Dear Readers,

Hope you all are doing well and taking proper precautions.

In the light of the Covid-19 led crisis, today we are going to discuss Risk Categorization of the stocks.

We believe it’s an important exercise that every investor should carry out on his/her portfolio stocks to determine the pockets where the risks could originate from. We did so recently and have shared the details below.

We think it should be quite obvious that for most of the companies FY 21 will be a washout in terms of earnings. Already, the lockdown stands extended till May 3rd 2020 and even if the same is lifted from 4th May’20, it will be in phases. Also, the resumption of production and the improvement in demand will be gradual.

So, in our view, more than the earnings, the primary focus at this point of time should be on whether the companies will be able to survive the lockdown and the next few quarters (we hope it’s only 1-2 quarters) of very tepid demand. Yes, with almost zero sales since the end of Mar’20 (for most of the companies) and there still being certain fixed costs, interest expenses and loan repayments to account for, the strength of the balance sheet becomes more important than ever.

While the first order thinking suggests that FMCG, Pharma, healthcare, etc will be the least impacted and therefore one should look at only such sectors for investment. That might prove to be true; however, returns on stocks are a function of both the growth and the valuations and therefore at least we don’t intend to stop looking at quality balance sheets in beaten down sectors, even though the next few quarters may not exactly be hunky dory for them.

Why do we think it’s important to look at quality balance sheets in beaten down sectors?

Just an example: In the metal alloys space, we have covered Maithan Alloys. Now, steel demand is likely to suffer and thereby the demand for alloys is also likely to go down over the next few quarters.

However, to a certain extent the correction in stock prices and the valuations are already reflecting the pain of the sector. Further, what could work in favour of a company like Maithan Alloys which is sitting on 600 crore + cash surplus (against current market cap of 1,070 crore) is that most of the other players in the segment are either leveraged or were reporting losses even before the Covid-19 led crisis.

With lower demand and liquidity issues, their problems will only compound and some may even go out of business.

Thus, even though the size of the market may shrink in the interim, stronger companies could end up gaining higher market share in their respective industries.

