Hello Sir,

In order to recommend the best stock ideas to our members, we keep looking for new opportunities and add them to our watchlist. Here's 1 company we recently added to our watch list: Goldiam International.

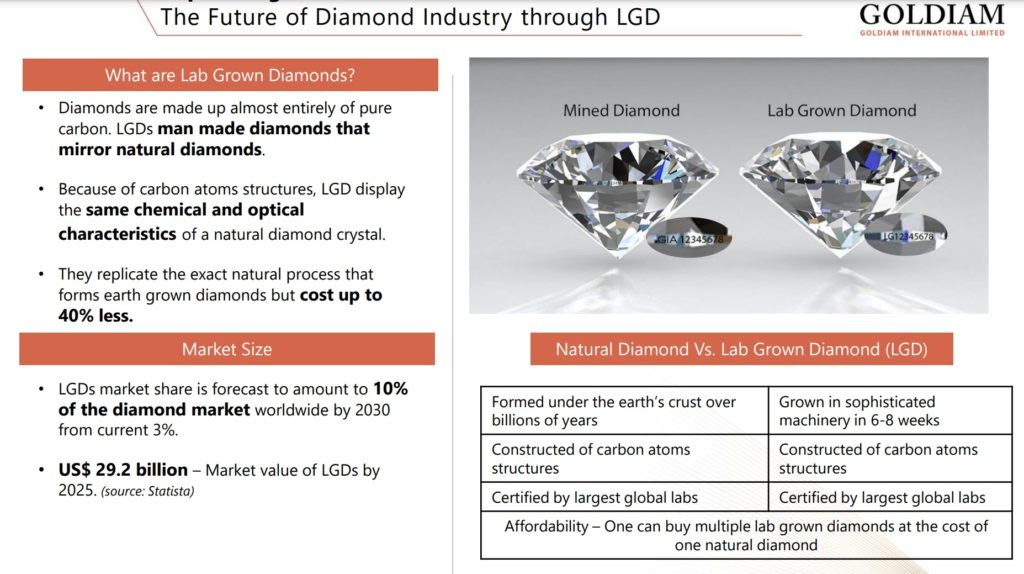

Did you know? The market share of Lab Grown Diamonds (LGDs) is forecast to increase to 10% (of the worldwide diamond market) by 2030 from 3% currently. LGDs also cost up to 40-50% less than natural ones.

Source: Goldiam International presentation

We believe these facts alone make it up for an interesting sector to study about and find potential investment opportunities, if any.

Before that, if you are interested in investing in a branded processed foods company that has reported 9x growth in sales and 9x growth in PAT in just 4 years in its US business and available at 10 times next year's earnings, you can read about it here - LINK

LGD Industry

What are LGDs? - Lab grown diamonds (lab created, man-made, engineered diamonds) are chemically, optically and physically identical to earth mined diamonds, but are more affordable than mined diamonds.

They mirror actual diamonds as they consist of carbon atoms structures.

Are LGDs real diamonds? - Even the most sophisticated gem laboratories certify them as diamonds. Only difference is the origin as they are grown under controlled environment in a lab and not mined from earth.

How are LGDs made? - Natural diamonds grow through intense heat and pressure which over millions of years transforms carbon atoms into diamonds. Lab-created diamonds grow in the same way, only through a man-made process that takes several weeks.

LGDs begin a with tiny piece of diamond, known as diamond seed. This seed is placed inside a special chamber designed to mimic conditions within Earth’s crust. The seed coated in pure carbon transforms into a synthetic diamond, chemically identical to natural diamond.

Type of methods to make LGDs - High Pressure-High Temperature (HPHT) and Chemical Vapor Deposition (CVD).

CVD is a relatively new technique but more popular in use. HPHT process typically produces yellow or brown diamonds of lower economic value. Low costs associated with CVD production and low space consumption has led to a greater adoption of the CVD manufacturing technique.

