Hello Sir,

Hope this blog finds you well. We have previously shared that the only two insurances people need are Term life insurance and Health Insurance. There are a lot of other insurance products in the market that are pushed by insurance agents and bankers like ULIPs (Unit linked insurance plans), Endowment plans, etc.

In today's blog, we will explain to you what a ULIP is and share some arguments for and against the scheme in comparison to Term Insurance + Mutual funds.

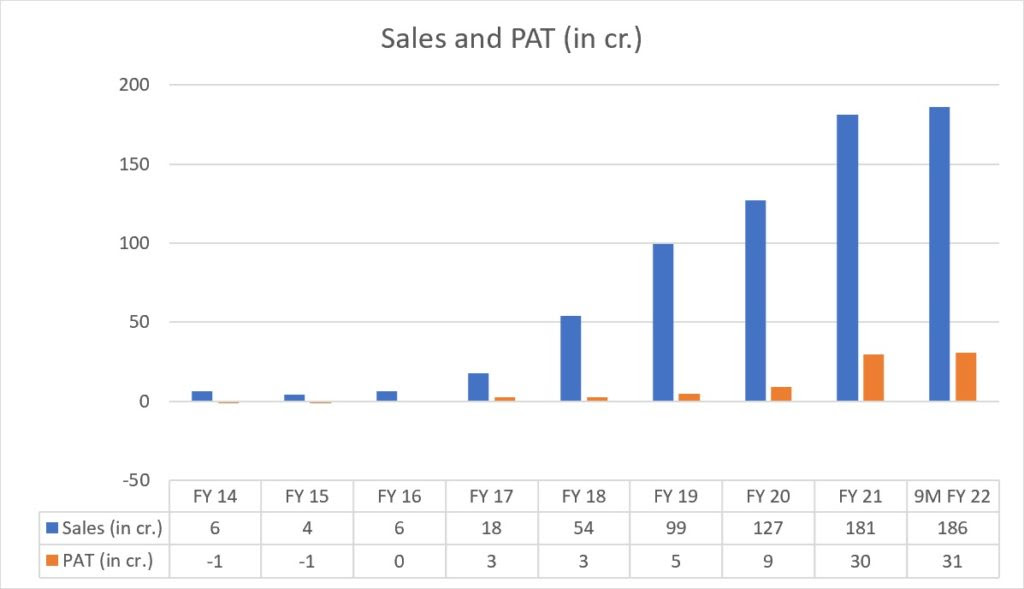

Before that, if you are interested in investing in a branded processed foods company that has reported 9x growth in sales and 9x growth in PAT in just 4 years in its US business and still available at 10 times next year's earnings, you can read about it here - LINK

You won't find this data unless you dig deep inside company's annual reports

Unit Linked Insurance Plan

This is an insurance plan in which you pay the insurance company premiums and in exchange of those premiums you get an insurance cover which is approximately 10 times the amount of the premiums you have paid. Along with that at the time of maturity you get back your investment along with approximately 10% return depending on the performance of the markets during the time period of your investment.

The premiums you pay under this scheme are tax deductible under Section 80C. This means that you can pay up to Rs 1.5 lakh as premiums under this scheme for which you will not have to pay income tax. The returns that you will receive at the time of maturity will also be tax free. There are multiple asset management companies that offer ULIPs and the performance of the ULIP that you invest in will also be affected by the performance of the fund manager handling your ULIP. To conclude, you can think of a ULIP as a mutual fund that is tax deductible under section 80C, returns are tax free and you also get an insurance cover of ~10 times the premium paid.

Arguments for ULIP

Premiums are not wasted - One dilemma that a lot of people face while buying Term life insurance is that the premiums you pay are forever gone in case you do not need to make a claim (which is a good thing). Financial institutions therefore claim that if you buy a ULIP then the premiums you pay will not be wasted and you will get a handsome tax free 10% return at the time of maturity. This tempts a lot of investors to opt for this scheme instead of a simple term life insurance.

Tax Benefits - If you fall under any tax bracket then the tax free return on your investment can be a major benefit. Whenever comparing the return of ULIP with any other investment option you must compare with the post tax return of the other investment option. Also, instead of using your current tax bracket, try predicting the tax bracket that you will fall under at the time of maturity and use that (assuming your income will increase over time).

Lock in Period - ULIPs have a lock in period of 5 years. While selling ULIPs, it is pitched as a better alternative from PPF which gives a lower return of ~7-8% and has a lock-in period of 15 years (partial withdrawals under specific scenarios after 7 years). However, you must remember that the returns in PPF are guaranteed by the government and have a much lower risk. It is much better to compare ULIP with ELSS as both are market linked products assuming similar levels of risk. ELSS have a lock in period of only 3 years however their returns are only tax free up to Rs. 1 lakh after which LTCG @ 10% is charged.

Arguments against ULIP

Low Cover - ULIPs only offer a cover of 10 times the premium amount. On the other hand a simple term life insurance could get you a cover of as much as 100 times the premium you pay each year. In case of a mishap, the proceeds from a ULIP might not give a significant financial safety to the family however in case of Term life insurance the net is much bigger.

Fewer Options - Most asset management companies will offer ULIPs however the types of assets that these schemes invest in will be limited. Most companies only offer Equity ULIPs that invest in large cap stocks. If you wish to have greater flexibility with the type of investment you want to make, mutual funds will give you way more options compared to ULIPs.

Initial Charges - One of the biggest disadvantages of investing in ULIPs is the high amount of charges associated with them. In fact, in the initial years these charges weigh heavily on the returns as they go towards policy administration etc. It is only after a few years that these charges start to level off and the returns begin to make some sense.

Hope this blog will help you in making more informed choices while buying insurance or making an investment.

If you are looking for investment opportunities do check out our premium subscriptions.