Hello Sir,

Hope you are doing well.

Everybody wishes to own stocks that could turn out to be potential multi-baggers. While there’s no fixed formula; however, as we analyse several stocks on a daily basis, we think there’s one pattern that does help in identifying stocks that could do well in future.

It’s important to know here that we are talking about medium to long term investment, i.e., 2-3 years +

Before that, if you are interested in investing in our Latest Stock Recommendation which could benefit from the massive growth expected in the CNG segment and still available around 10 times earnings, you can read about it here - LINK

So, in general, how does a stock deliver good returns?

It does so when its earnings expand or if the market perception of the stock improves, i.e., the valuation multiples expand.

If we get the combination of both, that’s when the returns tend to be extremely good

So, here’s 1 basic pattern we identified that can help you get good returns on stocks.

Look for companies with the following traits:

- – Rising sales year on year

- – Depressed margins and earnings at one point of time

- – Depressed valuations during periods of low margins

Let’s understand each point in some detail

Rising sales year on year: Here, we are looking for companies which have this uncanny ability of growing sales on sequential basis. Yes, there could be 1-2 odd years (in say 10 years history) where there might be a small drop in sales; however, the general trend should be moving upwards.

It’s not easy for companies to grow year after year and that’s why the above trait ensures that in general you are looking for growth companies.

Do check for details like if the company is expanding capacity, or adding new clients or new products as that would ensure continuity of growth.

Depressed margins and earnings at one point of time: Unless there’s a very high-quality business with great operating efficiency or very strong pricing power, the margins of the companies tend to be volatile.

While analysing the company, find out the average gross and operating margin range of the company.

Mean reversion does work in a lot of cases and therefore if the margins are significantly higher than average range, it’s important to determine if there’s a change in product mix or some significant improvement in operating efficiency which will sustain.

If not, then margins could revert to mean levels or drop further.

Here, we are in general more interested when the margins are lower than mean values or if there’s a drop in earnings despite the increase in sales.

The trick is to determine if the lower margins is a temporary phase and if they will revert back to mean or move up even higher; because if they do, there could be major growth in earnings from the depressed state.

Other way earnings could move higher is if the company is repaying debt which could result in substantially lower interest outgo.

Depressed valuations during periods of low margins: The way the markets are, more so in the case of small and mid-caps, once the earnings go down, the stocks tend to start correcting.

Also, despite higher sales, margins could remain depressed for 2-3 years and small-mid cap stocks tend to start trading at very low valuations in terms of both earnings and Price/book.

Thus, there are times when you get growth stocks (refer 1st point, i.e., sequential growth in sales) at depressed valuations on depressed earnings.

Conclusion: Assuming the analysis is correct and the company does deliver higher turnover with expansion in margins, there could be substantial growth in earnings and at the same time rerating in valuations to higher multiples.

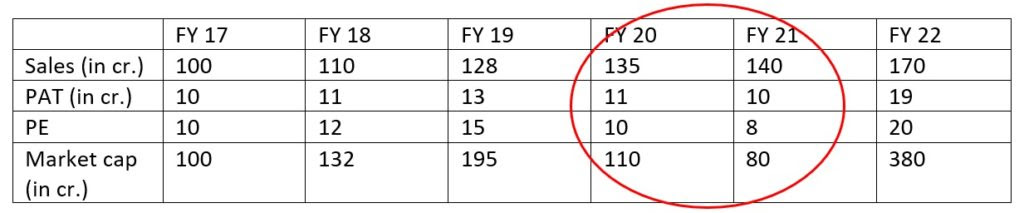

Here’s an example:

The encircled numbers are where things start getting interesting and one should dig deeper because while the sales did grow, the earnings declined because of contraction in margins and the valuation multiples declined further.

If you are looking for investment opportunities do check out our premium subscriptions. We have been helping our clients with our stock research for over a decade now.