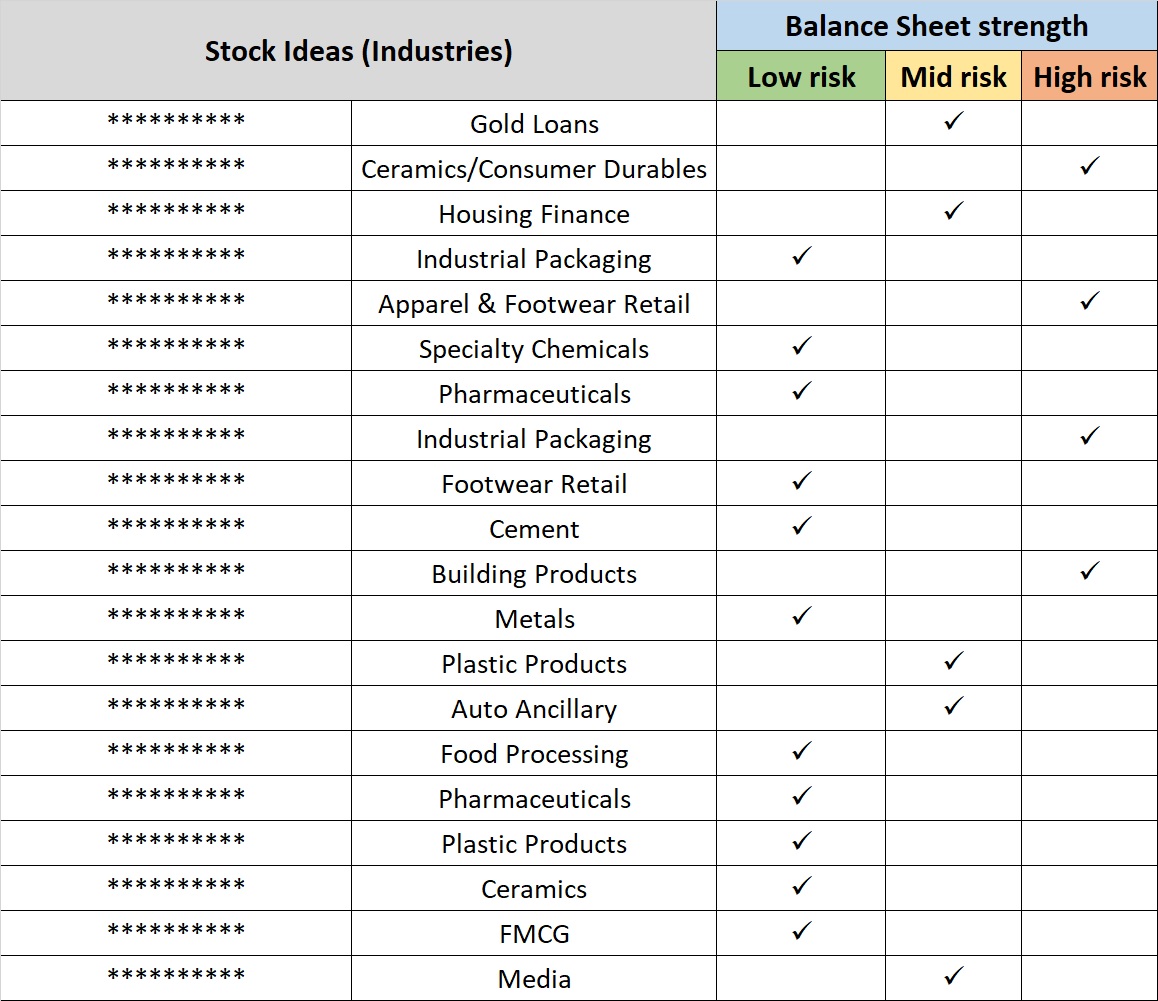

Now, coming back to the stocks under our coverage, we have tried to categorize them in three categories, purely based on their balance sheet strength and the nature of the industry (debt equity, interest coverage ratio, discretionary, non-discretionary, etc).

At this point of time, it’s all too difficult to make assumptions about the survivability of the businesses based on their presumed fixed costs and the near-term demand and we leave that exercise to when the companies announce their Mar’20 results and share their plans for the future.

Also, the categorization has got nothing to do with the expected future returns from the stocks. This is just a preliminary exercise to determine where the problems could emanate from if the situation doesn’t improve or continues as is.

If required, we will make the necessary changes to the ratings in the upcoming results season. For the moment, there are no changes.

Note: The names of the stocks have not been disclosed here as part of Premium Subcription. If interested, you can check the details at the following LINK

In the low risk category are mostly the ones with zero or negligible debt and had decent surplus cash at the end of Sep’19 quarter. One pharma company’s debt equity ratio is relatively higher at 0.77; however, it falls under essential category and therefore we don’t foresee any liquidity related issues with the company.

In the mid-risk category, again the balance sheets are strong; however, in order to differentiate them from cash rich, debt free balance sheets, we have categorized them in mid-risk category. Even for leveraged entities like Gold Loans and Housing Finance Companies, we believe they are relatively better placed than other NBFCs because of their focus on gold loans and salaried customers respectively.

We would have categorized Gold loan company as Low risk if it was only focused on Gold loans; however, on account of 21% exposure (in terms of AUM) to Microfinance, we have kept it in mid-risk category.

Out of 20, we believe there are 4 stocks that fall in slightly high-risk category. While all the 4 companies had adequately capitalized balance sheets for the normal times and had in fact started deleveraging even before the crisis began, but considering the fact that their products are discretionary in nature (barring Packaging company), we have kept them in high-risk category.

Before we jump to the conclusion that high-risk stocks should be sold, it is important to take into account the fact that Packaging company resumed operations from 3rd Apr’20 onwards and the consumer durables company resumed operations from 14th Apr’20 to fulfil the backlog of export orders.

Even for other companies in the high-risk category, we believe they could benefit from some shift in global supply chain from China to India and have therefore kept the rating unchanged for the time being.

As we have mentioned this often in the last 2 months, rather than thinking of the top-3 or top-5 stocks, it’s important to spread one’s investments across the stocks and sectors. In our view, the uncertainty of the situation doesn’t lend itself well to building over concentrated 3-5 stocks portfolios.

Wish you good health and wealth.

Disclosure: I have personal investment in Maithan Alloys.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: In Maithan Alloys

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – Yes, investment in Maithan Alloys

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No