Dear Members,

We have released 9th Nov’22: Special situation opportunity on the proposed buy-back of shares of Triveni Engineering & Industries (NSE Code – TRIVENI). The same has also been produced below. For details and other updates, please log into the website at the following link – http://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 9th Nov’22

CMP – 278.90 (BSE); 278.80 (NSE)

Rating – Positive – 3% weightage; this is not an investment advice (refer rating interpretation at the end)

TRIVENI’s buy-back offer

On 5th Nov’22, the Board of Directors of Triveni approved a Buy-back of 2,28,57,142 shares at a price of Rs 350/- per share from all the existing shareholders of the Company as on the record date, on a proportionate basis through “Tender Offer” route.

The buy-back is subject to the approval of the shareholders of the company and therefore the ex-date for the buy-back offer will be decided at a later date.

Rationale behind this opportunity

It is important to note here that Buy-Back through tender offer route is similar to Open Offer in many aspects as against Buy-back through open market purchases.

In buy-back through tender offer route all the shareholders can participate (including the promoters) and the buy-back is on proportionate basis from all the shareholders of the company.

Considering Triveni has 24.17 crore shares listed and the buy-back is only for 2.28 crore shares, theoretically only 9 share out of 100 shares (8% acceptance ratio) should get accepted at 350/- per share if all the shareholders participate in the tender offer and 91 shares will be returned back.

However, there are a few important regulations regarding buy-back through tender offer route which increases the acceptance ratio in the case of Triveni. They are:

- 15% of the number of Equity Shares which the Company proposes to buyback or number of Equity Shares entitled as per the shareholding of small shareholders, whichever is higher, shall be reserved for the small shareholders as part of this Buyback.

- Small Shareholder is a shareholder who holds equity shares having market value, on the basis of closing price on recognized exchanges as on Record Date of buy-back, of not more than Rs 200,000 (2 lakhs).

Based on the above regulations, out of 2,28,57,142 shares, 34,28,571 shares will be reserved for the small shareholders.

The small shareholder will be the one with less than 714 shares (based on 9th Nov’22 prices). Actual quantity will be known based on the stock price on the record date.

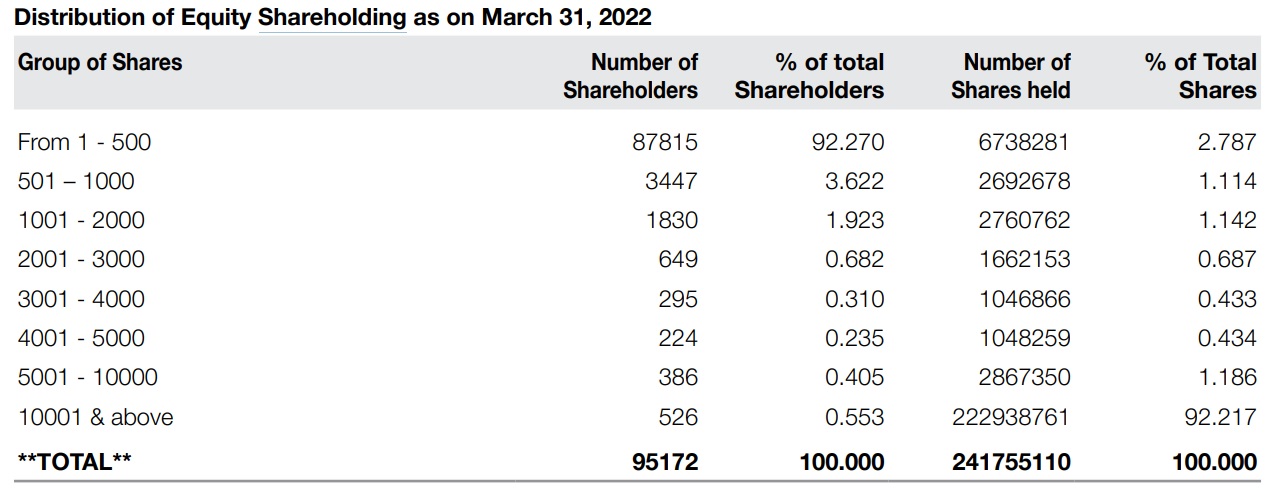

Shareholding distribution

Source: Triveni’s AR 22

If we look at the shareholding distribution of the company as on 31st Mar’22, there were around 94 lakh shares with the shareholders holding shares in the range of 1-1000.

The company came out with the tender based buy-back offers in 2019 and 2020 as well. During those times, the stock price was around 50-80 and the number of the shares in the small shareholder category were found in the range of 1.4-1.45 crore. Out of the same 41-45 lakh shares got tendered in the buy-back offer.

Though the shareholding distribution as per AR 22 suggests around 94 lakh shares in the small shareholder category, assuming the number increases to 1.45 crore by the record date and the tendering increases to 50%, the acceptance ratio in the small shareholder category will work out to around 47%.

Some Estimates

Let’s work with some estimates:

Cost of 100 shares – 280 * 100 = 28,000

Cost of residual shares based on various acceptance scenarios, i.e., the number of shares that get accepted at Rs 350.

| Acceptance Ratio | Cost of Residual Shares |

| 30% | 250.00 |

| 40% | 233.33 |

| 50% | 210.00 |

| 60% | 175.00 |

We believe 40-60% acceptance is quite probable; anything, above that will be bonus. So, in the case of 40% acceptance, one starts losing money only when the stock starts falling below 233 odd levels.

Risks/concerns

The actual ratio will be known only once the entire process is over and in case of lower acceptance ratio our returns will diminish.

The time line for this opportunity is around 3-4 months and therefore in the interim if the market corrects in a major way the exit price for the unaccepted shares will get impacted.

Buy-backs are widely tracked these days and therefore our assumption of minimum 40-60% acceptance may not hold true.

Disclosure: I do not have any holding in Triveni Engineering & Industries.

Best Regards,

Ekansh Mittal

Research Analyst

http://www.katalystwealth.com

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to investors on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No