Hello Sir,

Hope you are doing well.

Private diagnostic players minted great sums of money during the covid-19 scare.

However, there's one listed company which follows a slightly different business model than others in the diagnostics space. The company is Krsnaa Diagnostics and is one of the largest players operating on the PPP (Public Private Partnership) model.

We decided to understand the working of the PPP model to understand the company better.

Hope you find the insights useful for your own investments or to add the stock to your watch list.

Before that, recently, we released our New Stock Recommendation for Alpha and Alpha + Members

It's a food processing company, virtually debt free, compounded profits at 20% + consistently, maintained returned ratios like ROE and ROCE at 20% +, doubled its market share in exports in its segment in the last 6-7 years and yet available at less than 7 times Pre-tax earnings.

You can get it along with other recommendations, by subscribing HERE

PPP model in Diagnostics industry

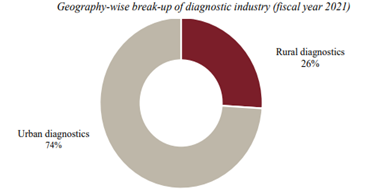

The diagnostic market in India is around Rs 75,000 crore divided into two parts — private and government.

Out of this, pathology and radiology in private sector is about Rs 45,000 crore (60%) and government sector is about Rs 27,000- 28,000 crore (40%).

PPPs are fast becoming a preferred mode of delivery across various geographies of the country with main focus on rural, remote areas and semi urban areas.

What is PPP (Public Private Partnership) Model in Indian Diagnostics Industry?

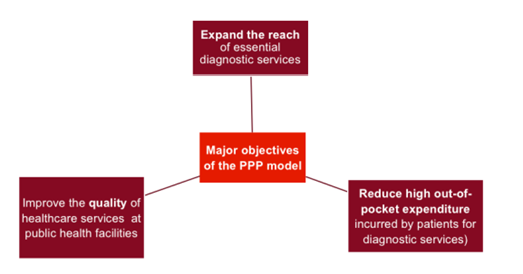

In PPP Model, Central & State Governments invite the private established & qualified diagnostic players to perform the diagnostic services (pathology & radiology) under tender based pre-approved long-term contract of 5-10 Years.

The government contributions can vary from providing land/space, upfront capital infusion, basic facilities and giving financial concessions on the capital infused by the private players.

Finer points of the PPP model:

Center/State governments float the tenders for providing affordable diagnostic services in rural and remote areas especially for economically backward people.

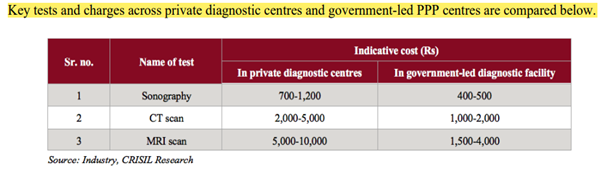

The private diagnostic players submit the bids for lower testing rates which are generally 50-60% lower than standard private facilities. PPP model provides for a yearly 3-7% price escalation in the contracts.

The private player performs free diagnostic services for those who are covered under Central or state govt health insurance scheme, having BPL Card, etc. The diagnostic charges are reimbursed by the Central Govt, State govt or National Health Mission scheme.

For others, the govt approved rates are applicable and collected on cash or digital basis.

The land or the space for setting up the diagnostic services are generally provided free of cost by the govt.

How are private players able to offer such low testing rates?

Large addressable customer base from Day 1 of operations, as majority of the population is treated at government hospitals.

Zero doctor referrals fees for patient acquisition and limited expenses incurred in marketing and promotion.

Zero rentals to government hospitals for providing the space and availability of subsidized utility and electricity rates.

(End)

Disclaimer: This is not a recommendation to buy/sell Krsnaa Diagnostics. These notes are as announced by the companies on exchanges and only for the purpose of information and education.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here - LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No