Hello Sir,

Hope you are doing well.

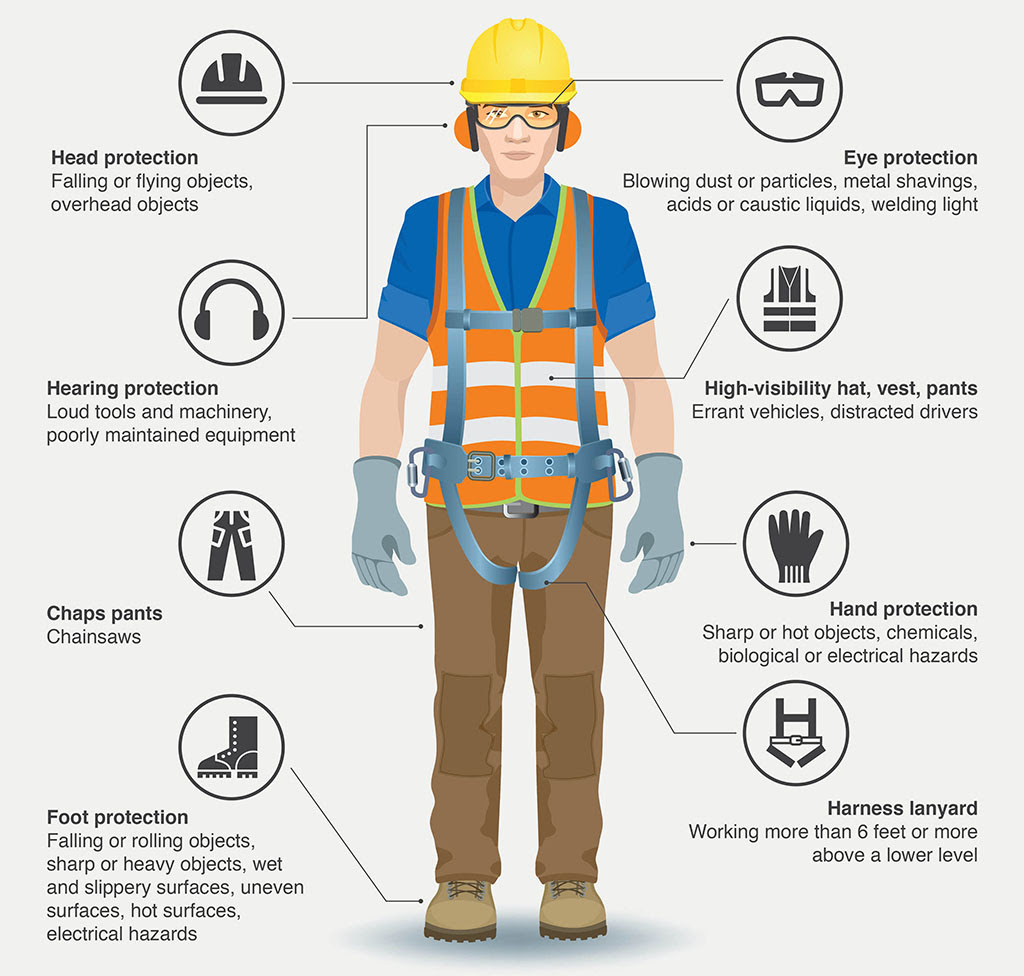

Do you know what PPE is?

It's personal protective equipment. The below image will make it clear.

In India, the seriousness and the penetration regarding such products is relatively low; while PPE usage is strictly followed in developed regions like Europe, US, etc.

In this mail, we have shared notes from the Q1 FY 23 con-call of Mallcom (India) which is one of the largest manufacturers and distributor of PPE in India. Hope you find the details useful for your own investments or to add the stock to your watch list:

[New Stock recommendation] - How often does one get a High growth stock, Market leader with almost 50% market share, Minimal debt at Cheap valuations?

Not often, right? We think we have found one and recommended recently to our Premium Members. For details - click HERE

Mallcom (India) - Notes from Q1 FY 23 concall

Basic details -

- Mallcom (India) is a four decade old company and one of the largest manufacturers and distributors of personal protective equipment (PPE) in India.

