KW - Unit of Mittal Consulting

Financial Independence - A crazy dream till you achieve it

OUR PHILOSOPHY

Investing in Stocks - Risky in Short term

Not Investing in Stocks - Detrimental to Wealth creation in Long term

The best part about investing in stocks without taking leverage is - Asymmetric payoff.

In the long term, stocks can go up 2x, 5x, 10x or much higher while the max you can lose on a stock is 100%.

Our experience has been, if the process is right, out of 10 stocks, 2-3 will surely go wrong. But, the gains from the winners can be far higher than the losses from the bad ones.

Also, one should invest only that money in stocks, which you think you won't need for the next 3-4 years.

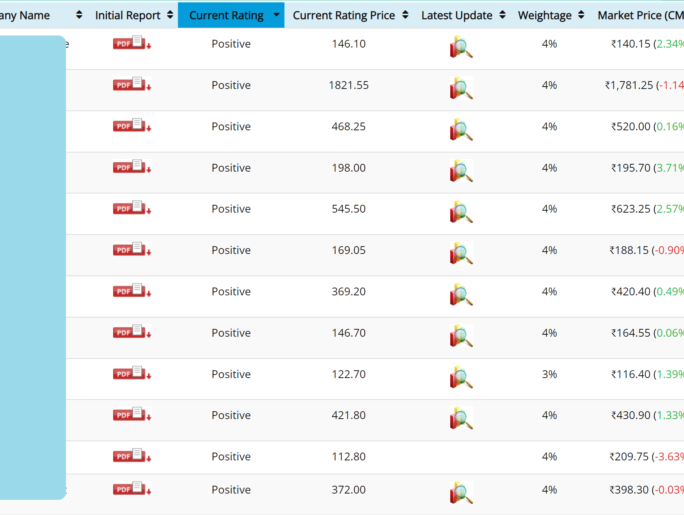

TRANSPARENCY

Fact Sheet: Here's an example of the list of the stocks recommended by us.

Note: The purpose of sharing the list is to maintain transparency and communicate factual information. By scrolling lower to check the list, you understand that investments are subject to market risks and agree that stocks list was not used as an advertisement or promotion to influence your investment decisions. Disclaimer

HOW WE DO IT?

- Focus on growth stocks with potential for earnings and valuations re-rating

- Recommend stocks from a perspective of medium-long term wealth creation

- Try identify opportunities with long runway for 20-25% CAGR potential

- Evaluate special situations like delisting, demerger, buybacks to identify potential value unlocking opportunities

- Use checklist to make fewer mistakes

WHAT WE OFFER?

Alpha

12,900/Year (incl. of GST)

Stock Recommendations

14-18 stocks for medium-long term investment

Stock Updates

Important updates on Stocks through e-mail and WhatsApp

Tracker Sheet

An excel to compare research performance on portfolio basis against benchmark indices

Investing Lessons

We share everything we know about stock investing, equity research, etc. through our blog

Alpha +

18,900/Year (incl. of GST)

Stock Recommendations

14-18 stocks for medium long term Investment

Special Situation Opportunities

Mispriced opportunities wherein delisting, demerger, buyback can unlock value in 3-6 months

Stock Updates

Important updates on Stocks through e-mail and WhatsApp

Tracker Sheet

An excel to compare research performance on portfolio basis against benchmark indices

Investing Lessons

We share everything we know about stock investing, equity research, etc. through our blog

OUR USP?

Skin in the game

Invested in most of the recommended stocks

Recognition

Coverage in Forbes and Economic Times

SEBI Registered

SEBI Registration (Research Analyst) No. INH100001690

Transparency

Stocks recommendation list shared

2200 +

Investors have subscribed and benefited

12 +

Years of serving investors

Ekansh Mittal, Founder

Coming from a family of Stock investors, Ekansh started reading The Economic Times when he was 12 and made his first investment with his pocket money in 2008 when he was in the 3rd year of his B. Tech. In 2009, he started writing equity research reports on small cap stocks for an equity research firm.

With humble beginnings, he founded Katalyst Wealth in 2011 and got SEBI registration (research analyst) in 2015.

Soon, he got the due recognition from Forbes India in 2015 and Economic Times in 2017 for his investing prowess and ability to spot emerging small cap companies at an early stage.

EASY TO FOLLOW

Members get access to stock recommendations dashboard which consists of a table with the following details:

- Stock Names

- Detailed Initiation Reports

- Current Rating - This is the latest rating/view on the stock. Positive rating is akin to Buy rating on the stock

- Current Rating price - This indicates the price range in which one can consider buying the stock with a positive rating

- Latest Update - This is a link to latest view/report on the stock

Overall, the table covers everything our members need to know about our stock recommendations

MEDIA

BLOG POSTS

GET IN TOUCH

Monday - Friday

10am - 5pm

7, Panch Ratan, 7/128

Swaroop Nagar, Kanpur - 208002

WHO WE ARE

www.katalystwealth.com (herein referred to as 'Katalyst Wealth') is the domain owned by Mittal Consulting (Ekansh Mittal is the Sole Proprieotor). We offer Independent Equity research services to investors on subscription basis. SEBI (Research Analyst) Registration No. INH100001690

Copyright ©2021 Mittal Consulting. All rights reserved.

Compliance Officer - Mr. Ekansh Mittal, +91-9818866676, ekansh@

Grievance Redressal - Mittal Consulting, grievances@

“Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors”.

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing.”