Hello Sir,

Hope you are doing well.

You must have surely heard of terms like BS-IV and BS-VI, but have you heard of terms like RDE, TREM-V?

Recently, I was going through the details of Sharda Motor Industries which commands 30% market share in exhaust systems in passenger vehicles/LCV segment.

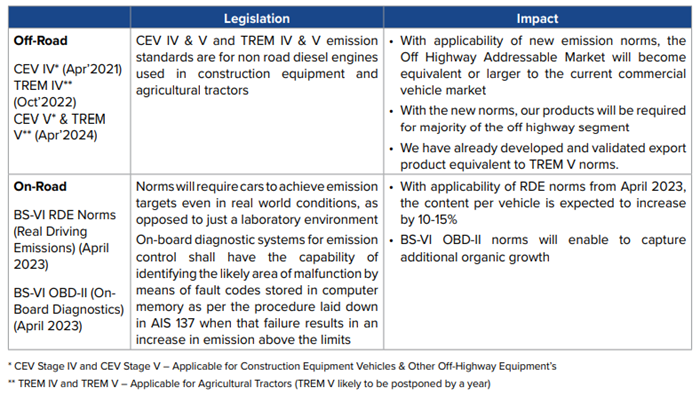

From the con-call, I learnt about TREM V emissions standards and RDE norms which will open up opportunities for the company in the Tractors, PV and the CV segments.

Below, we have shared our notes from the Q3 FY 23 con-call transcript of Sharda Motor. Hope you find them useful for your own investments or to add the stock to your watch list:

Before that, some good news for medium-long term investors

Individual investor participation in shares dropped to 34 months low in Jan'23. Google trends - Multibagger chart also indicating low investor interest

To know why this is good news if your investment horizon is 3-4 years - Click HERE

Sharda Motor - Notes from Q3 FY 23 con-call

- General Points

- We have two competitors, an American and a French Company. These are the main competitors. There is no significant domestic player in our product line (exhaust systems in emission)

- Our market share is different across different segments, but a rough guesstimate could be 30% (PV/LCV)

- In our standalone number it is PV and LCV. So, as a revenue split about 90% comes from exhaust, 6% from suspension and others is about 4% and when we look deeper into the exhaust numbers, roughly 45%-50% is PV and 50%-55% is CV which is LCV

- The M&HCV segment does not come in our standalone results that comes in the JV results

- Most of the OEMs are preparing for all powertrain scenario and one of them is CNG and we are actively working with almost all of our customers for the CNG platforms also and it is likely to be neutral when it comes to switch over to CNG if it happens

- EV segment

- In the case of the lithium-ion battery business we are simply assembling the batteries into packs right now. It is in pre-revenue stage and we have a joint venture along with Kinetic Green

- As per the joint venture agreement we will begin the activity of simply assembling the batteries as well as the BMS and providing it to them as Phase-1

- Eberspaecher JV (for M&HCV)

- We are just about coming into profitability right now

- We are working with the OEMs to make all our products modular so that they can go into the old engine, new engine and then the mix will not have such an impact

- We have the approval that we can utilize them modularity wise and in terms of that we have kickstarted the development work

- In principal we are working with our customers to cross utilize our products for commercial vehicles across engine families

- Growth drivers for next few years

- First one the emission vertical there are multiple legislations that are coming up in the next 2-3 years. Number one being RDE BS-VI-II which starts on 1st Apr'23. This will increase our content per car, LCV, etc.

- On product side content should probably increase by 10% in gasoline and roughly 20%-25% in diesel. So, depending on the mix and also the information of RDE on how customer sales go there would be a little bit of an upswing in terms of RDE numbers

- In addition, TREM-IV and TREM-V norms are coming. TREM-IV norms have already started, TREM-V norms are going to start in the next couple of years and in the case of TREM-V market the entire domestic tractors will also require our emission products

- It is a large opening for the company from an addressable market point of view and in this case we are expecting a very solid market share and we have already been nominated for lot of programs here

- In TREM-V roughly all the tractors will require our product and we would be participating in the full market for TREM-V

- The next growth driver is of course on the sub-component side. So, we have started this initiative to export sub components as well as emission systems for smaller engines

- Balance sheet

- It is Rs 588 crores including cash, cash equivalent and bank balances

- Guidance

- We expect similar margins going forward as well, but no specific numbers that we will give out as guidance

(End)

If you are looking for wealth creation with growth stocks do check out our premium subscriptions. We have been helping our clients with our stock research for over a decade now.

Disclaimer: This is not a recommendation to buy/sell Sharda Motor Industries. These notes are as announced by the companies on exchanges and only for the purpose of information and education.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here - LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No