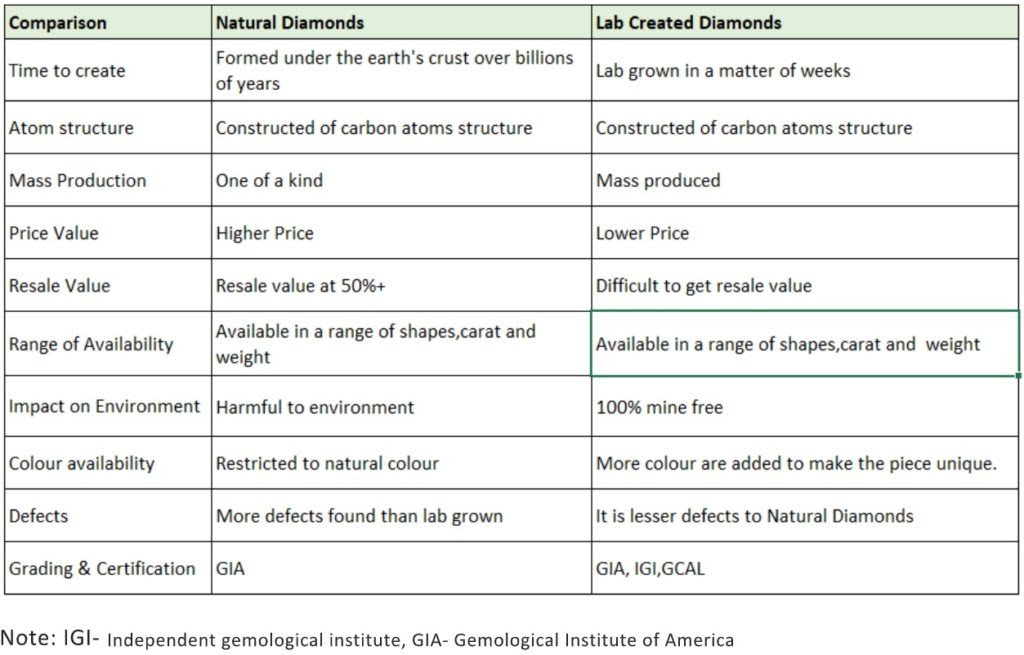

Comparison between Natural diamonds and LGDs - LGDs can be distinguished from natural diamonds only with tests using specialized equipment. LGDs available for purchase should always come with a gem certification identifying them as laboratory grown.

Source: Katalyst Wealth research

Source: Katalyst Wealth research

Industry info - The global LGDs market size was valued at $19.3 Bn in 2020, and is projected to reach $49.9 Bn by 2030 at a CAGR of 9.4%. LGDs market share is forecast to amount to 10% of the diamond market worldwide by 2030 from current 3%

Major global players - BD Diamonds, Clean Origin, De Beers Group, Diam Concept, Diamond Foundry Inc., Henan Huanghe Whirlwind Co., Mittal Diamonds, New Diamond Technology LLC, Swarovski AG, and WD Lab Grown Diamonds.

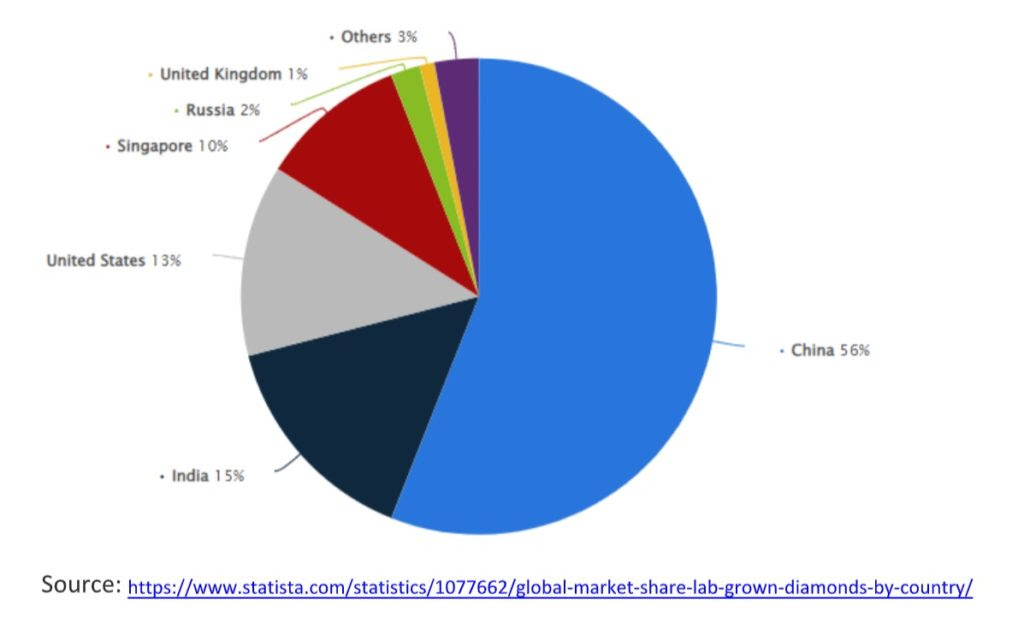

Global market share - Like any manufacturing industry, China is by far the world's largest producer at 50% + share of LGD production. India comes 2nd at 15% and US is 3rd at 13% (Source: Statista)

Note: This is not a recommendation to buy/sell Goldiam International. Currently, we don't have a coverage or holding in Goldiam.

We are working on few more interesting stock investment opportunities and will share something good in the next few days. You can get it along with our other Premium Members by signing up HERE.

If you are looking for investment opportunities do check out our premium subscriptions.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected]

Disclaimer: You can access it here - LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No