Hello Sir,

Hope you are doing well.

One of my favorite Peter Lynch quotes is - The person that turns over the most rocks wins the game.

This is so true for investing, especially if you invest in small-mid cap stocks.

There are so many opportunities around; however one does have to keep running various screens and scout for potential stock investment opportunities.

Recently, we came across Excel Industries which is a major agrochemical intermediate maker. The numbers looked decent and we decided to dig deeper. Below, we have shared notes from the Apr'22 Crisil rating report on the company.

Hope you find the details useful in your search of investment opportunities.

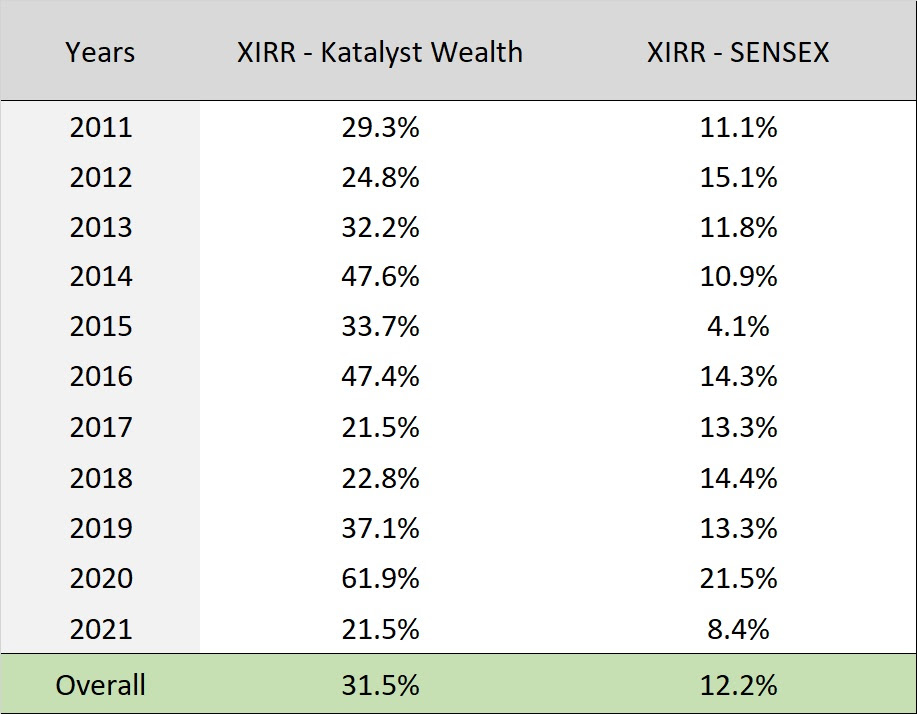

We have been running stock recommendation services since 2011. For the sake of transparency (good, bad, everything), we have put up the entire list of recommendations (as latest as Sep'22) for everyone to see @ - Click HERE

Excel Industries - Notes from Apr'22 Crisil Rating report

- Incorporated as a private limited company in 1960, Excel was reconstituted as a public limited company in 1971. Following the de-merger of its crop protection business from its former associate, Excel Crop Care Ltd, Excel began manufacturing chemical intermediaries used in agrochemicals, commodity polymers, engineering polymers, soaps and detergents, water-treatment chemicals, and biocides.

- The company started as an agrochemical intermediate manufacturer and has expanded its product portfolio over the years by leveraging its process chemistry capabilities in other segments, such as performance and specialty chemicals, polymer additives, and pharma inputs.

- Performance and specialty chemicals cater to diverse segments, such as soaps and detergents, water treatment, and paints and coating. The company has also entered the polymer additives and pharmaceutical inputs segments to diversify revenue and reduce dependence on agrochemicals.

- DETC (di-ethyl thiophosphoryl chloride) had about 36% share in overall revenue in the nine months ending December 2021, which exposes the company to product concentration risk.

- DETC finds application in making chlorpyrifos (CPP) and Profenofos, which are agrochemical technical used in making pesticides. Out of the two, use of CPP is under review by the Central Insecticides Board.

- However, currently only ~50% of DETC sales are used for CPP, and this contribution is on a declining trend, which partially offsets the product concentration risk.

- Further, contribution from non-agrochemicals segments which is on a rising trend,(currently at 45% of revenues in 9M FY 22 vis-a-vis 34% of overall sales in fiscal 2018) is expected to reduce the concentration risk going forward.

- Planned capacity expansions have been completed in Q4 FY 22, which will also help drive the growth going forward. In an effort to reduce dependence on DETC, EIL has been diversifying into other business segments focused towards specialty chemicals, including pharma intermediates and polymers.

- CRISIL Ratings also notes that risks associated with any ban on chlorpyrifos, a key agrochemical produced using DETC, will remain key monitorables over the medium term given its considerable contribution to Excel’s revenue.

- CRISIL Ratings believes that any decision to ban chlorpyrifos is likely to be implemented in a phased manner considering the wide usage of the chemical both in the domestic as well as global markets.

- Further, EIL has also been reducing its DETC exposure for use of chlorpyrifos by focusing on DETC sales to non-chlorpyrifos segments and have also diversified into specialty and environmental product segments.

- Company had cash surplus of Rs 75 crore as of 30 Sep, 2021. Further, annual cash accruals are expected to be in the range of Rs 180-200 crore per fiscal in fiscals 2022 to 2024, against negligible term debt obligation.

(End)

Disclaimer: This is not a recommendation to buy/sell Excel Industries. These notes are as announced by the companies on exchanges and only for the purpose of information and education.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here - LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No