- It provides a one stop solution for manufacturing one of the widest range of head to toe PPE.

- The company is also one of the largest exporter of PPE from India exporting to 55 different countries across 6 continents.

- We have an expansive manufacturing footprint with 13 production facilities spread across India and over the years we have focused on backward integration wherever possible resulting into significant cost savings and gradual margin expansion.

- We do business in two main formats - One is in our own brand name which is mostly concentrated in the Indian subcontinent, Middle East, Africa. For rest of the world we are white label manufactures and in this category it is the imports or distributors of brand owners who are our customers.

- For our branded sales we sell through a network of dealers and distributors and the end users are any of the factories and SMEs who have people who require any kind of protection on the work floor.

- In India we have close to 70-75 dealers. So, if we get a lead or our dealers get a lead the item is sold through the dealer only.

Q1 FY 23 performance -

- Quarter 1 is historically the slowest quarter for the company and the sector and the company has posted very good growth on year-on-year basis.

- The income growth was on account of both price and volume growth.

- Our margins have also improved slightly due to better operational efficiency and deduction in operation cost which nullified increase in cost of raw material.

- Additionally, there was some normalcy in shipping cost which helped importers and exporters to pass on the cost to the consumers and therefore ease pressure on margins.

- Trade deals signed with UAE and Australia are also helping get more interest from these markets and upcoming deals with UK should also improve revenue potential from such countries.

Europe -

- Europe is 40-45% of overall sales.

- With respect to Europe slowdown there are definitely talks about it, but as such there has not been any firm ask from the customers that we need to slowdown the production or orders.

- Some countries are definitely suffering more than the others and there it is kind of getting difficult. One of the examples is Turkey where the currency has devalued extremely.

Ahmedabad CAPEX -

- Total investment which we have done in Ahmadabad is around 18 cr only and the project cost is 25 cr. So, yes we need to invest further for machinery so it would be part of the investment goals into setting up of additional lines of machinery.

- For this year we are targeting minimum 24 to 30 crore turnover from this unit and EBITDA margin remains around 15% and for next year it can be in the range of 30 to 40 cr.

Ghatakpukur plant -

- The first phase will start from July first week and then we will go phase by phase. So, we have also mentioned in the past that overall the project will take two to three years because it is a big land and we are going phase by phase because we are planning to migrate a lot of manufacturing and also build capacity and it will not be just one product line, there will be different product categories.

Domestic growth opportunity -

- Domestic will grow bigger because even if you combine some big importing countries the population itself is not so big as India.

- So, by just sheer number in India we have a lot of population to cater and because it is under penetrated, growth will come faster than the international markets and this is more of stock and sell. So, it is relatively easier to have growth here than in the international market where it is more of a gestation period for a long term partnership and not easy to change the supply chain.

How can company grow faster -

- If you are talking about the European economy a lot of these smaller countries which come under the category of under developed or semi developed, they have the privilege of 0% duty with them.

- So, for example, a lot of the business goes through Bangladesh because they have duty free exports to Europe. So, one, macro level we are expecting some policy decisions from government of both countries. So, there are talks of trade deal. So, hopefully that should be a big boost for all the Indian manufacturers.

- We have seen the starting effects of the trade deals with UAE and Australia that the interest is rising and we are also hoping that UK trade deal will finish by Diwali this year.

- Second is the raw material, lot of high end raw material has to be imported in India. Again there is a push to build technical textile to build a lot of chemicals here so that we can be self reliant.

- We are definitely feeling the sense that people are looking at India as an option and there is increasing interest for these kind of products.

- We all know how Sri Lanka is placed right now, Bangladesh also having some economic trouble and same thing with Pakistan. So, companies which want to mitigate their country risk are definitely looking at India, Indonesia, Vietnam as options.

Guidance -

- For FY 23 we should have a top line growth of around 10% to 12% minimum and the EBITDA margin should be maintained. So, last year we had around 360 so next year we are targeting around 410 crore.

(End)

Disclaimer: This is not a recommendation on the stock. These updates are as announced by the companies on exchanges and only for the purpose of information and education.

If you are looking for investment opportunities do check out our premium subscriptions. We have been helping our clients with our stock recommendations for over a decade now.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here - LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No