Dear Sir,

Hope you are doing good and taking proper precautions.

As discussed in our Risk categorization update, we are increasingly focusing on leading well-managed companies which will probably emerge stronger from this pandemic and capture higher market share in the years to come. Have also benefited from this strategy with good returns in bad markets – details HERE

Also, if such companies come debt free and with low valuations, one can only blame himself for not buying such stocks during periods of distress.

Unless, you are from the group that justifies buying high quality low growth stocks at almost any valuation, you may find our latest stock report and the thesis behind the same interesting. The stock report has been shared only recently with Premium Members.

New/Returning Member

A few days back we initiated another delisting opportunity with seemingly lower downside and possibility of strong upside like Ineos. Currently, we have 2 active delisting opportunities.

You can access latest Investment Reports, Special situation opportunities by opting for Premium Subscription at the following LINK

Stock Idea (Jul’20)

The company we are talking about has the following attributes:

- Market cap > 1,000 crore

- Market Share – Leading player in India with 20% + market share

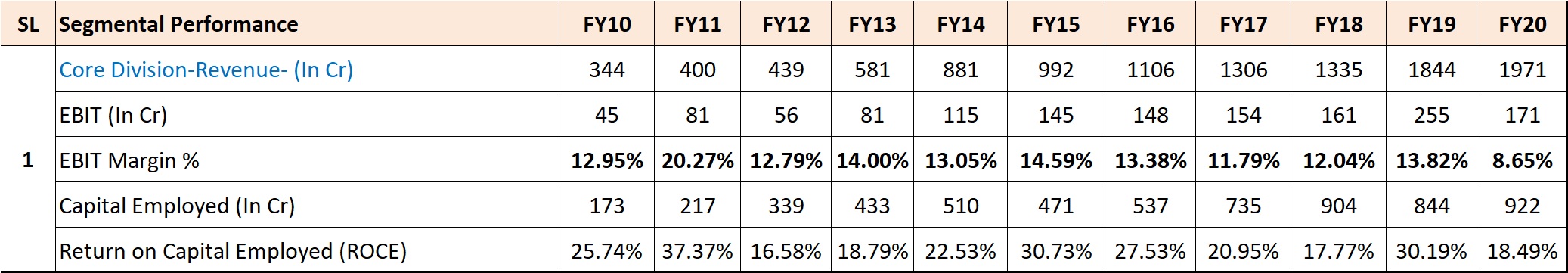

- FY 10-FY 19 – 20% CAGR in sales, 21% CAGR in Profits and 19% CAGR in Capital employed in core division

- Dividend – Consistently paying since 10-11 years

- Debt – Almost debt free at the end of Mar’20, despite spending more than 600 crore in the last 5 years on capacity expansion

- Cash flows from operations (5 yrs avg.) 40% higher than reported PAT

- Valuations – Available at around 11.5 times 5 years avg. PAT and around 8 times cash flows from operations

- CAPEX – Expanding capacity by 25% in FY 21 through internal accruals

- Promoter stake – Higher than 50% with further addition through open market purchases in the month of Jun’20

Source: Katalyst Wealth Research

These days there’re a few decent sized debt free companies with strong operating track record and good outlook available at 10-12 times earnings and yet investors are not willing to touch them even with a barge pole.

A few years down the line many might end up substantially higher and would appear no-brainer then.

Wish you good health and wealth.

Best Regards,

Ekansh Mittal

Web: https://katalystwealth.

Email: [email protected]

Ph: +91-727-5050062, Mob: +91-9818866676