Hello Sir,

Hope you are doing well.

Did you know - Bath ware products industry has created immense wealth for investors.

In fact, one of our highest conviction and best recommendations for our Premium Members came from this space - Cera Sanitaryware which went up 11x before we closed it.

There are other major companies as well one can consider adding to watch list, like - Hindware Home Innovation, Kajaria Ceramics, Somany Ceramics, etc.

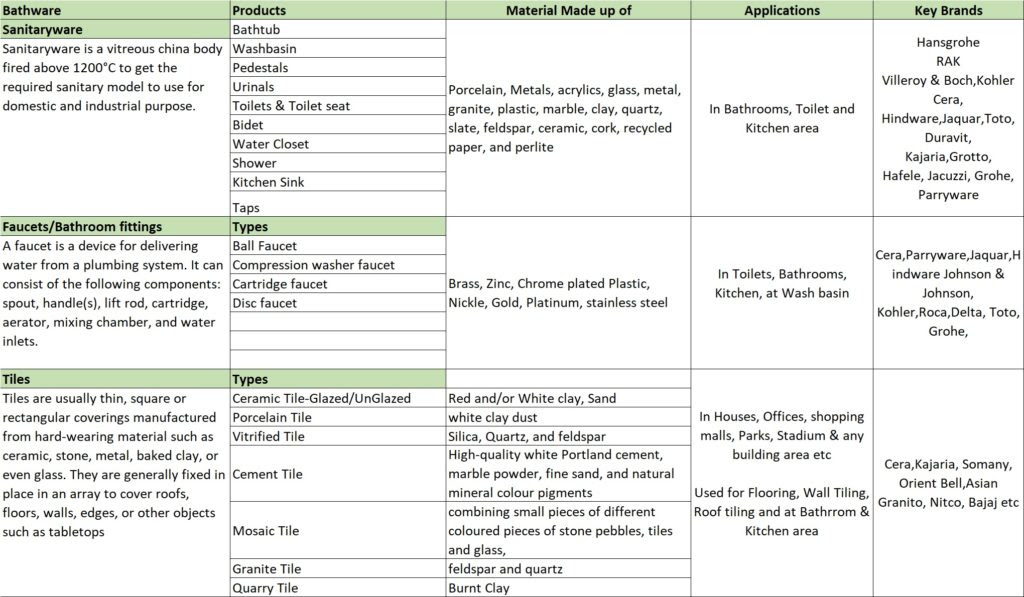

Let's just briefly look at some major data points w.r.t. key constituents of bath ware industry - sanitary ware, faucets, tiles.

[Before that]: Recently we released a New Stock Recommendation for our Premium Members. It's a leading Pharmaceutical company with global leadership in its product segment, net debt free and available at just around 11.5 times FY 23 (E) earnings. Can read about the company HERE

You too can get it along with other recommendations, by subscribing HERE

Bath ware industry

- Indian tiles, sanitary ware and bathroom fittings market reached a value of Rs 60,128 Crore in 2021

- IMARC Group expects the market to reach Rs 96,048 by 2027 at a CAGR of 8.39%

- Aside from the growth in real estate; rapid urbanization, government’s affordable housing program and demand for furnished, ready-to-move-in homes is contributing to growth of the above segments

- Sanitary ware

- India sanitary ware market was valued at Rs 8,480 Crores in 2020

- Expected to reach Rs 13,215 Crores by 2027, at a CAGR of 6.7%

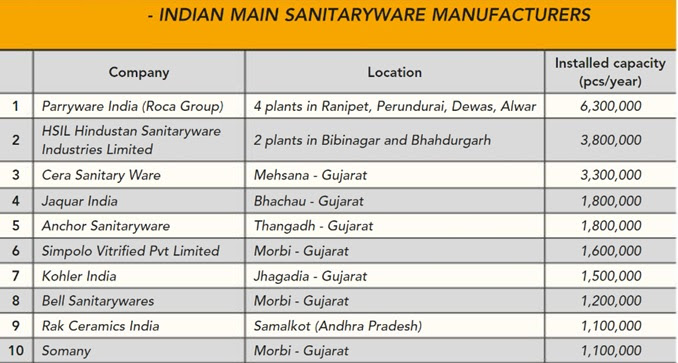

- India is the 2nd largest sanitary ware market in the world

- Indian sanitary ware market is fragmented into ceramic, Pressed metal, acrylic plastics & Perspex, and others based on materials

- 75% of the production comes from Gujarat

- Unorganized players cater mostly to the mass market with a focus on low-income strata group

- Organized players mainly serve the mid income, premium market and super-premium segment

- 2 most dynamic production areas in Gujarat are the ceramic clusters of Morbi and Thangadh

- India is among the top exporting countries, though its share in exports was only 6.3% in 2018

Source: Ceramic World Magazine - 2019

Source: Ceramic World Magazine - 2019

- Faucet ware

- The Indian faucet industry was estimated to be valued at Rs 11,000 crores in 2021

- Jaquar is the leading faucet ware brand in India

- Globally, commercial segment leads the market with 57% share in 2021

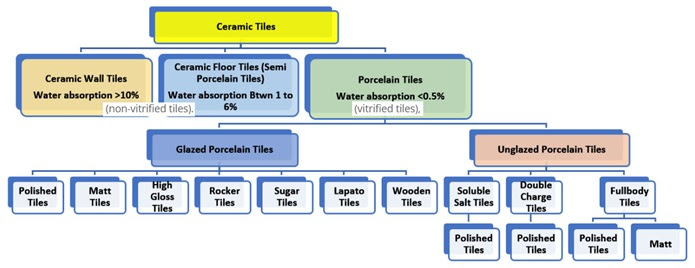

- Tiles

- Indian ceramic tiles market size was valued at Rs 29,762 crores in 2019 and is expected to reach Rs 57,157 crores by 2027

- Premium tiles market in the country is worth Rs 11,500 crores

- Organized: Unorganized ratio is around 40:60

- India is the 2nd largest producer of ceramic tiles across the globe

- In CY19, India maintained its position as the 2nd largest producer with increase in volumes from 1,145 million sqm to 1,266 million sqm

- In CY 19 domestic production grew by 4% to 780 mn sqm

Disclaimer: This is not a recommendation on any of the stocks mentioned above.

If you are looking for investment opportunities do check out our premium subscriptions. We have been helping our clients with our stock recommendations for over a decade now.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here - LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No