Dear Sir,

Hope you are doing well.

We would like to share with you an interesting stock idea on: Gujarat Ambuja Exports (NSE: GAEL).

While the name of the company may not be very inspiring, they are actually doing very good business in the Maize Processing Segment in India.

On the face of it Maize Processing may sound boring; however, you will be surprised to know that the value added downstream products manufactured by the company find application in industries like Food, Pharma, Textiles, Paper, Leather, Adhesives, etc.

The company currently holds 20% + market share in the Maize processing segment in India and aiming for 30% in the next few years on the back of ongoing CAPEX.

For us the stock has proved to be good as we initiated the coverage on the same for our Premium Members around 79-80 odd levels (adjusted for 1:1 bonus) on 24th Jul’20 and currently the stock is trading around 110-120 odd levels.

We continue to like the company even around current levels. In fact, in our 23rd Oct’20 update, we assigned a positive rating to the stock. Our positive rating is akin to Buy rating given by others.

New/Returning Member

You can subscribe to Premium Memberships at the following LINK

Reports on GAEL

- You can read the initiation report (Free access) on Gujarat Ambuja Exports at the following LINK

- The latest 23rd Oct’20 update on the stock has been produced below:

Gujarat Ambuja Exports (NSE – GAEL) – Jul’20 Alpha stock

(23rd Oct’20 – Sep’20 earnings update)

CMP – 121.80 (BSE); 121.75 (NSE)

Rating – Positive – 4% weightage; this is not an investment advice (refer rating interpretation)

