Dear Sir,

Decision making is not always as easy as it appears. More often than not our decisions for the future are based on the most recent results and the same can be attributed to first-order thinking.

Our failure to consider second and third order consequences is what leads to bad decisions. As Ray Dalio (Investor, Hedge fund manager) says, “Never seize on the first available option, no matter how good it seems, before you’ve asked questions and explored.”

The most pertinent case of first order thinking in play is in the field of investment. Most investors look at the most recent performance of an investment product, asset class, fund manager, mutual fund, etc and extrapolate the same, be it on the upside or downside.

First order thinking is fast and easy. As it requires little effort, it results in herd mentality.

Extraordinary results come from out-thinking the herd and seeing things others can’t. Second order thinking requires you to ask questions, think about the interplay of various factors and the probable consequences.

Like in equities, if some segment or stock has done remarkably since the past few years, first order thinkers extrapolate the performance, extrapolate the price rise and buy the same without giving due consideration to other factors and vice-versa for the beaten down stocks/sectors.

Second order thinkers don’t jump straight to the conclusion. They think of the factors like: if the performance is sustainable, if the valuations are reasonable, is the market still big enough to sustain strong growth, has the segment become too crowded, etc.

New Member

Want Premium access? No Problem, You’ll have the option to

chose Membership during check out

Enough of theory, let’s look at an example from the past:

In early 2000, IT segment was the go-to segment for most of the investors. Companies could do no wrong, even if they didn’t have any sales. And, of course companies like Infosys were trading at lofty valuations because they were both high quality and growing fast.

Around the same time, the other segments of the market were being ignored. One of them was capital goods. The sector was languishing and had not delivered any return in the last few years.

As one would expect, first order thinking investors lapped up IT stocks in 2000 assuming the past performance could be extrapolated far into future and ignored the other segments of the market including Capital Goods.

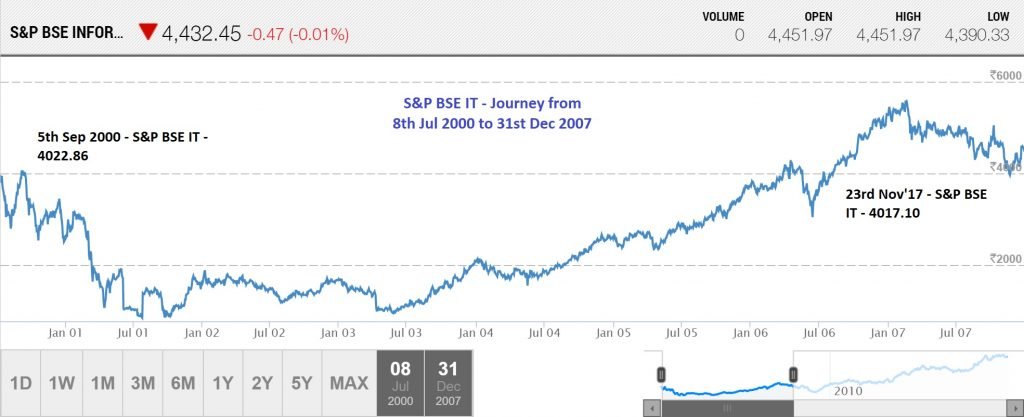

Let’s look at how the two sectors fared over the next 7-8 years.

Source: moneycontrol.com

Source: moneycontrol.com

Between Sep’2000 and Nov’2007:

- S&P BSE IT delivered almost 0 return…In the interim, it also fell by almost 80%

- For the same period S&P BSE Capital Goods appreciated from 600 odd levels to 20,000 odd levels i.e. a gain of more than 30x against 0 return from the IT index

The purpose of the whole exercise is to make you wear your 2nd order thinking hat. Don’t just fall for the recent out-performance of any stock/segment and buy it without giving due consideration to factors like: sustainable growth, valuations, market size, etc.

Similarly, look for segments not doing well or have been beaten down beyond comprehension, but are showing signs of improvement (Read more about it HERE). Sometimes, the best opportunities lie in companies/segments that are being ignored while they are laying seeds of growth and making improvements on various fronts.

Stock/segments not doing well today, could turn around to deliver the most extraordinary returns and the best performers of the recent past could prove to be the laggards of the future.

It’s important to try and judge things on their merit than falling for the narrative of the day.

Think different.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://katalystwealth.com/

Email: [email protected]

Ph: +91-727-5050062, Mob: +91-9818866676