Dear Sir,

We read several annual reports in a year and make notes for our reference. Going forward, we will be positing such notes for the benefit of the readers of our website.

We believe Annual Reports are one of the best documents to increase your understanding of the company and you can learn more about how to use them at the following LINK

However, do keep in mind, such notes are mostly cut, copy and paste from the annual reports of the companies and are in no way a research report or a recommendation on the stock.

Here are some interesting details from the Management Interview, Annual Report and Investor Presentation:

Aarti Jhunjhunwala’s Sep’20 Interview with India Infoline

-

Fineotex Group was founded in 1979 and is engaged in the manufacturing of Specialty Chemicals and Enzymes.

-

We manufacture the entire value chain for the textile industry including pretreatment, dyeing, printing, and finishing process.

-

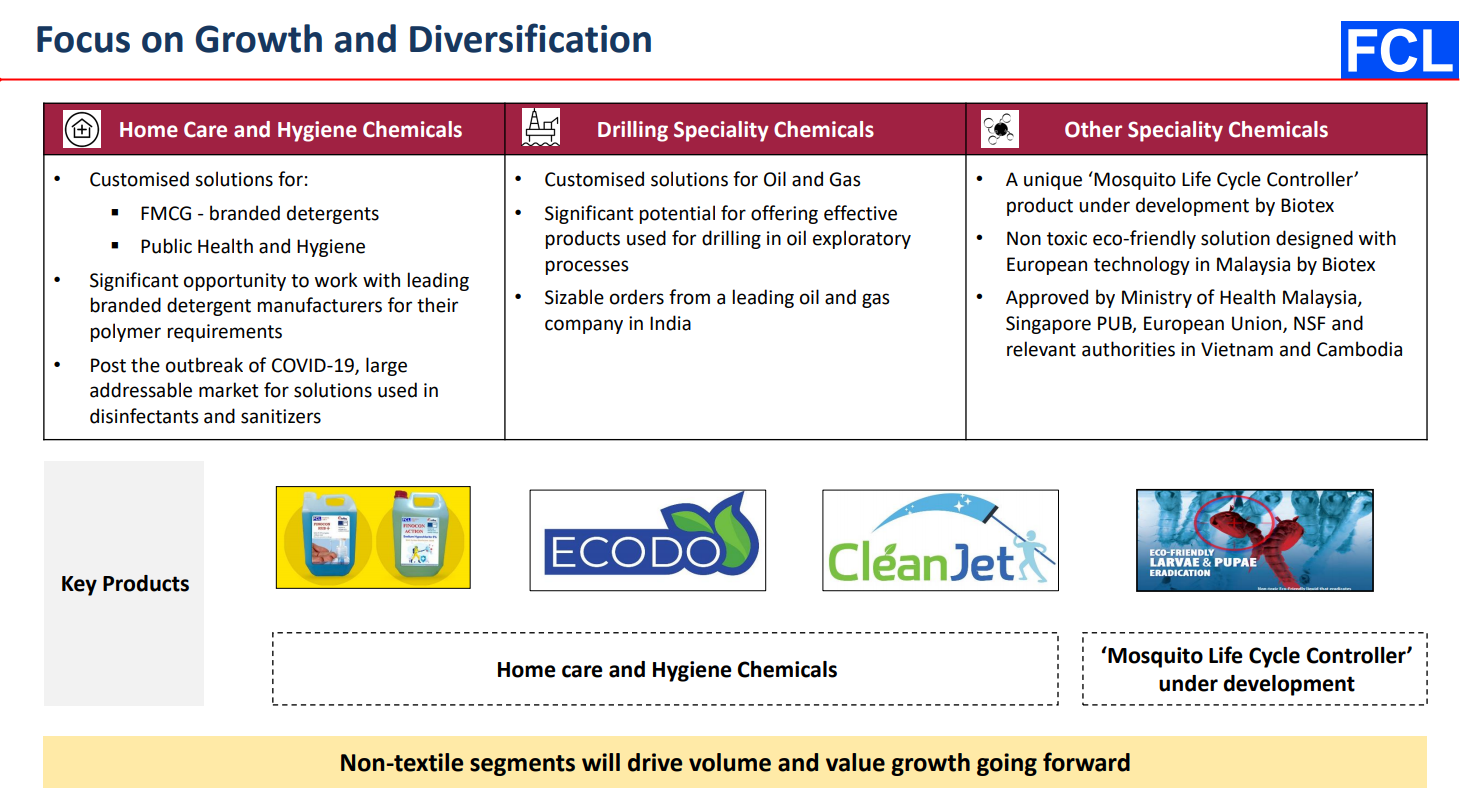

We have recently entered fast-growing home care and hygiene and drilling speciality chemicals segments

-

Our Malaysian subsidiary, Biotex, spearheads R&D solutions, application research, and product development

-

We have a successful acquisition track record, having turned around our Malaysian subsidiary into a debt-free company and its net profit has grown by a factor of 4x since acquisition in 2011.