Source: bseindia.com

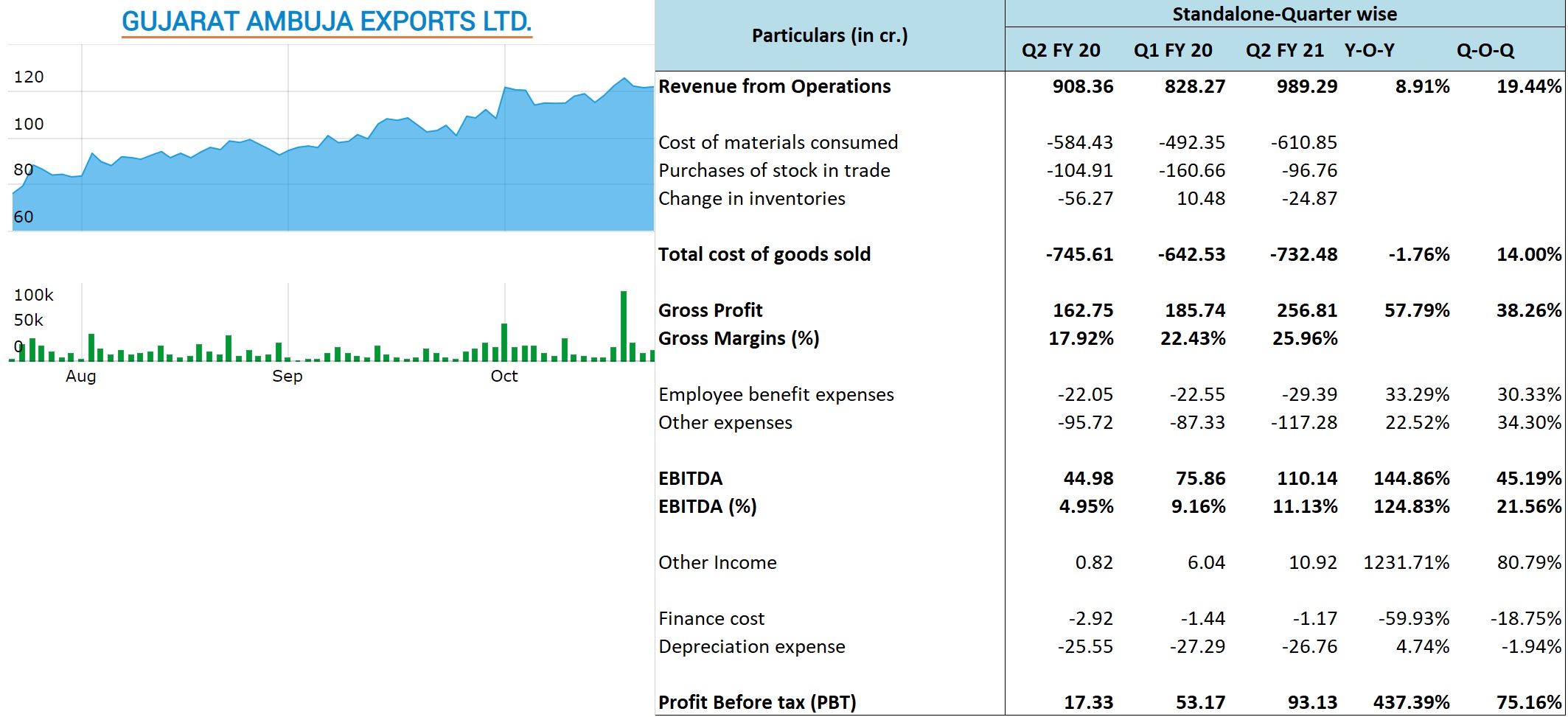

GAEL has reported decent set of results for the quarter ending Sep’20 with around 9% growth in sales on YOY basis, 58% growth in gross profits, 145% growth in EBITDA and 437% growth in PBT.

The above growth in profits is on the back of major contraction in margins in the year ago quarter on account of sharp rise in raw material prices.

While the company has 3 business divisions, Maize segment is the major contributor to the profits of the company at around 60-80%.

In FY 20, the maize segment’s performance was below average with EBIT margins of only around 8.65% against the average range of 12-14%. The primary reason for the same was more than 55% increase in prices of the Maize in 9M FY 20 against 9M FY 19. As the company couldn’t increase the prices of the end products proportionately, the margins suffered.

The maize prices have softened since then and as a result despite only 2.5% growth in sales of Maize division to Rs 482 crore, its EBIT stands increased to Rs 76 crore with EBIT margins of 15.76% against Rs 28 crore in Sep’19 quarter and EBIT margins of 5.97%.

During the quarter the agro division also posted better performance with 15% growth in sales and EBIT of Rs 33.95 crore against Rs 2.17 crore in Sep’19 quarter.

The Agro division’s performance tends to be volatile on quarter on quarter basis; however, over the last few years it has reported annual sales in the range of Rs 1400-1800 crore with EBIT margins of around 4%.

Another good feature of the performance during the quarter was significantly lower interest cost. As per the Sep’20 ending balance sheet, the company is debt free on net basis with cash in excess of borrowings.

Other Important points:

- In the Maize division 40% of the output is value-added products and the rest is commoditized products

- The company is increasing its Maize processing capacity by another 750-1000 TPD (from the existing 3,000 TPD) at Malda and expects to complete the expansion in next 15-18 months

- In Chalisgaon facility, the company has commenced the production of Value-added products. Further, as the FSSAI standards for the production of HFCS (High Fructose Corn Syrup) are announced, the company will set up 100 TPD HFCS plant at Chalisgaon

- As per the management, post the completion of the Malda plant, the company will have ~30% market share in the Maize processing segment. Further, the management intends to keep on adding to its capacities at regular intervals

As mentioned in our initiation report, Maize processing is increasingly becoming the core and focus area and provides stable margin profile and better growth potential on the back of increasing demand for starch and its derivatives.

Further, the company will realize the full benefit of Phase-2 expansion of Maize processing unit at Chalisgaon in Q3 and Q4.

We believe, sharp rise in raw material cost, as it panned out in FY 20 is the major risk for the company; otherwise, the company has been executing well and that too without significant leverage.

Adjusting for normalized other income of around Rs 10 crore, the stock is currently trading around 14 times trailing twelve months earnings.

Considering the growth potential ahead, planned expansions, strong balance sheet and reasonable valuations, we have a positive rating on the stock.

Wish you good health and wealth.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://katalystwealth.com/

Email: [email protected]

Ph: +91-727-5050062, Mob: +91-9818866676

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to Investors on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – Yes, Gujarat Ambuja Export’s in wife’s account

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No