Hello Sir,

Hope you are doing well.

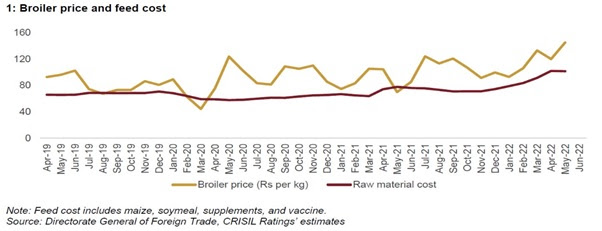

Did you know - Last year was bad for poultry industry stocks because of exorbitant rise in feed prices.

Stocks are down 40% + from the peak.

There are a handful of poultry industry related listed stocks with the major one being Venky's India and now might be a good time to understand the industry a bit.

[Before that]: Recently we released a New Stock Recommendation for our Premium Members. It's a leading Pharmaceutical company with global leadership in its product segment, net debt free and available at just around 11.5 times FY 23 (E) earnings. Can read about the company HERE

You too can get it along with other recommendations, by subscribing HERE

Poultry Industry

- Poultry refers to rearing, hatching, breeding, and processing domesticated birds or broilers

- India poultry market size reached a value of Rs 1,74,990 Crores in 2021

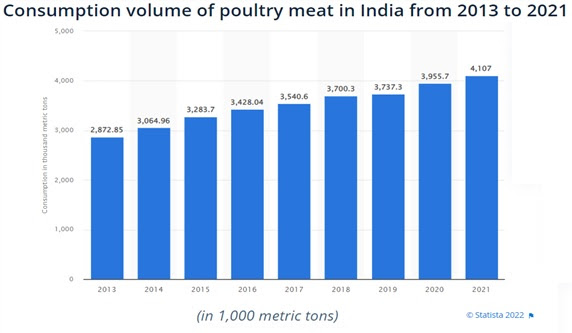

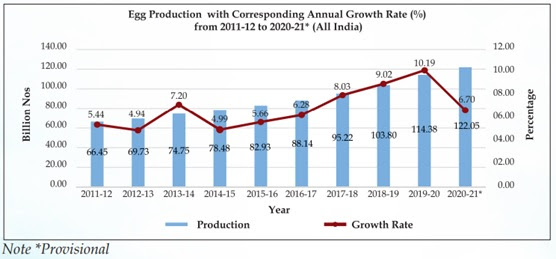

- Consumption growth in meat and eggs was 5% and 4% at 4.3 lakh tonne and 120 billion in FY 22

- As per ET, revenue of the Indian poultry industry is seen rising over 30% to Rs 2,50,000 crore in FY 23

- The demand continues to be robust because of rising population, higher per-capita consumption of meat, and increasing preference for protein-rich diet

- The price of broiler meat is expected to average Rs 135-140 per kg this fiscal, a 30% year-on-year increase from the average price of Rs 104 per kg last fiscal. This is owning to ~35% increase in poultry feed prices

- Classification (on the basis of segments)

- Broiler (Used for only meat purpose)

- Eggs

- 5 major players (Suguna in Coimbatore, Venky’s in Pune, CP, Sneha, and Shalimar in Kolkata) constitute ~60 % of the Indian broiler meat market

- Sale of poultry products in various forms

- Sale of 1-day old broiler chicks which are further used only for meat purpose

- Sale of 1-day old layer chicks which are further used only for table eggs

- Sale of grown-up live broiler birds/chicken (for meat purpose)

- Sale of grown-up live layer birds/chicken (for egg purpose)

- Sale of eggs

- Sale of raw, processed and completely cooked chicken

- Sale of Poultry Feed & supplements

- Eggs come from hens raised specifically to lay eggs, but chickens that are raised for meat are called “broilers”

- These are typically white, and are bred specifically for optimal health and size

- Broilers in India are usually reared for 35-45 days to a wgt of 1.8-2.2 kg

- How much poultry meat does Indian consume? As per Economic Survey 2021-22, India ranks third in production of eggs and eighth in meat production in the world

- Egg production and growth rate

- Price trend of Broiler realization vs Feed cost? The price of broiler meat is expected to average Rs 135-140 per kg in FY 23, a 30% increase from the average price of Rs 104 per kg last fiscal FY 22

- Feed contributes to 80% of the total expenses that are there in the production of an egg and broiler

- Major ingredients in poultry feed are - Maize, Bajra, Jowar, Soybean Meal, Fish Meal, Meat & Bone Meal, Shells, Marble Powder, Marble Chips, etc

(End)

Disclaimer: This is not a recommendation on any of the stocks mentioned above.

If you are looking for investment opportunities do check out our premium subscriptions. We have been helping our clients with our stock recommendations for over a decade now.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here - LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No