Hello Sir,

Hope you are doing well.

These days there are 1000s of Youtube and Instagram content creators acting as market experts who have not even spent 3-5 years in the market or seen 1 major down cycle.

Fortunately, some investors who have been in the market for 2-3 decades now and who have actually created wealth are on social media and occasionally share their Investment wisdom.

One of them is Mr. Ashish Kacholia. While he needs no introduction, just in case you are not aware, he started investing in early 90s with a capital of 2-3 lakhs and currently his stocks portfolio is worth Rs 1,500-2,000 crore.

We follow him on Twitter. Recently he jokingly tweeted about inflation in the wake of the recent market correction. There were a flurry of replies to his tweet. Luckily, he responded to few of them and as you will notice, you will find the most practical and humble answers from someone who has seen several downcycles and yet created immense wealth from the market.

Most important, he doesn't act in a way as if he knows it all.

Before that, in this market correction, if you are interested in investing in a Pharmaceutical company which has made an extremely complex and poisonous material from scratch (with a worldwide market potential of Rs 27,000 crore +) and is the only Indian maker, you can read about it here - LINK

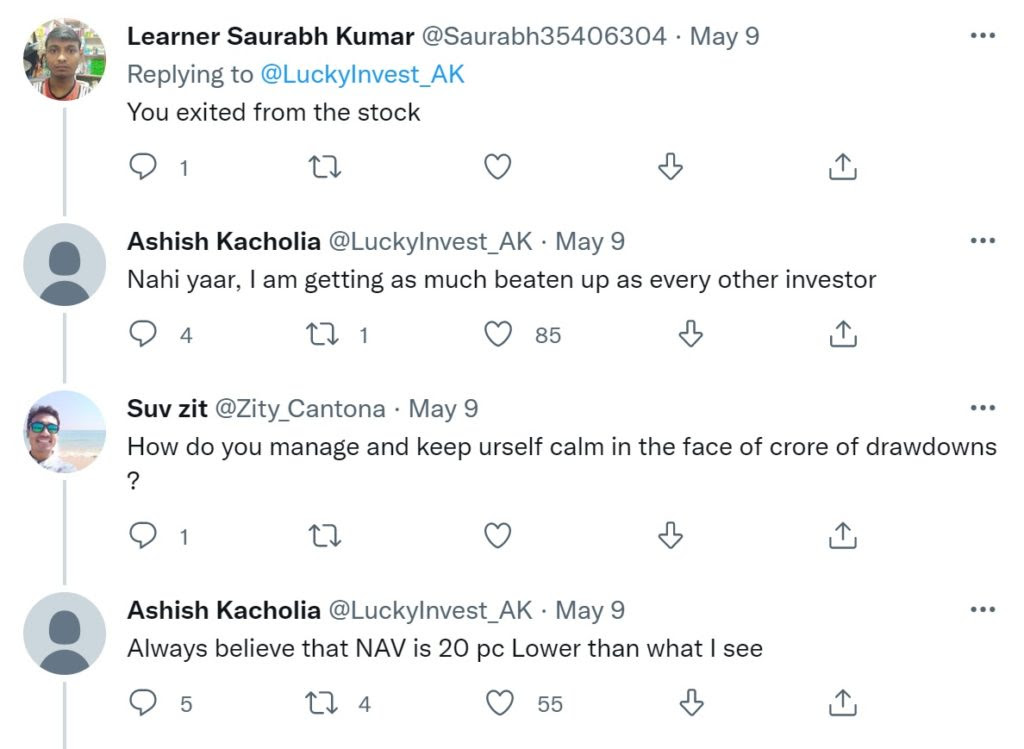

On how to handle down cycles and yet remain calm

Ashish sir is a great investor and he is candid enough to admit that his portfolio got beaten up in the recent market correction just like others.

What's important though is that in general he assumes his portfolio value to be 20% lower than what he sees on screen. This is a psychological manoeuvre.

He has been investing for 3 decades now and knows very well that corrections can happen anytime. Thus, when he assumes his PF value to be 20% lower, he probably doesn't feel as much pain as he would have felt otherwise.

His thoughts on SL (Stop loss) and Charts and Technicals

We haven't seen many value investors acknowledge the importance of looking at charts or technicals.

Here Ashish sir clearly acknowledges their importance along with fundamentals.

Frankly speaking, we too never looked at charts a few years back. However, after reading Mark Minervini books, we believe it's always good to look at charts and understand patterns. They could help you fine tune your buying and selling to a certain extent.

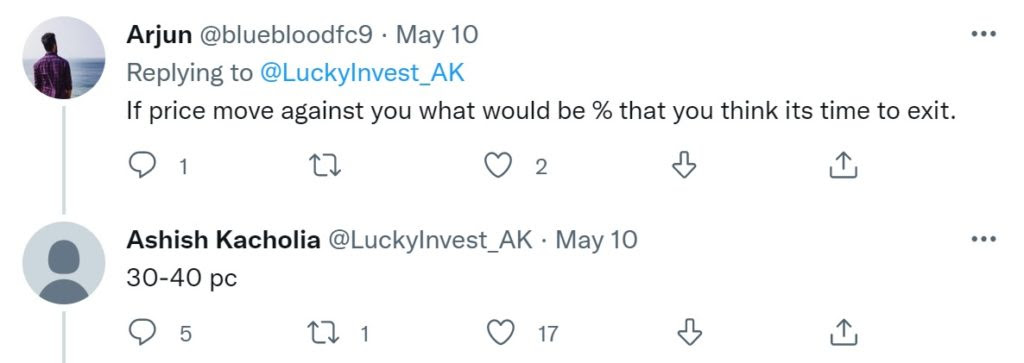

His thoughts on exit from stock

This one is quite interesting. While I am sure he doesn't use this strategy for all his stocks and probably buys more of ones where he thinks his hypothesis is intact and there's greater value after 30-40% correction.

Yet, even as value investors, there are times when you don't necessarily buy on all the dips and in fact sell a position after a 30-40% fall because you think either the thesis has changed or probably you don't really comprehend as to why the stock is falling so much and if there's something we don't know yet the markets know.

Knowing that we can't know it all and the fact that mistakes are bound to happen is something all investors should be aware of.

If you are looking for investment opportunities do check out our premium subscriptions. We have been helping our clients with our stock research for over a decade now.