Dear Sir,

The last 2 years or so have been tough for the investors in general.

While there’s not much to be sanguine about, the good thing is we are already 26 months into the bear market and over the last 2 decades most of the bear markets haven’t lasted more than 36 months with bottoms recorded even earlier.

So, starting Nov-Dec’19, things had started looking up; however, the markets first got spooked by the Corona virus issue, then the YES Bank moratorium and the latest addition is more than a 25% plunge in Crude oil prices, the largest one-day drop since 17th Jan’91.

Every time the markets records a major fall, the main question that comes to mind is that when will the carnage stop?

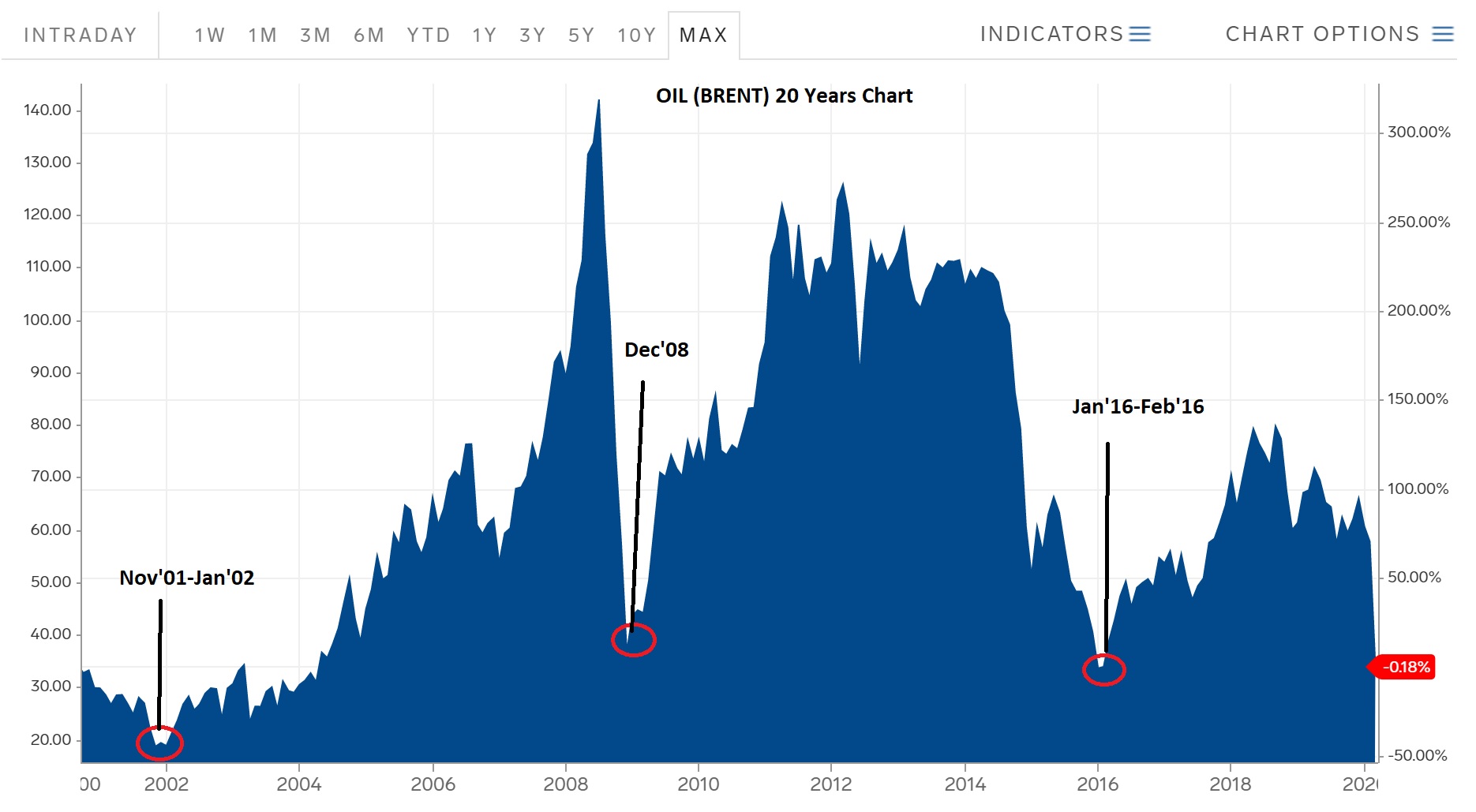

While the recent 1-day fall in crude prices might be one of the biggest in over 2 decades, being a commodity, it does have a history of sharp corrections and we are going to take some cues from the same:

Last time the crude dropped to 33-34 USD in Jan-Feb’16…SENSEX bottomed out in Feb’16

Before that Crude dropped to 36-37 USD in Dec’08…SENSEX bottomed out between Nov’08-Mar’09

During the 2000-03 correction…crude bottomed out in Nov’01-Jan’02 and the SENSEX bottomed out in Sep’01.

With respect to 2000-03 correction, it’s also important to note here that the US got attacked on 11th Sep’01 and the markets bottomed out somewhere around 25th Sep’01.

Big events do have the tendency of scaring us to the core, but the markets also tend to bottom out in the vicinity of such events.

Source: markets.businessinsider.com

Source: markets.businessinsider.com

Source: moneycontrol.com

So, do we know if the markets have bottomed out?

We surely don’t know if the crude and the markets have bottomed out; however, what we do know is that some big negative events have transpired in the last few weeks, globally the markets have corrected sharply and could remain choppy and probably the bottom is closer than ever.

Being greedy when the news flow is bad is easier said than done, but the least we can do is remain invested (while obviously churning the portfolio, if needed) and increase the SIP amounts if possible.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://katalystwealth.com/

Email: [email protected]