Dear Sir,

Hope you are doing well and staying safe.

Recently, we came across an important piece of data on the bounce back in under-performing or beaten down sectors and we believe it can be really helpful for you as an investor.

We all like to buy stocks/sectors that have done well recently; however, as value investors it’s important to not get trapped at high valuations because the draw-downs can be huge and the wait for getting even the principal back can prove to be eternal.

Some examples:

- 2016-17 – Only small and mid-caps are worth investing

- 2019-20 – Small and mid-caps are bad…only large caps are good and that too the high-quality ones that can be bought at any valuations

- 2014-15 – It was believed that Pharma could never go down

- 2007-08 – It was believed that sky is the limit for Capital goods, metals, real estate, infra stocks

- 2000-01 – Anything even remotely connected to IT, .com, was considered a money-making machine

We all know what happened to the above themes right when most of the investors got super-excited with the recent performance and took a plunge.

On the flip side, there have been sectors that were considered untouchable by the investor community (after a few years of under-performance) which then turned around to deliver huge returns.

New Member

A few days back we released our New Stock idea for Premium Members. It’s a leading cash rich company and offering dividend yield of more than 15%

Get access to May’20 and other reports and Model sheet by selecting Premium Membership

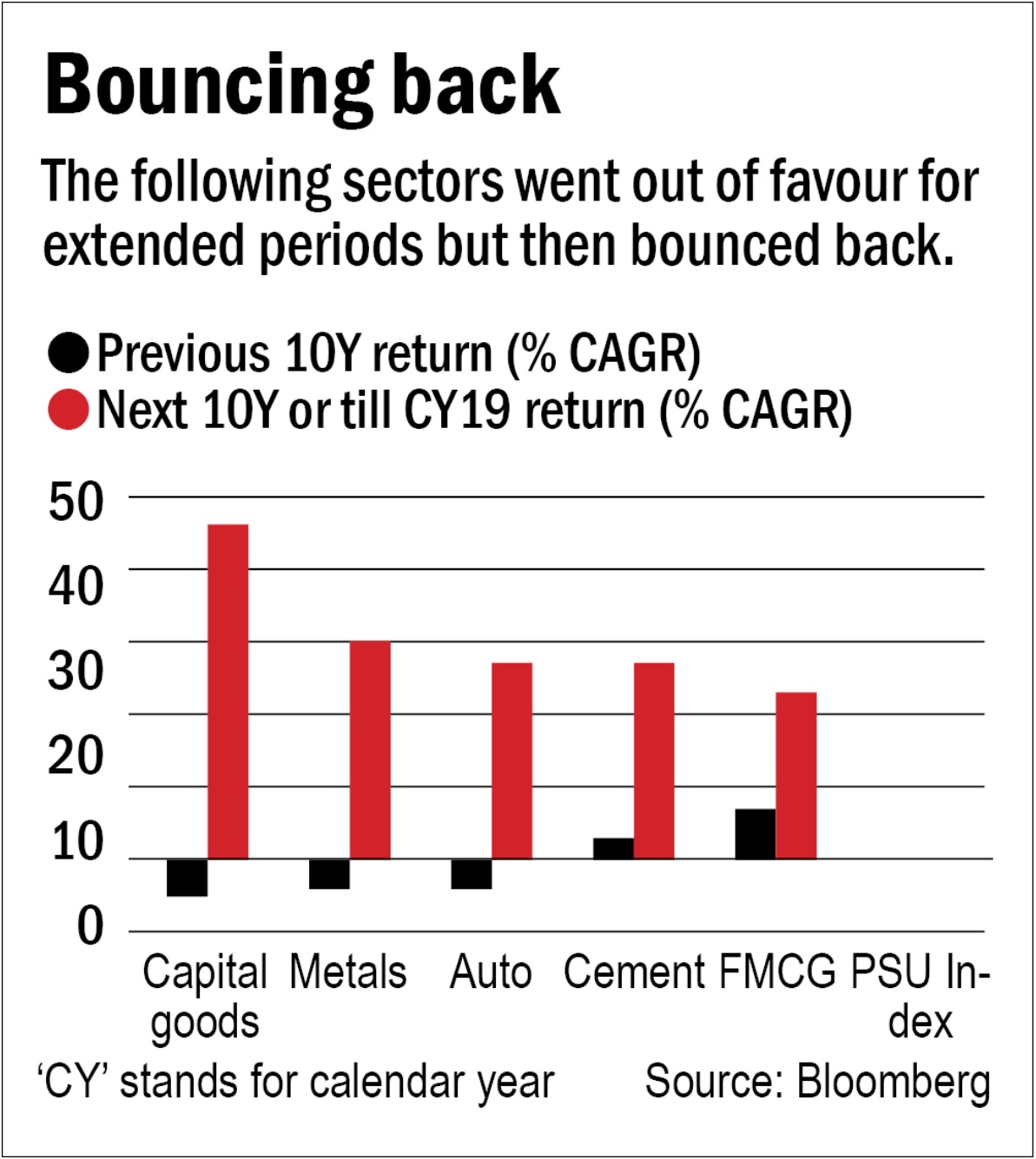

It is said a picture is worth a thousand words, so let’s check some past data:

Source: valueresearchonline

Look at how sectors like capital goods, metals, auto, cement, etc bounced back and went on to deliver 25-45% CAGR over a course of 10 years after underperforming for the prior 10 years.

These days it’s hard to imagine that one could have made 14x or 30x on cement and capital goods sectors (individual stocks delivered 10-100x) while the beloved IT sector delivered 0 return during the same period.

Source: moneycontrol

Source: moneycontrol

Between Sep’2000 and Nov’2007:

- S&P BSE IT delivered almost 0 return…In the interim, it also fell by almost 80%

- For the same period S&P BSE Capital Goods appreciated from 600 odd levels to 20,000 odd levels i.e. a gain of more than 30x against 0 return from the IT index

We are already witnessing something similar in a sector like Pharma which delivered almost 0 return between May’13 to Mar’20 and has now become one of the best performing sectors in the last 2 months.

The purpose of sharing the above data is to make you wear your 2nd order thinking hat. Don’t just fall for the recent out-performance of any stock/segment and buy it without giving due consideration to factors like: sustainable growth, valuations, market size, etc.

Stock/segments not doing well today could turn around to deliver the most extraordinary returns and the best performers of the recent past could prove to be the laggards of the future.

We believe it’s an opportune time to look for stocks with strong balance sheets in out of favour sectors. Those could be PSUs, Metals, Utilities, Other commodities, Small and mid-caps in general, etc. These segments and some more are probably trading at an equivalent of 5000 on NIFTY.

There are companies offering 5-20% dividend yield, are debt free, trading at 15-20% of asset replacement cost and yet investors are not interested in them. However, there will surely come a time when the same set of stocks will be up 5-10x or even more and there will be a deluge of investors taking plunge towards the very end of the run up.

Wish you good health and wealth.

Best Regards,

Ekansh Mittal

Web: https://katalystwealth.com/

Email: [email protected]

Ph: +91-727-5050062, Mob: +91-9818866676