Dear Sir,

After successfully providing stock recommendations for 7 years, we rolled out Model Portfolio service on 15th Aug’18 and below we have shared with you the performance of the same.

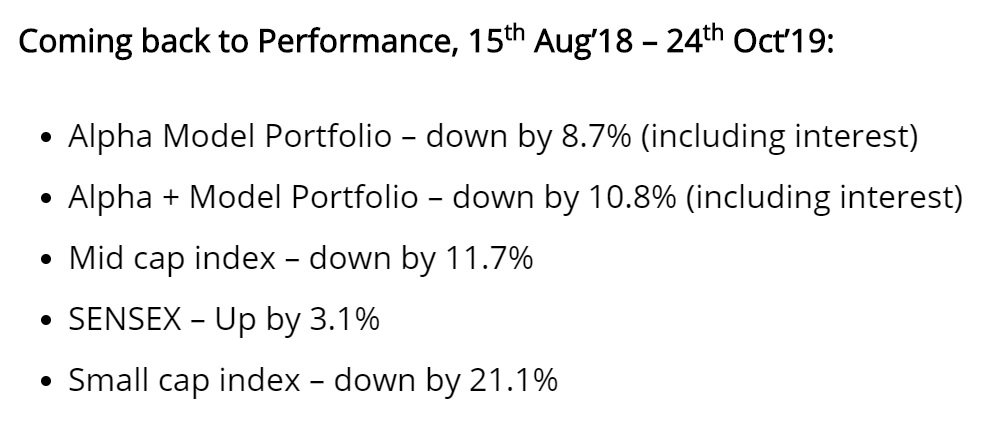

I have got some bad news and some good news. The bad news is that in the last 14 months our model portfolio is down a few per cent age points; the good news is that we have performed much better than the overall markets and on the back of good mix of stocks, quite hopeful of significantly outperforming in the long run.

Our Performance: Aug’18 – Oct’19:

- Alpha Model Portfolio – down by 7.85% (including interest)

- Alpha + Model Portfolio – down by 9.84% (including interest)

Indices: Aug’18 – Oct’19:

- Mid cap index – down by 10.10%

- Small cap index – down by 20.06%

This is not one of those times wherein you will find a lot of advisers sharing performance details; however, we believe in transparency in all market conditions.

We believe, the same trust and transparency has helped us retain most of our subscribers year after year.

Some basic points about our Alpha Model Portfolio:

- Currently, there are 18 stocks in the same

- All the stocks are from Small cap space ranging from market cap of Rs 100 crore to Rs 15,000 crore

- We are invested more than 75%

- Model portfolio is same for all and entirely based on our past and new stock recommendations

- The stocks are from diverse industries like: FMCG, Auto-ancillary, building products, NBFC, Housing finance, Pharma, Chemicals, Packaging, Cement, Footwear, Media and Entertainment.

Basically, it’s easy to perform when the overall market is going up; in fact, towards the later stages of bull run, junk stocks go up even more.

What is important though is how your portfolio performs during bear phase, because it’s easy to get decimated during market corrections on account of factors like leverage, concentrated portfolio, over-valued stocks, junk stock, etc.

Another important point that needs mention here is that sometimes we as investors get over enthusiastic about individual stocks and their performance; however, what really matters is how well your overall portfolio is performing and that needs balance, discipline and some amount of diversification.

You cannot have all the winners in your portfolio, more so, when the economy is going through a slow phase. Like in a cricket team, you cannot have all 11 players as batsmen, similarly a portfolio needs to have a good balance of stocks from diverse sectors, segments, etc so as to avoid clubbing of risks and have a winning combination.

The portfolio also needs to be aligned in terms of prevailing market conditions. For instance, most of us would like to hold growth oriented high-quality stocks; however, one cannot justify buying such stocks at any price as that could result in short term gains, but the long-term returns would suffer.

Last, but not the least, if you wish to run a really concentrated portfolio of 5-10 stocks, never do it on the back of someone else’s recommendation/research and borrowed conviction.

You can register for Model portfolio subscription at the following

Happy Investing.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://katalystwealth.com/

Email: [email protected]

By subscribing to Alpha & Model Portfolio/Alpha Plus & Model Portfolio, you agree to accept the following terms/conditions:

www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690. The model portfolio service is an extension and reflection of our research analysis and is in no way a portfolio advisory or buy/sell recommendation for you. The purpose of model portfolio is to get a tentative performance snapshot on portfolio basis than on individual stock basis.

The model portfolio service is basically an information service and doesn’t take into account your personal financial situation or risk profile. Please consult your financial adviser before following or implementing the same partially or in totality.

The transactions mentioned are not the actual transactions, but take into account the ending prices for the day and ~0.3% transaction charge.

For the purpose of calculation of returns, the surplus cash (cash i.e. not invested in stocks) will be assumed to be invested in liquid funds at around 6% return per annum.

There’s zero refund policy for model portfolio service because as soon as you subscribe to the same you get access to the complete portfolio snapshot.