Dear Sir,

Please find below Performance Snapshot of our Stock Recommendations shared with all our Premium members.

We started offering equity research services in 2011 and have completed 1 full bull-bear cycle of the markets.

From 2011-13 the markets were down in the dumps, then we had a great 2014-17, then a really bad 2018-20 and now again the markets are doing well.

A full cycle is long enough and encapsulates both the good and the bad and therefore we believe the best way to measure the performance is over a complete cycle than any particular period in time.

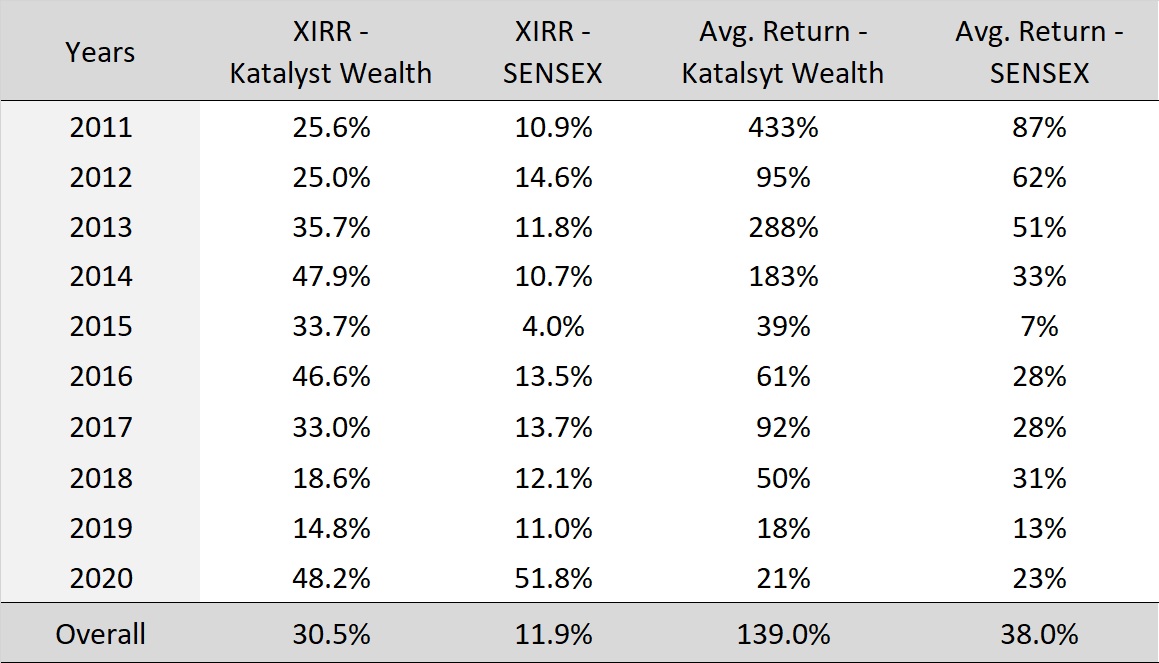

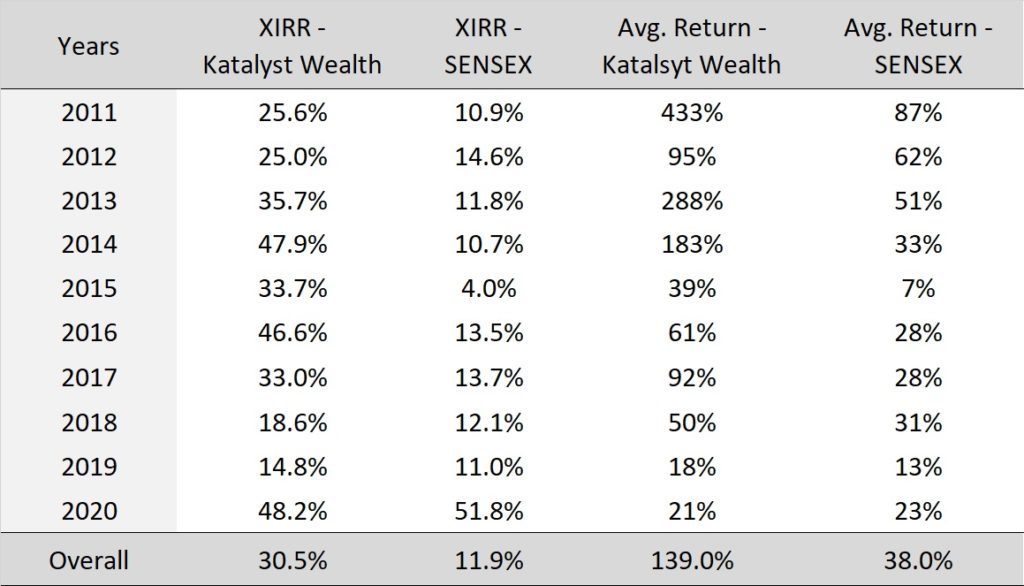

Highlights of our Investment Reports Research [2011-20] as on 27th Dec’20

- KW XIRR [2011-20] – 30.52% vs SENSEX XIRR [2011-20] – 11.91%

- Significant out performance over SENSEX and other benchmark indices over the last 9 years

- Major Correction in Small and Mid cap stocks since 2018; however stocks recommended in any particular year have still delivered significant out performance over SENSEX

- Max. return by a stock – 1,523%

The above snapshot captures returns delivered by the stocks based on the calendar year in which they were initiated.

XIRR return for Katalyst Wealth stocks and SENSEX is calculated assuming equal amounts invested in all the initiated stocks (at the time of initiation) and SENSEX on the date of the initiation. XIRR is a better indicator of the performance than Avg. Return (especially over longer periods) as XIRR takes into account the timing of both the buying and the selling of the stock.

You can find details on all the stocks initiated, date of initiation, closure, returns, method of calculation, etc by downloading the following excel sheet – Investment Track Record_27th Dec’20

What does the above performance indicate?

Investments made during down markets are painful in the short term but deliver significant returns in the long term.

All our picks are from small and mid-cap spaces. Yes, there have been a few failures, but longer term investing while focusing on Growth cum Value strategy does deliver great returns.

While it may appear benchmark indices are unbeatable, on the contrary, it is possible to achieve significant out-performance in the longer run.

In Equity investing, not all the years are same.

Out of 15 stocks under research, not all 15 will do well. But if 10 do well over longer run, the gains from those 10 will more than compensate for the losses from the other 5.

The gains that can be accrued on any good stock are virtually limitless, while the downside is limited (unless, you are leveraged).

To know more about our Stock research services, check out the following page – LINK

Wish you good health and wealth.

Best Regards,

Web: https://katalystwealth.

Email: [email protected]

Ph: +91-727-5050062, Mob: +91-9818866676