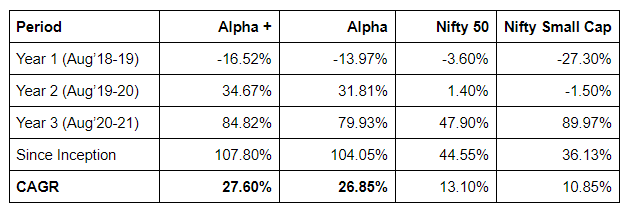

OUR TRACK RECORD

Performance against benchmark indices

Note - Alpha/Alpha + returns include assumed interest at the rate of 4 - 6% on unutilized cash.

Note - We started maintaining Model Portfolio since 15th Aug' 18

OUR CLIENT'S TRACK RECORD

We have been lucky to have been part of wealth creation journey of more than 2,500 clients some of whom have stuck with us through market volatility, endured corrections and have still gotten incredibly wealthy over the past 10 years.

It's amazing and hugely satisfying to see how some members who started small with 5,10, 20 lakh portfolios and have been able to multiply their portfolios to 1-1.5 crore.

Kudos to them for saving regularly, investing through market volatility and diligently following our updates.

LET'S GET STARTED?

By subscribing to Alpha/Alpha +, you agree to accept the following terms/conditions:

www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to investors on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690. The model sheet is an extension and reflection of our research analysis and is in no way a portfolio advisory or buy/sell recommendation for you. The purpose of model sheet is to get a tentative performance snapshot on portfolio basis than on individual stock basis.

The model sheet service is basically an information service and doesn’t take into account your personal financial situation or risk profile. Please consult your investment adviser before following or implementing the same partially or in totality.

The transactions mentioned are not the actual transactions, but take into account the ending prices for the day and ~0.3% transaction charge.

For the purpose of calculation of returns, the surplus cash (cash i.e. not invested in stocks) will be assumed to be invested in liquid funds at around 6% return per annum.

There’s zero refund policy because as soon as you subscribe to the same you get access to the complete portfolio snapshot.