Hello Sir,

Hope you are doing well.

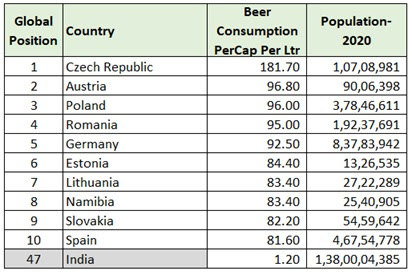

By the way, did you know this - The per capita Beer consumption in India in 2020 was only around 1.2 ltr while the same was 181.70 in Czech Republic.

Recently, we were studying a listed Beer company - Som Distilleries and therefore decided to look at some data on Beer consumption in India.

Below, we have shared our notes about the industry. Hope you find them useful for your own investments or to add the stocks to your watch list:

[New Special situation] - Latest special situation recommendation looks like a relatively low downside opportunity (around 20%) based on the combination of factors discussed in our report. The holding period for this one should be around 3-4 months

Regarding upside, 20-50% is possible from our recommended levels; however, nothing can be said with certainty in such cases and therefore what’s important to know is – how much can be the downside? For details - click HERE

Beer Industry

- Beer is an alcoholic beverage produced by mixing fermented yeast, hops, water and cereal grains

- The value of India beer market was ~ ₹ 371 bn in 2020 and expected to reach around ₹ 662 bn by 2026

- The global beer market size reached ~ US$ 640.2 bn in 2021

- Beer can broadly be classified into 2 subcategories:

- Strong beer with alcohol content of 6-8%

- Mild or lager beer with alcohol content of 4-6%

- It seems Indians prefer strong beer as the same accounts for 85% of the total volume sold in India

- Also, Super Premium segment within both the Strong and Mild beer categories has been growing faster than the overall beer industry

- Sales trends:

- ~30% of the sales are in the summer months

- 25% beer consumption happens out of home in places like bars, pubs, etc

- Some facts/figures

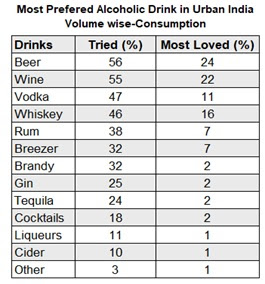

- Beer and wine seem to be the most tried and loved drinks among urban Indian consumers

- Per capita beer consumption in India in 2020 was 1.2 Ltr against 181.70 Ltr in Czech Republic

- Beer comprises about 12% of the total alcohol consumed in India

- Taxation on Beer

- Globally, beer is taxed on alcohol strength...in India, it is taxed on alcohol by volume

- Alcohol consumption in India

- Nearly 15 crore adults drink Alcohol in India

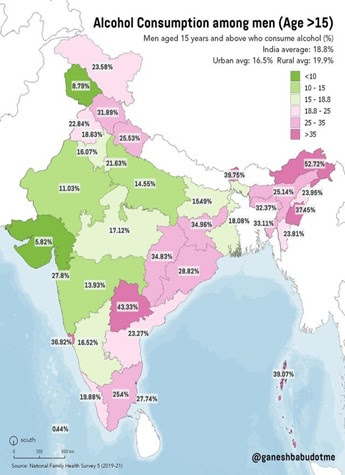

- Alcohol consumption among adult men is at 18.8%

- Alcohol consumption among adult women is at 1.3%

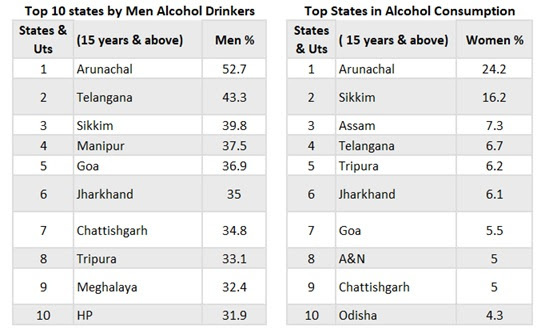

- Arunachal Pradesh has the highest proportion of both men (53%) and women (24%) who drink alcohol among all Indian states

(End)

If you are looking for investment opportunities do check out our premium subscriptions. We have been helping our clients with our stock research for over a decade now.

Disclaimer: This is not a recommendation to buy/sell any of the stocks mentioned above.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here - LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No