Dear Investor,

Please find below Performance Snapshot of Stocks Recommended to our Premium members.

We started offering equity research services in 2011 and have completed 1 full bull-bear cycle of the markets.

From 2011-13 the markets were down in the dumps, then we had a great 2014-17, then a really bad 2018 till mid 2020 and now again the markets are doing well.

A full cycle is long enough and encapsulates both the good and the bad and therefore we believe the best way to measure the performance is over a complete cycle than any particular period in time. Also, remaining invested through both good and bad periods is what actually creates wealth than flipping in and out of the markets.

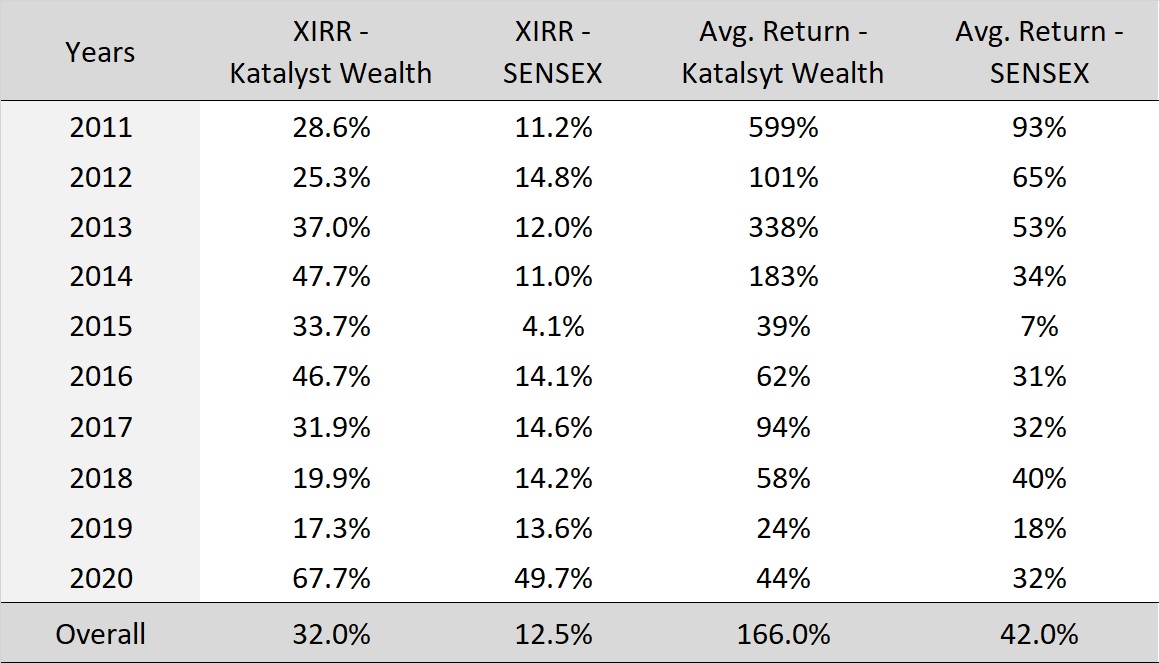

Highlights of our Investment Reports Research [2011-20] as on 14th Mar’21

- KW XIRR [2011-20] – 31.99% vs SENSEX XIRR [2011-20] – 12.47%

- 3 out of every 4 stocks recommended by us have delivered positive returns

- Max. return by a stock – 2,138%

- Major Correction in Small and Mid cap stocks since 2018; however stocks recommended in any particular year have still delivered significant out performance over SENSEX

The above snapshot captures returns delivered by the stocks based on the calendar year in which they were initiated.

You can find details on all the stocks initiated, date of initiation, closure, returns, method of calculation, etc by downloading the following excel sheet – Investment Track Record_14th Mar_21

What does the above performance indicate?

Investments made during down markets are painful in the short term but deliver significant returns in the long term.

All our picks are from small and mid-cap spaces. Yes, there have been a few failures, but longer term investing while focusing on Growth cum Value strategy does deliver great returns.

While it may appear benchmark indices are unbeatable, on the contrary, it is possible to achieve significant out-performance in the longer run.

In Equity investing, not all the years are same.

Out of 20 stocks under research, not all 20 will do well. But if 15 do well over longer run, the gains from those 15 will more than compensate for the losses from the other 5.

The gains that can be accrued on any good stock are virtually limitless, while the downside is limited (unless, you are leveraged).

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: https://www.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here – LINK