Dear Sir,

Hope you are doing good.

We are writing this mail to share with you our views on the current market situation.

The mid and small cap indices have been butchered, while SENSEX has held on to its levels, courtesy a few stocks.

Market corrections are part of overall cycle and we are frankly not so much concerned about the same. There was obviously some excess on the upside in 2017-18 and may be there’s some excess on the downside in 2019.

Such corrections have happened in the past and will continue to happen in future. However, what is slightly different this time is the extent of polarization in valuations of some stocks.

Even within SENSEX as well, there’s huge polarization, with stocks like Bajaj Finance up more than 115% since Jan’18 and stocks like Vedanta, Tata Motors, Tata Steel, Yes Bank, etc, down more than 50% (some even 70-80%).

Source: Katalyst Wealth Research

What is interesting to note is that in some cases what was already expensive has got even more expensive and vice-versa. For instance, despite the fact that Asian Paints has delivered 10-12% CAGR over the last few 5-10 years and there’s no major scope for super-normal growth in profits, the stock is trading at more than 70 times earnings.

Similarly, Bajaj Finance is trading at more than 10 times book value.

While we have nothing against the two companies and hope that they continue making wealth for all the stakeholders, we believe that as the growth is lacking in general, market is paying exorbitant premium for consistent growth being reported by select few companies.

Similarly, there are no takers for even good stocks (good strong balance sheet, cash flows, management, etc) that are reporting subdued performance.

This holds true for most of the small and mid-cap stocks as well.

As we all know, growth is not sacrosanct and almost everything is cyclical. Case in point: Page Industries, Housing Finance, Pharma, etc. All these were once believed to be secular growth stories and we already know the fate of some of them.

How does one make money in stocks?

A medium to long term investor makes money in stocks when the companies owned by him report growth in earnings and/or the multiples expand.

In general, it’s been observed that for mature companies or where the scope for super-normal growth is limited, markets tend to value the good companies in the range of 20-30 times earnings.

There was a time in early 2000 when large IT companies of India started trading around 50-60 times earnings and some even reached 100 times earnings. Today, they all are trading around 20 times.

For a considerable period (5-10 years) post 2000, despite reporting reasonably good growth in earnings, such stocks didn’t deliver any gains for their investors.

Source: Katalyst Wealth Research

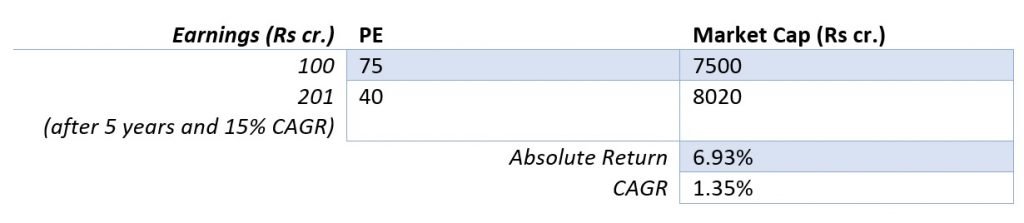

As can be observed above, in a hypothetical scenario, despite the company recording 15% CAGR in earnings, the stock ends up delivering only 1.35% CAGR.

The point of the whole discussion is that although certain stocks from the entire universe of listed stocks are doing well, most of them are quite expensive and may not necessarily help the cause of (from this point onwards) wealth creation over the foreseeable future.

Unless, of course, the PE of 75 remains as it is or expands further to 100. At which point we will only have ourselves to blame for not being crazy and greedy enough.

What should be the stock selection/portfolio strategy?

At this point, one thing is for sure that growth in general is missing. There are pockets of growth; however, they are either already trading at very expensive valuations or the numbers themselves do not seem very sustainable.

At the same time, wherever the performance has been subdued, the stock’s been beaten out of shape.

We believe, sooner than later, growth will eventually come back; already, there are some positive signs from the perspective of Indian economy like: Oil and Commodity prices trending downwards, One of the best monsoons of the last 25 years, lower corporate tax rates, seemingly pro-active govt., etc.

However, not all the companies will be able to capitalize on the opportunity. The ones with strong balance sheets or those that have already created excess capacities and now in the process of de-leveraging will likely gain the most.

Though, they may seem risky (considering the way the prices have come off), good companies (decent past record, healthy balance sheet, high promoter holding, etc) from the small and mid-cap space are actually the ones where the probability of permanent loss of capital (from current levels) is low and there’s in fact high probability of decent gains over the next few years.

To add further, by beaten down, we don’t mean names like DHFL, India bulls, Yes Bank, etc. The core focus is strong balance sheet and management integrity and with lending companies, one is generally not sure of asset side.

As rightly mentioned by Ian Cassel, instead of focusing on where you can make the most in the next 6 months, invert that and find situations where you can’t lose over the next few years. The latter is often times where you will find the next multi-bagger.

We have been trying to achieve the above, and though the results for the last 1-1.5 years haven’t been good, we are hopeful of significant improvement in results in the years to come.

Disclosure: Don’t have any investments in any of the stocks mentioned above. The names have been mentioned for the sake of examples.

Happy Investing.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://katalystwealth.com/

Email: [email protected]