Dear Readers,

We all know that consumption story is playing out well in India and almost every good brand name in the FMCG segment (Dabur, Emami, Hindustan Unilever, ITC, GSK Consumer healthcare, Britannia, Marico, etc) has rewarded its shareholders immensely over the years.

What about packaging of such products?

Well, any product that you buy from the above mentioned companies needs to be packed and we believe that packaging of any product plays a crucial role in attracting consumers, retaining the quality and also determines the ease of carry and movement from one location to another (remember the days when Tomato Ketchup was marketed in those bulky glass bottles against the current trend of using easy to use flexible pouches).

In fact packaging is the first direct contact between consumer and the product and to a small extent plays a crucial role in building a brand for any product.

So, do we have any listed and investment worthy company in the packaging space?

We recently came across Paper Products Ltd (PPL) and you can therefore understand all the talk about packaging.

Note: Please don’t construe this note on Paper Products as investment advice. The readers are suggested to carry out their own due diligence. For paid equity research refer (opens in new tab)Alpha, (opens in new tab)Alpha +

Basic details on Paper Products Ltd

Paper Products Ltd (PPL) primarily caters to the FMCG sector’s flexible packaging requirement. The company offers a number of packaging products such as film labels, packaged food pouches, holographic solution, etc.

As per the various reports, PPL is a preferred supplier to all major brands like HUL, ITC, Marico, GSK Consumer, Pepsi, Heinz, Britannia, Cadbury, Dabur, etc., and commands ~ 65% market share in the high end flexible packaging in India due to its superior quality and innovative packaging solutions at competitive prices.

It is important to note here Paper Products Ltd is a subsidiary of Huhtamaki Packaging Worldwide. Huhtamaki Finland is a leading global consumer packaging company with operations in over 30 countries. The company had a group turnover of over USD 2bn (~10,000 crores) in 2011 of which Emerging Markets contributed 24%. Paper Products Ltd. (PPL) is the India subsidiary which accounts for approximately 47-50% of Asia’s contribution to the top line.

PPL became a 51% subsidiary of Huhtamaki, a European packaging major, when the latter acquired 51% stake in PPL through a preferential allotment of equity shares in 1999. Since then Huhtamaki has increased its stake in the company to 60.77%, thus demonstrating greater confidence and support in the operations of Indian Subsidiary.

Flexible packaging, its advantages and the outlook for the industry

In the very beginning we gave you an example of bulky glass bottles being used during the last decade for packing tomato and other ketchups. Those have now been replaced by stand up flexible pouches which are much lighter and very easy to handle.

Being lightweight, flexible plastic packages help reduce transportation cost and occupy less shelf space. Further, they also offer the advantage in being able to deliver a high degree of product differentiation, particularly with attractive flexo-graphic printing and lower overall handling and logistics cost on the finished product.

As per the various reports, the flexible packaging market has got a boost from the growth in the processed food, personal care, and hygiene industries. One main reason for popularity of flexible packaging over rigid packaging is that it offers the advantage of packing smaller quantities compared to traditional packaging and hence, enabling deeper product penetration covering smaller towns and villages for FMCG players.

Further, it is believed that flexible packaging industry stands to gain immensely with the entry of major MNCs in the food processing industry in India. The Indian government has formulated Vision 2015 to triple the size of the food processing industry enhancing her global share to 3%.

There is an increasing demand for processed and convenience food and hectic schedules and changing preferences have lead to the emergence of ready-to-cook (RTC) and ready-to-eat (RTE) food in India.

We believe over the next 5-6 years PPL could be a direct beneficiary of the changing trend as it is one of the leading companies in the flexible packaging solutions in India.

Performance of PPL over the last few years

At the end of the day, it boils down to the performance of the company, no matter how good the outlook for the sector/industry is; so let’s run through the performance of PPL for the last 4-5 years.

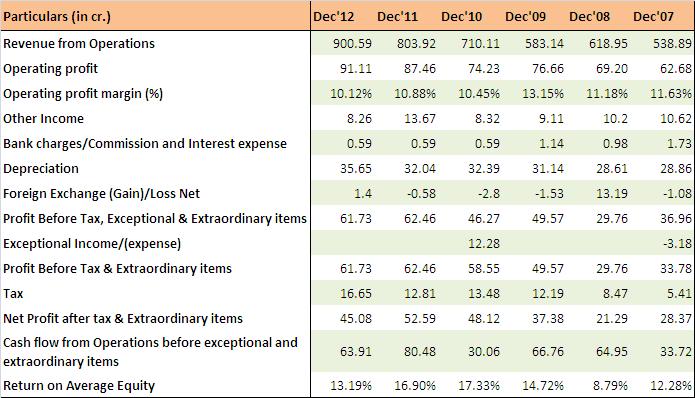

As can be observed from the above illustration, the performance of PPL has been good over the years on most of the parameters, though its sales growth has been average at just 11% annualized growth in sales and 14% annualized growth in profit before tax.

On an average, the company has delivered 15-16% return on equity and the operating margins have been in the range of 10.50-12%. Since the flexible packaging industry is highly competitive, PPL isn’t able to pass on the rise in the cost of raw materials immediately to its customers and therefore in the case of high volatility in the prices, its margins get impacted in the short term.

Balance sheet

In order for shareholders to realize gains from their investments, it is important for the company to grow, however what is even more important is the quality of growth. It’s been observed in a lot many cases, that the managements are hell bent upon conjuring higher sales and profitability at the cost of sacrificing the quality of their balance sheet and cash flows. Over a period of time, such companies end up in debt traps with abysmal returns for the shareholders.

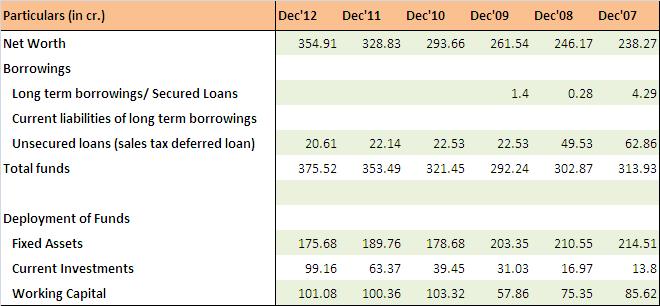

In the case of PPL, as can be observed above, the management has been able to grow the intrinsic value, while attaining debt free status. The Rs 21 crore unsecured loan is basically the interest free Sales tax deferred loan from the Govt. of Andhra Pradesh for its Hyderabad factory in accordance with sales tax deferral scheme while the company holds Rs 63 crore investments in various liquid funds.

PPL has been extremely efficient with working capital management and the ratio of working capital to sales has gone down over the years. The same has also enabled the company generate very good cash flows from operations consistently (Avg. cash flows from operations for the last 5 years – Rs 61.23 crore against average net profit for the last 5 years – Rs 40.89 crore), repay its debts and carry out expansions at existing and new locations from internal accruals.

Valuations

PPL is currently available at a market cap of 400 crores. As illustrated above, the company is debt free, holds liquid investments to the tune of Rs 60-65 crores and has been steadily growing at 14-15% YOY for the last few years.

The company also has a very good history of dividend payout and the current dividend yield is more than 4%.

We believe the valuations of the company are very reasonable at ~8-8.5 times trailing earnings and EV/EBITDA of less than 5.

If the flexible packaging industry does well and PPL is able to capitalize on the opportunities, there’s scope for both earnings and valuations re-rating from the current levels.

Best Regards,

Ekansh Mittal

https://www.katalystwealth.com/

Ph.: 0120-4109766, Mob: +91-9818866676

Email: [email protected]