Hello Sir,

Hope you are doing well.

As they say, it takes a prepared mind to capitalize on the opportunities and we therefore keep searching for new Investment opportunities for our Premium Members.

Recently, Bharat Rasayan came to our notice. The stock has done extremely over the last 10 years and has created huge wealth for its shareholders by compounding at 50% +.

The numbers looked decent and we decided to dig deeper. Below, we have shared notes from the Dec'21 and May'22 CARE credit rating reports of the company.

Hope you find the details useful in your search of investment opportunities.

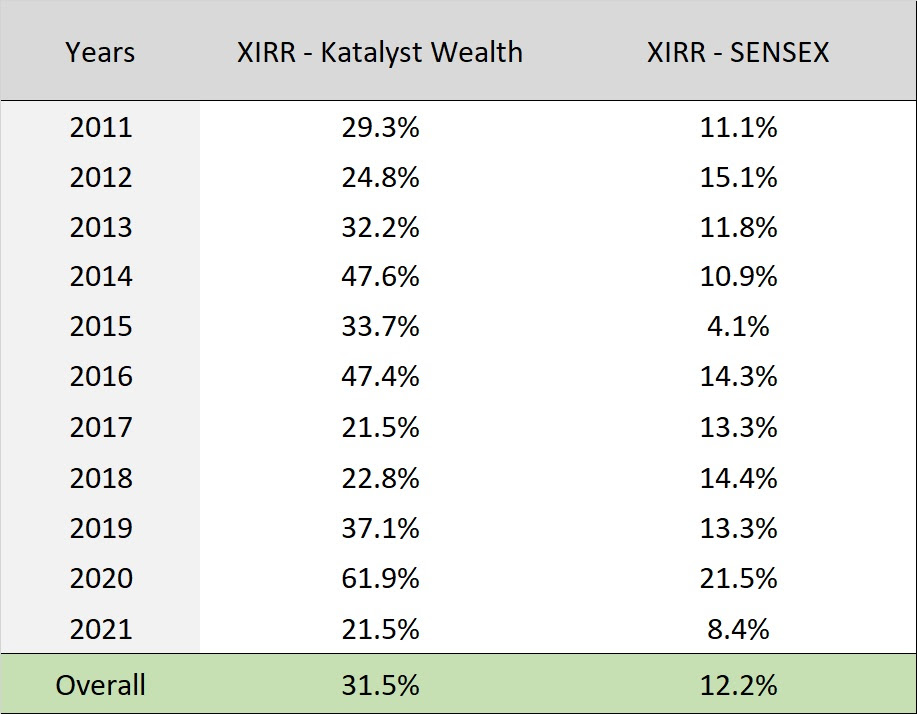

We have been running stock recommendation services since 2011. For the sake of transparency (good, bad, everything), we have put up the entire list of recommendations (as latest as Sep'22) for everyone to see @ - Click HERE

Bharat Rasayan (BRL) - Notes from CARE credit rating reports

- Basic business details:

- BRL is one of the leading manufacturers of technical-grade pesticides in India

- BRL is majorly in the manufacturing of technical. It also manufactures intermediates, which is the raw material for manufacturing technical grades

- BRL was incorporated in May 1989 by its current Chairman and Managing Director, SN Gupta. BRL is the flagship company of the Bharat group, which also comprises BR Agrotech Ltd (BRAL)

- Capacity:

- BRL commenced its operations by setting up a manufacturing plant with an installed capacity of 5,000 MTPA at Mokhra, Haryana, in 1989 and later increased its production capacity in 2012 by setting up a plant with an installed capacity of 12,000 MTPA at Dahej, Gujarat

- Product portfolio:

- BRL product portfolio comprises of wide range of pesticides including insecticides, fungicides, herbicides, weedicides, intermediates and plant growth regulator to cater to all the pest problems of major crops grown in India including paddy, cotton, soybean, sugarcane, wheat, groundnut, maize, cumin, all vegetables and horticulture crops including their formulations & intermediates

- BRL has a market leadership in many technical products including Lambda Cyhalothrin Technical, Metaphenoxy Benzaldehyde, Metribuzine Technical, Thiamethoxam (Insecticides) and Fipronil (Insecticides) among others for which BRL is a preferred supplier in the international markets

- Exports:

- BRL has around 107 international registrations and has been exporting its products (technical grade, intermediates and formulations) to more than 60 countries across the globe and is a preferred supplier for several MNCs for their global demand of several molecules

- Domestic sales account for around 63.23% of total sales of BRL in FY 21 (51.52% in FY20) and 60.40% in H1 FY 22 (H1 FY 21: 60.64%)

- BRL has a large institutional customer base in the domestic market as well as in the international market with long standing relationship and low client concentration risk. In the international market, the group has strong presence in East Asia, South America, Europe and Middle East

- Few large customers like Syngenta and Sumitomo contribute to both the domestic and export pie of BRL

- Product Concentration:

- There is a product concentration risk as the top 10 products of BRL accounts for around ~70% of total sales of BRL in FY 21 (PY: 71%) and around 62% of total sales of BRL in H1 FY 22

- Seasonality:

- Around 60% sales for the whole year is done on the first half of the year for the BRL and most of the sales are done on a credit of around 90 days-120 days to its customers

- Foreign Currency exchange:

- BRL is exposed to foreign currency fluctuation risk as the total export sales constituted 37% of total sales of the company in FY 21.

- BRL is also importing raw materials for manufacturing of technical grade pesticides. The mix of Domestic & imported raw material is 45:55 and 70% of the imported raw material is from China (the mix has reduced from 80% from China in FY 18 to 70% in FY 20 & FY 21)

- Fire incident:

- BRL has intimated about the occurrence of a fire accident in one of its four blocks at its Dahej plant (Bharuch district, Gujarat; 12,000 MTPA) on May 17, 2022

- The estimated loss of production or the financial impact is, at present, not shared by the management as the process of ascertaining the same is underway. However, the plant and machinery, including the inventory and production loss, are completely insured

Recently, we released our new stock recommendation for our Premium Members. It's a leading Pharmaceutical company with global leadership in its product segment, net debt free and available at very reasonable valuations. Can read about the company HERE

Disclaimer: This is not a recommendation to buy/sell Bharat Rasayan. These notes are as announced by the companies on exchanges and only for the purpose of information and education.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here - LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No