Hello Sir,

No matter how much we all say one should not try to time the market, we all still want to know if the market is at its peak or if it has bottomed out.

I personally think, one should always prepare than predict. For instance, if you think the markets are overheated, then one can increase cash component in the portfolio. Similarly, if you think markets are offering great bargains, you could increase the investments and reduce liquidity in the portfolio.

No such tools have been developed where one could predict the exact top and bottom and therefore, I have always preferred remaining invested in the range of 70-95% in the market and the rest in FDs, liquid funds, etc.

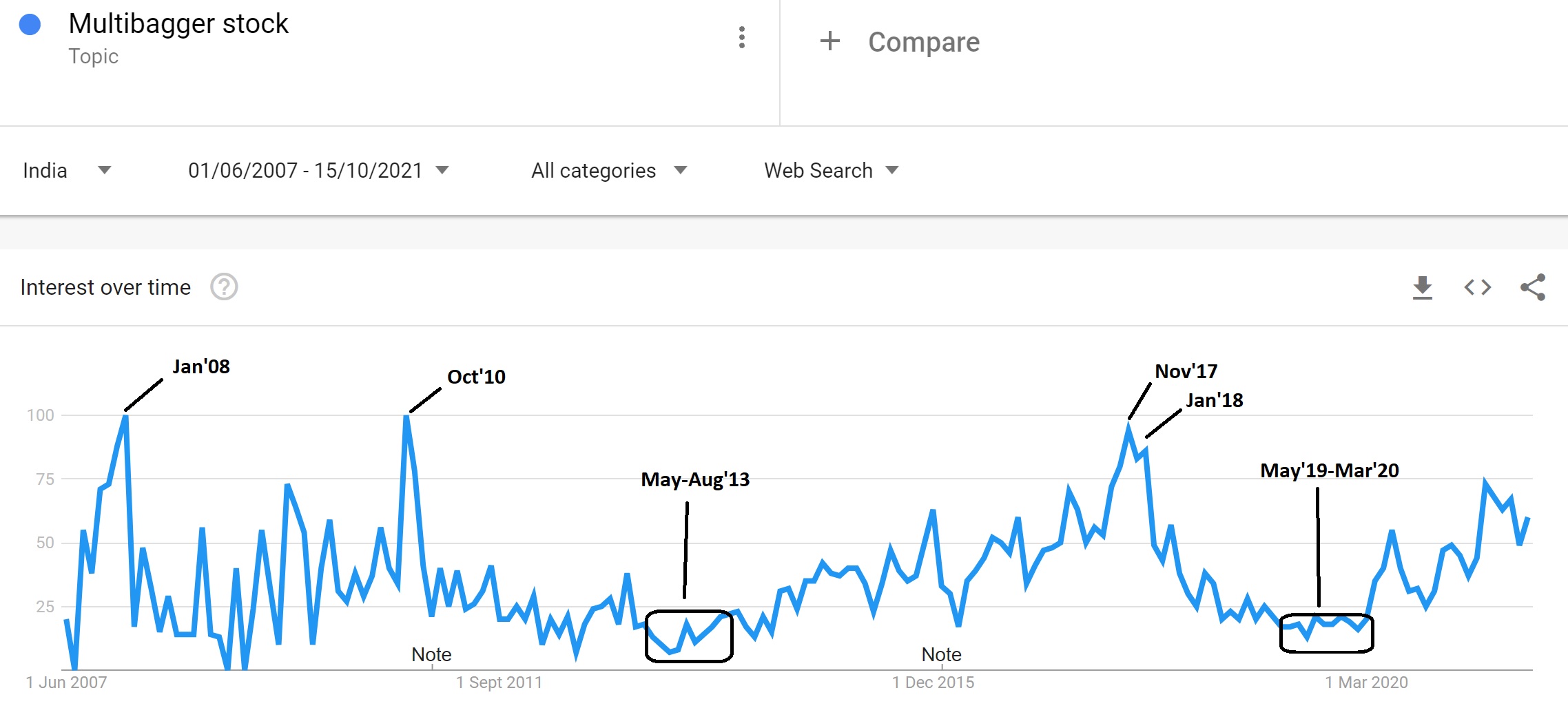

Coming back to the topic, well the tool is none other than Google itself – Google Trends.

You can check it out HERE.

We started using the tool in the year 2019 and it has proved to be extremely useful in guiding our clients since then:

- In Oct’19 we asked them to become greedy as the market was throwing great bargains – check HERE

- In Dec’20 when investors were mostly expecting a major correction post the run up from Mar’20, we asked our members to continue focusing on out of favour small and mid-cap stocks – check HERE

Where do we stand as of today?

Well, the SENSEX is above 60,000; however, the tool is still not suggesting a market top like Jan 2008 or Jan 2018.

We do believe there’s frothiness in certain segments of the market and some of the high flying, high valuation stocks may have topped out. Also, 10-20% correction and some consolidation can’t be ruled out. In fact, it would be good for the market.

In terms of investments in model portfolio, unlike Mar’20, when we had more than 95% invested in the market, it’s now down to around 85%. It may go down further if we book profits in certain stocks or if some stocks hit trailing stop loss.

Our approach right now is to look for stocks/sectors that are currently not doing so well, but offer low downside opportunities from a perspective of 2-3 years. The other approach is to look for companies where we are quite sure of earnings growth over the next 2-3 years but available at reasonable valuations.

One mistake that I would surely not do is to exit completely from the market. Many do not realize this, but investors have lost far more money waiting for correction than in correction themselves.

Best Regards,

Ekansh Mittal

Research Analyst