Hello Sir,

Hope you are doing well.

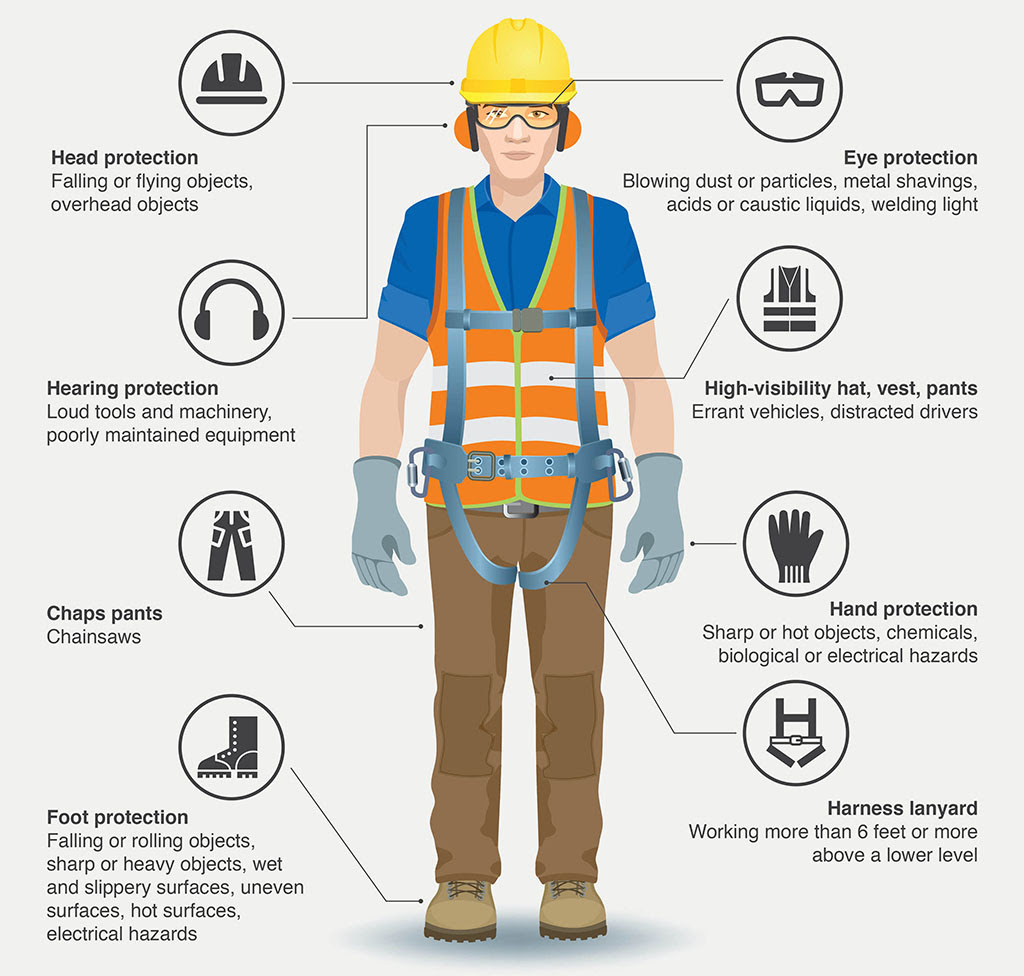

Do you know what PPE is?

It's personal protective equipment. The below image will make it clear.

In India, the seriousness and the penetration regarding such products is relatively low; while PPE usage is strictly followed in developed regions like Europe, US, etc.

In this mail, we have shared notes from the Nov'22 presentation of Mallcom (India) which is one of the largest manufacturers and distributor of PPE in India. It also does private label manufacturing for large global customers.

Recently, we released our New Stock Recommendation for Premium Members

It's a food processing company, virtually debt free, compounded profits at 20% + consistently, maintained returned ratios like ROE and ROCE at 20% +, doubled its market share in exports in its segment in the last 6-7 years and yet available at less than 7 times Pre-tax earnings.

