Hello Sir,

We have seen the influence of Tech in almost every product we use. But there are many services out there that we do not directly use and hence don’t pay much attention to. These segments often offer great opportunities to start a venture.

Today we bring to you the story of Delhivery. A startup that captured a significant market share in a fairly unorganised industry. Did you know that many products that you order from Amazon and other e-commerce brands are sometimes delivered by Delhivery? So let us find out how Delhivery became a billion dollar business and a trusted delivery partner for the likes of Amazon, Flipkart etc.

Interesting details about Delhivery

Delhivery was started by Sahil Barua and Sandeep Barasia, who quit their jobs in Bain and started this journey in 2011. Delhivery was initially a food delivery company that would deliver for restaurants; however, when Sahil and Sandeep noticed a gap in the logistics space for ecommerce they quickly pivoted.

Problem Statement - At the time there were two main problems that most e-commerce businesses were facing -

- Cash on Delivery - 90% of all orders that e-commerce companies were receiving were cash on delivery orders. There were also many cases of return orders. Traditional logistics companies did not have any system to accommodate these requirements.

- Speed - As competition in e-commerce increased, time of delivery started playing a decisive role when comparing two company’s services. While traditional systems would take a week or two for delivering an order, markets wanted it delivered in 2-3 days.

The Solution - Of Course there are a lot of little little things that help Delhivery solve these issues and deliver 12 Million packages a month. Here we will talk about a few of the most important ones.

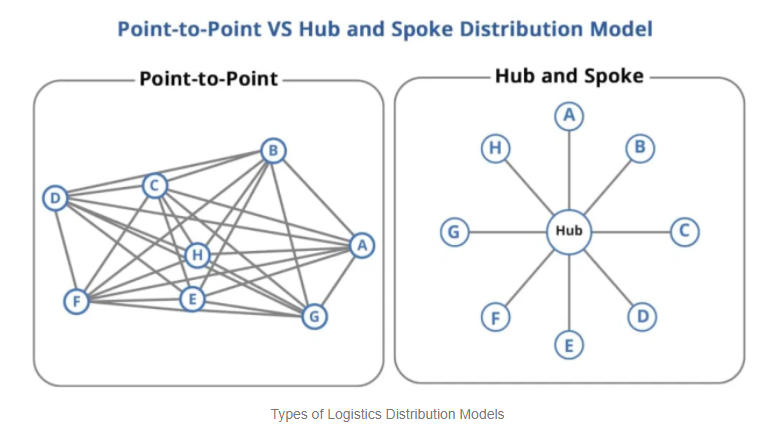

Delivery Model - The first thing that Delhivery did differently was the way it planned its delivery network. Delhivery currently operates in over 12000 pin codes. Traditional logistics companies mostly followed a Hub and spoke model. Delhivery follows a point to point delivery system which helps it reduce its delivery time massively. In this system each point acts as a hub and sorting facility itself.

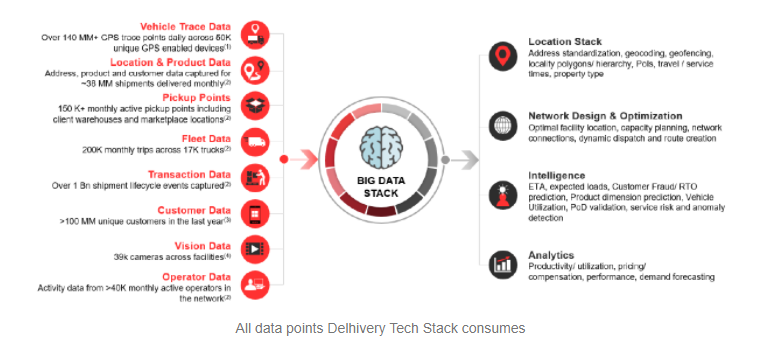

Technology - The company operates in the logistics industry but at the core the company is truly a tech company. It has built over 80 proprietary apps that work together to help Delhivery deliver millions of packages each month.

The company also collects data on all the packages that it delivers. This data is then fed into its machine learning algorithms that find ways to further optimise the systems and help Delhivery take key strategic decisions like where to add a new node for sorting etc. This tech helped the company quickly optimise itself to get back in business at the time of Covid lockdowns to operate only the completely necessary facilities for the delivery of essential goods.

The company is now planning to sell its tech to other logistics players as well. It is working on building some standalone applications that can be sold with the SAAS model.

Img Source: Invest Karo India

Asset light approach - Logistics business is by nature a capital intensive business; however, Delhivery has followed an asset light model since the beginning. The company only invests in critical infrastructure and leases the remaining network.

It takes significant help from technology to achieve this. This model has also allowed them to increase their capacity much faster than it would have been had they decided to purchase the entire fleet of trucks and warehouses.

Note: This is not a recommendation to invest in Delhivery IPO, nor do we have any coverage on the same. Even though the story and the business are inspirational, this does not mean that you should invest in the stock as well. There are multiple things that you need to consider before you can invest.

If you are looking for investment opportunities do check out our premium subscriptions.

Best Regards,

Archit Mehrotra

Web: https://www.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected]

Disclaimer: You can access it here - LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No