Considering the great opportunity the market has been providing us, we are glad to inform you that in the recent past we have initiated 2 new recommendations for our premium members.

We believe both the companies can deliver substantial returns from current levels and have therefore included them in our Model portfolios (Alpha and Alpha +) with decent allocations.

Besides the 2 new recommendations, we also have around 12-13 active recommendations which are investment worthy around current prices as we have positive rating on those.

So, for someone willing to build a portfolio or looking for good stock ideas for investment, you will have plenty to look forward to in our Model portfolios:

Alpha & Model: Multibagger stocks for long/medium term investment

Alpha + & Model: Multibagger stocks for long/medium term investment and Special situations

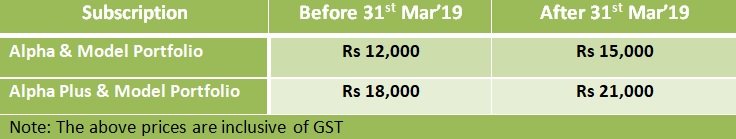

Note: Currently, we are offering the above two subscriptions on introductory prices; however the prices will be revised upwards by Rs 3,000/– post 31st Mar’19.

You can register now by clicking HERE

Let’s get down to the basic details of 2 new recommendations:

Investment idea #1 – It’s not very often one gets a good company at dirt cheap valuations; and when you get a high quality company with a very strong track record and strong balance sheet, that’s a steal.

So for the company under consideration we carried out a small exercise of numbers and based on the same we found that the current valuations incorporate most of the risks and therefore the scope for further correction is low while there could be huge upside as the markets and the earnings recover from the low base.

The company has recently completed a major CAPEX programme. With the same the company has sufficient capacity to maintain high growth rate for the next 4-5 years.

We expect more than 23% CAGR in earnings over the next few years.

Despite the CAPEX, the company’s balance sheet is still very strong with low debt to equity ratio and even the cost of debt is also very low.

Investment idea #2 – You get a multibagger stock when combined with earnings growth, such stocks get re-rated from PE of say 7-8 to 15-20.

So the company under consideration is on the verge expanding its capacities in the near term and has already started commercializing in phases.

In our view, with expanded capacities in place, the company is likely to sustain 25%+ CAGR in sales and 20% + CAGR in profitability over the next 2-3 years.

Another major positive is that the valuations are reasonable at around 8 times trailing twelve months earnings while during the last 5 years it has traded in the range of 5 times to around 20 times earnings.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]