-

We have gained good traction in the textile chemical business in the last few years and hold a presence in more than sixty countries where we cater to the entire value chain for the textile industry including pre-treatment, dyeing, printing, and finishing process

-

I believe that the Company will benefit from its strategy to tap new global markets and efforts of our business development team. The textile chemical business is likely to benefit from FY22 onwards with lower chemical manufacturing in China due to strict environmental norms

-

Fineotex has responded to the COVID-19 pandemic by foraying into health and hygiene specialties to tap into the large market opportunities for health and hygiene products which have emerged post the outbreak of COVID-19. We are in early-stage dialogue with select FMCG companies for chemical solutions for branded detergents, which we envisage is a large addressable business opportunity

-

COVID-19 has also brought up opportunities for textile and garments to feature more technical chemistries like stain release, water repellents, antimicrobials, etc. which are strengths of BioTex Malaysia

-

Future plans – We have revamped our marketing model and we are aggressively engaging in marketing activities, exhibitions, and all. We are actively expanding our product range in developing specialties for drilling in the oil and gas industry. We have made significant progress in product development and are in discussion with a leading Oil and Gas Company in India. We are hopeful of achieving a breakthrough in the fast-growing hygiene segment and we are currently providing feedstocks like surfactants and other chemicals to select players in the detergent industry

-

Strategic outlook – We are aggressively entering fast-growing synergistic segments such as Home Care and Hygiene and Drilling Specialties while continuing to focus on the core Textile Chemicals business. We continue to develop direct customer relationships and expand the distribution network. Fineotex has a conservative approach to funding acquisitions, capacity expansions, and greenfield developments through internal accruals. We are currently exploring greenfield opportunities for our next leg of growth and we shall continue to explore partnership opportunities with international companies who wish to establish manufacturing facilities in India

Annual Report 2020

-

Specialty textile chemical manufacturer

-

The company has manufacturing facilities in Navi Mumbai and Malaysia with a combined production capacity of 43,000 MT/p.a

-

Company manufactures chemicals for the entire value chain for the textile industry including pre-treatment, dyeing , printing and finishing process

-

The company also manufactures other chemicals for various industries like agro, adhesives, construction, water treatment etc.

-

The company was listed on Bombay Stock Exchange in March 2011, and listed on the National Stock Exchange in January 2015

-

Sales break up – 97% textile chemicals, 1% fertilizer chemicals, 1% adhesives and 1% others

-

Standalone – 75% domestic and 25% exports

-

Consolidated – 52% overseas and 48% domestic

-

Strong R&D capabilities help them increase customization levels of their products

-

Extensive R&D is performed at the client’s site. This is an important source for new developments as a lot of variables/factors like the client’s plant machinery type and its speed, water quality, timing etc are critical for tweaking the quality and performance of the products

-

FCL have acquired land in Wada, Khopoli and additional land in Ambernath for future expansion

-

The Company is a zero debt company. The borrowings are taken for short term requirements so that the investment portfolio is not abruptly disturbed

-

The Board has approved the offer for the Buy Back of equity shares by way of an open offer which will be open only for public shareholders. The Company proposes to buy up to 11,00,000 equity shares of Rs. 2/- each fully paid at a maximum price of Rs 40/- (Rupees Forty only) per share. The offer will open on 5th August, 2020 and will be open till 4th February, 2021

Nov’20 Presentation

-

Successfully retained anchor customers and developed new customer relationships this quarter

-

Gradual improvement in sales trajectory month on month and strong visibility on future growth

-

We are pleased to deliver a robust operational performance this quarter as business returned to normalcy post the outbreak of COVID-19. We witnessed a strong revival in our flagship textile speciality chemical business. We have successfully retained our anchor customers and also developed new relationships despite a tough business environment. We are gradually witnessing improvement in business operations across all our verticals and have strong visibility of growth

-

Expect to commission first phase of the brownfield manufacturing facility at Ambernath, Maharashtra in Q1 FY22. Proposed deployment of Rs. 270 million. Located on ~4 acres of land

-

It will cater to customer demands in the existing Textile Specialities and fast growing Home Care and Hygiene and Drilling Specialties business

-

Upcoming facility provides additional manufacturing capacity for existing product lines and new growth areas

-

Q2 FY21 revenue growth was driven by gradual increase in order book from our leading customers. Expect sales trajectory to keep improving going forward

-

Cash position – Rs 600 million of investments across fixed deposits, debt markets and mutual funds. Aim to re-allocate capital from liquid investments towards capacity expansion and green field projects going forward

-

Approach to Acquisitions – Opportunity to drive growth through the addition of synergistic manufacturing platforms. Continue to evaluate acquisitions and collaborate with international companies to establish operations in India

-

Sales in 60+ countries including Brazil, Bangladesh, Germany, Indonesia, Malaysia, Singapore, Thailand, USA and Vietnam

Disclosure: This is neither a research report or a recommendation on the stock. I don’t have any investment in the stock.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to investors on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No