You too can get it along with other recommendations, by subscribing HERE

Mallcom India - Notes from Nov'22 presentation

- Founded in 1983 by Mr. Ajay Mall as a small leather gloves manufacturer headquartered out of Kolkata, India

- Grown to become one of the largest manufacturers and distributors of Personal Protective Equipment (PPE) products in India, with over 90% of orders coming from repeat customers

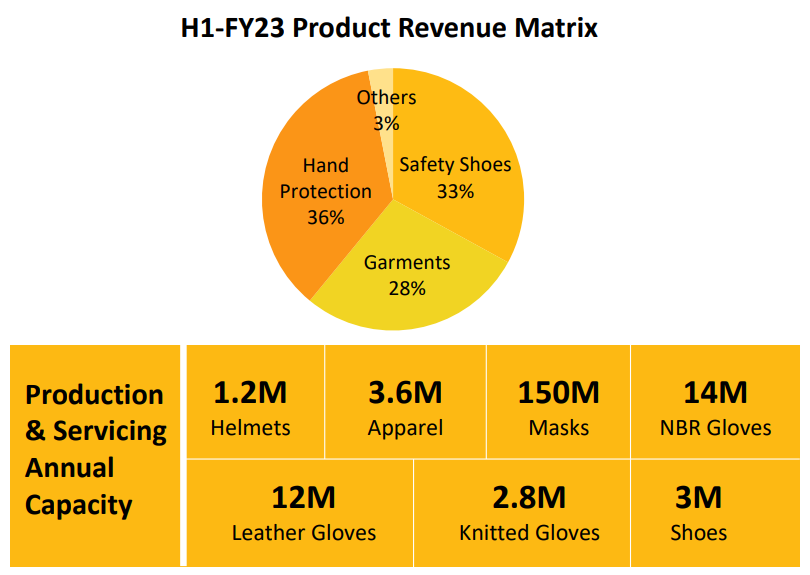

- Provides a one-stop solution for manufacturing one of the widest range of head-to-toe PPE products from helmets, eye-wear, ear protection, face masks, safety garments, gloves, to shoes, and many more

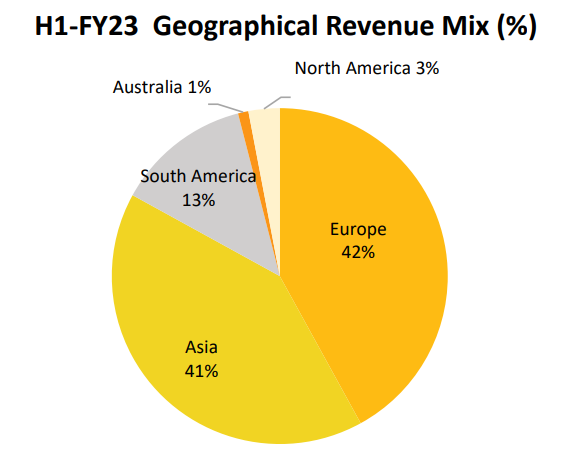

- One of the largest exporters of PPE products from India exporting to 55+ countries across 6 continents

- Expansive manufacturing footprint with 13 production facilities spread across India

- Company has focused on backward integration wherever possible resulting into significant cost savings and gradual margin expansions

- One of the few companies to have an indigenous expertise with various raw materials such as textile, leather, rubber, and plastic

Source: Mallcom India Nov'22 presentation

- Q2/H1 FY 23 operational highlights

- Company achieved its highest ever quarterly consolidated turnover & profit before tax in Q2-FY 23

- The improvement in EBITDA margin versus Q1 was mainly on account of raw material and administrative costs going down

- Turnover ratio between Branded Sales Vs. Private Label sales improved YOY from 34:66 to 37:63 in H1-FY 23, with branded Sales registering a growth of 34.65% YOY vis-a-vis 19.23% YOY growth for Private Label sales in H1-FY 23

- Relatively lower consolidated EBITDA margin of 13.80% in H1-FY 23 has been also due to higher operational costs for the subsidiaries namely "Mallcom Safety Private Limited" & "Best Safety Private Limited" both SEZ units, where we expect to ramp up the productivity and operations further in H2-FY 23

- During the Quarter, the Ghatakpur (Kolkata) Unit, Phase - 1 for Safety Garments was made operational and with the manufacturing facility further being ramped up we expect additional contributions from the unit in H2-FY 23

(End)

Disclaimer: This is not a recommendation to buy/sell Mallcom India. These notes are as announced by the companies on exchanges and only for the purpose of information and education.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here - LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No