Hello Sir,

Hope you are doing well.

We have always enjoyed digging up really small companies in the market cap range of Rs 20 crore to Rs 500 crore. Earlier, we could even recommend a Rs 100 crore market cap stock to our Premium Members; however, now it's almost impossible considering liquidity issues.

Nevertheless, it's always good to read about such companies and an individual investor can always look for potential investment opportunities

So, for sometime, Titan Biotech has been under our radar because of its extremely good financial performance history. In FY 21 and FY 22 it did get a boost to its earnings from the sale of Covid-19 related products to diagnostic labs; however Q1 FY 23 included minuscule contribution from the same. Going forward it will be interesting to see how the company performs.

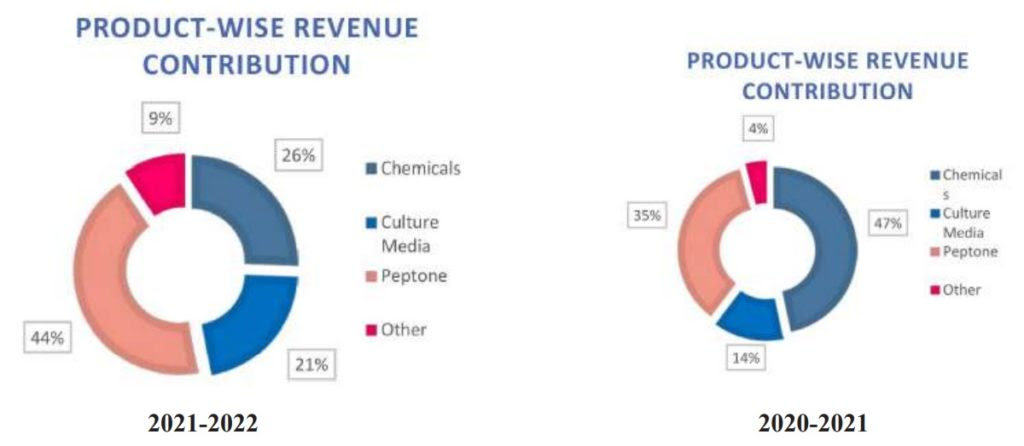

Source: Titan Biotech AR 22

Below, we have shared our notes (unedited) from the Annual Report 2022 and AGM 2022 of the company. Hope you find the details useful in your search of investment opportunities

[Before that]: Recently we released a New Stock Recommendation for our Premium Members. It's a leading Pharmaceutical company with global leadership in its product segment, net debt free and available at just around 11.5 times FY 23 (E) earnings. Can read about the company HERE

You too can get it along with other recommendations, by subscribing HERE

Titan Biotech - Notes from AR 2022 and AGM 2022

- Titan biotech limited is one of the leading manufacturers & exporters of the biological products used in the field of pharmaceutical, nutraceutical, food & beverages, biotechnology & fermentation, cosmetic, veterinary & animal feed, agriculture industries, microbiology culture media & plant tissue culture media etc.

- The Company is engaged in manufacture and export of Prepared Culture Media, Biological Goods, Plant Growth Promoters etc. The Company is manufacturing Peptones, Biological Extracts, Culture Media and Chemicals.

- The Company has developed its own technology for achieving high yield in Biological Peptones and Extract and Dehydrated Culture Media with special emphasis on process improvement.

Source: Titan Biotech AR 22

- Total sales in FY 22 included Rs 10.82 crore from the Covid related products and more particularly VTM kits. Covid related sales was Rs 34.91 crore in FY 21.

- Company's products used as ingredients in the healthcare, food, pharma, Diagnostics and animal feed Industries.

- Peptone is a wide term which includes different kinds of peptides used in different industries for fermentation, Health, Nutrition, animal feed and for making different kind of culture media for growth of microorganisms.

- The Peptones are partly used by the company for making the culture media in-house and partly for direct sales to the industries.

- The existing capacity of the company is approximately 3,500 tons a year and likely to go to 5,000 tons with the additional capex. The estimated capex can be more than Rs 15 crore over the next few years.

- The status of M/s Peptech Biosciences Limited has changed from subsidiary to associate Company from w.e.f 16th Feb 2022. Extent of holding in Peptech Biosciences - 36.87%

(End)

Disclaimer: This is not a recommendation to buy/sell Titan Biotech. These notes are as announced by the companies on exchanges and only for the purpose of information and education.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here - LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No