Hello Sir,

Hope you are doing well.

In order to recommend the best stock ideas to our members for their portfolios, our team does extensive research, goes through all the corporate announcements on daily basis and screens for various potential investment opportunities.

Through [Stocks to watch] email, we would like to share with you interesting stock updates we come across while performing our research. Hope you find them useful for your own investments or to add the stocks to your watchlist:

Before that, if you are interested in investing in a Pharmaceutical company which has made an extremely complex and poisonous material from scratch (with a worldwide market potential of Rs 27,000 crore +) and is the only Indian maker, you can read about it here - LINK

I think you must be already aware, Promoters, being closest to the business, have most information about the nuances of the business. They are better informed of the expected performance of the company.

Thus, as Peter Lynch said, “If insiders are buying, then there can be only one reason that the company is likely to report improvement in performance in future”.

So, recently we came across 2 companies where the promoters have been gradually increasing their stake through market purchases and thought of sharing the names with you.

GNA Axles – On going through daily corporate announcements, we come across this company on a very regular basis regarding the purchase of shares by Promoters. While the quantities tend to be small, the promoters have been steadily increasing their stake.

What's interesting though is that recently there was also an announcement regarding the purchase of shares by an Independent Director.

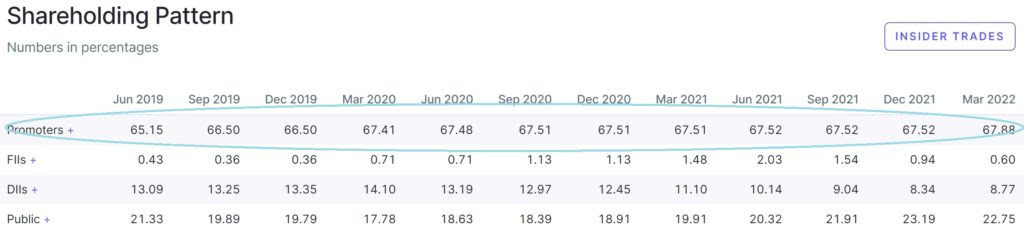

Source: Screener

Source: BSE India

We haven’t done detailed research on the company but it's always interesting when a stock is down 50% from its peak and the promoters are buying.

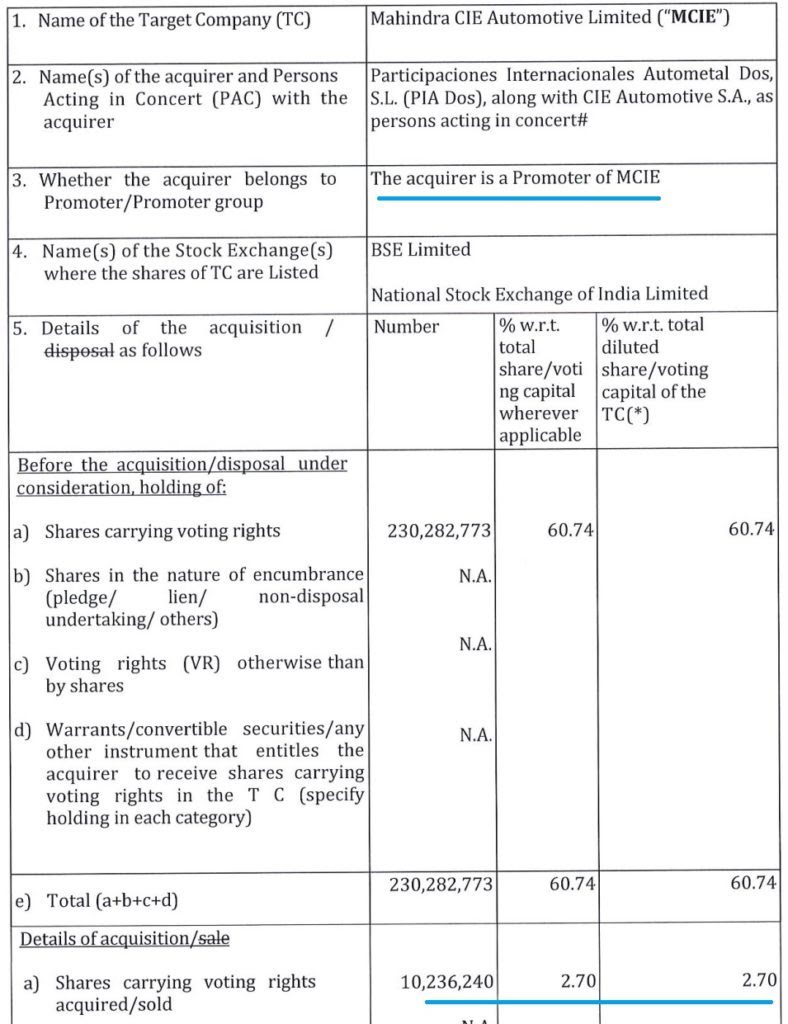

Mahindra CIE Automotive (MCIE) – On 13th May'22 we can across an announcement by MCIE regarding purchase of 10,236,240 shares of MCIE by one of its promoters from the open market. This wasn't a small purchase as it amounted to an additional 2.70% stake in the company.

Source: BSE India

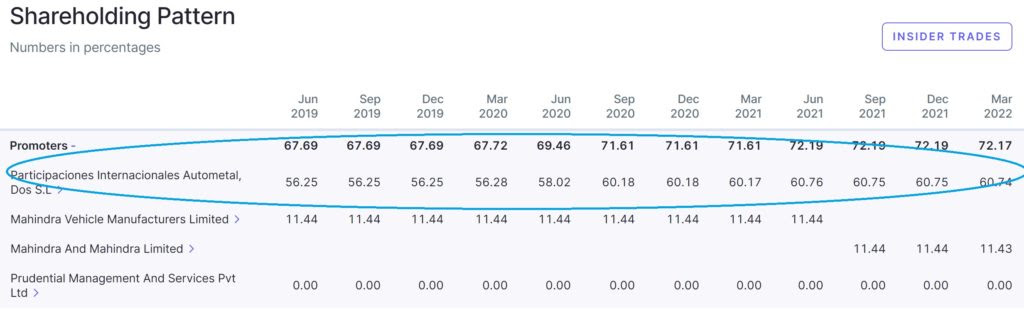

On checking further we found that promoters have been increasing stake in MCIE since Jun'19 or even prior to that.

Source: Screener

With the recent acquisition, promoter's stake in MCIE has increased to almost the max permissible limit of 75%.

Disclaimer: This is not a recommendation to buy/sell GNA Axles and Mahindra CIE Automotive. These updates are as announced by the companies on exchanges and only for the purpose of information and education.

If you are looking for investment opportunities do check out our premium subscriptions. We have been helping our clients with our stock research for over a decade now.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected]

Disclaimer: You can access it here - LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No